- Home

- »

- Medical Devices

- »

-

GCC And UAE Diabetes Devices Market Size Report, 2030GVR Report cover

![GCC And UAE Diabetes Devices Market Size, Share & Trends Report]()

GCC And UAE Diabetes Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Pharma, Drugs & Supplies), By Distribution Channel (Hospital Pharmacies,) By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-019-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The GCC and UAE diabetes devices market size was valued at USD 3.12 billion in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2030. This growth is attributed to the rising incidences of diabetes, the growing adoption of advanced technology to treat & manage fluctuating blood glucose levels, and the increasing adoption of telehealth services during the COVID-19 pandemic. The market is further driven by growing awareness about diabetes preventive care, and government initiatives. For instance, Saudi Arabia’s government set a goal of achieving a 0% rise in diabetes-related mortality by 2025 and a 10% reduction in overall diabetes incidences by 2030.

Diabetes is a rapidly growing disease, which affects a large population in the Middle Eastern region, owing to an increase in unhealthy lifestyles and other associated risk factors. According to the International Diabetes Federation, in UAE the number of people suffering from diabetes is expected to reach 1.32 million in 2045 from 0.99 million in 2021. This disease prevalence can be prevented at an individual level by adopting healthier lifestyles and growing government initiatives.

In 2020, the Ministry of Health and Prevention (MoHAP) launched a drive-in awareness-raising project aimed at improving the quality of life and ability to live with people suffering from diabetes. The Diabetes Prevention Program was also launched to provide information and training on diabetes-related healthy habits.

Gulf Cooperation Council countries have some of the world's highest diabetic prevalence rates. Over the past few decades, diabetes-related research activity has been observed to be low in this region. However, an increase in research funding and collaborations between local and international researchers and institutes are expected to boost the market's growth.

Management of blood glucose levels became a critical task for patients admitted to hospitals with severe lung infections. Medications used to treat the disease led to significant changes in the patient blood glucose levels. Moreover, people living with diabetes with COVID-19 conditions were strictly admitted to critical care. Hence, the need for using diabetes monitoring devices significantly increased.

Services Insights

The pharmaceutical, drugs, and supplies segment led the market and accounted for the largest market share of 39.5% in 2024. The rising prevalence of diabetes, increasing diabetes-related healthcare expenditures, and ongoing research are key factors driving the market growth. Furthermore, the growing demand for efficient medication therapies for diabetes treatment is also expected to propel segment growth over the forecast period.

The growth of the Pharma, Drugs, and Supplies segment in the GCC and UAE diabetes devices market is driven by increasing demand for efficient medication therapies. Rising diabetes prevalence, growing healthcare expenditures, and ongoing research also contribute to this growth. Additionally, government initiatives and awareness campaigns enhance the adoption of these services, further propelling market expansion.

The technology platforms and products segment is anticipated to grow at a CAGR of 7.5% over the forecast period. Various innovative and developing technologies continue to converge to influence the digital health trajectory for the prevention of diabetes. In addition, patients & healthcare providers continue to adopt various technologies. These include connected glucose meters, continuous subcutaneous insulin infusion, CGM systems, closed-loop systems, digitalization of health data, and diabetes-related applications. These new technologies are transforming healthcare delivery.

Distribution Channel Insights

The hospital pharmacies segment held the dominant position in the market with the highest revenue share of 55.3% in 2024. Hospitals consist of inpatient and outpatient pharmacies. The primary role of a hospital inpatient pharmacy is to supply medicines and medical equipment to several departments in need. In addition, their integration with healthcare systems, offering accessible and quality products, also contribute towards the markets’ growth. Moreover, they are the primary point of contact for patients, providing specialist-recommended devices and fostering trust through government-backed infrastructure advancements.

The online pharmacies segment is expected to witness the fastest CAGR of 7.7% from 2025 to 2030. As online pharmacies directly procure diabetes devices from manufacturers, they can offer lucrative deals to customers. Increasing patient awareness about online pharmacies and increased public-private funding are key factors driving the segment.

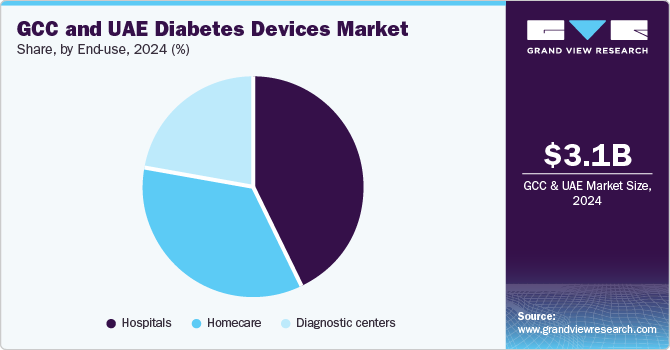

End-use Insights

The hospital segment dominated the GCC and UAE diabetes devices industry and accounted for the largest revenue share of 42.4% in 2024. Diabetes technology has evolved rapidly in the past few years. Most of these technologies aim to improve diabetes care in hospitals and clinics. These advancements in technology have increased the usage of insulin pumps in hospitals. Furthermore, the increasing number of hospital admissions for diabetes patients continues to boost the demand for the segment. Hospitals are often the first point of contact for patients, providing specialized care and training programs for healthcare workers and patients. Moreover, government support for healthcare modernization also contributes to this growth.

The homecare segment is anticipated to grow at a significant CAGR of 7.7% over the forecast period. Increasing government initiatives to promote awareness about diabetes and the user-friendly interface of insulin pumps are increasing the demand for insulin pumps in homecare settings. Furthermore, Advances in portable and user-friendly devices enable patients to monitor and manage diabetes effectively at home, reducing hospital visits and enhancing quality of life. This shift is supported by growing awareness and government initiatives promoting preventive care. Moreover, the increasing geriatric population also continues to boost the demand for homecare. According to WHO, by 2030, nearly one-sixth of the global population will be 60 or older, marking a significant increase from 1 billion in 2020 to 1.4 billion. This trend will continue, with the number of seniors doubling to 2.1 billion by 2050. Furthermore, the population of individuals aged 80 and above is projected to triple during the same period, reaching 426 million by 2050.

Country Insights

Saudi Arabia Diabetes Devices Market Trends

Saudi Arabia diabetes devices market dominated the market for GCC and UAE market and accounted for the largest revenue share of 28.9% in 2024. Diabetes is a major health concern in Saudi Arabia. The total diabetes-related healthcare spending in the country was about USD 7,459.5 million in 2021, which is expected to increase to USD 10,045.2 million by 2045. Key drivers of the market include the increasing prevalence of diabetes and technological advancements. In addition, the growth of the market is driven by increasing diabetes prevalence and government initiatives such as Vision 2030, which enhances healthcare infrastructure. Furthermore, technological advancements and a supportive regulatory environment also contribute to growth.

UAE Diabetes Devices Market Trends

The diabetes devices market in the UAE is expected to grow at a CAGR of 8.1% over the forecast period. Key drivers of the market include the high prevalence of diabetes, rapid adoption of innovative products, increasing R&D efforts, and growing awareness about diabetes preventive care. Several diabetes awareness programs and government initiatives are expected to contribute to market growth during the forecast period. Furthermore, strategic partnerships between healthcare providers and device manufacturers drive growth. Moreover, the focus on preventive care also boosts demand for diabetes devices.

Kuwait Diabetes Devices Market Trends

Kuwait diabetes devices market is expected to grow significantly over the forecast period, owing to lifestyle factors such as sedentary habits and dietary changes, increasing diabetes rates. Furthermore, government health initiatives and investments in modern healthcare facilities enhance access to advanced diabetes management solutions, supporting market growth.

Key GCC And UAE Diabetes Devices Company Insights

Key players in the GCC and UAE diabetes devices industry include Medtronic, Abbot Laboratories, Ascensia Diabetes Care Holdings, and others. These players are implementing various strategies including partnerships through mergers and acquisitions, geographical expansions, product launches, government approvals, and strategic collaborations to expand their market presence.

-

Dexcom specializes in manufacturing continuous glucose monitoring (CGM) systems, such as the G6 and G7 models, which provide real-time glucose insights for diabetes management. These devices are designed for both personal and professional use, supporting insulin-dependent users and those at risk of hypoglycemia. Dexcom operates in the diabetes devices segment, offering solutions for type 1 and type 2 diabetes management.

-

Sanofi develops and distribute diabetes medications, such as insulin and oral antidiabetic drugs. The company operates in the pharmaceutical segment of the diabetes market, providing treatments for various types of diabetes. Sanofi's products are designed to manage blood glucose levels effectively, complementing other diabetes management solutions such as devices.

Key GCC And UAE Diabetes Devices Companies:

- Medtronic

- Abbot Laboratories

- Ascensia Diabetes Care Holdings

- Dexcom

- F. Hoffmann- La Roche AG,

- Sanofi

- Novo Nordisk A/S

- Insulet Corporation

- Ypsomed AG

- Eli Lily

- Astra Zeneca

Recent Developments

-

In August 2024, Medtronic announced FDA approval of its Simplera CGM (Continuous Glucose Monitoring) system. This innovative technology simplifies the monitoring process for individuals using diabetes devices. In addition, Medtronic is partnering with Abbott to integrate their respective technologies. This collaboration aims to improve patient outcomes. The Simplera CGM system is designed for ease of use and accuracy, marking a significant advancement in diabetes devices and care. The partnership with Abbott is aimed at expanding access to comprehensive diabetes devices and solutions globally, benefiting many patients.

-

In December 2023, Tandem launched an insulin pump software, integrated with Dexcom G7 CGM technology, marking a significant advancement in diabetes devices. This insulin pump is its t:slim X2 allowing its current users to access Dexcom's advanced CGM. The integration offers benefits such as reduced wait times between sensor sessions and the choice of using either Dexcom G6 or G7. The Dexcom G7 boasts improved accuracy and a shorter warm-up time. This launch underscores Tandem's commitment to enhancing automated insulin delivery systems for better diabetes devices management.

GCC and UAE Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.32 billion

Revenue forecast in 2030

USD 4.73 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Services, distribution channel, end-use, country

Regional scope

Middle East

Country scope

Saudi Arabia, UAE, Oman, Qatar, Kuwait, Bahrain

Key companies profiled

Medtronic; Abbot Laboratories; Ascensia Diabetes Care Holdings; Dexcom; F. Hoffmann- La Roche AG; Sanofi; Novo Nordisk A/S; Insulet Corporation; Ypsomed AG; Eli Lily; Astra Zeneca.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC And UAE Diabetes Devices Market Report Segmentation

This report forecasts revenue growth a, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC and UAE diabetes devices market report based on services, distribution channel, end-use, and country:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Devices and Wearables

-

Pharma, Drugs and Supplies

-

Technology Platforms and products

-

Genomics and Multi omics

-

Diabetes Prevention

-

Prediabetes Early Intervention

-

Early Diagnosis and Diabetes

-

Behavioral and Lifestyle Changes

-

-

Diabetes Researches

-

Primary Care

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/ Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Diagnostic centers

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Kuwait

-

Bahrain

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.