- Home

- »

- Sensors & Controls

- »

-

Global Wearable Sensors Market Size, Industry Report, 2018-2025GVR Report cover

![Wearable Sensors Market Size, Share & Trends Report]()

Wearable Sensors Market Size, Share & Trends Analysis Report By Sensor Type, By Device (Smart Watch, Fitness Band, Smart Glasses, Smart Fabric), By Vertical, By Region, And Segment Forecast, 2018 - 2025

- Report ID: GVR-2-68038-154-2

- Number of Pages: 131

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Semiconductors & Electronics

Industry Insights

The global wearable sensors market size was valued at USD 149.3 million in 2016. Sensors are a vital aspect in wearable devices used by consumers owing to an increased focus on tracking real-time motion sensing activities. This is likely to propel industry growth over the forecast period.

The market is gaining prominence due to the rising number of health and fitness monitoring applications globally. Wearable device manufacturers have integrated contextual information and data points to determine motion sensing activities. Further, its analysis provides users with results that can be used to define health and fitness goals.

Technological development is expected to augment market growth over the forecast period. Sensor miniaturization and manufacturing have gained popularity with rising demand for compact wearables. Furthermore, its motion-sensing capabilities that track and record movements is a key factor driving the market growth. Increased spending on remote monitoring activities such as heart rate, blood oxygen level, fall detection, and the calorie count is another potential factor driving the market.

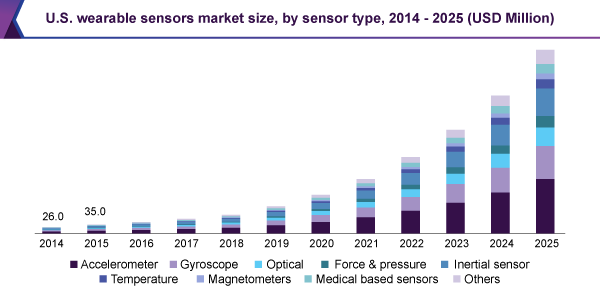

The U.S. is one of the most significant markets owing to the wide presence of OEMs in the country. Wearable devices are gaining prominence owing to the early adoption of sensing technology, miniaturization of sensors, and consumer awareness for a healthier lifestyle. Moreover, a rise in healthcare expenditure is estimated to drive demand for remote monitoring devices for athletes and patients.

Wearable Sensors Market Trends

The combination of right technology coupled with wearable sensors has augmented digital monitoring of health and fitness among youth as well as the older population for better living. Wearable device increasing demand across fitness application is a key factor to the development of motion sensing technology. The motion sensing technology used in sensors is expected to fuel robust growth in wearable sensors application of sports & fitness tracking devices. The amalgamation of sensor technology with wearable and Internet of Things (IoT) is creating opportunity, which will ultimately manifest a multipurpose device in coming years.

Wearable sensors are mainly driven by its ability to track performance and activity of the user. Traditional wearable sensors deliver raw data to the microcontroller to calculate and process useful information which leads to heavy current consumption. Recent advancement in miniaturization, data analysis technique, and sensor manufacturing has opened avenues for adoption of the wearable sensor in digital health ecosystems. Further, microcontroller function, front-end amplification, wireless data transmission and miniature circuits have surpassed the drawbacks in wearable device encompassing huge sensors. For instance, ST Microelectronics has developed inertial measurement unit (IMU) sensors with integrated gyroscope and accelerometer. It has smart first-in-first-out (FIFO) functionality that allows storage up to 8k of data. This enabled feature allows sensor to deliver superior performance and incredible power saving as well as to fit into tight space in wearable.

In developing and creating new technology, there is a significantly high cost associated with the wearable sensor, and thus manufacturing of such sensors is also relatively higher when compared to the conventional sensors in the wearable device. However, numerous OEMs present in the market with little differentiation in the product has impacted the component supplier to reduce hardware cost. Intense competition and increasing number of market players are expected to result in price erosion. Competition in the end-use industry also affects the industry as buyers’ demand reduction in price owing to lower end-product price. InvenSense expects ASP to decline over the next five years owing to competitive pricing pressure, shifts in customers’ product architectures, new product introduction, and product end-of-life programs.

Sensor Type Insights

The accelerometer segment was valued at USD 32.3 million in 2016 and is anticipated to exhibit the highest CAGR of 43.6% over the forecast period. The segment growth is accredited to the increasing popularity of wearable devices in the market.

Motion sensing with accelerometer sensors enhance the output and gives higher accuracy in tracking and monitoring user activities. The use of accelerometers in wrist-worn devices delivers fitness and wellness-related series and thus serves as a key source of market traction. Moreover, its ability to differentiate between when the user is taking a step or shaking just the wrist is a potential factor to segment growth.

The optical segment is anticipated to expand at a healthy CAGR of 38.0% over the forecast period. The application of optical sensors has been associated as an integral part in the growth of wearable devices. They are incorporated in smart wearables play a vital role in giving precise electrocardiogram (EKG) readings with the utmost accuracy. It enables highly sensitive measurement of health parameters and the surrounding environment, which is expected to boost its demand over the forecast period.

Device Insights

The fitness band segment accounted for the largest share in the wearable sensors market in 2016. The segment is expected to expand at a significant CAGR of 39.5% over the forecast period. This growth is attributed to the rising popularity of health and fitness devices among users. Moreover, new players in the market are offering advanced technologies in fitness bands at relatively lower prices than smartwatches. This is anticipated to be a key factor driving the segment growth.

Launch of new models and an expanding user base can be attributed to the capabilities of a fitness band in providing dynamic analysis of user activities such as step tracking, heart rate variation, calories count, and sleep quality analysis. Design perspectives, such as a simplistic model and miniaturization will also benefit the segment over the coming years.

Sharp growth in demand for fitness bands will continue in 2018 as vendors and sensor OEMs continue to add value proposition in their devices. Technological advancements in sensors are anticipated to play a vital role. It will enable higher accuracy in providing qualitative analysis with sensor fusion software, which is further expected to boost its application in fitness bands.

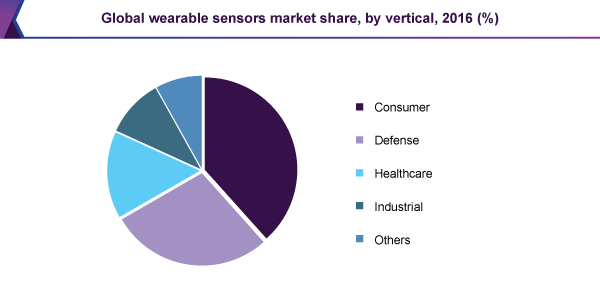

Vertical Insights

The consumer segment is anticipated to exhibit a high CAGR of 41.4% over the forecast period. Demand for sensor-fused devices are gaining traction as awareness regarding remote monitoring of wellness and fitness is gaining popularity among users. Demand is driven by a wide variety of factors, such as availability of numerous wearables, technological advancement in sensors, and vendors’ ability to provide differentiated products.

The adoption of wearables among consumers will continue to dominate the market over the forecast period. An increase in demand for fitness, wellness, and lifestyle tracking devices is a key factor driving shipments of wearables in the recent past. Consumer preferences for wrist-worn, VR headsets, and smart clothing are positively impacting the market, and vendors are thus looking to innovate and provide optimum solutions to users.

The segment is also expected to witness high growth with rising spending power among consumers, especially on electronics. Larger companies appear to be developing wearables focused on combining fashion as well as utility. Constant innovation will also benefit the growth of the consumer segment.

Regional Insights

The North America region is anticipated to continue its dominance over the forecast period. The rapid adoption of digital technology in the U.S. has allowed the region to account for a larger market share. Moreover, the healthcare sector in the region has been thriving, which is further anticipated to boost the adoption of wearable sensor-enabled products over the forecast period. An increase in the U.S. population along with significant health concern amongst youth as well as an aging portion is fueling need of healthcare activity monitoring devices. Wearable sensors are a vital component in a wearable device which provides accurate and reliable information on user activities and behavior. It detects activities by monitoring physical and physiological parameters along with other symptoms.

The APAC market was valued at USD 47.1 million in 2016 and is anticipated to register the highest CAGR over the forecast period. OEMs are making a substantial contribution to the development of IMUs, MEMS technology, and others, which can provide accuracy while keeping the price relatively lower for products developed through them. Many enterprises within China have been evolved in developing wearables at lower cost, which is attributed to the growing number of users in the market. The growing demand for home healthcare monitoring is anticipated to further propel the growth of the market across China.

Wearable Sensors Market Share Insights

Key players in the market include NXP Semiconductors N.V., Robert Bosh GmbH, Texas Instruments, STMicroelectronics N.V., and Knowles Electronics, LLC. Companies offer a variety of products and integrated solutions to fit the needs of end-users. These players frequently invest in research and development activities aimed at offering unique products and gaining a greater competitive edge in the industry.

Robert Bosh GmbH accounts for a major share in the global market. It provides a complete portfolio of micro-electro-mechanical systems (MEMS)-based sensors and solutions. Its portfolio of motion sensors includes gesture and motion-based products such as inertial measurement units, gyroscopes, and accelerometers. Its smart sensors provide user low-power and flexible solution for data processing and motion sensing. These are designed explicitly for always-on sensor applications in wearables, smartphones, and tracking devices.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America and MEA.

Country scope

The U.S., Canada, The U.K., Germany, France, China, India, Japan, Brazil, Mexico.

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global wearable sensors market report on the basis of sensor type, device, vertical, and region:

-

Sensor Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Accelerometer

-

Gyroscope

-

Optical

-

Force & pressure

-

Inertial sensor

-

Temperature

-

Magnetometers

-

Medical based sensors

-

Others

-

-

Device Outlook (Revenue, USD Million, 2014 - 2025)

-

Smartwatch

-

Fitness band

-

Smart glasses

-

Smart fabric

-

Smart footwear

-

Other wearables

-

-

Vertical Outlook (Revenue, USD Million, 2014 - 2025)

-

Consumer

-

Defense

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."