- Home

- »

- Homecare & Decor

- »

-

Glamping Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Glamping Market Size, Share & Trends Report]()

Glamping Market (2025 - 2030) Size, Share & Trends Analysis Report By Accommodation (Cabins & Pods, Tents, Yurts, Treehouses), By Age Group (18 - 32, 33 - 50, 51 - 65, Above 65 Years), By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-565-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glamping Market Summary

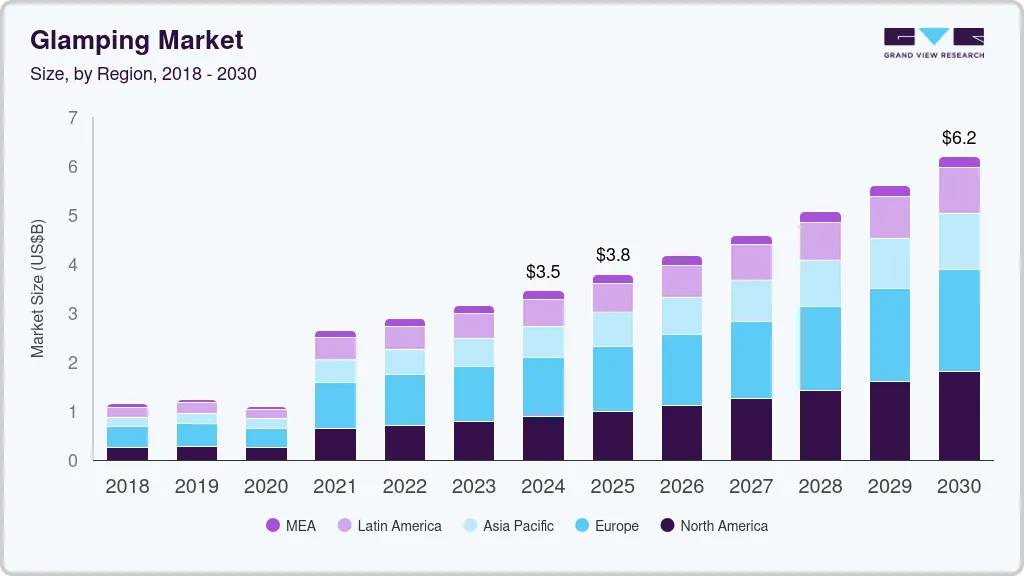

The global glamping market size was estimated at USD 3.45 billion in 2024 and is projected to reach USD 6.18 billion by 2030, growing at a CAGR of 10.3% from 2025 to 2030. This growth is primarily driven by the increasing demand for luxury outdoor experiences that combine the appeal of nature with modern comforts, particularly among millennials and eco-conscious travelers.

Key Market Trends & Insights

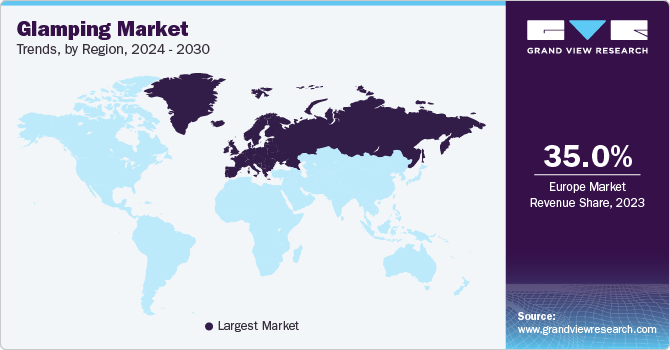

- The Europe glamping market accounted for a share of over 35% of the global market in 2024.

- The U.S. glamping market is expected to grow at a CAGR of 12.8% from 2025 to 2030.

- By accommodation, cabins & pods segment accounted for a revenue share of over 43% in 2024.

- By age group, glamping among 18 to 32 age group segment accounted for a revenue share of over 43% in 2024.

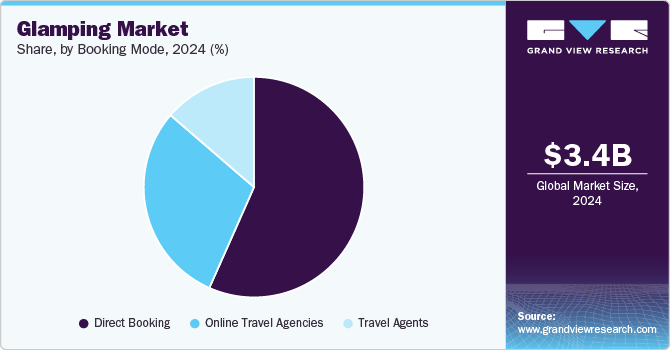

- By booking mode, direct bookings segment accounted for a revenue share of over 55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.45 Billion

- 2030 Projected Market Size: USD 6.18 Billion

- CAGR (2025-2030): 10.3%

- Europe: Largest Market in 2024

The rise in disposable income, coupled with the desire for unique travel experiences, has further spurred the market. Additionally, the growing trend of sustainable tourism and the preference for eco-friendly accommodation are pushing both consumers and operators to embrace glamping.The glamping market is experiencing rapid growth, fueled by the increasing demand for luxury outdoor experiences, particularly from eco-conscious travelers and millennials seeking unique travel options. The rise of new operators-28% of which are in their first year-demonstrates the growing interest in this space, as highlighted by the Glamping Americas 2023 State of the Industry Report. With businesses such as Quaint Glamping and Mitten Getaways Glamping Co. set to launch, the industry is poised for further expansion.

Strategic positioning near natural attractions, such as state and national parks, enhances guest experiences by combining luxury with outdoor exploration. Around 51% of glamping sites are located near state parks in the U.S., and 33% are adjacent to national parks, offering visitors a blend of nature and comfort. Additionally, sustainability and technology integration are expected to play a critical role in the future of the glamping industry. Eco-friendly practices, along with the use of digital solutions for seamless booking, are becoming key factors for both operators and travelers.

The financial dynamics of the glamping industry show that most operators are self-funded, with an average initial investment of USD 650,000. This indicates a strong belief in the industry's potential, driven by both small and large players alike. The market is also benefiting from a growing interest in global expansion and diversification, with new operators entering various regions to cater to evolving traveler preferences, such as remote working options and eco-friendly accommodations.

As the industry looks to 2024 and beyond, trends such as technological integration, sustainability, and a focus on safety and wellness will shape its future. Operators are likely to explore untapped markets, embrace digital innovations like Wi-Fi and EV charging stations, and cater to post-pandemic travel needs, ensuring the glamping sector remains dynamic and appealing.

Accommodation Insights

Cabins & pods accounted for a revenue share of over 43% in 2024. This is mainly due to the growing preference for more permanent, sturdy, and comfortable glamping accommodations. This shift is largely driven by glampers seeking a "home-away-from-home" experience with modern conveniences such as insulated walls, heating, air conditioning, and full bathrooms. Cabins and pods offer a level of privacy, security, and comfort comparable to hotels, making them highly attractive to families and couples.

The demand for tent accommodation is projected to grow at a CAGR of 11.4% from 2025 to 2030, driven by the rising demand for a more immersive and traditional camping experience. Modern glamping tents often feature high-end interiors, including plush beds and en suite bathrooms, while still offering a closer connection to nature than cabins or pods. The rise in eco-conscious travel and the desire for unique, customizable outdoor experiences-ranging from safari tents to yurts-continues to fuel demand for luxury tent accommodations, particularly in remote, picturesque locations.

Age Group Insights

Glamping among 18 to 32 age group accounted for a revenue share of over 43% in 2024, is largely driven by millennials and Gen Z’s inclination toward unique, experience-based travel. These younger generations prioritize adventure, nature, and social media-friendly experiences, which glamping fulfills with its blend of outdoor settings and luxury accommodations. The growth in online searches, influencer-driven content, and a shift toward eco-conscious travel also contribute to glamping's popularity within this demographic. Additionally, flexible work arrangements and the rise of "workcations" enable younger travelers to combine remote work with leisure, further boosting glamping demand among this age group.

The demand for glamping among 33 to 50 age group is projected to grow at a CAGR of 11.0% from 2025 to 2030,attributed to a different set of motivations. This demographic, typically more financially stable and often traveling with family, is drawn to glamping for its comfort, privacy, and upscale amenities that traditional camping lacks. As wellness and relaxation become key aspects of midlife travel, glamping offers the perfect balance between connecting with nature and enjoying luxurious conveniences like spa treatments, farm-to-table dining, and wellness retreats. Moreover, this age group is increasingly seeking family-friendly vacation options that provide a mix of outdoor activities and comfort, driving further growth in demand.

Booking Mode Insights

Direct bookings accounted for a revenue share of over 55% in 2024. One major driver is the increasing reliance on glamping operators' direct websites, which often offer personalized services, exclusive deals, and greater transparency in terms of pricing and amenities. These platforms provide a more tailored customer experience, allowing travelers to communicate specific requests and customize their stay directly with the host. Additionally, many glamping providers promote direct bookings by offering perks such as loyalty discounts, early check-ins, or complimentary upgrades, incentivizing travelers to bypass third-party platforms.

Bookings on online travel agencies are projected to grow at a CAGR of 11.1% from 2025 to 2030 in the glamping market. The rising demand for unique travel experiences has made glamping an appealing alternative to traditional hotels, particularly among millennials and Gen Z, who favor immersive, eco-friendly, and luxury stays. OTAs, with their wide reach and convenience, capitalize on this trend by offering diverse glamping options, ranging from high-end treehouses to safari tents. Additionally, the increasing digitalization of travel booking platforms enhances user accessibility and ease, contributing to the surge in OTA-based glamping reservations. The use of AI-driven personalization on these platforms also plays a crucial role in matching travelers with suitable accommodations, further driving growth.

Regional Insights

The North America glamping market accounted for a share of over 25% of the global market revenue in 2024. The market has seen significant growth in recent years, largely driven by an increasing demand for upscale outdoor experiences. A new report from Kampgrounds of America highlights that 34% of new campers in 2023 opted for glamping, up from 18% in 2021. This growing interest has brought 15.6 million new participants into the sector over the past five years.

U.S. Glamping Market Trends

The U.S. glamping market is expected to grow at a CAGR of 12.8% from 2025 to 2030. A variety of glamping accommodations have emerged across the U.S., offering travelers unique experiences. These range from restored Airstream trailers to yurts and cabins, often situated in scenic locations like private homesteads and ranches. These luxury camping options provide amenities that are not traditionally associated with camping, such as mattresses, upscale bath products, and air conditioning, catering to those seeking nature without sacrificing comfort. Properties like Eastwind Hotels in New York's Catskills offer year-round glamping experiences, combining outdoor activities like skiing and hiking with high-end accommodations. The trend also includes features like wellness programs and "digital detox" experiences, appealing to urban dwellers looking to unplug and reconnect with nature.

Europe Glamping Market Trends

The Europe glamping market accounted for a share of over 35% of the global market in 2024. One major factor driving the market growth is the increasing focus on sustainability, with many glamping sites adopting eco-friendly practices like using renewable energy and sustainable materials. This allows travelers to enjoy nature without a negative environmental impact. Technology is also playing a larger role in glamping, with innovations like smart tents and cabins, high-speed internet in remote locations, and virtual reality experiences that enhance the outdoor adventure while keeping guests connected and entertained.

Asia Pacific Glamping Market Trends

The Asia Pacific glamping industry is expected to grow at a CAGR of 10.8% from 2025 to 2030. One of the growing trends in Asia is the emphasis on wellness, with many glamping sites offering activities like yoga, meditation, and spa treatments. These experiences cater to the increasing demand for personal well-being and mindfulness, providing guests with a holistic retreat in nature. Family-friendly glamping options are on the rise in countries like Japan and India, offering larger accommodations, kid-friendly programs, and pet-friendly amenities, making glamping an appealing option for families and those traveling with pets.

Key Glamping Company Insights

The glamping industry is characterized by its fragmented nature. The fragmented nature of the glamping market is largely due to the presence of a mix of small, independent operators and larger, established companies. The market caters to a wide variety of travelers, from luxury-seeking tourists to eco-conscious adventurers. Many smaller, niche businesses have emerged, each offering unique, personalized experiences. These independent operators focus on boutique, local glamping experiences, such as yurts, safari tents, and treehouses, catering to specific customer preferences. Larger, more established players, on the other hand, offer standardized luxury glamping experiences across multiple locations, leading to a fragmented market structure.

Key Glamping Companies:

The following are the leading companies in the glamping market. These companies collectively hold the largest market share and dictate industry trends.

- Under Canvas

- Collective Retreats

- Tentrr

- Eco Retreats

- Baillie Lodges

- Nightfall Camp Pty Ltd.

- Tanja Lagoon Camp

- Wildman Wilderness Lodge

- Paperbark Camp

- Hoshino Resorts

Recent Developments

-

In September 2024, Quaint Glamping is launching in Twin Mountain, New Hampshire, offering year-round outdoor luxury experiences. The site will feature 15 dome-like structures with modern amenities such as full bathrooms, kitchenettes, and event spaces. This launch aims to cater to the increasing demand for winter glamping.

-

In September 2023, Starlight Haven in Hot Springs, Arkansas, expanded its glamping resort, adding luxurious options like safari tents, geodesic domes, and treehouses. The resort emphasizes sustainability and offers eco-friendly practices while integrating digital services for guest convenience.

Glamping Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.79 billion

Revenue forecast in 2030

USD 6.18 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation, age group, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Netherlands; China; Japan; India; Australia; Brazil; Argentina; South Africa; UAE

Key companies profiled

Under Canvas; Collective Retreats; Tentrr; Eco Retreats; Baillie Lodges; Nightfall Camp Pty Ltd.; Tanja Lagoon Camp; Wildman Wilderness Lodge; Paperbark Camp; Hoshino Resorts

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

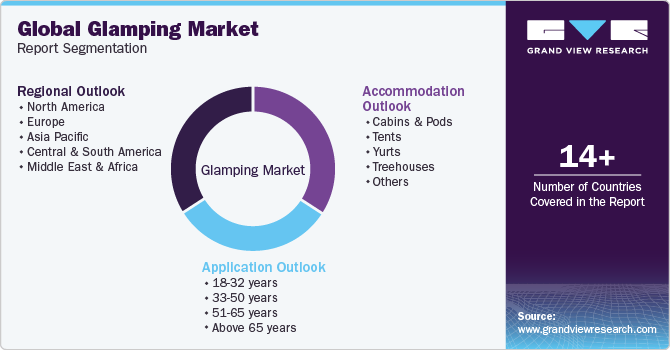

Global Glamping Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global glamping market report based on accommodation, age group, booking mode, and region:

-

Accommodation Outlook (Revenue, USD Million, 2018 - 2030)

-

Cabins & Pods

-

Tents

-

Yurts

-

Treehouses

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18 - 32 years

-

33 - 50 years

-

51 - 65 years

-

Above 65 years

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Booking

-

Travel Agents

-

Online Travel Agencies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global glamping market was estimated at USD 3.45 billion in 2024 and is expected to reach USD 3.79 billion in 2025.

b. The global glamping market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 6.19 billion by 2030.

b. Europe region dominated the global glamping market with a share of over 35% in 2024. This is attributable to the major tour operators and online glamping service providers focusing on introducing different accommodation types to attract consumers.

b. Some key players operating in the global glamping market include Under Canvas; Collective Retreats; Tentrr; Eco Retreats; Baillie Lodges; Nightfall Camp Pty Ltd.; Tanja Lagoon Camp; Wildman Wilderness Lodge; Paperbark Camp.

b. Key factors that are driving the glamping market growth include a rise in eco-tourism and consumer inclination toward adventure travel and the rising popularity of wellness tourism owing to the increasing number of travelers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.