- Home

- »

- Biotechnology

- »

-

Gene Delivery Technologies Market Size, Share Report, 2030GVR Report cover

![Gene Delivery Technologies Market Size, Share & Trends Report]()

Gene Delivery Technologies Market (2024 - 2030) Size, Share & Trends Analysis Report By Mode (AAV, Lentivirus, Retrovirus), By Application (Gene Therapy, Cell Therapy), By Method (Ex-vivo, In-vivo), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-291-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Delivery Technologies Market Trends

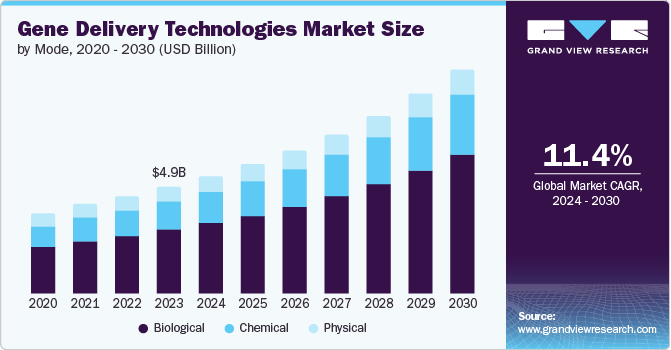

The global gene delivery technologies market, valued at USD 4.91 billion in 2023, is projected to grow at a CAGR of 11.4% from 2024 to 2030. The market growth is driven by the increasing prevalence of genetic disorders and cancers, which necessitates the development of effective gene therapies. In addition, advancements in biotechnology and molecular biology have led to the emergence of innovative gene delivery techniques, further propelling the market growth.

As of March 2023, 100 marketed and globally available approved gene, cell, and RNA therapies were available. In addition, another 3,700 therapies were in clinical and preclinical stages. This indicates a robust pipeline of gene therapies, which is a positive sign for the future of the market. The continuous evolution and application of these therapies are expected to significantly contribute to expanding the gene delivery technologies market in the coming years.

Rapid advancements in nanotechnology and physical technology have spurred the emergence of sophisticated physical gene delivery techniques such as magnetoreception, perfection, confection, and electrification. These methods are being acknowledged for their efficiency and non-toxic properties and are anticipated to benefit key players in the relevant product markets.

Numerous new companies have been drawn into the gene delivery technologies sector, fueled by the growth of its related markets. In addition, the existing players are leveraging different business strategies to advance the gene delivery technologies market. Currently, many companies have approached CMOs to build viral vectors. For example, in 2023, ViroCell received approval from the Medicines and Healthcare Products Regulatory Agency (MHRA) to produce viral vectors at its manufacturing facility at the Zayed Centre for Research at the Great Ormond Street Hospital in London, UK.

Mode Insights

The biological segment held a 59.9% revenue share in 2023 attributed to the inherent advantages that biological methods offer. These methods, which include viral and non-viral vectors, are often more efficient at delivering genes to target cells. Despite their potential safety concerns, viral vectors are particularly effective due to their evolutionary advantage in penetrating cells and integrating their genetic material. Non-viral vectors, while less efficient, are considered safer and more accessible to produce, making them a valuable alternative for specific applications. The robust growth of this segment underscores the ongoing research and development activities in the field, as well as the increasing commercialization of gene therapies that rely on these technologies.

On the other hand, the chemical segment is projected to grow at a CAGR of 11.9% from 2024 to 2030. Chemical methods of gene delivery, such as the use of liposomes or nanoparticles, offer certain advantages over biological methods. They are generally less likely to trigger an immune response and can often be produced more cost-effectively. The high growth rate of this segment indicates a growing recognition of these benefits within the scientific community. It also suggests that advancements in chemical gene delivery technologies are expected to accelerate, potentially leading to the development of more efficient and safer gene delivery methods. This projected growth reflects the increasing investment in this area, both from the public and private sectors, driven by the potential of these technologies to revolutionize healthcare.

Application Insights

The gene therapy segment dominated the market with a revenue share of 36.0% in 2023. This growth can be attributed to the rising demand for gene-based treatments, increased research activities, and the approval of gene therapy products. These factors, along with the surge in clinical trials, have contributed to the growth of this segment.

The cell therapy segment is projected to grow at the fastest CAGR of 12.4% from 2024 to 2030. The rapid growth in this segment can be attributed to the advancements in stem cell therapy and immunotherapy. For instance, CAR-T cell therapies have revolutionized the treatment of certain types of cancers. Moreover, stem cell therapies are being explored for their potential in treating various conditions, including neurological and cardiovascular diseases.

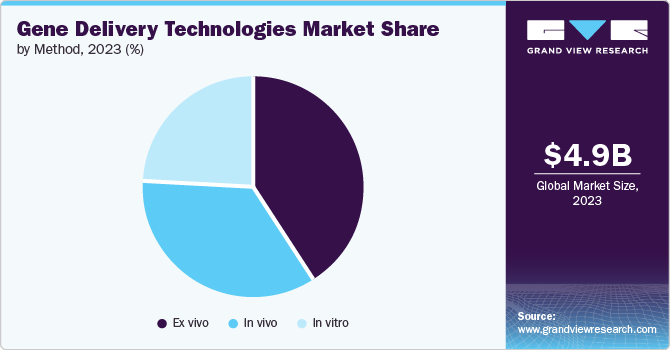

Method Insights

The ex vivo method led the gene delivery technologies market in 2023 with a revenue share of 41.4%, owing to its several advantages, such as the capacity to ascertain the effectiveness of transducing cells before reinjecting the patient and lowered immunogenicity. In addition, it has a high transduction efficiency, resulting in its high usage in research applications.

The in vitro method is projected to grow at a CAGR of 11.8% from 2024 to 2030. This method is commonly used in research and development activities due to its ease of use and cost-effectiveness. The rapid growth in this segment can be attributed to the increasing use of in vitro methods in the development of new gene therapies and the growing investment in research and development activities in the field of gene delivery technologies. Advancements in in vitro techniques and the increasing understanding of human genetics are expected to drive the growth of this segment in the gene delivery technologies market over the forecast period.

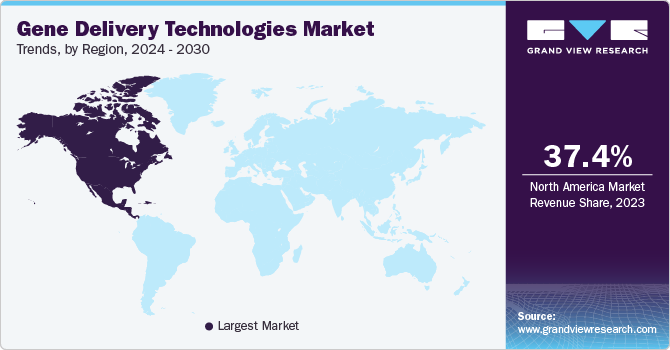

Regional Insights

North America gene delivery technology market dominated the market in 2023. Factors behind this growth include the strong research infrastructure, well-established pharmaceuticals and biotechnological sectors, and heavy investments in gene therapy and genetic medicine.

U.S. Gene Delivery Technology Market Trends

The U.S. gene delivery technology market dominated North America with a share of 78.0% in 2023 due to enhanced therapeutic efficacy and support for precision medicine application and improvement in the field of viral vectors such as lentiviruses, retroviruses, and Adeno-Associated Viruses (AAV). The expansion of gene editing technologies has fueled the market growth significantly.

Europe Gene Delivery Technology Market Trends

Europe gene delivery technology market was identified as a lucrative region in 2023. Improved regulatory standards and advanced therapy products are propelling the market in this region.

The UK gene delivery technology market is expected to grow rapidly in the coming years due to supportive regulatory frameworks, increasing therapeutic pipelines, and technological advancements.

Asia Pacific Gene Delivery Technology Market Trends

Asia Pacific gene delivery technology market is anticipated to witness significant growth over the forecast period. This growth can be attributed to the increasing investment in biotechnology research, the growing prevalence of genetic disorders, and the rapid adoption of advanced medical technologies in the region.

The gene delivery technology market in China held a substantial market share in 2023 owing to its growing size and revenue, which are due to diverse therapeutic areas such as ophthalmology, neurology, and oncology.

Key Gene Delivery Technologies Company Insights

The market is expected to witness a surge in R&D by new entrants due to the growing interest from public and private investors in gene delivery technologies. Furthermore, the existing key players are actively pursuing strategic measures such as mergers, acquisitions, licensing, and partnerships to strengthen their market position. Notably, the gene delivery technologies market has experienced significant mergers and acquisitions in recent years.

Key Gene Delivery Technologies Companies:

The following are the leading companies in the gene delivery technologies market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Horizon Discovery Ltd.

- QIAGEN

- Oxford Biomedica PLC

- OriGene Technologies, Inc.

- SignaGen Laboratories

- Promega Corporation.

- SIRION BIOTECH GmbH

- Flash Therapeutics

- Takara Bio Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- System Biosciences, LLC.

- Catalent, Inc.

Recent Developments

-

In July 2024, UniQure transferred ownership of its gene therapy manufacturing facility in Massachusetts to Genezen. Genezen is set to assume responsibility for the production of Hemgenix, a hemophilia B treatment developed by CSL Behring.

-

In June 2024, Syncona completed a merger between Freeline and SwanBio, and the combined company has been rebranded as Spur Therapeutics. Syncona has committed an additional USD 50 million to fund the new company's gene therapy research.

-

In April 2024, Ascend Advanced Therapies completed the acquisition of the Chemistry, Manufacturing, and Controls (CMC) team and site located in Alachua, Florida, from Beacon Therapeutics. Through this transaction, Ascend gained access to an operational good manufacturing practice facility, process and analytical development capabilities, and an infusion of experienced professionals to strengthen its team further.

Gene Delivery Technologies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.39 billion

Revenue forecast in 2030

USD 10.27 billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Mode, application, method, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; QIAGEN; Horizon Discovery Ltd.; OriGene Technologies, Inc.; Oxford Biomedica PLC; SignaGen Laboratories; Flash Therapeutics; Takara Bio Inc; Bio-Rad Laboratories, Inc.; System Biosciences, LLC.; Promega Corporation.; F. Hoffmann-La Roche Ltd; SIRION BIOTECH GmbH; Catalent, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Delivery Technologies Market Report Segmentation

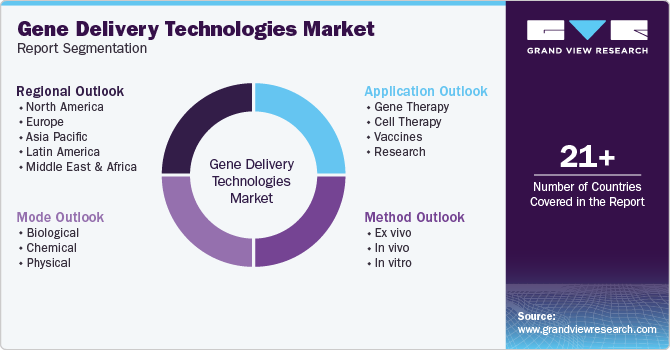

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the subsegments from 2020 to 2030. For the purpose of this study, Grand View Research has segmented the global gene delivery technologies market report on the basis of mode, application, method, and region:

-

Mode Outlook (Revenue, USD Million, 2020 - 2030)

-

Biological

-

Adenovirus

-

Retrovirus

-

AAV

-

Lentivirus

-

Other viruses

-

Non-viral

-

-

Chemical

-

Physical

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Gene Therapy

-

Cell Therapy

-

Vaccines

-

Research

-

-

Method Outlook (Revenue, USD Million, 2020 - 2030)

-

Ex vivo

-

In vivo

-

In vitro

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.