- Home

- »

- Advanced Interior Materials

- »

-

Ceramic Matrix Composites Market, Industry Report, 2030GVR Report cover

![Ceramic Matrix Composites Market Size, Share & Trends Report]()

Ceramic Matrix Composites Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Oxides, Silicon Carbide, Carbon), By Application (Aerospace, Defense, Energy & Power, Electrical & Electronics, Hypersonic Missiles), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-254-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Matrix Composites Market Summary

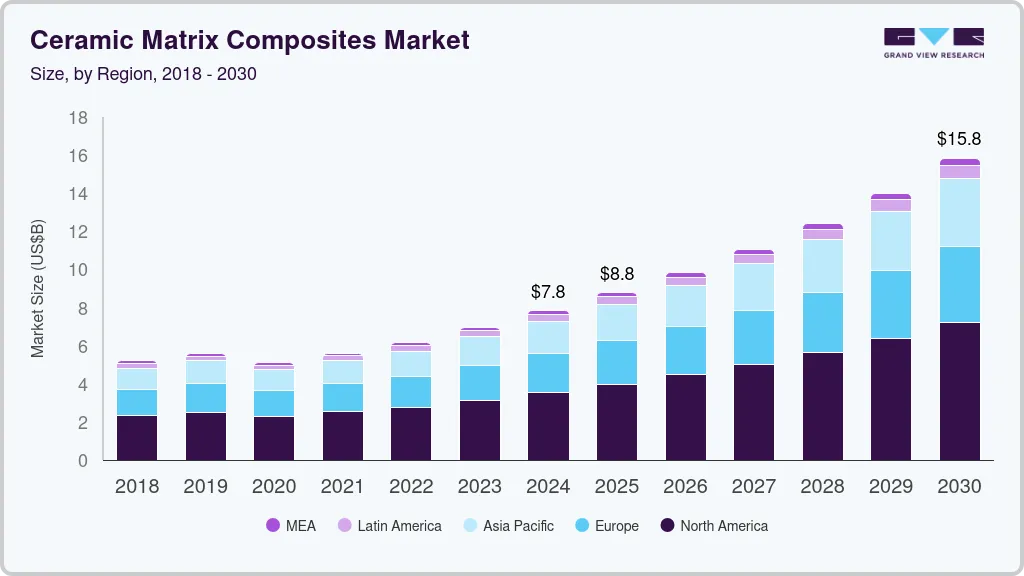

The global ceramic matrix composites market size was estimated at USD 7.83 billion in 2024 and is projected to reach USD 15.83 billion by 2030, growing at a CAGR of 12.5% from 2025 to 2030. The growth is driven by the increasing demand for lightweight and high-performance materials across various industries.

Key Market Trends & Insights

- North America dominated the ceramic matrix composites industry and accounted for the largest revenue share of 45.2% in 2024.

- Based on product, the carbon segment led the market and accounted for the largest revenue share of 49.59% in 2024.

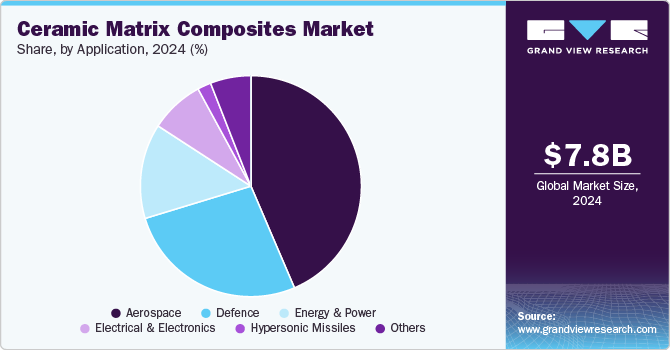

- Based on application, the aerospace segment dominated the market and accounted for the largest revenue share of 43.77% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.83 Billion

- 2030 Projected Market Size: USD 15.83 Billion

- CAGR (2025-2030): 12.5%

- North America: Largest market in 2024

These composites offer superior mechanical properties, including high-temperature resistance, low weight, and enhanced durability, making them ideal for aircraft engine components, thermal protection systems, and missile applications. The growing emphasis on fuel efficiency and environmental regulations has further accelerated the use of CMCs in commercial aircraft, as they help reduce fuel consumption and emissions while improving overall operational efficiency.

The growing investments in energy and power generation sectors also contribute to market expansion. CMCs are widely utilized in gas turbines, nuclear reactors, and other high-temperature applications where traditional metal alloys fail to perform efficiently. The increasing global focus on clean energy, along with advancements in power generation technologies, has led to higher adoption of CMCs in industrial gas turbines and renewable energy systems. Their ability to enhance efficiency, reduce maintenance costs, and withstand extreme conditions positions them as a critical material in modern energy solutions.

Furthermore, ongoing research and development (R&D) activities and technological advancements are playing a crucial role in driving the growth of the ceramic matrix composites industry. Leading manufacturers and research institutions are actively engaged in developing advanced CMCs with improved properties and cost-effective production techniques. The introduction of innovative fabrication methods, such as additive manufacturing and hybrid CMC processing, is expected to enhance the scalability and affordability of these materials, further driving their adoption across diverse applications.

Market Concentration & Characteristics

The global ceramic matrix composites (CMC) market exhibits a moderate to high market concentration, with a few dominant players such as General Electric, Rolls-Royce, and SGL Carbon holding significant market shares. The degree of innovation in this market is high, driven by advancements in manufacturing techniques such as additive manufacturing and infiltration processing, which enhance CMC properties like thermal resistance and durability. Additionally, there is an increasing focus on mergers, acquisitions, and strategic collaborations as companies seek to strengthen their supply chains and expand their technological expertise. The impact of regulations is considerable, particularly in aerospace and defense applications, where stringent standards related to material performance and environmental sustainability influence product development and commercialization.

The presence of service substitutes for CMCs, such as metal alloys and polymer-based composites, remains a limiting factor in certain applications, but CMCs continue to gain preference due to their superior strength-to-weight ratio and thermal stability. The end-use concentration is predominantly in aerospace, automotive, energy, and industrial sectors, with aerospace leading due to the increasing adoption of CMCs in aircraft engines and structural components. As industries seek lightweight, high-performance materials for improved fuel efficiency and reduced emissions, the demand for CMCs is expected to rise, further shaping market dynamics.

Product Insights

The carbon segment led the market and accounted for the largest revenue share of 49.59% in 2024, driven by increasing demand for lightweight and high-strength materials across various industries. Carbon-based ceramic matrix composites offer exceptional mechanical properties, including high-temperature resistance, excellent thermal stability, and superior strength-to-weight ratio. These characteristics make them highly suitable for aerospace, defense, and automotive applications, where reducing weight while maintaining structural integrity is a critical requirement. The growing emphasis on fuel efficiency and emission reduction in the transportation sector further propels the adoption of carbon-based CMCs, as they contribute to improved performance and lower environmental impact.

The silicon carbide segment is expected to grow at the fastest CAGR of 13.6% over the forecast period, driven by its superior properties such as high-temperature resistance, excellent strength-to-weight ratio, and exceptional wear and corrosion resistance. These characteristics make SiC-based CMCs highly desirable in industries such as aerospace, defense, automotive, and energy. In the aerospace sector, the increasing demand for lightweight yet durable materials to enhance fuel efficiency and performance in aircraft engines and structural components is a key driver. Silicon carbide CMCs are being increasingly utilized in next-generation jet engines due to their ability to withstand extreme temperatures while reducing overall engine weight, leading to improved efficiency and lower emissions.

Application Insights

The aerospace segment dominated the market and accounted for the largest revenue share of 43.77% in 2024. CMCs offer superior mechanical properties, including high-temperature resistance, enhanced toughness, and reduced weight compared to traditional metal alloys. These advantages contribute to improved fuel efficiency and overall performance in both commercial and military aerospace applications. With stringent environmental regulations and industry-wide efforts to reduce carbon emissions, the aerospace sector is increasingly adopting CMCs to enhance engine efficiency and structural durability while minimizing fuel consumption.

The hypersonic missiles segment is expected to grow at the fastest CAGR of 13.5% over the forecast period, driven by advancements in aerospace and defense technologies. One of the primary drivers is the increasing demand for hypersonic weapons due to their strategic advantages in modern warfare. Hypersonic missiles, which travel at speeds exceeding Mach 5, require materials that can withstand extreme temperatures and mechanical stress. CMCs, known for their high thermal stability, superior strength-to-weight ratio, and resistance to oxidation, are essential for ensuring the structural integrity and performance of these missiles during high-speed flight. The enhanced durability and lightweight nature of CMCs contribute to improved maneuverability and fuel efficiency, making them a preferred material in the development of next-generation hypersonic missile systems.

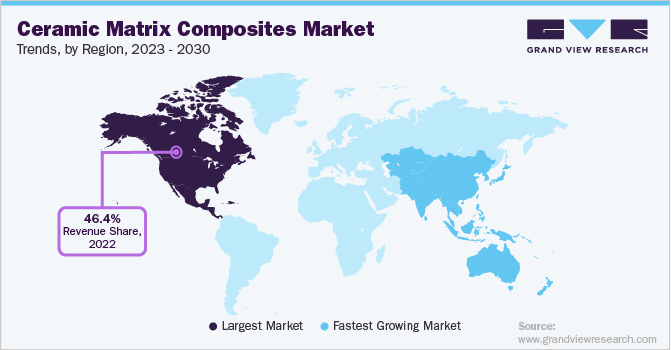

Regional Insights

North America dominated the ceramic matrix composites industry and accounted for the largest revenue share of 45.2% in 2024. Advancements in manufacturing technologies are contributing to the rapid growth of the CMC market in North America. Cutting-edge techniques such as additive manufacturing, automated fiber placement, and advanced sintering processes are making the production of CMCs more cost-effective and scalable. These improvements enhance the material’s mechanical properties while reducing production costs, allowing for broader adoption across multiple industries. With ongoing research focused on optimizing manufacturing efficiency and reducing defects, the commercialization of CMCs is expected to accelerate further.

U.S. Ceramic Matrix Composites Market Trends

The growing aerospace industry in the U.S. is a significant driver of the ceramic matrix composites industry. CMCs are highly sought after for their exceptional ability to withstand high temperatures and mechanical stresses, making them ideal for aerospace components such as turbine engines, thermal shields, and high-performance airframes. The advancement of commercial and military aerospace projects, such as next-generation aircraft, space exploration technologies, and hypersonic vehicles, has created a demand for materials with superior thermal resistance and light weight. CMCs' ability to improve fuel efficiency and performance in extreme conditions makes them a key material in modern aerospace engineering, boosting market growth.

Europe Ceramic Matrix Composites Market Trends

Europe's focus on sustainable energy generation, including nuclear, geothermal, and renewable sources, has spurred demand for CMCs. CMCs offer exceptional resistance to heat and radiation, making them ideal for components used in nuclear reactors and advanced energy generation systems. Their ability to withstand high temperatures and harsh environmental conditions is essential in improving the efficiency and safety of energy production, which is crucial for Europe’s long-term energy strategy. The growing shift towards cleaner, more efficient energy sources enhances the role of CMCs in the region’s energy infrastructure.

Germany ceramic matrix composites market is expected to grow during the forecast period. The automotive industry in Germany is driving the demand for CMCs, particularly in the context of electric vehicle (EV) development and high-performance vehicle components. As manufacturers focus on reducing the weight of vehicles to improve energy efficiency and reduce emissions, CMCs are being adopted for high-temperature applications such as brake discs, turbochargers, and exhaust systems. The lightweight and high-strength properties of CMCs enable better fuel efficiency and enhanced performance in both conventional and electric vehicles. Germany’s automotive giants, including BMW, Mercedes-Benz, and Volkswagen, are increasingly investing in advanced materials like CMCs to develop next-generation automotive technologies, thereby boosting market growth.

Asia Pacific Ceramic Matrix Composites Market Trends

The growth of the space exploration and satellite industry in Asia Pacific is driving the demand for ceramic matrix composites. As countries like India and China expand their space programs, there is a growing need for advanced materials that can endure the harsh conditions of space travel. Ceramic matrix composites are used in rocket nozzles, heat shields, and other critical components that must endure extreme thermal stresses and high-speed friction. The rapid development of space exploration capabilities and the increased launch frequency in Asia Pacific are expected to drive significant demand for CMCs in the region’s aerospace and space industries.

China ceramic matrix composites market is expected to witness steady growth over the forecast period. China’s focus on advancing manufacturing technologies plays a crucial role in market expansion. The country has invested heavily in improving CMC production techniques, including automated fiber placement, additive manufacturing, and more efficient processing methods. These innovations have reduced production costs and improved the scalability of CMCs for industrial use, making them more accessible for a range of applications in defense, aerospace, and other high-performance industries. As these manufacturing advancements continue, the market for CMCs is expected to expand significantly.

Latin America Ceramic Matrix Composites Market Trends

The automotive industry’s shift towards electric and hybrid vehicles is fueling the demand for CMCs in Latin America. As the region adopts more stringent environmental regulations aimed at reducing carbon emissions, automotive manufacturers are under pressure to innovate. CMCs offer significant advantages in this regard, providing lightweight solutions that help reduce the overall weight of vehicles, thereby improving fuel efficiency and reducing emissions. The high-temperature resistance and low thermal expansion properties of CMCs make them ideal for use in electric vehicle batteries and power electronics, further expanding their application in the automotive sector.

Middle East & Africa Ceramic Matrix Composites Market Trends

The rapid industrialization and infrastructure development in the Middle East, especially in countries such as the UAE and Saudi Arabia, also plays a vital role in driving the demand for CMCs. As urbanization and industrial activity continue to expand across the region, there is a growing need for advanced materials that can support the construction of high-performance machinery, reactors, and components used in various industries. The increasing number of large-scale construction projects, particularly in the field of high-speed rail, commercial aviation, and energy, requires the use of CMCs for parts that demand high durability, thermal stability, and lightweight characteristics. With governments in the region pushing for further industrialization, there is an increased reliance on advanced materials like CMCs to support the growth of infrastructure projects.

Key Ceramic Matrix Composites Company Insights

Some of the key players operating in market include3M, COI Ceramics, Inc.

-

3M offers a range of high-performance products such as ceramic fibers, resins, and matrices. These products are widely used in aerospace, automotive, and defense applications, where high-temperature resistance, durability, and lightweight properties are essential. 3M's CMC solutions are designed to meet the demands of industries that require advanced materials for critical, high-performance applications.

-

COI Ceramics, Inc. is a leading manufacturer specializing in advanced ceramic products, including ceramic matrix composites. The company focuses on providing CMC solutions for aerospace, defense, and industrial applications. COI Ceramics offers CMCs based on silicon carbide (SiC) and carbon matrices, which are known for their superior heat resistance, strength, and thermal conductivity. These products are used in components such as thermal protection systems, missile components, and turbine blades, where high temperature and mechanical stress resistance are crucial.

Coorstek, Inc., General Electric Company are some of the emerging market participants in Ceramic Matrix Composites market.

-

Coorstek, Inc. is a major player in the manufacturing of advanced ceramics and CMCs, supplying a wide range of products for industries including aerospace, defense, and energy. Coorstek’s ceramic matrix composites are used for high-performance applications where reliability and durability are critical. They offer products like ceramic fibers and SiC-based composites, which are particularly suited for turbine engines, missile components, and industrial applications that require high thermal resistance and mechanical strength.

-

General Electric Company (GE) is a multinational conglomerate with a strong presence in the aerospace and defense sectors. In the ceramic matrix composites market, GE provides high-performance CMC products primarily for the aerospace industry, such as SiC-based composites used in turbine blades, thermal protection systems, and other critical aerospace components. GE’s CMC solutions are known for their superior performance under extreme temperature conditions and are integral to the development of next-generation jet engines and high-efficiency propulsion systems.

Key Ceramic Matrix Composites Companies:

The following are the leading companies in the ceramic matrix composites market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- COI Ceramics, Inc.

- Coorstek, Inc.

- General Electric Company

- Kyocera Corporation

- Lancer Systems LP

- SGL Carbon Company

- Ultramet, Inc.

- Ube Industries, Ltd.

Recent Developments

-

In July 2021, Pratt & Whitney, a subsidiary of Raytheon Technologies Corp., built an engineering and development center for ceramic matrix composites (CMC) in Carlsbad, California. The new 60,000-square-foot facility is designed to be a fully integrated center for engineering, research, and low-volume manufacturing, with a focus only on CMCs for aerospace applications.

Ceramic Matrix Composites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.78 billion

Revenue forecast in 2030

USD 15.83 billion

Growth rate

CAGR of 12.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

3M Company; COI Ceramics, Inc.; Coorstek, Inc.; General Electric Company; Kyocera Corporation; Lancer Systems LP; SGL Carbon Company; Inc.; Ultramet, Inc.; Ube Industries, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

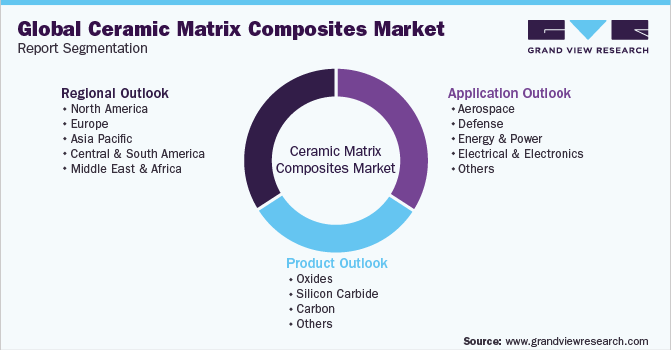

Global Ceramic Matrix Composites Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic matrix composites market report based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Oxides

-

Silicon Carbide

-

Carbon

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Defense

-

Energy & Power

-

Electrical & Electronics

-

Hypersonic Missiles

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global ceramic matrix composites market size was estimated at USD 7.83 billion in 2024 and is expected to reach USD 8.78 billion in 2025.

b. The global ceramic matrix composites market is expected to grow at a compound annual growth rate of 12.5% from 2025 to 2030 to reach USD 15.83 billion by 2030.

b. The carbon segment led the market and accounted for the largest revenue share of 49.59% in 2024, driven by increasing demand for lightweight and high-strength materials across various industries

b. Some of the key players operating in the ceramic matrix composites market include 3M Company; Applied Thin Films, Inc.; CeramTec International; COI Ceramics, Inc.; Coorstek, Inc.; General Electric Company; Kyocera Corporation; Lancer Systems LP; SGL Carbon Company; StarFire Systems, Inc.; Ultramet, Inc.; Ube Industries, Ltd.

b. The ceramic matrix composites market is likely to be driven by increased demand from the aerospace and military, automotive, and energy and power application industries. In addition, the capacity to withstand high temperatures and tougher government fuel economy rules are expected to enhance the industry in the next years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.