- Home

- »

- Digital Media

- »

-

Geomarketing Market Size, Share And Growth Report, 2030GVR Report cover

![Geomarketing Market Size, Share & Trends Report]()

Geomarketing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Mode (Cloud, On-premises), By Location (Indoor, Outdoor), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-390-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geomarketing Market Size & Trends

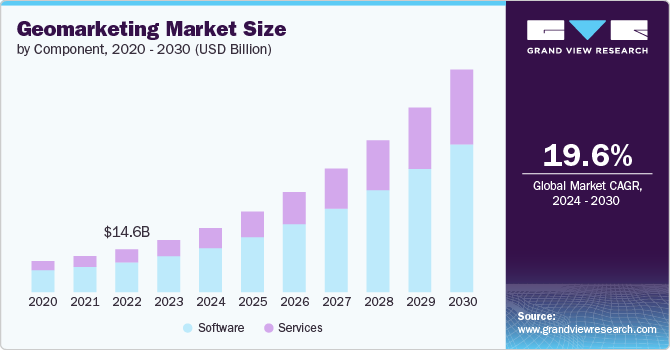

The global geomarketing market size was estimated at USD 17.77 billion in 2023 and is projected to grow at a CAGR of 23.1% from 2024 to 2030. The rapid development of geospatial technologies, such as geographic information systems (GIS) and remote sensing, has significantly enhanced data accuracy and visualization. The cumulative use of geospatial technologies with real-time analytics, which provides deeper insights into consumer behavior, preferences, and market trends, enabled targeted marketing campaigns and resource optimization, thereby boosting the growth of the market.

The integration of geospatial data helps businesses to analyze complex spatial data, leading to more informed decision-making.

The widespread use of smartphones and mobile devices has accelerated the adoption of location-based services (LBS). This trend allows businesses to deliver personalized content, offers, and advertisements based on a user's real-time location. By leveraging LBS, companies can enhance customer engagement, improve customer experience, and increase conversion rates. This growing demand for location-specific marketing solutions is a key driver for the market growth.

The proliferation of big data and advanced analytics has transformed how businesses approach marketing strategies. It leverages vast amounts of spatial data to identify patterns, trends, and correlations. By integrating demographic, psychographic, and behavioral data, companies can create highly targeted and efficient marketing campaigns. The ability to analyze and visualize data geographically helps businesses optimize their operations, identify new market opportunities, and improve overall business performance, fueling the growth of the market.

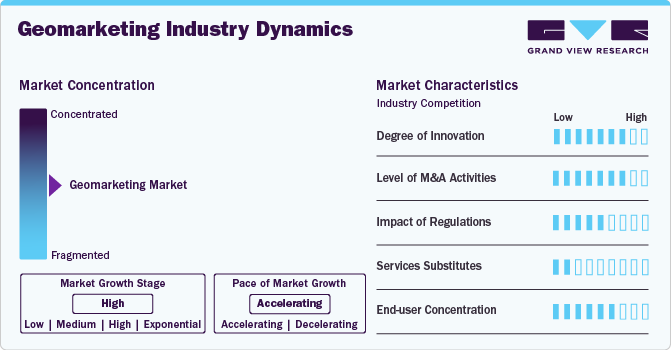

Market Concentration and Characteristics

The market growth stage is high, and it is accelerating. Rapid technological advancements, increasing smartphone adoption, and growing recognition of location-based marketing's effectiveness are fueling this acceleration. The integration of AI and big data analytics is opening new possibilities. Rising demand across various industries and the continuous evolution of consumer behavior are further propelling the market's swift progression.

The geomarketing industry is seeing an increase in the number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. Companies are consolidating to expand capabilities, market share, and geographic reach. These mergers combine complementary technologies and datasets, enhancing service offerings. The trend underscores investor confidence in the future, driving innovation and creating more comprehensive solutions for businesses leveraging location-based marketing strategies.

The market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. Regulations such as GDPR and CCPA impact data collection and usage practices. Compliance requirements influence operational strategies and product development. Companies must balance innovative location-based marketing with user privacy protection. These regulatory considerations affect market entry, international expansion, and overall strategic decision-making in the industry.

Geomarketing faces minimal competition from product substitutes in the market. This is due to its unique value proposition. Traditional marketing methods lack the precision and personalization of location-based strategies. While some alternatives exist, they often cannot match the ability to deliver targeted, context-aware content. This relative lack of substitutes strengthens its position in the digital marketing landscape, driving continued growth and adoption.

End user concentration is a significant factor in the market. Key industries such as retail, hospitality, and real estate drive demand and shape technology development. This concentration influences product features, pricing strategies, and market competition. It also affects innovation, as solutions are often tailored to specific sector needs, potentially limiting broader market applications. Understanding end user dynamics is crucial for market players' success.

Component Insights

Software accounted for the largest market revenue share in 2023. The market is driven by increasing demand for advanced location intelligence tools. The growing integration of AI and machine learning capabilities enhances predictive analytics and personalization. The rising adoption of GIS software for spatial data analysis fuels market growth. The development of user-friendly, intuitive platforms makes the software more accessible to non-technical users. Increasing focus on real-time data processing and visualization tools boosts software adoption. The need for cross-platform compatibility and mobile-first solutions further propel innovation in the software. Emerging technologies like augmented reality create new opportunities for location-based software applications.

Services are expected to register the fastest CAGR from 2024 to 2030. The market is propelled by a surging demand for expert guidance in implementing and optimizing location-based marketing strategies. The soaring complexity of technologies drives the need for professional services, including consulting and training. The rise of managed services offers cost-effective solutions for businesses lacking in-house expertise. Rising emphasis on data privacy and compliance creates demand for specialized legal and regulatory services. The need for seamless integration of location-based services with existing marketing technologies fuels system integration services.

Deployment Mode Insights

On-premises accounted for the largest market revenue share of 57.0% in 2023. The market is driven by organizations' need for greater data control and security, especially in highly regulated industries. Large enterprises with existing IT infrastructure often prefer on-premises solutions for seamless integration and customization. This mode offers better compliance with strict data protection regulations in certain regions. Industries handling sensitive location data, such as government and healthcare, fuel demand for on-premises deployment. The need for real-time processing of large volumes of location data without internet dependence also contributes to the growth of this segment.

The cloud segment is expected to register the fastest CAGR of 25.0% from 2024 to 2030. The market is propelled by its scalability, cost-effectiveness, and ease of implementation. Strengthening the adoption of cloud computing across industries drives market growth. Cloud-based solutions offer better flexibility for remote access and multi-location businesses. The rise of edge computing enhances real-time location-based services in the cloud. Growing demand for AI and machine learning integration in geomarketing fuels cloud adoption. Small and medium-sized enterprises prefer cloud solutions for lower upfront costs.

Location Insights

Outdoor accounted for the largest market revenue share in 2023. The market is driven by rising smartphone penetration and improved GPS accuracy. The rising adoption of location-based advertising in urban areas boosts market growth. The rise of smart cities creates opportunities for outdoor digital signage with location-specific content. Advancements in 5G technology enable more precise location tracking and real-time marketing. Increasing use of geofencing for targeted promotions around physical stores and events propels market expansion. The integration of outdoor location data with social media platforms for hyper-local marketing further accelerates growth in this segment.

Indoor is expected to register the fastest CAGR from 2024 to 2030. This rapid growth is fueled by a surge in demand for enhanced customer experiences in the retail, hospitality, and healthcare sectors. Advancements in technologies such as Wi-Fi, Bluetooth beacons, and ultra-wideband enable precise indoor positioning. The growing adoption of IoT devices in smart buildings creates opportunities for location-based services. The rise of large indoor spaces like shopping malls and airports drives demand for indoor navigation and proximity marketing. Increasing focus on optimizing space utilization and workforce management in commercial buildings further boosts the adoption of indoor location-based solutions.

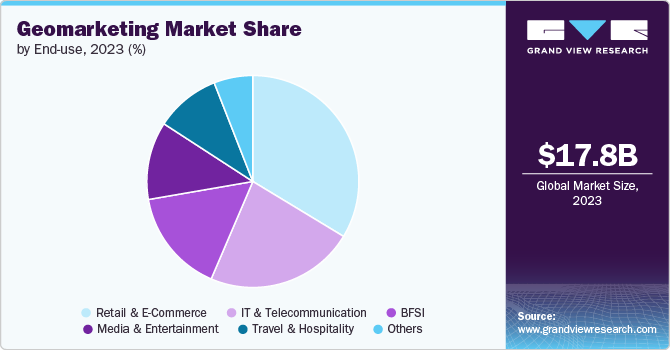

End Use Insights

The retail & E-Commerce segment accounted for the largest market revenue share in 2023. The market is driven by cumulative demand for personalized shopping experiences. Mobile app usage and beacon technology enable precise in-store navigation and targeted promotions. The rise of omnichannel retailing necessitates seamless online-offline integration, boosting location-based marketing. Rising competition drives retailers to leverage customer location data for inventory management and supply chain optimization. The expansion of e-commerce platforms into physical stores (and vice versa) creates new opportunities for location-based customer engagement.

The travel & hospitality segment is expected to grow at a significant CAGR from 2024 to 2030. The market is fueled by increasing demand for personalized travel experiences. Location-based services enable real-time recommendations for nearby attractions, restaurants, and accommodations. The rise of experiential tourism drives the need for location-specific content and offers. Mobile check-ins and contactless services, accelerated by the pandemic, create opportunities for location-based engagement. Integration of location-based services with loyalty programs enhances customer retention. The rise in the use of geofencing for targeted promotions at airports and tourist hotspots boosts market growth. Increasing adoption of AI for predictive travel planning further drives the market growth.

Regional Insights

North America accounted for the highest market revenue share in 2023, driven by advanced technological infrastructure, high smartphone penetration, and widespread adoption of location-based services. The region's robust e-commerce sector and increasing focus on personalized marketing contribute significantly. Expanding investments in AI and big data analytics for location intelligence fuel market growth. The presence of major tech companies and startups fostering innovation in location-based technologies is a key driver. Rising demand for real-time location-based advertising and the integration with social media platforms further propel market expansion in this region.

U.S. Geomarketing Market Trends

The geomarketing market in the U.S. is expected to have a notable CAGR from 2024 to 2030, propelled by a tech-savvy consumer base and high digital advertising spending. Rapid adoption of IoT devices and smart city initiatives create new opportunities for location-based marketing. The country's diverse retail landscape and competitive business environment drive demand for targeted marketing solutions. Increasing use of geofencing and beacon technology in retail and hospitality sectors boosts market growth. Growing emphasis on customer experience and personalization in marketing strategies, coupled with advancements in 5G technology, further accelerate the adoption of solutions.

Asia Pacific Geomarketing Market Trends

The geomarketing market in the Asia Pacific accounted for a significant revenue share in 2023. The market is driven by rapid urbanization, increasing smartphone adoption, and expanding middle-class populations. The region's booming e-commerce sector and digital payment systems create fertile ground for location-based marketing. Government initiatives promoting smart cities and digital infrastructure in countries like India and China fuel market growth. The rising popularity of location-based social media and mobile apps presents new opportunities. Burgeoning investment in AI and machine learning for predictive location analytics, coupled with the region's diverse and expanding consumer markets.

The Japan geomarketing market is estimated to grow significantly from 2024 to 2030. The growth is driven by its technologically advanced society and high mobile internet penetration. The country's dense urban population and efficient public transportation systems create unique opportunities for location-based marketing. Japan's aging population drives demand for personalized, location-specific services. The widespread adoption of contactless payment systems and QR codes facilitates seamless integration in daily consumer interactions. Government initiatives promoting Tourism 4.0 and smart city development further boost the market growth. The country's focus on innovation in robotics and AI also contributes to advanced solutions.

The geomarketing market in India is estimated to record a notable CAGR from 2024 to 2030. The market growth is propelled by rapid digitalization, increasing smartphone penetration, and a growing young population. The government's Digital India initiative and push for smart cities create a conducive environment for location-based services. The country's diverse linguistic and cultural landscape drives demand for localized marketing strategies. The booming e-commerce sector and growing adoption of digital payment systems fuel market growth.

The China geomarketing market had the largest revenue share in 2023. The market growth is driven by its massive mobile user base and advanced digital ecosystem. The country's leadership in 5G technology deployment enables more sophisticated location-based services. China's integrated super-apps and widespread use of QR codes facilitate seamless offline-to-online marketing. The government's push for smart cities and digital transformation across industries boosts market growth. Increasing adoption of AI and big data analytics for consumer behavior analysis fuels the demand for solutions.

Europe Geomarketing Market Trends

The geomarketing market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030. The market growth is driven by stringent data protection regulations like GDPR, fostering trust in location-based services. The region's focus on sustainable urban development and smart city initiatives creates opportunities for innovative solutions. High internet penetration and advanced digital infrastructure support market growth. Increasing adoption of IoT and connected devices in various industries fuels the demand for location intelligence.

The France geomarketing market accounted for a significant revenue share in 2023. The country's emphasis on smart city development, particularly in Paris, creates opportunities for location-based services. High smartphone penetration and advanced mobile networks support market growth. Increasing adoption of beacon technology in tourism and cultural sectors boosts applications. France's strict data protection laws encourage the development of privacy-compliant location-based marketing solutions.

The geomarketing market in the UK is estimated to grow at the fastest CAGR from 2024 to 2030. High adoption of mobile devices and contactless payment systems facilitates location-based marketing. The country's focus on smart city initiatives, particularly in London, drives market growth. Increasing use of geofencing in retail and hospitality sectors boosts demand for solutions. The UK's emphasis on data-driven marketing strategies and personalized customer experiences fuels market expansion.

The Germany geomarketing market is estimated to grow at a moderate CAGR from 2024 to 2030. The market is driven by its strong automotive and manufacturing sectors adopting location intelligence for supply chain optimization. The country's emphasis on Industry 4.0 creates opportunities for integrating with IoT and AI. High internet penetration and advanced digital infrastructure support market growth. Germany's strict data protection laws encourage the development of privacy-centric solutions. Increasing adoption of location-based services in retail and tourism sectors fuels market expansion.

Middle East & Africa (MEA) Geomarketing Market Trends

The geomarketing market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. The market is driven by rapid urbanization and increasing smartphone adoption. Government initiatives promoting smart cities, particularly in Gulf countries, create opportunities for location-based services. The region's young, tech-savvy population fuels demand for mobile-based marketing. Rising e-commerce and digital payment adoption in countries like the UAE and Saudi Arabia boost market growth. Increasing investment in AI and big data analytics for customer insights drives market adoption. The region's diverse cultural landscape necessitates localized marketing approaches, further propelling market expansion.

The geomarketing market in Saudi Arabia accounted for a considerable revenue share in 2023. The market is driven by its Vision 2030 initiative, promoting digital transformation across sectors. The country's high smartphone penetration and young, tech-savvy population fuel demand for location-based services. Rapid development of smart cities, like NEOM, creates opportunities for innovative solutions. Expanding the e-commerce sector and increasing adoption of digital payment systems boost market growth.

Key Geomarketing Company Insights

Some of the key players operating in the market include IBM Corporation, Microsoft Corporation, and Cisco Systems Inc.

-

IBM's growth strategy in the market leverages its strengths in AI, cloud computing, and data analytics. The company focuses on integrating location intelligence into its existing solutions, particularly through its Watson AI platform. IBM emphasizes developing customized tools for various industries, such as retail, telecommunications, and financial services. They're investing in partnerships with geospatial data providers to enhance their offerings. IBM also aims to capitalize on the growing demand for real-time location-based marketing by incorporating IoT and mobile data into their solutions.

-

Cisco's growth strategy in the market centers on leveraging its networking and IoT expertise. The company is developing location-based services that integrate seamlessly with its networking infrastructure, enabling businesses to gather and analyze location data more efficiently. Cisco is investing in edge computing solutions to process location data closer to the source, reducing latency and improving real-time marketing capabilities. They're also focusing on creating industry-specific solutions, particularly for retail, hospitality, and smart cities. Cisco is expanding partnerships with location analytics startups to enhance its offerings.

Saksoft, and Software AG are some of the emerging market participants in the geomarketing market.

-

Saksoft's growth strategy in the market focuses on leveraging its data analytics and digital transformation expertise. The company is developing customized solutions for small to medium-sized businesses, particularly in retail and e-commerce sectors. Saksoft is investing in AI and machine learning capabilities to enhance location-based predictive analytics. They're also expanding partnerships with local businesses to gain market share in emerging economies.

-

Software AG's growth strategy centers on its IoT and integration platforms. The company is focusing on developing location-based services that seamlessly integrate with its Digital Business Platform. Software AG is investing in real-time data processing capabilities to enhance location-based marketing effectiveness. They're expanding their partner ecosystem to include geospatial data providers and location intelligence specialists. The company is also emphasizing the development of industry-specific solutions, particularly for manufacturing, logistics, and smart cities. Additionally, Software AG is leveraging its strengths in integration to offer comprehensive, interoperable solutions across various enterprise systems.

Key Geomarketing Companies:

The following are the leading companies in the geomarketing market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Adobe Inc.

- Salesforce.com Inc.

- Qualcomm

- Xtremepush

- Software AG

- MobileBridge

- Saksoft

Recent Developments

-

In May 2024, IBM announced updates to its watsonx platform and new data, and automation capabilities aimed at making AI more accessible and cost-effective for businesses, including those in the geomarketing sector advancements were expected to enhance geomarketing capabilities by providing more flexible and powerful tools for location-based data analysis and targeted marketing strategies.

-

In February 2023, HERE Technologies partnered with Cognizant to enhance geomarketing capabilities across various sectors. The collaboration leveraged HERE's location platform, providing real-time traffic, weather, and POI data. Cognizant integrated these insights into spatial intelligent solutions for its clients in retail, ride-hailing, logistics, manufacturing, and automotive industries. The partnership aimed to improve customer targeting and service delivery through accurate location-based analytics.

Geomarketing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.90 billion

Revenue forecast in 2030

USD 76.23 billion

Growth Rate

CAGR of 23.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, location, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, and South Africa

Key companies profiled

IBM Corporation, Microsoft Corporation, Cisco Systems Inc., Oracle Corporation, Adobe Inc., Salesforce.com Inc., Qualcomm, Xtremepush, Software AG, MobileBridge, Saksoft, and among others.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geomarketing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geomarketing market report based on component, deployment mode, location, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Retail & E-Commerce

-

Media & Entertainment

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geomarketing market size was estimated at USD 17.77 billion in 2023 and is expected to reach USD 21.90 billion in 2024.

b. The global geomarketing market is expected to grow at a compound annual growth rate of 23.11% from 2024 to 2030 to reach USD 76.23 billion by 2030.

b. North America accounted for the highest market revenue share in 2023, driven by advanced technological infrastructure, high smartphone penetration, and widespread adoption of location-based services. The region's robust e-commerce sector and increasing focus on personalized marketing contribute significantly. Growing investments in AI and big data analytics for location intelligence fuel market growth. The presence of major tech companies and startups fostering innovation in location-based technologies is a key driver. Increasing demand for real-time location-based advertising and the integration with social media platforms further propel market expansion in this region.

b. Some key players operating in the geomarketing market include IBM Corporation, Microsoft Corporation, Cisco Systems Inc., Saksoft, Software AG and among others

b. The rapid development of geospatial technologies, such as geographic information systems (GIS) and remote sensing, has significantly enhanced data accuracy and visualization. These tools enable businesses to analyze complex spatial data, leading to more informed decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.