- Home

- »

- Advanced Interior Materials

- »

-

Gaskets And Seals Market Size, Share, Growth Report, 2030GVR Report cover

![Gaskets And Seals Market Size, Share & Trends Report]()

Gaskets And Seals Market Size, Share & Trends Analysis Report By Product (Gaskets, Seals), By Application (Automotive, Aerospace), By End-use (OEM, Aftersales Market), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-801-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Gaskets And Seals Market Size & Trends

The global gaskets and seals market size was estimated at USD 60.77 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. The global market is expected to be driven by the growth of the aerospace and automotive industry. In addition, the utilization of advanced materials in the production of gaskets and seals for key applications, including chemical processing, medical equipment, and aircraft manufacturing, is expected to drive product growth over the forecast period. Furthermore, the market for gaskets and seals is likely to benefit from the increasing growth of the products for reducing vibrations in electrical & electronic components.

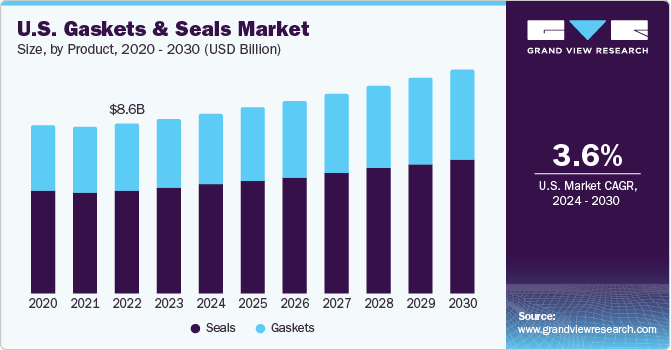

The U.S. market is anticipated to advance at a CAGR of 3.6% from 2024 to 2030, owing to the continuous rise in demand for consumer durable goods coupled with the launch of advanced technological products. In addition, the rising use of high-value and better-performing gaskets and seals in OEM installations is expected to boost market growth.

Gaskets and seals are manufactured from various materials, including metals, thermoplastics, elastomers, ceramics, glass, and concrete. The material used determines the properties of gaskets and seals, such as strength, durability, and thermal and chemical resistance. Key raw materials used for manufacturing gaskets and seals include stainless steel, aluminum, thermoplastic elastomers, and titanium.

Product distribution in the industry takes place primarily due to the direct sales channels, as the majority of gaskets and seals used by end-user industries are customized. However, the companies also operate through a dedicated network of third-party distributors and suppliers, which is done primarily to increase the company's operational area.

Market Concentration & Characteristics

The market growth stage is low, and the pace of market growth is accelerating. The development of automated gasketing technologies with advanced features coupled with convenient, repeatable, and precise applications has improved production output. In addition, the emergence of 3D printing techniques for manufacturing gaskets and seals is anticipated to feature low turnaround time and multi-material options and prints.

The market is governed by many regulations that specify their production, application, and installation. Several entities laying regulations and standards on gaskets and seals production include Food and Drug Administration (FDA), ASTM (American Society for Testing and Materials), and Code of Federal Regulations (CFR).

The market witnesses a very low threat of substitution as no commercially viable substitute is available for gaskets and seals. In addition, the emergence of advanced technologies, including robotic programming coupled with automated dispensing in FIP liquid gaskets, is expected to cause internal substitution. However, superior characteristics exhibited by metallic and semi-metallic gaskets in heavy-duty applications are anticipated to propel their demand over the forecast period.

Product Insights

The seals segment dominated the market in 2023 with a revenue share of 60.2%. Packing seals are widely used in power transmitting shafts of a rotating machine. The product is used in a variety of applications, such as consumer devices, industrial plant equipment, ships, automobiles, and rockets. These seals prevent the leakage of fluid used in the machine to the external environment. Thus, rise of electronics and automotive production globally is anticipated to fuel the demand for mechanical seals over the forecast period.

The gaskets product segment is anticipated to witness growth at a CAGR of 4.7% over the forecast period. The gaskets have a wide range of applications, including water purifiers, water softeners, filtering systems, and demineralization. In addition, metallic gaskets are majorly used in high-temperature and pressure applications such as water heaters, steam pressure vessels, generators, treatment vessels, and steam humidifiers. Moreover, these gaskets handle pressure and temperature fluctuations, bolt stress relaxation, and creep, which are further expected to witness an increase in demand over the coming years.

Application Insights

The automotive segment held the largest market revenue share of 33.2% in 2023. The automotive gaskets and seals are used extensively in engine applications of an automobile, including powertrain, chassis, exhaust manifolds, and other components. Interior applications in an automobile include sealing instrument panels, sunroofs, headliners, interior door panels, visor mirror glass, and fuse boxes. Thus, wide application of seals in interiors coupled with consumers' growing affinity toward electronics in automobiles is anticipated to drive product growth.

Application of gaskets and seals in aerospace is expected to register the fastest CAGR during the forecast period. MRO activities for aircraft are likely to increase over the forecast period, thus driving the demand for gaskets and seals, propelling the market growth. Factors such as pricing pressures from aircraft OEMs and the growth of high-margin aftermarket services are expected to drive M&A activity globally. This has further pushed the suppliers to consolidate for scale and cost-effectiveness. In addition, the development of engineered plastics and elastomers for manufacturing seals in aerospace applications is also likely to drive the replacement of conventional seals and gaskets.

End-use Insights

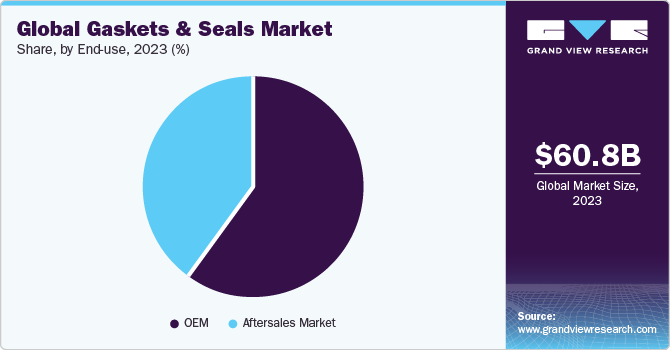

The OEM segment dominated the market in 2023 with a revenue share of 60.1%. In industrial applications, OEMs need a wide range of gaskets and seals in a variety of thicknesses to meet different product criteria. The marine industry OEM requires more than fluid or water resistance properties through their cushioning and gasketing system to withstand physical shocks, weather vibrations, intense temperature fluctuations, and more to protect industrial duty applications.

The aftersales market is projected to grow at a CAGR of 4.1% over the forecast period. Gaskets and seals are considered an important part of any engine repair and can prevent leakage of fuel, coolants, and gases and are single-use items. They are replaced each time as these fluids and gases are removed from the engine. A sizeable number of gaskets and seals are required with any major repair in the system, thereby raising the revenue of the gasket and seals through the aftermarket distribution channel.

Regional Insights

Asia Pacific dominated the market with a revenue share of 45.2% in 2023 and it is further expected to witness the fastest CAGR over the forecast period. Factors such as robust economic growth, increasing business investment, and substantial gains in manufacturing output have been driving the growth of the market in the region over the past years, especially in countries such as China and Japan. In addition, demand is further expected to increase in developing countries, such as India, owing to the expansion of the manufacturing sector coupled with growing foreign investments.

Middle East & Africa is anticipated to witness significant market growth. Increasing foreign investments in the automotive sector in the Middle East are expected to open the market for seals in automotive applications over the forecast period. The government of Saudi Arabia is making efforts to boost the growth of non-oil industries, thereby, driving the manufacturing sector in the country. Therefore, presence of a robust oil and gas sector coupled with an expected rise in the manufacturing sector is anticipated to drive the demand for sealing products over the forecast period.

Key Gaskets And Seals Company Insights

Some key players operating in the market include SKF, Flowserve Corporation, Dana Limited, and Garlock Sealing Technologies LLC.

-

SKF, a company based in Gothenburg, Sweden, supplies products, solutions, and services within seals, mechatronics, roller bearings, services, and lubrication systems. The company’s services also include remanufacturing, logistics, condition monitoring, engineering consultancy and training, asset efficiency optimization, maintenance services, and technical support. The company’s business activities are segregated into two segments, including automotive and industrial.

-

Dana Limited is engaged in designing and manufacturing motion and drive products, thermal management technologies, sealing solutions, and fluid power products for engine and vehicle manufacturers in North America, Europe, Asia Pacific, and South America.

Freudenberg Sealing Technologies GmbH & Co. KG, Bruss Sealing System GmbH, and Crown Gaskets Pvt. Ltd. are some of the emerging market participants in the market.

-

Crown Gaskets Pvt. Ltd. is engaged in the development and manufacturing of passenger car segment gaskets and commercial vehicle gaskets. The company caters to several automotive manufacturers in India. Also, it exports its products to several overseas locations, including the U.S., UK, Australia, South Africa, UAE, Canada, Mexico, Turkey, Egypt, and Ghana.

-

Bruss Sealing System GmbH, headquartered in Schleswig-Holstein, Germany, is engaged in developing and manufacturing sealing systems for powertrain applications. The company also offers cover modules, elastomer gaskets, bonded pistons, and aluminum die-casting components. It serves automotive manufacturers worldwide, including BMW, Daimler, Porsche, Volkswagen, and Jaguar Land Rover.

Key Gaskets And Seals Companies:

The following are the leading companies in the gaskets and seals market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these gaskets and seals companies are analyzed to map the supply network.

- SKF

- Dana Limited

- Freudenberg Sealing Technologies GmbH & Co. KG

- Flowserve Corporation

- Smiths Group Plc

- Trelleborg Sealing Solutions

- ElringKlinger AG

- Cooper Standard.

- Bruss Sealing System GmbH.

- Garlock Sealing Technologies

- Crown Gaskets Pvt. Ltd.

Recent Developments

-

In June 2023, Pipeotech launched its new seal product, 304L stainless steel DeltaV-Seal, for nitric acid service. The product will help reduce the frequency of changing gaskets in fertilizer plants. This, in turn, will reduce maintenance costs and increase the function time of the plants.

-

In August 2022, Trelleborg Sealing Solutions launched its new HMF FlatSeal product range. It is a flat gasket suitable for static sealing in high and low-temperature applications. In addition, the range includes several materials used in industries including automotive, aerospace, food & beverage, oil & gas, pharmaceutical, and chemical processing.

Gaskets And Seals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.08 billion

Revenue forecast in 2030

USD 81.69 billion

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

SKF; Dana Limited; Freudenberg Sealing Technologies GmbH & Co. KG; Flowserve Corporation; Smiths Group Plc; Trelleborg Sealing Solutions; ElringKlinger AG; Cooper Standard; Bruss Sealing System GmbH; Garlock Sealing Technologies; Crown Gaskets Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gaskets and Seals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gaskets and seals market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gaskets

-

Metallic

-

Semi-metallic

-

Non-metallic

-

-

Seals

-

Shaft Seal

-

Molded Packing & Seals

-

Motor Vehicle Body Seals

-

-

Other

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Marine & Rail

-

Industrial & Manufacturing

-

Aerospace

-

Oil & Gas

-

Chemicals & Petrochemicals

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftersales Market

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global gaskets and seals market size was estimated at USD 60.77 billion in 2023 and is expected to reach USD 63.08 billion in 2024.

b. The global gaskets and seals market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 81.69 billion by 2030.

b. Seals led the market and accounted for over 60% share of the revenue in 2023. They are used in various applications ranging from automobiles, rockets, ships, industrial plant equipment and consumer devices. These seals prevent the leakage of fluid used in machine to the external environment.

b. Some of the key players operating in the global gaskets and seals market include SKF, Dana Limited, Crown Gaskets Pvt. Ltd., Freudenberg Sealing Technologies GmbH & Co. KG, Flowserve Corporation, Trelleborg Sealing Solutions, Smiths Group Plc, Garlock Sealing Technologies LLC, Bruss Sealing System GmbH, Cooper Standard, ElringKlinger AG.

b. The key factors that are driving the global gasket and seals market include, the market for the gaskets and seals is expected to benefit from the growth in usage of the products for reducing vibrations in electrical & electronic components.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."