- Home

- »

- Green Building Materials

- »

-

Glue Laminated Timber Market Size, Industry Report, 2030GVR Report cover

![Glue Laminated Timber Market Size, Share & Trends Report]()

Glue Laminated Timber Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Commercial), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-051-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glue Laminated Timber Market Size & Trends

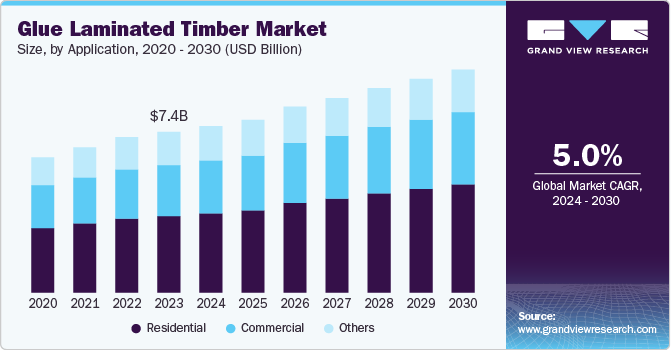

The global glue laminated timber market size was valued at USD 7.44 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. This growth is attributed to the increasing demand for sustainable building materials, particularly in residential and commercial construction. Factors such as superior strength, design flexibility, and aesthetic appeal enhance its attractiveness for architects and builders. The rise of mass timber construction and government initiatives promoting eco-friendly practices further support market growth.

Glue laminated timber, also called glulam, and is utilized in various applications such as framing, floor and roof beams, columns, door headers, and trusses. The demand for glulam is anticipated to rise due to its more common utilization in residential, commercial, and industrial construction industries. The popularity of glue laminated timber has grown over the past few years due to its alternative as a cost-effective and eco-friendly to steel and concrete. In the upcoming years, glue-laminated timber will become more popular due to its higher strength, ease of production, and minimal maintenance needs. With all these advantages, glue-laminated lumber has become a preferred choice for architects and builders due to its strong, dimensionally stable, and design-flexible characteristics, leading to market expansion of glue-laminated timber in the upcoming period.

Another factor contributing to the growth of the glue laminated timber market is the shift towards environmentally friendly and sustainable construction approaches across the world. In addition, there is a growing trend towards using environment-friendly materials such as glulam in construction due to increased awareness of the environmental impacts of traditional materials and methods. Glulam has numerous benefits, such as strong load-bearing capacity, resistance to warping and cracking, and the capability to cover large spans. It is commonly used for beams, columns, and arches in several building projects due to its strength and versatility, comprising residential, commercial, and industrial constructions.

Furthermore, the increasing adoption of architectural designs that blend natural elements has also increased the need for such designs. It can be shaped in various ways and has a natural wooden look. It is becoming increasingly popular in modern infrastructure projects due to its seamless integration with contemporary architectural designs. Moreover, with the increasing emphasis on green construction materials in environmental regulations and consumer preferences, glulam's eco-friendly qualities appeal to builders and architects. Key industry leaders are always working towards improving technology to produce high-quality products more efficiently due to the minimal carbon footprint of glue laminated timber, compared to traditional building materials such as steel or concrete, supports the worldwide push to decrease greenhouse gas emissions and address climate change. The increasing popularity of glue-laminated timber in construction projects, including residential housing and commercial and industrial structures, is fueled by a focus on eco-friendly practices.

Application Insights

Residential applications led the market and accounted for the largest revenue share of 47.8% in 2023. Customers are shifting to wood-based construction due to its wide-ranging benefits. Glulam is considered an eco-friendly construction material as it is created from renewable wood resources. The growing use in residential construction applications, such as flooring & roofing systems and straight or arched beams, is why. The appealing visual looks of glulam make it well-suited for residential construction, especially since there is a strong desire to create fashionable homes. The significance of sustainable building materials is growing due to escalating concerns about climate change and environmental impacts. Glue-laminated beams are versatile materials commonly used in commercial and residential construction projects.

Commercial applications are projected to grow significantly over the forecast period. Commercial projects frequently need longer spans and the ability to support larger loads, where the wood's strength and natural design are advantageous. Wooden timber is known for being extremely long-lasting and resistant to moisture, allowing for the making of large pieces and one-of-a-kind shapes. Since it can support weight, glue laminated timber is utilized in eco-friendly construction materials, increasing its popularity. Glue laminated timber offers better strength and stability than solid timber, allowing for constructing larger and sturdier structures and facilitating the design of spacious open areas. In addition, there is a strong presence of commercial construction projects happening worldwide, which is also impacting the glue-laminated timber market.

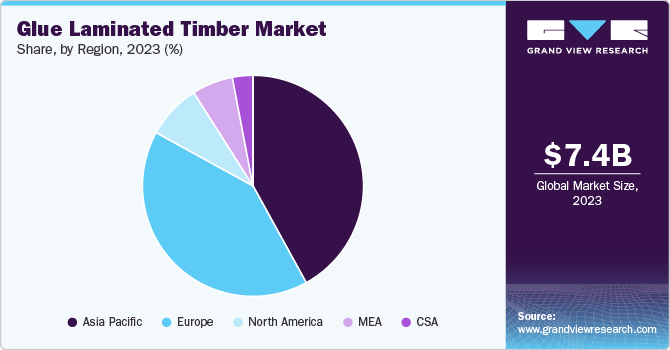

Regional Insights

The Asia Pacific glue laminated timber marketdominated the global market and accounted for the largest revenue share of 41.9% in 2023. The construction industry is rapidly growing, and manufacturers focus more on providing better glue-laminated timbers with enhanced quality. The rising emphasis on sustainable and environmentally friendly construction methods in the area led to a higher need for glue-laminated timber. Glulam became popular as a sustainable option due to its renewable and eco-friendly qualities.

Japan Glue Laminated Timber Market Trends

The glue laminated timber market in Japan dominated the Asia Pacific market and accounted for the largest revenue share in 2023. The use of glulam in Japan's residential sector has grown due to the increasing attraction of wooden houses for their beauty and flexibility in design, as well as advancements in design. The enhanced convenience of building with glulam structures, especially in earthquake, flood, and disaster-prone regions, is anticipated to boost the use of glulam even more. The rise in demand for environmentally friendly and recyclable materials and Japan's increasing focus on sustainability are expected to boost the demand for the glue-laminated timber market.

Europe Glue Laminated Timber Market Trends

Europe glue laminated timber market is expected to grow substantially over the forecast period due to rising demand from both the residential and commercial sectors for glulam, which offers remarkable fire resistance, versatility, and adaptability. Europe's commitment to advanced engineering and design increases the utilization of glue-laminated timber by enabling unique structural solutions that comply with strict safety standards.

The glue laminated timber market in Germany is expected to experience significant growth over the forecast period attributed to the increasing use of sustainable and eco-friendly products and the growing popularity of engineered wood in construction; the demand for glue laminated timber is expected to increase exponentially. Moreover, furniture and interior designers in the country are gradually embracing glue-laminated timber due to its environmental friendliness and aesthetic look.

North America Glue Laminated TimberMarket Trends

North America glue laminated timber marketis expected to grow at a CAGR of 5.6% over the forecast period due to its increased use in residential and commercial construction projects. Rising renovation projects drive the growing requirement for glue-laminated timber for specific structural causes in the country. The market growth has been further propelled by continuous technical advancements, the utilization of glued laminated timber, and other engineered wood products such as glue laminated timber.

The glue laminated timber market in the U.S. is significantly growing, owing to the increasing government investments for glue laminated materials and the rise in construction projects due to expanding urban populations. Continual improvements in architecture and interior design, an emphasis on sustainable construction methods, architectural flexibility, increased energy efficiency, thermal performance, and the push for green building certifications are key factors driving the positive outlook for the glue laminated timber industry.

Key Glue Laminated Timber Company Insights

Some of the key companies in the glue laminated timber market include Boise Cascade., Western Forest Products., PFEIFER GROUP, Canfor, Setra Group AB, Schilliger Holz AG, Mercer Mass Timber LLC.; in the market with a focus on providing better quality products and services to clients.

-

Boise Cascade is known for its BOISE GLULAM products, which combine functional beauty with structural integrity. The company specializes in engineered wood products, offering a range of glulam beams ideal for residential and commercial applications.

-

Mayr-Melnhof Holz is a manufacturer of glue laminated timber, which emphasizes on using renewable resources and eco-friendly practices in its production processes. Mayr-Melnhof Holz's glulam products are designed for versatility and strength, catering to various construction needs, from residential buildings to large-scale commercial projects.

Key Glue Laminated Timber Companies:

The following are the leading companies in the glue laminated timber market. These companies collectively hold the largest market share and dictate industry trends.

- Boise Cascade.

- Western Forest Products.

- PFEIFER GROUP

- Canfor

- Setra Group AB

- Schilliger Holz AG

- Mercer Mass Timber LLC.

- Mayr-Melnhof Holz Holding AG

- Binderholz GmbH

- B & K Structures

Recent Developments

-

In May 2024, Canfor Corporation announced its acquisition of the El Dorado lumber manufacturing facility in Union County, Arkansas, from Resolute El Dorado Inc., a Domtar Corporation affiliate. The deal, valued at USD 73 million, is expected to enhance Canfor's operations by creating collaborations and opportunities for vertical integration in the region. This strategic move aligns with Canfor's growth objectives in the Southern Pine market, reinforcing its commitment to expanding its manufacturing capabilities and strengthening its presence in the U.S. lumber industry.

-

In August 2023, Boise Cascade announced an agreement to acquire Brockway-Smith Company (BROSCO), a prominent wholesale distributor of doors and millwork, for USD 172 million. This acquisition included BROSCO's two distribution centers located in Hatfield, MA, and Portland, ME. The deal aimed to enhance Boise Cascade's millwork business and expand its market presence in the Northeast.

Glue Laminated Timber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.74 billion

Revenue forecast in 2030

USD 10.36 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Brazil

Key companies profiled

Boise Cascade.; Western Forest Products.; PFEIFER GROUP; Canfor; Setra Group AB; Schilliger Holz AG; Mercer Mass Timber LLC.; Mayr-Melnhof Holz Holding AG; Binderholz GmbH; B & K Structures

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glue Laminated Timber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glue laminated timber market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

Austria

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.