- Home

- »

- Homecare & Decor

- »

-

Bathroom Vanities Market Size, Share & Trends Report, 2030GVR Report cover

![Bathroom Vanities Market Size, Share & Trends Report]()

Bathroom Vanities Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Non-residential), By Material (Stone, Glass, Metal), By Size (24 - 35 inch, 38 - 47 inch), By Region, And Segment Forecasts

- Report ID: 978-1-68038-391-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bathroom Vanities Market Summary

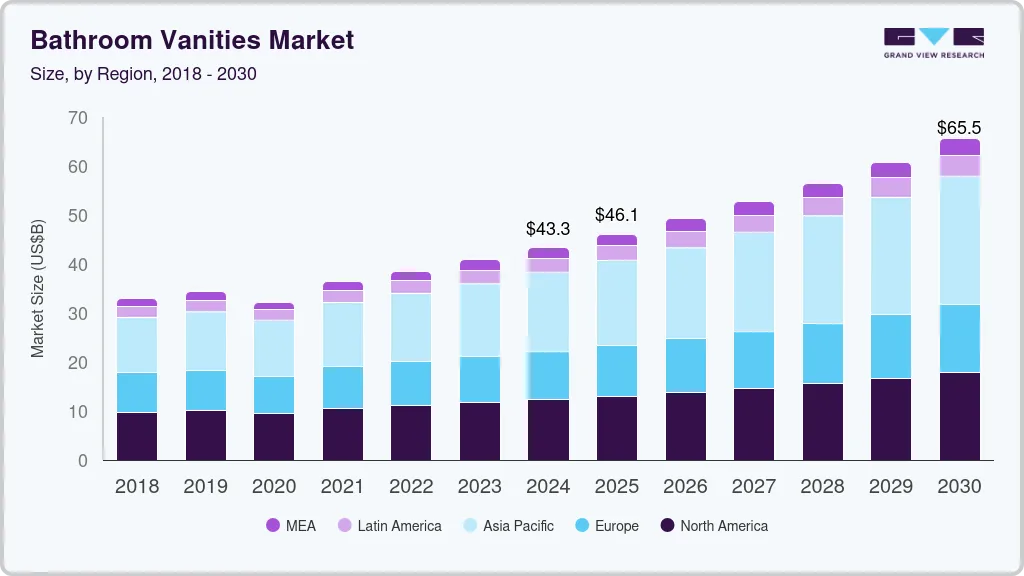

The global bathroom vanities market size was estimated at USD 43.34 billion in 2024 and is projected to reach USD 65.55 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The increasing trend of bathroom remodeling and home restoration activities across major economies is expected to elevate the demand for bathroom furniture in the coming years.

Key Market Trends & Insights

- The bathroom vanities market in North America accounted for a market share of 28.64% in 2024.

- The bathroom vanities market in the U.S. accounted for a market share of around 71.19% in 2024 in the North American market.

- By application, the demand in the residential sector accounted for a market share of 76.72% in 2024.

- By material, wood accounted for 34.43% of the market in 2024.

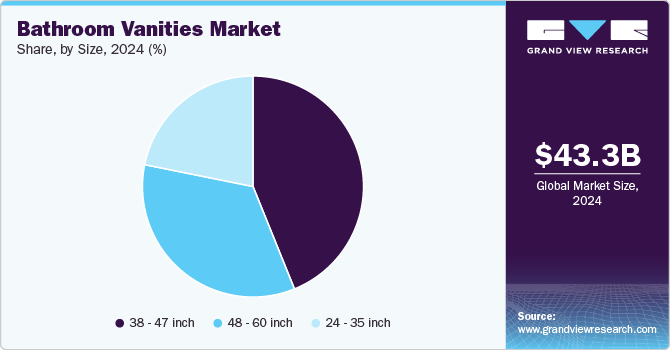

- By size, bathroom vanities of 38 - 47 inch size accounted for a share of 43.88% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 43.34 Billion

- 2030 Projected Market Size: USD 65.55 Billion

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

As a fairly consolidated industry, major companies, including Masco, RSI Home Products, American Woodmark, and Kohler, hold sizeable shares in the market as of 2022. Moreover, branding and customized offerings are expected to be key to being competitive in this market. Eco-friendly and durable bathroom vanities are also expected to gain prominence in the market over the forecast period.There has been a growing demand for environment-friendly and sustainable home furniture, including bathroom vanities. For instance, according to a 2021 SFC survey, in the U.S., nearly 97% of respondents expressed an interest in purchasing environmentally friendly furniture for their homes, assuming favorable style and cost are about the same. According to the same survey, it was noted that most respondents (87%) were willing to pay at least 5% to 10% more for environmentally friendly furniture products, including bathroom furniture.

Moreover, key market players are investing in R&D and introducing new products regularly to stay competitive and grow their business over time. For instance, in July 2022, Wilsonart LLC announced its Wilsonart HPL Commercial Collection and the Wilsonart Traceless Laminate Collection. The designs feature new textures and surfaces that create realistic and authentic spaces. The Aligned Walnut Finish is a highlight of this new portfolio and can be paired with four new colors to create walnut designs.

In addition, bathroom vanities come in various sizes to accommodate bathrooms of different dimensions. These are typically purchased in colors and accents that complement the bathroom interiors. Customization of bathroom vanities is, therefore, a popular trend among consumers. According to a Houzz 2022 study, around 60% of consumers in the UK prefer customizing their bathroom furniture during bathroom remodeling. In response to this trend, major players have been offering personalized options according to the requirements of the consumers.

Furthermore, the popularity of bathroom furniture, including cabinets, shelves, and storage products, is due to rising urbanization and a significant increase in consumer adoption. Product manufacturers operating in this space are taking major initiatives such as advancements in raw materials, manufacturing technologies, and connected technology to cater to ever-growing consumer demand. This is expected to offer key players lucrative business expansion opportunities. The continued emphasis of manufacturers on new product development and improvements will also contribute to the market's future expansion.

With rising costs associated with home prices and mortgage rates, consumers are increasingly investing in home improvement or remodeling projects to revamp their traditional household structure. Growing home values have doubled homeowner equity in the past five years, thus indicating a trend of homeowners feeling richer and disposed toward spending money on home improvement.

The demand for built-in organizational features, such as electrical strips that allow curling irons or electric toothbrushes to be used off counters, is expected to boost profits. Integrated LED lighting in storage offerings with decorative feet and door options has raised customer interest in premium features and finishes.

With the increasing expansion of real estate and commercial constructions, the market is bound to grow in the bathroom fittings industry, thereby propelling the demand for bathroom vanities in commercial and residential settings. According to a Global Real Estate report published by Morgan Stanley Capital International (MSCI) in 2021, the professionally managed real estate market's size increased to USD 11.4 trillion from USD 10.5 trillion in 2020. A total of 40.2% of the estimated global market size came from the Americas region. This was an increase of 12.9% from 2020, coming in at USD 4.6 trillion.

Application Insights

The demand in the residential sector accounted for a market share of 76.72% in 2024. Increasing residential construction across developing economies such as China, India, and Indonesia opens new growth avenues for market growth. According to the World Economic Forum, approximately 200,000 people migrate to urban areas daily for affordable housing and infrastructure.

Nonresidential application demand is expected to grow at the fastest CAGR of 8.3% from 2025 to 2030. Rapid commercial construction, especially in the hospitality sector, has also driven demand for bathroom vanities. The hotel industry significantly contributes to the hospitality market, fueling the development of new hotels and rooms. For instance, according to TOPHOTELPROJECTS, in April 2022, 431 new hotels were planned to open in the UK over the next few years, out of which 112 were scheduled to open by the end of 2022.

Material Insights

Wood accounted for 34.43% of the market in 2024. Due to its aesthetic appeal, consumers highly prefer wood. In addition, wood is a major component in cabinets, especially modern cabinetry, which is often frameless and typically constructed from engineered materials such as MDF, plywood, or chipboard. Moreover, plywood is an excellent choice for bathroom vanities among different wood types.

Demand for glass bathroom vanities is projected to expand at a CAGR of 9.2% from 2025 to 2030. The growing popularity of eco-friendly products such as glass knobs and frames is expected to drive demand over the forecast period. Glass is easy to maintain and is non-toxic as it does not contain hazardous chemicals, additives, or petroleum resins. Glass countertops mainly consist of semi-precious stone fragments, post-consumer recycled glass, and transparent tempered glass.

Size Insights

Bathroom vanities of 38 - 47 inch size accounted for a share of 43.88% in 2024. The category is primarily driven by spacious storage and its suitability for small bathrooms. Medium-sized vanities are characterized by their compact shape, which improves their visual appeal. There is a growing demand for the 38-47 inch range in residential and non-residential application categories.

The demand for 24 - 35-inch items is expected to grow at a CAGR of 8.2% from 2025 to 2030. Small bathroom products are preferred in urban areas due to limited space availability, thereby driving the demand for this category. For instance, according to a blog published by Flexible Finance Inc. in January 2023, the average size of flats is getting smaller as more micro-apartments are built. The typical new apartment is just 941 square feet in size, which is 5% less than it was a decade ago. This is expected to drive segment growth over the forecast period.

Regional Insights

The bathroom vanities market in North America accounted for a market share of 28.64% in 2024. The demand for bathroom vanities is majorly attributed to Americans' increasing spending on residential renovations and repairs. North America is a key region for this market owing to several high-priced hotels providing world-class facilities and a boost of expensive and exquisite bathroom fittings for a competitive edge. Another noteworthy trend in North America is the increase in investments in residential construction. Consumers in the region seek premium products as a one-time investment. This has driven the installations of distinctive and creative designs that fit in with every aspect of home décor setups. Regional companies are segmenting their markets to gain a competitive edge and meet regional demand.

U.S. Bathroom Vanities Market Trends

The bathroom vanities market in the U.S. accounted for a market share of around 71.19% in 2024 in the North American market. A high fascination for bathrooms among American households and commercial sectors such as hotels, restaurants, or any other public areas has resulted in a prominent demand for bathroom vanity installations. As per the housing layout patterns in America, almost all the bedrooms have an attached washroom. According to the U.S. Census Bureau, in 2021, out of 371,000 multi-family units, 160,000 had only one bedroom, and 35,000 had three or more bedrooms. The higher the number of bedrooms, the greater the number of bathrooms, leading to increased demand for bathroom vanities.

Europe Bathroom Vanities Market Trends

The bathroom vanities market in Europe accounted for a market share of 23.23% in 2024 in the global market. Numerous industries in the European markets are currently experiencing a good demand momentum, and this trend appears to last the rest of the forecasted year. A significant growing trend in hotel reservations across major tourist destinations in Europe is observed. These trends indicate the resurgence of travel in Europe, which is pushing hoteliers to renovate the rooms according to customer needs. The European hotel industry is undergoing a technological and luxury transformation to adapt to new and innovative products and services, majorly driven by the changing client needs. This renovation will likely focus on every area, including the hotel room bathrooms and walk-in cabinets, thereby driving the application of bathroom vanities.

Asia Pacific Bathroom Vanities Market Trends

The bathroom vanities market in Asia Pacific is anticipated to rise at a CAGR of 8.4% from 2025 to 2030. The region is expected to grow substantially during the forecast years because of the range of products offered by various regional and international market players, such as pedestals, freestanding, and under-mounted sinks & cabinets. According to data released by the United Nations Environment Programme (UNEP) in 2021, construction in the Asia Pacific is booming, and by 2040, the region will be home to nearly half of all new construction in the world.

Key Bathroom Vanities Company Insights

The market is fragmented and highly competitive, with a range of companies offering various products. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to compete effectively.

Key Bathroom Vanities Companies:

The following are the leading companies in the bathroom vanities market. These companies collectively hold the largest market share and dictate industry trends.

- American Woodmark Corporation

- Avanity Corporation

- Bellaterra Home, LLC

- Design Element Group, Inc.

- Design House (DHI Corp.)

- Empire Industries, Inc.

- Foremost Groups

- Wyndham Collection

- Kohler Company

- Water Creation, Inc.

- Wilsonart LLC

- Dupont Kitchen and Bath Fixtures

- Caesarstone

Recent Developments

-

In January 2023, Caesarstone launched its latest multi-material surfaces portfolio at the Kitchen & Bath Industry Show held at the Las Vegas Convention Center in the U.S. Porcelain and Natural Stone ranges were added to its Quartz and Outdoor Quartz portfolio.

-

In October 2022, Kohler Company unveiled its new line Anthem, which includes shower controls and valves. The products are created to provide users with an immersive showering experience tailored to their unique requirements. The line is available in both analog and digital control panels.

-

In October 2022, American Woodmark Corporation announced an investment of around USD 65 million to increase its kitchen and bath cabinet capacity in North Carolina, U.S., and Monterrey, Mexico. To improve the overall supply chain and capacity in both categories on the East Coast, it plans to build a fourth facility in Mexico and expand its Hamlet, North Carolina site.

Bathroom Vanities Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 46.12 billion

Revenue forecast in 2030

USD 65.55 billion

Growth rate (revenue)

CAGR of 7.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, material, size, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

American Woodmark Corporation; Avanity Corporation; Bellaterra Home, LLC; Design Element Group, Inc.; Design House (DHI Corp.); Empire Industries, Inc.; Foremost Groups; Wyndham Collection; Kohler Company; Water Creation, Inc.; Wilsonart LLC;Dupont Kitchen and Bath Fixtures; Caesarstone

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Bathroom Vanities Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bathroom vanities market report based on application, material, size, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stone

-

Ceramic

-

Glass

-

Wood

-

Metal

-

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

24 - 35 Inch

-

38 - 47 Inch

-

48 - 60 Inch

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bathroom vanities market was estimated at USD 43.34 billion in 2024 and is expected to reach USD 46.12 billion in 2025.

b. The global bathroom vanities market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 65.55 billion by 2030.

b. Asia Pacific dominated the bathroom vanities market, with a share of around 35% in 2024. This is owing to the rising population, improving standards of living, and increased spending power, which bode well for this regional market.

b. Some of the key players operating in the bathroom vanities market include American Woodmark Corporation, Avanity Corporation, Bellaterra Home, LLC, Design Element Group, Inc., Design House (DHI Corp.), Empire Industries, Inc., and Foremost Groups. Wyndham Collection, Kohler Company, Water Creation, Inc., Wilsonart LLC, Dupont Kitchen and Bath Fixtures, Caesarstone.

b. Key factors that are driving the bathroom vanities market growth the rising consumer disposable incomes, changing lifestyles, and increasing home renovation projects and hospitality projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.