- Home

- »

- Advanced Interior Materials

- »

-

Welding Products Market Size & Share, Industry Report, 2030GVR Report cover

![Welding Products Market Size, Share & Trends Report]()

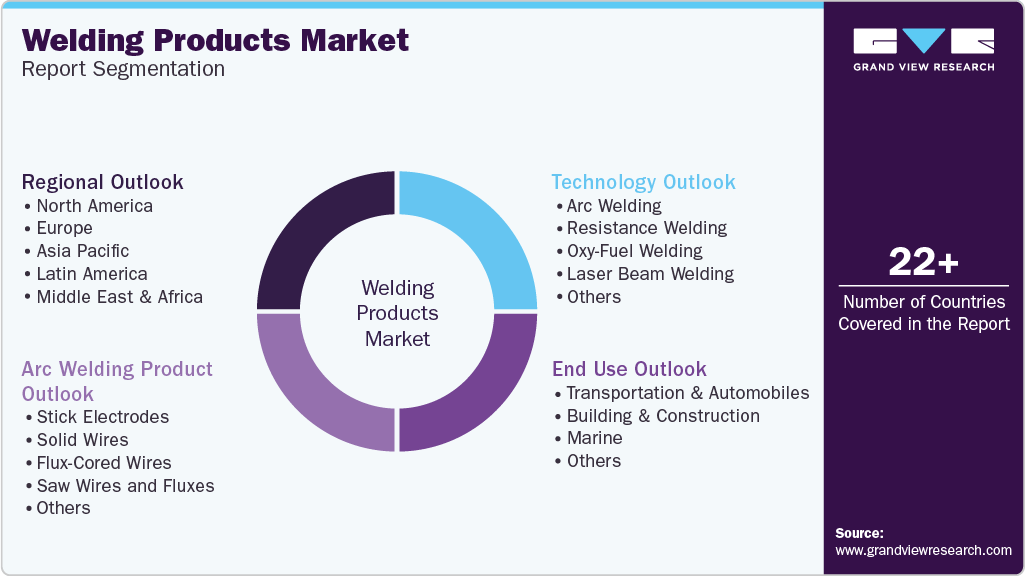

Welding Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Arc Welding, Resistance Welding, Oxy-Fuel Welding, Laser Beam Welding), By Arc Welding Product (Stick Electrodes, Solid Wires), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-856-5

- Number of Report Pages: 198

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Welding Products Market Summary

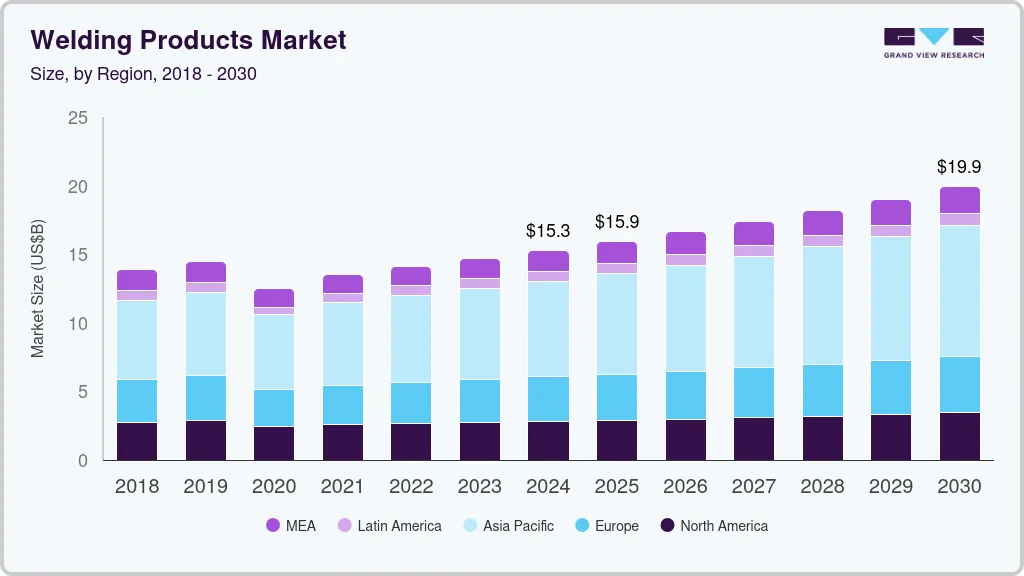

The global welding products market size was estimated at USD 15.30 billion in 2024 and is projected to reach USD 19.94 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. Factors such as design flexibility, reduction in the overall weight of the buildings and structures, and the ease in modification are projected to promote the use of welding products in construction and industrial application segments.

Key Market Trends & Insights

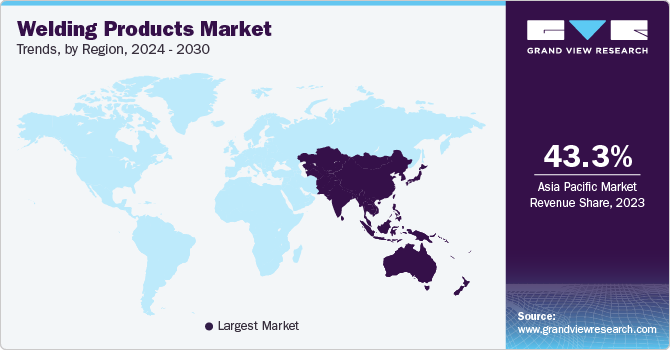

- Asia Pacific region led the market and accounted for over 45.6% share of global revenue in 2024.

- By technology, resistance welding segment accounted for more than 27.5% share of the global revenue in 2024.

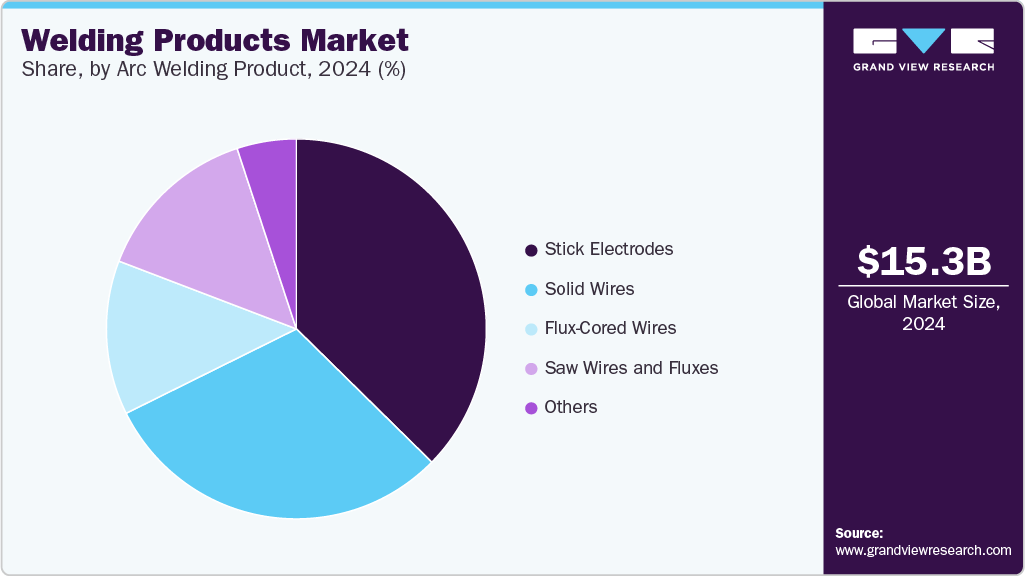

- By arc welding product, the stick electrodes segment led the market and accounted for more than 37.0% share of the global revenue in 2024.

- Based on end use, automotive & transportation segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.30 Billion

- 2030 Projected Market Size: USD 19.94 billion

- CAGR (2025-2030): 4.6%

- Asia Pacific: Largest market in 2024

Furthermore, growing construction and infrastructure industries around the major economies of the world is expected to increase global welding products market. The increasing costs of construction materials and equipment, along with supply chain disruptions, are the major factors limiting the growth of this industry. However, the use of aerial measurement and 3D modeling technologies increased during the pandemic, which supported the market growth.

Increasing investments in public infrastructural projects are expected to drive the demand for welding products in the U.S. Government has taken several initiatives to upgrade public infrastructure. For instance, U.S. Department of Transportation (USDoT) announced to invest USD 906 million in infrastructure through the Infrastructure for Rebuilding America (INFRA) discretionary grant program. The construction sector is expected to witness high growth over the forecast period, which, in turn, is predicted to drive the demand for welding products due to the wide range of welding applications in construction.

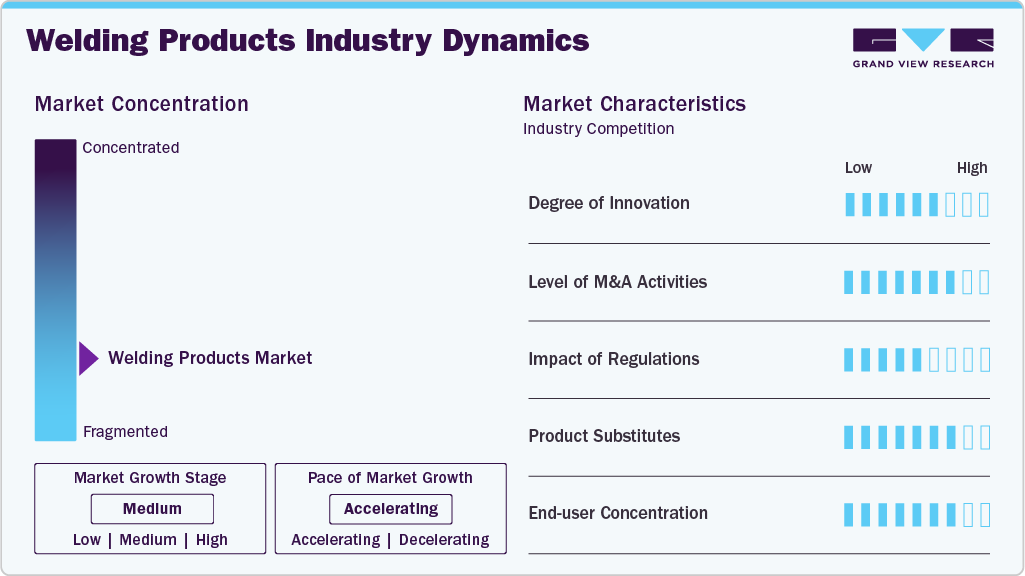

Market Concentration & Characteristics

Welding products market growth stage is medium, and pace of the market growth is accelerating. The market is highly fragmented in nature. Major market players promote their products, mainly those with advanced features and better cost-efficiency. Furthermore, the market participants aim to achieve maximum market growth and extend their market presence through numerous expansion strategies such as collaborations, partnerships, agreements, acquisitions, and capacity expansion in new areas.

The market has been positively impacted by technical innovations in welding products. For instance, hybrid laser-arc welding process is an advanced process that combines the utilities of laser and arc welding. The hybrid bonding process exhibits individual advantages of both processes. Technical innovations and improvements in the production process have resulted in the manufacturing of welding products with superior durability with extended lifespan.

Prominent manufacturers have been adopting mergers and acquisitions, to enhance their market presence and to cater to the changing requirements of application industries. For instance, Voestalpine Böhler Welding Group GmbH acquired Selco s.r.l in order to strengthen its presence in the Middle East & African region for the continuous supply of welding products and equipment. In addition, The Lincoln Electric Company acquired Air Liquide Welding Ltd., a subsidiary of Air Liquide to.

Occupational Safety and Health Administration, Local Exhaust Ventilation (Lev) Guidelines, American National Standard, General Directorate of Standards, and REACH has laid down some regulatory standards which specifysafety and health issues related to welding process. For instance, according to LEV standards, while using LEV to control welding fumes, the operator must thoroughly assess the hazards to be controlled.

The industry is witnessing an emergence of a set of substitutes that can act as a complete replacement for welding technology. Structural adhesives, pressure sensitive adhesive tapes and fasteners are rapidly replacing welding joints across several applications in various application industries owing to superior performance characteristics. Thus, the product substitutes in the industry is expected to remain high over the forecast period.

Rising demand for welding products in various application industries, especially construction and transportation, owing to the growing construction, infrastructural, and transportation vehicle repair & maintenance activities, is projected to increase the levels of application concentration.

Technology Insights

Resistance welding technology accounted for more than 27.5% share of the global revenue in 2024. The growing use of resistance welding technology in the automotive industry for various processes such as spot welding, projection welding, and seam welding is likely to promote segmental growth over the forecast period.

Continuous innovations in arc welding technology, such as robotic arc welding, by the key market players, are one of the key factors driving the welding products market across the globe. The technology is used to weld metals in a wide range of thicknesses with good flexibility. The growing use of the technology across various applications is projected to drive market growth.

Oxy-fuel welding technology is gaining significant growth on account of its growing use in industrial manufacturing applications. The welding equipment and products used in this technology are highly cost-efficient which promotes its implementation in welding fillet, butt, and lap joints with the object thickness up to 5mm.

Other welding technologies include electron beam welding, induction welding, flow welding, electro-slag welding, and laser hybrid welding. These technologies are employed in various applications such as heavy plate fabrication, shipbuilding, switchgear devices, railway tracks, and storage tanks among others.

Arc Welding Product Insights

The stick electrodes Arc Welding Product segment led the market and accounted for more than 37.0% share of the global revenue in 2024. The demand for stick electrodes for the welding of a wide range of components is witnessing growth in various application areas on account of their ability to increase the welding strength as well as their high corrosion resistance & tensile strength.

The solid wire product segment is projected to register a CAGR of 4.1% in terms of revenue over the forecast period. The flexibility and ruggedness of solid wires are properties that increase their utility in application areas such as house electrical wiring and breadboards that require flexible wires.

Saw wired fluxes react with the weld pool to provide high-quality metals with desired properties. This promotes its utilization in applications such as exploration platforms, pressure vessels, fabrication of offshore drilling platforms, and post-weld heat treatment. The growing use of saw wire fluxes in the construction of the aforementioned applications is likely to fuel the segment growth.

Other welding products such as stainless-steel alloys, MIG wires, metal-cored wires, aluminum MIG, TIG, and thermal spray wires are contributing significantly to the growth of the market. These products are extensively utilized on account of their unique mechanical properties and cost-efficiency.

End Use Insights

Based on end use, the market is segmented into automotive & transportation, building & construction, marine, and repair & maintenance. Automotive & transportation segment accounted for the largest revenue share in 2024 owing to growing automotive industry in India, China, U.S., Japan, and Germany.

Tungsten inert gas (TIG) and metal inert gas (MIG) welding are the most commonly used welding processes in automotive industry. TIG welding is useful while connecting the thin work pieces and specialty alloys, whereas, MIG welding can be used to weld body and interior parts of vehicles.

Regional Insights

Asia Pacific region led the market and accounted for over 45.6% share of global revenue in 2024. The expansion of residential, commercial, and industrial sectors due to the sustainable economic growth of countries in the region is expected to fuel construction activities, thereby driving the demand for welding products.

The market in the Asia Pacific is expected to exhibit the highest growth for the welding products market on account of the rapid expansion of the automotive industry on account of the highest automobile production.

Europe Welding Products Market Trends

European countries are initiating efforts to balance their economic trade, which is expected to boost the maritime activities in the region. In addition, the rising tourism sector is also expected to drive demand for recreational marine products, thereby driving the growth of shipbuilding activities in the region. This in turn is likely to augment the growth of welding operations.

The increasing demand for electric cars and hybrid cars on account of shifting consumer preferences towards affordable energy-efficient plug-in cars such as Nissan-leaf, Toyota Prius PHV, and others is expected to drive the automotive industry, which in turn is expected to benefit the market for welding products over the forecast period.

Key Welding Products Company Insights

The global market is characterized by the presence of various small- and large-scale vendors, resulting in a moderate level of concentration in the market. The surging requirement for reliable and precise welding solutions is fueling the growth of the market. Key manufacturers of welding products in the market are focusing on offering suitable and innovative welding products that are rigid and durable.

A large number of roofing product manufacturers are focused on backward integration in order to keep the product quality under control. The industry participants emphasize expanding their product portfolio by developing innovative solutions and cheaper products with superior properties to cater to the increasing consumer demand.

-

In April 2023, Kemppi announced the launch of its all-new robotic welding solution - the AX MIG Welder. The welder features an easy-to-use interface, seamless integration, and cutting-edge welding technology to perform challenging tasks and cater to critical production targets.

-

In March 2023, Kemppi introduced new portable welding machines - Master M 205 and Master M 323, for MIG/MAG welding. The latest equipment series is ideal for industrial welding in shipyards and repair shops, as well as for passionate hobby welders. The latest equipment series is ideal for industrial welding in shipyards & repair shops, as well as for passionate hobby welders.

Key Welding Products Companies:

The following are the leading companies in the welding products market. These companies collectively hold the largest market share and dictate industry trends.

- Colfax Corporation

- Veostalpine AG

- The Lincoln Electric Company

- Illinois Tool Works, Inc.

- Hyundai Welding Co., Ltd.

- Obara Corporation

- Kiswel, Inc.

- Sandvik AB

- Tianjin Bridge Welding Materials Co., Ltd.

- Kemppi Oy

- Mitco Weld Products Pvt. Ltd.

- Senor Metals Pvt. Ltd.

- Metrode Products Ltd.

- Ador Welding Limited

Welding Product Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.95 billion

Revenue forecast in 2030

USD 19.94 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, arc welding product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy, Netherlands, China; Japan; India; Australia; Indonesia, Brazil; Argentina, Saudi Arabia; South Africa

Key companies profiled

Colfax Corporation; Veostalpine AG; The Lincoln Electric Company; Illinois Tool Works, Inc.; Hyundai Welding Co., Ltd.; Obara Corporation, Kiswel, Inc.; Sandvik AB; Tianjin Bridge Welding Materials Co., Ltd.; Kemppi Oy; Mitco Weld Products Pvt. Ltd.; Senor Metals Pvt. Ltd.; Metrode Products Ltd. & Ador Welding Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Welding Products Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the welding products market based on technology, arc welding product, end use, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Arc Welding

-

Resistance Welding

-

Oxy-Fuel Welding

-

Laser Beam Welding

-

Others

-

-

Arc Welding Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stick Electrodes

-

Solid Wires

-

Flux-Cored Wires

-

Saw Wires and Fluxes

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation & Automobiles

-

Building & Construction

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Indonesia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global welding products market size was estimated at USD 15.30 billion in 2024 and is expected to reach USD 15.95 billion in 2025.

b. The global welding products market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 19.94 billion by 2030.

b. Arc welding technology led the market and accounted for over 36.3% share of the revenue in 2024 as it can weld a large number of metals in a wide range of thicknesses with good flexibility.

b. Some of the key players operating in the global welding products market include Colfax Corporation, Veostalpine AG, Air Liquide Welding Ltd., The Lincoln Electric Company, and Illinois Tool Works, Inc.

b. The key factors that are driving the global welding products are ascending demand for luxury cars and electric cars, on account of rising disposable income and changing consumer preferences, coupled with favorable regulations pertaining to the use of high strength materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.