- Home

- »

- Pharmaceuticals

- »

-

Gastrointestinal Therapeutics Market, Industry Report, 2030GVR Report cover

![Gastrointestinal Therapeutics Market Size, Share & Trends Report]()

Gastrointestinal Therapeutics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type, By Drug Class, By Application (Crohn’s Disease, Ulcerative Colitis, GERD), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-338-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gastrointestinal Therapeutics Market Summary

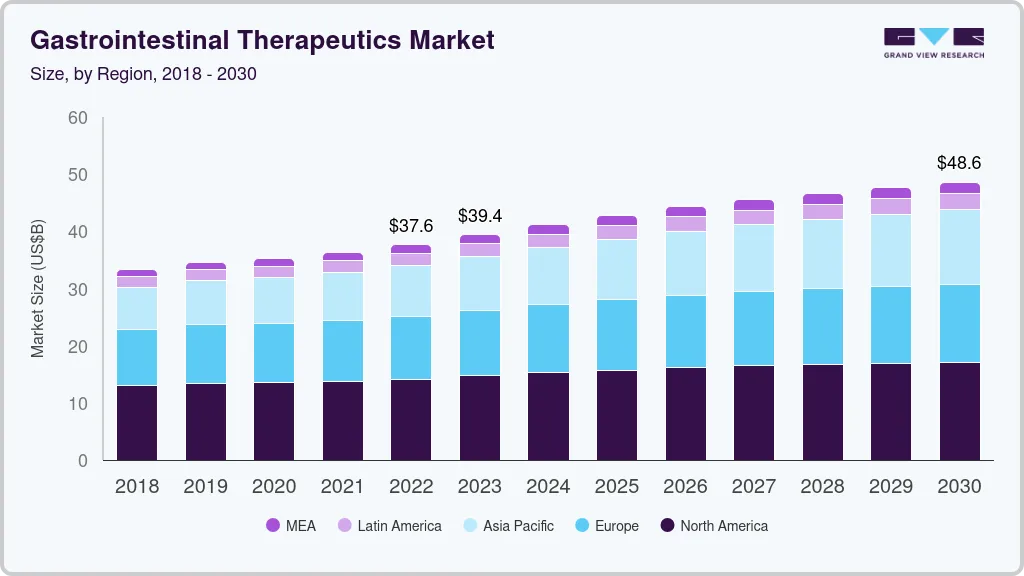

The global gastrointestinal therapeutics market size was estimated at USD 37.6 billion in 2022 and is projected to reach USD 48.61 billion by 2030, growing at a CAGR of 3.3% from 2023 to 2030. The increasing prevalence of gastrointestinal disorders such as IBS, Crohn’s disease, and ulcerative colitis, and the rising demand for gastrointestinal (GI) drugs are the major factors driving the market growth.

Key Market Trends & Insights

- North America led the overall market for gastrointestinal therapeutics with 37.64% of the revenue share in 2022.

- By type, the branded segment held the largest share of 67.64% in 2022.

- By drug class, the biologics/biosimilar segment dominated the market for gastrointestinal therapeutics with a 44.14% revenue share in 2022.

- By route of administration, the injectable segment held the dominant market share of 51.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 37.6 Billion

- 2030 Projected Market Size: USD 48.61 Billion

- CAGR (2023-2030): 3.3%

- North America: Largest market in 2022

Moreover, the surge in R&D efforts by pharmaceutical companies to develop novel GI drugs and increasing product approvals are expected to enhance market growth during the forecast period. According to the GI Alliance data from February 2021, it is estimated that around 20 million Americans suffer from chronic digestive diseases and over 62 million Americans are diagnosed with gastrointestinal diseases annually, and the incidence of gastrointestinal disorders rises with age. Moreover, as per data published by the International Foundation for Gastrointestinal Disorders, Inc (IFFGD), the prevalence of GERD is 18-28% in North America, 23% in South America, and 9-26% in Europe. Thus, the high prevalence of gastrointestinal diseases is likely to drive market growth in the coming years.Technological advancements and increasing R&D investments to develop novel therapies such as biologics & targeted drugs for the treatment of gastrointestinal diseases are expected to increase the market growth. A wide number of next-generation therapeutic targets are being investigated, including innovative small molecules and cellular therapy for gastrointestinal disorders. For the treatment of gastrointestinal diseases, the U.S. FDA-approved biological drugs are Amjevita, Cimzia, Entyvio, Inflectra, Remicade, Renflexis, and Tysabri, among others, which are available in the market.

Moreover, the increasing prescription of biological drugs and the presence of strong pipeline drugs such as ustekinumab, risankizumab, and ABBV-154 are expected to boost market growth during the projected period. The increasing regulatory approvals for novel gastrointestinal therapeutic drugs are anticipated to facilitate market expansion in the coming years.

For instance, in March 2022, AbbVie Inc. received U.S. FDA approval for its RINVOQ (upadacitinib) prescription medicine for the treatment of severe to moderate ulcerative colitis in adults. It is expected to increase the adoption of RINVOQ to treat patients who have an inadequate response to TNF blockers.

In addition, the increasing introduction of novel drugs to treat gastrointestinal disorders is expected to drive the prescription rate of innovative & effective drugs in the coming years. For instance, in May 2021, BMS received U.S. FDA approval for Zeposia for the treatment of moderate to severe ulcerative colitis. Zeposia is the only approved sphingosine 1-phosphate (S1P) receptor modulator for the treatment of active UC.

However, high investment requirements and a long approval process for biological drugs are restraining market players’ opportunities to develop innovative therapeutic products. Moreover, patent expirations and stringent regulatory policies are likely to hamper growth. For instance, in April 2020, the U.S. FDA requested the removal of all ranitidine products (Zantac) from the market due to the identification of some contaminants in ranitidine preparation. Moreover, the introduction of biosimilars for Humira has reduced market growth.

Type Insights

The branded segment held the largest share of 67.64% in 2022 and is anticipated to expand at a steady growth rate during the projected period. Factors such as the strong commercial performance of branded gastrointestinal therapeutics, market exclusivity coupled with high prices, and promising investigational pipeline candidates are fueling segment growth.

The strong sales of products such as Linzess, Entyvio, Humira, and Tysabri among others have increased the segment share significantly. Moreover, rising regulatory approvals of branded drugs are anticipated to drive market growth in the coming years. For instance, in June 2022, AbbVie received U.S. FDA approval for SKYRIZI for the treatment of severe Crohn’s disease.

The generic segment is expected to register a lucrative growth rate throughout the forecast period. The growth of the segment can be attributed to the cost-effectiveness of generics & biosimilars, the rising adoption of generic medicines, and the increasing introduction of generics for branded drugs. In addition, increased government initiatives to promote awareness about generic medicines are likely to support segment growth.

Drug Class Insights

The biologics/biosimilar segment dominated the market for gastrointestinal therapeutics with a 44.14% revenue share in 2022 and is anticipated to expand at the fastest rate during the projection period. The high prescription rate of biologic & biosimilar preparations, along with the high effectiveness of drugs in the treatment of gastrointestinal disorders such as Crohn’s disease, ulcerative colitis, GERD, and others, are driving the segment demand. For instance, some common biologic preparations used to treat gastrointestinal disorders are adalimumab, certolizumab, infliximab, natalizumab, and others.

In December 2021, the U.S. FDA approved Yusimry, a biosimilar to adalimumab, developed by Coherus BioSciences. However, the prescription rate of aminosalicylates and proton pump inhibitors, among others, are also high for the treatment of gastrointestinal disorders.

Route Of Administration Insights

In 2022, the injectable segment held the dominant market share of 51.4%, owing to the high adoption rate of biological drugs, coupled with higher prices, higher bioavailability of injectable drugs, rapid onset of action, and less possibility of first-pass metabolism in case of injectable drugs. Moreover, the availability of many intravenous drugs for the management of gastrointestinal diseases has increased the segment share. For instance, top-selling products such as Tysabri, Entyvio, and Sandostatin are administered via the intravenous route.

The oral segment held the second largest share in the market due to the increasing demand for oral drugs, ease of administration, and cost efficiency of oral products. Moreover, increasing approval of novel oral drugs such as Xeljanz and Rinvoq for the treatment of GI disorders is further expected to drive segment growth during the forecast period. Moreover, the presence of a strong pipeline of oral drugs for the treatment of gastrointestinal diseases is expected to support segment growth in the coming years.

Application Insights

Crohn’s disease (CD) was the leading application segment in 2022 in the gastrointestinal therapeutics market, accounting for 32.89% of the revenue share, and is anticipated to maintain its dominance through the forecast period. The increasing incidence of Crohn’s disease, the high cost of treatment, and the increasing approval of novel drugs for CD are some of the key factors fueling segment growth. For instance, the prevalence of Crohn’s disease is high in Western Europe and North America regions, where the prevalence ranges from 100 to 300 cases per 100,000 population.

Ulcerative colitis (UC) is anticipated to be the fastest-growing application segment with 4.3% CAGR during the projection period, due to the easy availability of drugs for ulcerative colitis, rising product approvals, and rising clinical urgency to curb the prevalence of ulcerative colitis. The high prevalence of the disease is due to the consumption of unhealthy food and poor prognosis. Moreover, key market players such as AstraZeneca, Lilly, Celgene Corporation, and AbbVie Inc. among others are involved in the development of novel drugs for UC treatment.

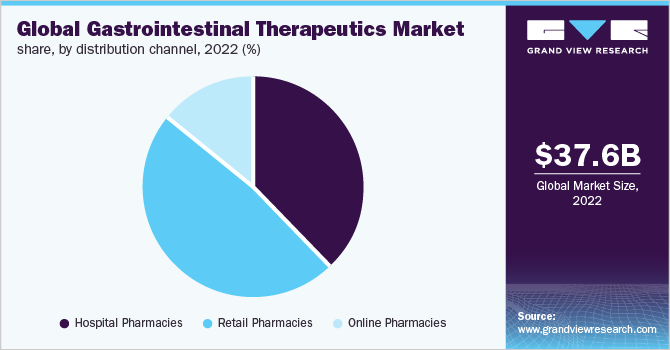

Distribution Channel Insights

The retail pharmacies segment captured the largest revenue share of 48.4% in 2022. Factors such as the rising demand for OTC drugs such as antacids, anti-emetics, and laxative preparations, and unhygienic dietary patterns that often lead to stomach upsets, are driving the segment growth. Moreover, increasing approval & adoption of oral drugs for the treatment of GI disorders and the availability of novel drugs are further supporting growth. The hospital pharmacies segment held the second-largest market share.

On the other hand, the online pharmacies segment is likely to be the fastest-growing during the coming years. The rising internet penetration, increasing trend of online pharmacies, and various discounts offered by online pharmacy players are some of the factors contributing to the segment’s expansion. Moreover, increased adoption of telemedicine during & after the COVID-19 pandemic is further anticipated to boost the segment growth in the coming years.

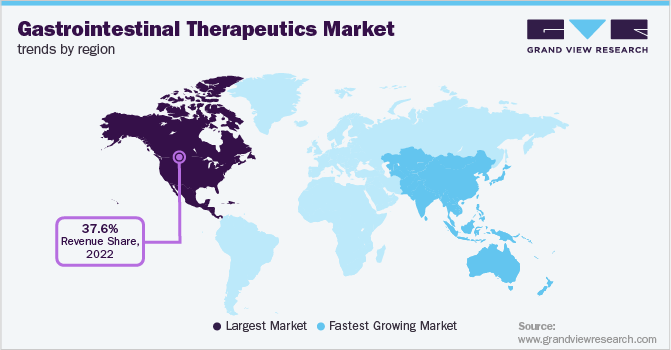

Regional Insights

North America led the overall market for gastrointestinal therapeutics with 37.64% of the revenue share in 2022 due to the presence of many market players, coupled with various strategic initiatives undertaken by them. Moreover, the increase in disease prevalence and the presence of various government and non-government organizations to promote research activities for gastrointestinal therapeutics are fueling the regional market growth Moreover, the easy availability of products and increased patient awareness are the other factors contributing to regional expansion.

Asia Pacific is projected to witness the fastest growth rate of 5.1% during the forecast period. The increasing geriatric population, large patient pool with a high prevalence of GI diseases, and steadily growing economies are some of the primary factors driving market growth in the region. Moreover, the increasing adoption of biologics & biosimilars and rising investments by market players in the region are anticipated to propel the growth of the market during the projected period.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, mergers & acquisitions, and partnerships to increase their market share. Market players such as AbbVie Inc., Pfizer Inc., Galapagos NV, F. Hoffmann-La Roche AG, and others are actively involved in the development of novel therapeutics for gastrointestinal diseases. For instance, in March 2022, AbbVie Inc. received U.S. FDA approval for its novel drug, RINVOQ (upadacitinib), for the treatment of moderately to severely active ulcerative colitis. Some prominent players in the global gastrointestinal therapeutics market include:

-

AbbVie Inc.

-

AstraZeneca

-

Salix Pharmaceuticals

-

Takeda Pharmaceutical Company Limited

-

Pfizer Inc.

-

Bayer AG

-

Abbott

-

Janssen Pharmaceuticals NV

-

Sun Pharmaceutical Industries Ltd.

-

Cipla Inc.

-

Gilead Sciences, Inc.

-

Biogen

-

Organon Group of Companies

Gastrointestinal Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 39.4 billion

Revenue forecast in 2030

USD 48.61 billion

Growth rate

CAGR of 3.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, number of patients in million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, application, distribution channel, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

AbbVie Inc.; AstraZeneca; Janssen Pharmaceuticals NV; Sun Pharmaceutical Industries Ltd.; Takeda Pharmaceutical Company Limited; Salix Pharmaceuticals; Pfizer Inc.; Bayer AG; Abbott; Cipla Inc.; Gilead Sciences, Inc.; Biogen; Organon Group of Companies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gastrointestinal Therapeutics Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global gastrointestinal therapeutics market report based on type, drug class, route of administration, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030) (Number of Patients in Million)

-

Branded

-

Generics

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Aminosalicylates

-

Digestive enzymes

-

Proton Pump Inhibitors

-

Laxatives

-

Anti-Emetics

-

H2 Antagonists

-

Anti-Diarrheal

-

Biologics/Biosimilar

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030) (Number of Patients in Million)

-

Oral

-

Injectable

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Number of Patients by Type in Million)

-

Crohn's disease

-

Ulcerative colitis

-

GERD

-

IBS

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Number of Patients in Million)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gastrointestinal therapeutics market size was estimated at USD 37.6 billion in 2022 and is expected to reach USD 39,358.6 million in 2023.

b. The global gastrointestinal therapeutics market is expected to grow at a compound annual growth rate of 3.3% from 2023 to 2030 and is expected to reach USD 48.61 billion by 2030.

b. The biologics/biosimilars segment is expected to dominate the gastrointestinal therapeutics market with a share of 43.95% in 2022 due to the high prescription rate of biological drugs coupled with improved efficacy, and high cost of treatment.

b. Some key players operating in the gastrointestinal therapeutics market include AbbVie Inc., Pfizer Inc., Galapagos NV, F. Hoffmann-La Roche AG, Takeda Pharmaceutical Company Limited, Bayer AG, and Biogen among others.

b. Key factors that are driving the gastrointestinal therapeutics market growth include high prevalence of gastrointestinal, introduction of novel therapies, increasing R&D activities by major players.

b. North America held the largest share of 37.64% in 2022 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the high investment in R&D, increasing adoption of novel drugs for the treatment of GI disorders, and the presence of leading players in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.