- Home

- »

- Medical Devices

- »

-

Glaucoma Surgery Devices Market Size, Share Report, 2030GVR Report cover

![Glaucoma Surgery Devices Market Size, Share & Trends Report]()

Glaucoma Surgery Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Laser Systems, Diamond Knives), By Surgery Method (MIGS, Laser Surgery), By End-use (Hospitals, Ophthalmic Clinics), And Segment Forecasts

- Report ID: GVR-4-68038-197-9

- Number of Report Pages: 188

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glaucoma Surgery Devices Market Summary

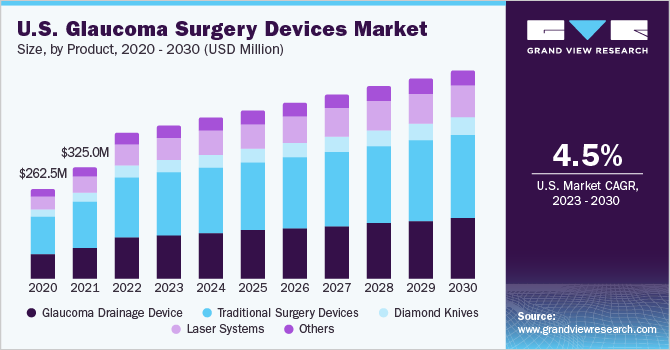

The global glaucoma surgery devices market size was estimated to reach USD 1.57 billion in 2022 and is estimated to grow at a CAGR of 4.61% from 2025 to 2030. Driving factors include a rising elderly population, growing adoption of surgical treatments for glaucoma, an increasing number of government & non-government glaucoma care initiatives, and a high prevalence of diabetes.

Key Market Trends & Insights

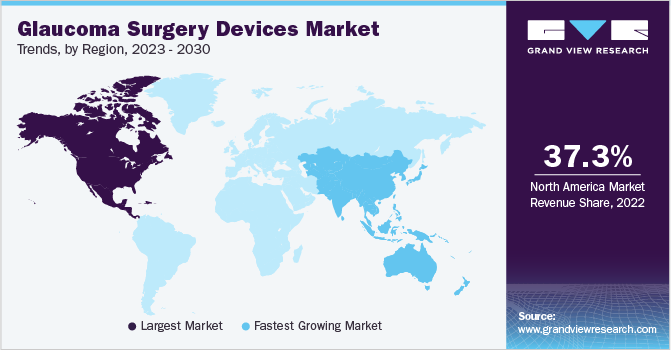

- North America dominated the market, accounting for the largest share of 37.26% in 2022.

- By product, the traditional surgery devices segment dominated the market, capturing over 40% of the global revenue share in 2022.

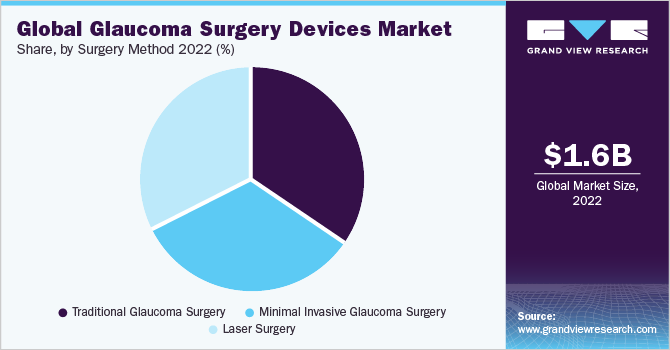

- By surgery method, the traditional glaucoma surgery segment held the largest share of 35.11% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.57 Billion

- 2030 Projected Market Size: USD 2.27 Billion

- CAGR (2023-2030): 4.61%

- North America: Largest market in 2022

Lifestyle changes have increased the incidence of various diseases that cause visual impairment, such as diabetes and hypertension. Conditions, such as cataracts, glaucoma, age-related macular degeneration, and diabetic retinopathy, are major causes of visual impairment and blindness globally. The market is anticipated to be driven by the increased government efforts to raise awareness about visual impairments.

According to the WHO, about 6.9 million people globally have glaucoma. The rise in visual impairment also presents social & economic challenges. People in China, India, and sub-Saharan Africa are affected by eye disorders, such as cataracts and glaucoma. The remainder consisted of people with trachoma, glaucoma, onchocerciasis, and other diseases common in youngsters. VISION 2020: Right to Sight-INDIA was created in partnership with the Indian government by the WHO and the International Agency for the Prevention of Blindness (IAPB). It was established in 2004 as an additional NGO federation to the global organization. It assists in creating state-level plans and programs, which the state governments direct with significant participation from local and international NGOs.

It also plans additional events, such as Eye Donation Fortnight and World Sight Day, with the active involvement of the Indian government. In recent years, patients have been opting for permanent surgical solutions over long-term management with prescription drugs. Glaucoma patients are usually characterized by taking two or more different medications depending upon the stage of glaucoma, thus creating a lot of patient compliance issues. Undergoing a glaucoma surgery significantly reduces the medication burden of the patients. Moreover, therapeutic efficiency issues associated with medication, such as low bioavailability, drug resistance, and toxicity, have increased the demand for surgical procedures and devices, thereby fostering market growth.

Product Insights

Based on product, the market is classified into glaucoma drainage devices, traditional surgery devices, diamond knives, laser systems, and others. The glaucoma drainage devices segment is further categorized into valves, glaucoma drainage implants, glaucoma tube shunts, and stents. Traditional surgery devices include scalpels, forceps, ophthalmic scissors, punch, sutures, surgical drapes, microcatheter, and others. The traditional surgery devices segment dominated the market in 2022 by capturing over 40% of the global revenue share. This is attributed to the high preference for traditional glaucoma surgery, known as trabeculectomy.

Trabeculectomy is considered the best treatment option for people with advanced glaucoma or those who have failed medical or laser treatments for glaucoma. The diamond knives segment is expected to witness the highest CAGR of 5.42% during the forecast period owing to their accuracy and delicacy during eye surgery. Diamond knives have exceptional sharpness, durability, and the ability to produce precise incisions in delicate eye tissues. These devices are frequently utilized in microsurgical treatments. In glaucoma surgery, diamond knives may be used in certain procedures like trabeculectomy, deep sclerectomy, and canaloplasty.

Surgery Method Insights

Based on the surgery method, the market is segmented into traditional glaucoma surgery, minimally invasive glaucoma surgery (MIGS), and laser surgery. The traditional glaucoma surgery segment held the largest share of 35.11% in 2022. Traditional glaucoma surgeries are more invasive than newer MIGS but can be highly effective, especially in cases of advanced or refractory glaucoma. However, longer hospital stays, availability of other advanced surgical technology and devices, and increased chances of postoperative complications, such as leakage, hypotony, choroidal effusion, and hyphema, are some of the factors driving the patients and surgeons to opt for alternatives.

The traditional glaucoma surgery segment is further divided into trabeculectomy and tube shunt surgery. The MIGS segment is further categorized into trabecular meshwork bypass, suprachoroidal space implants, subconjunctival space implants, schlemm’s canal implants, gonioscopy-assisted transluminal trabeculectomy, and endocyclophotocoagulation. The laser surgery segment is sub-segmented into trabeculoplasty, iridotomy, and cyclophotocoagulation. Minimally invasive glaucoma surgery is expected to exhibit the fastest CAGR of 5.43% during the forecast period.

Shorter hospital stays and smaller incisions that lead to shorter recovery times are some of the major factors contributing to the segment's growth. In addition, clinical evidence suggests that the use of two iStent’s (MIGS devices) for an efficient treatment of glaucoma is expected to drive the segment. Furthermore, frequent product launches & approvals are expected to boost the segment growth over the forecast period. For instance, in August 2022, Glaukos Corp. received FDA 510 (k) clearance for iStent Infinite'. The product is used in a standalone procedure to reduce elevated Intraocular Pressure (IOP) in patients with primary open-angle glaucoma.

End-use Insights

Based on end-use, the market is segmented into hospitals, ophthalmic clinics, and others. The hospitals segment held the largest market share of 36.68% in 2022 and is expected to exhibit a lucrative CAGR over the forecast period. A large patient base, availability of highly skilled medical professionals, and advanced surgical devices are the key factors expected to boost the segment growth. Furthermore, investments in ophthalmic equipment, including IOLs, are gradually rising in hospitals, driving market growth. The ophthalmic clinics segment is expected to witness the fastest CAGR of 4.80% over the forecast period. This can be attributed to the increasing number of patients suffering from ophthalmic and other related disorders.

In addition, factors, such as the increasing number of individuals visiting ophthalmic clinics in developing economies, especially in rural areas, and easy accessibility are anticipated to boost the demand for ophthalmic equipment in ophthalmic clinics, thereby driving the growth of this segment over the forecast period. The others segment includes academics, research institutes, and mobile ophthalmic units. The others segment is expected to register a significant CAGR over the forecast. The rising number of undiagnosed glaucoma cases, increasing investments in glaucoma research, and poor healthcare facilities in remote areas are among the key factors expected to fuel the growth of this segment over the forecast period.

Regional Insights

North America dominated the market in 2022 accounting for the largest share of 37.26% of the overall revenue. It is expected to maintain its dominance during the forecast period. Major factors contributing to the growth of this region include the increasing geriatric population, the growing burden of diabetes due to lifestyle changes, the rising prevalence of obesity, and the high cost of treatment. According to the American Diabetes Association, in 2021, the North America and Caribbean region had the highest expenditure for diabetes of around USD 415 billion, which accounted for around 43% of global expenditure. The adoption of smart diabetes devices and technologically advanced devices, such as Artificial Intelligence (AI) and data analytics, are also driving the market growth.

Europe accounted for over 24% share of the global revenue in 2022 and held the second position in the industry. The region has a dynamic reimbursement paradigm for glaucoma surgery, where some countries have proper coverage of modern surgery devices and methods while others must cater to trabeculectomy despite the availability of wider options. According to the International Diabetes Federation report (2021), approximately 61 million people in Europe suffer from diabetes, which accounts for around 1 in 11 adults. The Russian Federation, Germany, Turkey, Spain, and Italy are the top five countries in Europe with a high prevalence of diabetes.

Asia Pacific is expected to witness the fastest CAGR of 5.23% during the forecast period. The Asia Pacific market is majorly driven by China and Japan. China dominated the overall regional market in 2022, in terms of revenue share. This can be attributed to the presence of major market players and the high prevalence of diabetes in the country. In addition, technological advancements in glaucoma surgery devices, the increasing geriatric population, and the growing prevalence of lifestyle diseases, such as obesity, are anticipated to promote the growth of the regional market in the years to come.

Key Companies & Market Share Insights

The market is highly fragmented. Key players in the market are adopting strategic initiatives, such as mergers and acquisitions, to strengthen their product portfolios. For instance, in April 2023, Nova Eye Medical Ltd. received FDA 510 (k) clearance for its canaloplasty product ' iTrack Advance'. The product is indicated to reduce IOP in adult patients with primary open-angle glaucoma. In July 2022, iSTAR Medical and AbbVie announced a strategic partnership for the treatment of glaucoma. This collaboration gave AbbVie the chance to significantly diversify its line of eye care products and give glaucoma patients more treatment options. Some of the prominent players in the global glaucoma surgery devices market include:

-

Alcon, Inc.

-

Glaukos Corporation

-

Johnson & Johnson Vision

-

AbbVie Inc. (Allergan Plc.)

-

ASICO, LLC

-

Carl Zeiss Meditec AG

-

Katalyst Surgical

-

Lumenis Lt.

-

Ziemer Ophthalmic Systems AG

-

Iridex Corporation.

-

Altomed

Glaucoma Surgery Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.66 billion

Revenue forecast in 2030

USD 2.27 billion

Growth rate

CAGR of 4.61 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product, surgery method, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Alcon, Inc.; Glaukos Corp.; Johnson & Johnson Vision; AbbVie Inc. (Allergan Plc.); ASICO, LLC; Carl Zeiss Meditec AG; Katalyst Surgical; Lumenis Ltd.; Ziemer Ophthalmic Systems AG; Iridex Corp.; Altomed

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glaucoma Surgery Devices Market Report Segmentation

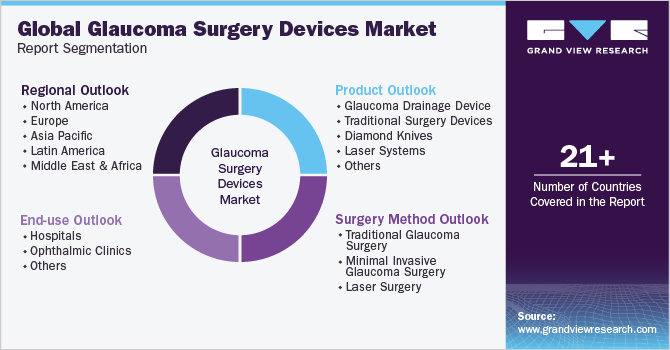

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the glaucoma surgery devices market report based on product, surgery method, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glaucoma Drainage Device

-

Valves

-

Glaucoma Drainage Implant

-

Glaucoma Tube Shunts

-

Stents

-

-

Traditional Surgery Devices

-

Scalpel

-

Forceps

-

Ophthalmic Scissors

-

Punch

-

Sutures

-

Surgical Drapes

-

Microcatheter

-

Others

-

-

Diamond Knives

-

Laser Systems

-

Others

-

-

Surgery Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Glaucoma Surgery

-

Trabeculectomy

-

Tube Shunt Surgery

-

-

Minimal Invasive Glaucoma Surgery

-

Trabecular Meshwork Bypass

-

Suprachoroidal Space Implants

-

Subconjunctival Space Implants

-

Schlemm’s Canal Implants

-

Gonioscopy-assisted Transluminal Trabeculectomy

-

Endocyclophotocoagulation

-

-

Laser Surgery

-

Trabeculoplasty

-

Iridotomy

-

Cyclophotocoagulation

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global glaucoma surgery devices market size accounted for USD 1.57 billion in 2022 and is anticipated to reach 1.66 billion in 2023.

b. The global glaucoma surgery devices market is expected to grow at a CAGR of 4.61% from 2023 to 2030 to reach USD 2.27 billion by 2030

b. In 2022, North America dominated the market in terms of a revenue share of 37.26%. The market's growth in North America is boosted by the increasing prevalence of diabetes and related comorbidities due to lifestyle changes, the rising geriatric population, the growing prevalence of obesity, and the high cost of treatment.

b. Some key players operating in the glaucoma surgery devices market include Alcon, Inc.; Glaukos Corporation; Abbott Medical Optics; Allergan Plc.; ASICO; Carl Zeiss Meditec AG; Katalyst Surgical; Lumenis Ltd.; Ziemer Ophthalmic Systems AG; and Iridex Corporation.

b. Key factors that are driving the market growth include the rising prevalence of glaucoma, growing demand for minimally invasive glaucoma procedures, and increasing participation of public and private sectors in sponsoring glaucoma surgery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.