- Home

- »

- Consumer F&B

- »

-

Gluten-free Bakery Market Size & Share Report, 2030GVR Report cover

![Gluten-free Bakery Market Size, Share & Trends Report]()

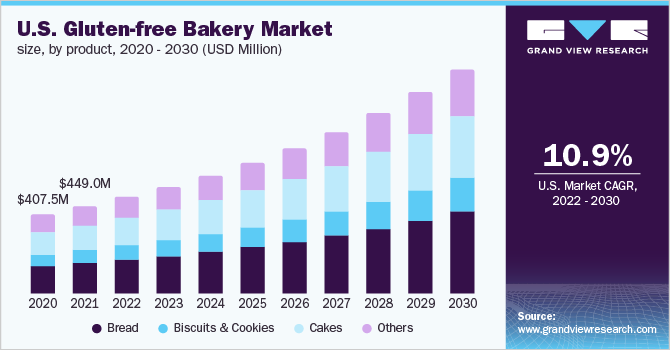

Gluten-free Bakery Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Biscuits & Cookies, Bread, Cakes), By Distribution Channel (Online, Supermarkets & Hypermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-961-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gluten-free Bakery Market Summary

The global gluten-free bakery market size was valued at USD 1.64 billion in 2021 and is projected to reach USD 4.15 billion by 2030, growing at a CAGR of 10.8% from 2022 to 2030. The major driving factor for the growth of the industry is the increasing demand for healthy and nutritional food products due to rising health concerns across the globe.

Key Market Trends & Insights

- North America accounted for the largest revenue share of more than 33.90% in 2021

- By product, The bread segment contributed to a larger market share of more than 36.30% in 2021.

- By distribution channel, The supermarkets & hypermarkets segment dominated the industry in 2021 and accounted for the largest share of over 34.00% of the global revenue.

Market Size & Forecast

- 2021 Market Size: USD 1.64 Billion

- 2030 Projected Market Size: USD 4.15 Billion

- CAGR (2022-2030): 10.8%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

In addition, the growing demand for healthy food products to prevent health problems, such as heart disease, diabetes, obesity, Chronic Pulmonary Disease (COPD), and metabolic syndrome, is likely to industry growth. Furthermore, new product releases by manufacturers are contributing significantly to the industry growth.

There was a surge in demand for healthy foods, particularly gluten-free bakery products, during the COVID-19 pandemic, which supported the growth of the industry. During the pandemic, healthcare professionals advised the daily consumption of healthy foods to maintain the body’s immunity. Consumers spent more time at home during the pandemic, which increased customer interest in personal health and fitness management and boosted the sales of gluten-free bakery items, such as bread, cookies, and biscuits. The significant number of cases of celiac diseases across the globe further contributes to the product demand.

As per the study by the Celiac Disease Foundation, in 2018, the prevalence of celiac disease was 0.4% in South America, 0.5% in Africa & North America, 0.6% in Asia, and 0.8% in Europe & Oceania. Coeliac disease is typically treated by consuming gluten-free food products. Food products without gluten reduce intestinal lining damage and the associated symptoms of diarrhea and stomachache. As a result, the increased demand for gluten-free goods for celiac disease treatment is fueling industry growth. Gluten-free bakery products are also gaining importance due to the increased popularity among individuals suffering from other diseases including inflammatory diseases, autoimmune disorders, and non-celiac gluten sensitivity.

Moreover, the rising government awareness programs related to the intake of gluten-free products for the treatment of celiac and other non-celiac disease treatments further contribute to the industry growth. These promotions have increased the need for the diagnosis of celiac disease among consumers and increased the product demand. Furthermore, the rising trend of following a healthy diet in developing countries is projected to provide ample opportunity for market growth. The rising adoption of micro-encapsulation technology to increase the shelf life of gluten-free bakery products by manufacturers is further projected to boost industry growth. This technology can be used to extend the shelf life and improve the texture of bakery products having no gluten, particularly in the frozen food category. As a result, the high demand for frozen gluten-free baked goods is fueling the industry growth. The availability of a diverse product range with continual improvements is expected to have a favorable impact on the growth.

Product Insights

The bread segment contributed to a larger market share of more than 36.30% in 2021. The market is mainly driven by the significant demand for low-carb gluten-free bread, rye bread, wheat-free bread, and others, owing to the health benefits associated with these bread. Gluten-free bread meets the demand for quick and convenient food, particularly among the working population. The capacity to customize bread to meet specific needs is also predicted to drive the segment growth. The rising consumption of gluten-free bread by patients having celiac diseases further enhances the industry's growth.

The biscuits & cookies segment is estimated to register the second-fastest CAGR during the forecast period. Shifting the food preferences of consumers and evolving trends toward healthy diets are augmenting the product demand across the globe. Furthermore, busy lifestyles and increased health & wellness concerns are expected to fuel healthy snacking habits and accelerate industry growth over the next decade. The rising demand for healthy cookies among children further contributes to the segment growth. Significant growth in the food processing industry further creates ample opportunities for segment growth.

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the industry in 2021 and accounted for the largest share of over 34.00% of the global revenue. The supermarkets & hypermarkets provide a wide range of product options and allow consumers to know the product details before purchasing, which contributed to the segment growth. Furthermore, the strong offline retail chain in many economies, such as the U.S., China, India, and other major countries, aided in the growing sales of gluten-free bakery items via hypermarkets & supermarkets. The greater availability of healthy food product items in supermarkets and hypermarkets has increased the overall sales of gluten-free bakery products. In addition, customers prefer to shop at traditional supermarkets due to convenience and wide product availability, which further drives segment growth.

On the other hand, the online segment is projected to register the fastest CAGR from 2022 to 2030 due to the growing trend of online shopping for healthy bakery products across the globe. The benefits of buying from the convenience of one’s home, doorstep delivery, free shipping, and savings are primarily attracting millennials and the younger generation to the online shopping platforms. In recent years, businesses in the FMCG industry have recognized the potential of e-commerce and, as a result, host their shopping websites to better respond to their customers’ requirements and make a suitable profit margin. Furthermore, the growing number of smartphone users is adding to the segmental growth.

Regional Insights

North America accounted for the largest revenue share of more than 33.90% in 2021 and will remain dominant throughout the forecast period. The regional market is mainly driven by the significant population of consumers with celiac disease in the region. As per a survey by the Celiac Disease Foundation, around 0.6% of the total population has celiac disease in the U.S. Furthermore, the increased demand for healthy diet foods in the U.S. and Canada contributed to the region’s high share. Significant demand from the millennials and younger population for healthy and convenience food with a high nutritional profile aided the market expansion in this region.

Asia Pacific, on the other hand, is expected to emerge as the fastest-growing region during the forecast period. The industry in the Asia Pacific region is mainly driven by the rising awareness regarding the health benefits of food products with no gluten in major countries, such as India, China, and others. Moreover, the growing concerns regarding celiac disease are estimated to further boost the demand for gluten-free foods in these countries. In addition, significant growth in the processed food sector in India and China is projected to create lucrative growth opportunities for the industry in the region.

Key Companies & Market Share Insights

The rising demand for gluten-free products has widened the scope of growth opportunities for manufacturers across the globe. Thus, the major players in the industry are adopting various competitive strategies, such as product launches, partnerships & collaborations, and geographical expansions to gain higher market shares. For example:

-

In January 2022, MYBREAD Gluten Free Bakery announced the launch of original flatbread pitas at selected Walmart stores across the U.S. The pitas will be available in the frozen section of the stores located in Florida, California, Illinois, Nevada, Iowa, Louisiana, Oregon, Wisconsin, and Texas

-

In June 2021, Dawn Foods launched injected muffins and chocolate brownies prepared with the company’s gluten-free fillings and mixes. With this product launch, the company expanded its product portfolio in the gluten-free bakery industry

-

In March 2021, Dawn Foods acquired JABEX, a family-owned firm in Bielsko-Biala, Poland, that specializes in high-quality fruit-based products for the bakery industry

Some of the prominent players in the global gluten-free bakery market include:

-

Amy’s Kitchen

-

Bob's Red Mill Natural Foods, Inc.

-

Dawn Food Products

-

The Hain Celestial Group

-

Dr. Schar AG

-

Freedom Nutritional Products Ltd.

-

General Mills

-

Conagra Brands

-

Valeo Foods Ltd.

-

WGF Bakery Products

-

Europastry S.A.

-

Kelkin

Gluten-free Bakery Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.81 billion

Revenue forecast in 2030

USD 4.15 billion

Growth rate

CAGR of 10.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Malaysia; Australia; South Africa; Brazil

Key companies profiled

Amy's Kitchen; Bob’s Red Mill Natural Foods, Inc.; Dawn Food Products; The Hain Celestial Group; Dr. Schar AG; Freedom Nutritional Products Ltd.; General Mills; Conagra Brands; Valeo Foods Ltd.; WGF Bakery Products; Europastry S.A.; Kelkin

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-free Bakery Market Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global gluten-free bakery market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bread

-

Biscuits & Cookies

-

Cakes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gluten-free bakery market size was estimated at USD 1.64 billion in 2021 and is expected to reach USD 1.81 billion in 2022.

b. The global gluten-free bakery market is expected to grow at a compound annual growth rate of 10.8% from 2022 to 2030 to reach USD 4.15 billion by 2030.

b. North America dominated the gluten-free bakery market with a share of 33.98% in 2021. This is attributable to increasing demand for healthy and nutritional food products due to rising health concerns.

b. Some key players operating in the gluten-free bakery market include Amy's Kitchen, Bob's Red Mill Natural Foods, Inc., Dawn Food Products, The Hain Celestial Group, Dr. Schar AG, Freedom Nutritional Products Limited, General Mills, Conagra Brands, Valeo Foods Ltd., WGF Bakery Products, Europastry S.A., and Kelkin.

b. There was a surge in the demand for healthy diet items, particularly gluten-free bakery products, during the COVID-19 pandemic, which supported the growth of the industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.