- Home

- »

- Next Generation Technologies

- »

-

Legal Services Market Size, Share & Trends Report, 2030GVR Report cover

![Legal Services Market Size, Share & Trends Report]()

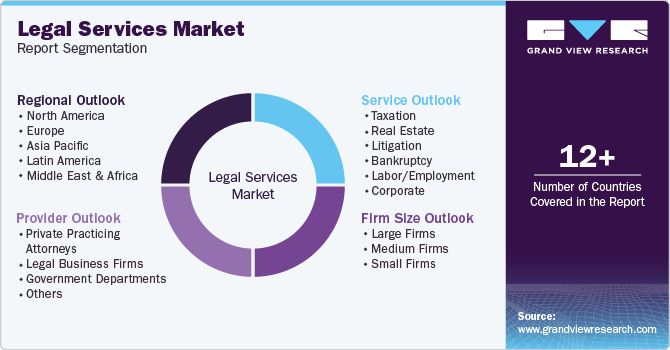

Legal Services Market Size, Share & Trends Analysis Report By Services (Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, Corporate), By Firm Size (Large, Medium, Small), By Provider, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-818-3

- Number of Pages: 119

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Legal Services Market Size & Trends

The global legal services market size was estimated at USD 952.29 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. The increasing adoption of advanced technologies and several macroeconomic factors including growing business competition, commoditization, varying economic growth trends, and Foreign Direct Investment (FDI). There is an emerging trend of businesses employing Alternate Legal Service Providers (ALSPs) for high-demand legal services such as contract management, document review, and litigation support. The law firms are also outsourcing non-revenue generating tasks, including business analysis, project management, and billing and expenses, to ALSPs. This trend will support the market growth in the upcoming years.

Furthermore, ALSPs are collaborating with Artificial Intelligence (AI) technology providers to expand the capabilities of their offerings. For instance, in February 2023, QuisLex, one of the leading ALSPs, collaborated with ContractPodAi, the provider of AI-powered Contract Lifecycle Management (CLM) products, to provide technologically advanced contract solutions to their clients.

Businesses globally continue to face an exponential increase in evolving legal duties and regulatory criteria. As organizations expand global operations and services, the number of regulations to comply with increases, creating a demand for an integrated approach to legal Governance, Risk Management, and Compliance (GRC), consequently driving the global legal services market’s growth. Legal services help legal departments within organizations to streamline complexities associated with compliance through services such as matter management, policy management, investigations, and reporting and filing, among others.

Advanced technologies such as Machine Learning (ML) and artificial intelligence help professionals automate some processes and utilize their resources and time on vital legal operations. These technologies enable businesses to draft and evaluate contracts and mining and due diligence of documents. Big data analytics is also projected to offer favorable growth prospects. Law firms can identify new unexplored correlations among data by using ML and AI to large datasets, enabling their increased capacity to mitigate risk, tailor solutions, optimize delivery, and forecast outcomes to consumer demands.

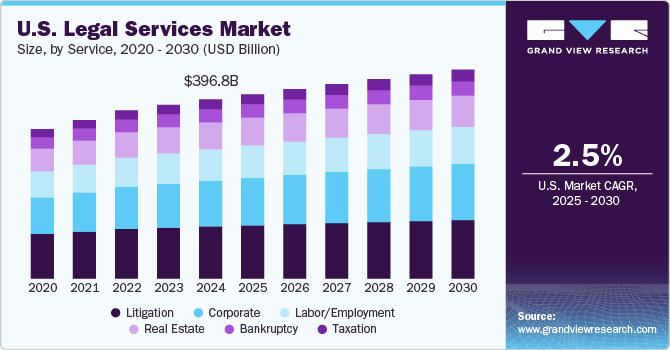

Services Insights

The corporate segment led in 2022, accounting for over 30% share of the global revenue. the segment is driven by the increasing complexity of business regulations and the growing company requirements to navigate them effectively. As a result, law firms are expanding their services to cater to the needs of corporate clients, including contract drafting and negotiation, mergers and acquisitions, intellectual property protection, and employment law matters. Additionally, technology is playing an increasingly key role in the delivery of legal services with the adoption of AI-powered tools to streamline workflows and improve efficiency.

The litigation segment held a considerable revenue share of around 27% in 2022. As businesses face increasing legal challenges, there is a growing demand for litigation services to help resolve disputes and protect their interests. This trend is driven by a variety of factors, including the complexity of modern legal disputes, the need for specialized expertise in various areas of law, and the rising costs of litigation. As a result, litigation is becoming an increasingly major area of practice for legal professionals, with many firms investing in this area to meet the growing demand. This growth is expected to continue in the coming years as businesses and individuals seek out legal services to help them navigate the complex and ever-changing legal landscape.

Firm Size Insights

The large firm dominated the global market with a revenue share of over 38% in 2022. Large firms' diversified range of services is attributed to this high share. For instance, large firms deliver most judicial work, such as large-scale litigations, significant business transactions, and criminal defense matters for businesses across various industries. The increased demand from large organizations for corporate and judicial services is expected to drive the growth of the large firm segment during the estimated period. Large firms are expanding their services and hiring more lawyers to cater to the needs of their clients. This trend can be attributed to several factors, including the complexity of legal matters, the globalization of business, and the need for specialized expertise.

The small law firms segment is expected to witness the highest CAGR of over 5% from 2023 to 2030. Such law firms provide personalized services and a one-on-one working relationship as they oversee a limited number of cases. Moreover, they are more affordable as they charge less due to their lesser cost of operations as compared to large firms. These legal service firms are growing geographically while expanding their global customer base by providing high-end specialized services that involve complex transactions, which is expected to drive segmental growth over the coming years.

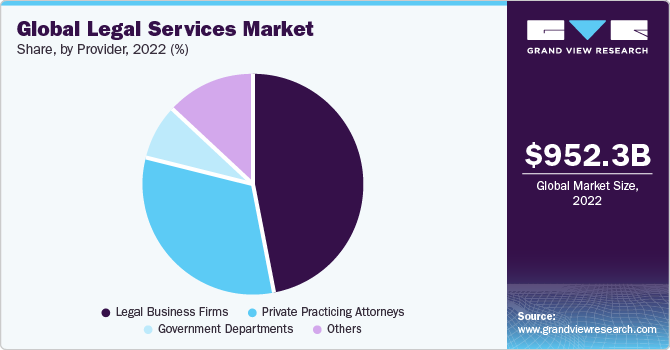

Provider Insights

The legal business firms sector accounted for a significant revenue share of around 47.3% in 2022. The strategic investments made by legal business firms are attributed to this high share. The increasing investments by these firms in client education, pipeline management, local community activities, and public relations are expected to drive segmental growth over the forecast period. This segment is also projected to show significant growth during the estimated period. Due to the stagnant growth of the market over the years, some firms have started to either lower their expenses or raise their rates since they find it challenging to maintain profitability.

The private practicing attorneys’ segment is expected to witness the highest CAGR of around 5.4% from 2023 to 2030. This can be credited to increasing preference for private attorneys as they give undivided attention to a particular client’s case. Moreover, they have access to resources such as mental health assessments, DNA and other testing, expert witnesses, forensics specialists, private investigators, etc., required to mount a viable defense. This can be attributed to the increasing demand for specialized legal services from individuals and small businesses. Private practicing attorneys offer a wide range of legal services, including family law, real estate law, personal injury law, and criminal defense.

Regional Insights

North America accounted for a significant revenue share of over 41% in 2022. The growing assignment volumes within the legal divisions of the corporate industry in the U.S. are fueling the growth in this region. The growing number of business acquisitions and mergers in the region amplifies the demand for legal services. Law firms in North America are expanding their services and hiring more lawyers to cater to the needs of their clients. Additionally, the increasing use of technology in the delivery of legal services has led to the adoption of AI-powered tools to streamline workflows and improve efficiency. This has resulted in an increased demand for legal services from both corporate and individual clients.

Asia Pacific is expected to witness the highest CAGR of over 7% during the forecast period due to the expeditious implementation of regulatory and legal requirements, particularly in China and India. Service providers such as Venable LLP, Baker & McKenzie, and Allen & Overy LLP are also entering the Asia Pacific market, which is expected to further boost regional growth.

Key Companies & Market Share Insights

Market players concentrate on growing their consumer base and acquiring a competitive advantage over their competitors. They are implementing various strategic initiatives, including collaborations, mergers and acquisitions, partnerships, and new product/technology development. For instance, in October 2023, Baker McKenzie entered into a joint venture (JV) with KL Partners, the Korean disputes and corporate law firm, to reinforce the firm’s presence in East Asia. Through this JV, Baker McKenzie is anticipated to bring international legal connectivity and support to its Korean client base.

Key Legal Services Companies:

- Baker McKenzie LLP

- Clifford Chance

- Deloitte

- DLA Piper LLP

- Ernst & Young Global Limited

- Kirkland & Ellis LLP

- KPMG

- Latham & Watkins

- PwC

- Skadden, Arps, Slate, Meagher & Flom LLP

Legal Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,000.86 billion

Revenue forecast in 2030

USD 1,362.81 billion

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, firm size, provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Chile; South Africa

Key companies profiled

Baker McKenzie LLP; Clifford Chance; Deloitte; DLA Piper LLP; Ernst & Young Global Limited; Kirkland & Ellis LLP; KPMG; Latham & Watkins; PwC; Skadden; Arps; Slate; Meagher & Flom LLP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Legal Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legal services market report based on service, firm size, provider, and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Taxation

-

Real Estate

-

Litigation

-

Bankruptcy

-

Labor/Employment

-

Corporate

-

-

Firm Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Firms

-

Medium Firms

-

Small Firms

-

-

Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Practicing Attorneys

-

Legal Business Firms

-

Government Departments

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global legal services market size was estimated at USD 952.29 billion in 2022 and is expected to reach USD 1,000.86 billion in 2023.

b. The global legal services market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 1,362.81 billion by 2030.

b. The legal business firms segment dominated the global legal services market with a share of 47.5% in 2022. This is attributed to the increasing investments by legal business firms in client education, pipeline management, local community activities, and public relations.

b. Some of the key players in the global legal services market include Baker & McKenzie; Clifford Chance LLP; E&Y; Deloitte; Kirkland & Ellis LLP; LATHAM & WATKINS LLP; PwC; and KPMG.

b. Key factors that are driving the legal services market growth include technological disruptions in the legal industry and a rise in the number of alternative legal service providers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."