- Home

- »

- Consumer F&B

- »

-

Gluten-free Chocolate Market Size And Share Report, 2030GVR Report cover

![Gluten-free Chocolate Market Size, Share & Trends Report]()

Gluten-free Chocolate Market Size, Share & Trends Analysis Report By Product (Dark, White, Milk), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-515-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Gluten-free Chocolate Market Size & Trends

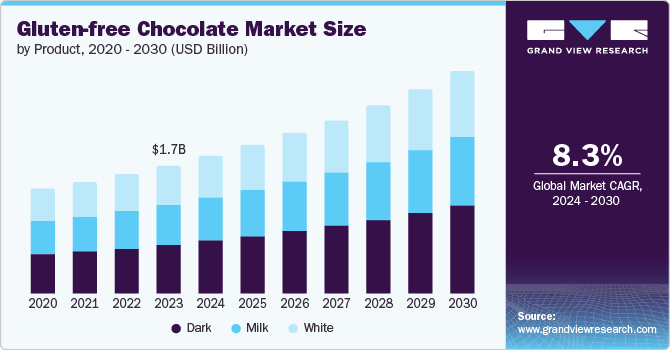

The global gluten-free chocolate market size was valued at USD 1.66 billion in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. The rising prevalence of celiac disease, recognized by the National Institutes of Health as a common condition, is the primary driver of product demand. This increasing affliction is significantly boosting market growth. Furthermore, the demand for gluten-free chocolates, perceived as a healthier alternative to traditional chocolates, drives market demand.

The increasing diagnosis of celiac disease has led to a higher demand for gluten-free products, including chocolates. Consumers seeking to avoid gluten for health reasons drive growth in the market. A broader interest in gluten-free diets for perceived health benefits further supports this trend. According to the Beyond Celiac, approximately about 1% of the population, or 1 in 133 Americans, are estimated to have celiac disease. However, screening studies suggested that the prevalence in the U.S. may be higher than 1%. A large-scale screening program of children in Italy found a celiac disease prevalence of 1.6%.

The demand for gluten-free chocolates, viewed as a healthier option than traditional chocolates, is fueling the market's growth. Consumers with gluten intolerance and those seeking health-conscious choices are key drivers of this trend, which is expanding the market for gluten-free chocolate products. For instance, in July 2024, Antonina's Gluten-free Bakery launched Double Chocolate Brownies, which is expected to target the growing gluten-free market, helping stores boost sales and keep gluten-free customers happy.

Product Insights

The dark chocolate segment dominated the market and accounted for a share of 38.8% in 2023 and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The rising awareness about the health benefits of dark gluten-free chocolates such as in lowering the stress and dealing with disorders such as Alzheimer’s disease, improving blood circulation and improving memory power are the major factors in growth of the market. For instance, in December 2023, CATALINA CRUNCH launched Dark Chocolate Cookie Bars, a new line of low-sugar chocolate bars. These bars combine a crunchy cookie center with a creamy mint or raspberry filling, all enrobed in dark chocolate, with only 2 grams of sugar each.

Milk chocolate segment is expected to grow at the CAGR of 8.2% over the forecast period. Driving factors for milk chocolate in the gluten-free chocolate market include the rising awareness of celiac disease and gluten intolerance, which increases the demand for safe and delicious alternatives. In addition, the perception of milk chocolate as a comforting and indulgent treat attracts health-conscious consumers seeking gluten-free options. Product development and labeling transparency innovations further boost consumer confidence and market growth. For instance, in January 2024, English Bay Blending Inc., a chocolate and protein bar company, acquired Kinnikinnick Foods & Kinnikinnick Fresh Bakery, a manufacturer of gluten-free products. This expands their offerings to include gluten-free baked goods alongside their existing specialties.

Regional Insights

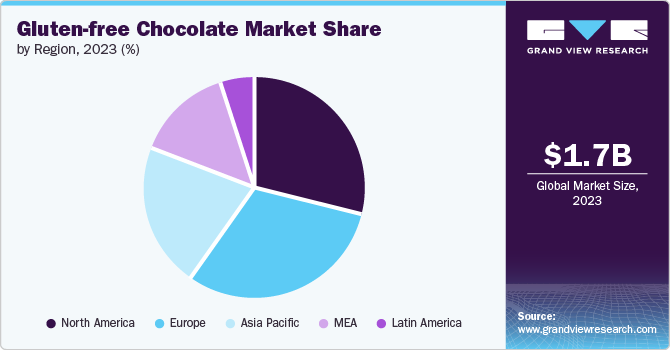

The North American gluten-free chocolate market is anticipated to grow significantly over the forecast period. The presence of large food companies such as Hershey and many more have influenced the growth in the market. The increasing number of gut-related diseases has propelled the consumption of gluten-free products in the region. For instance, in March 2022, Undercover Chocolate Co., LLC., known for its healthy chocolate snacks, announced its popular Dark Chocolate + Sea Salt Quinoa Crisps, available in over 40 Costco locations across the Bay Area in the U.S.

U.S. Gluten-free Chocolate Market Trends

The U.S. gluten-free chocolate market was identified as a lucrative country in 2023 and attributed to the rising health consciousness among consumers, increased prevalence of celiac disease and gluten sensitivity, and growing demand for specialty and premium products. These trends are supported by broader dietary trends favoring gluten-free options.

Europe Gluten-free Chocolate Market Trends

The European gluten-free chocolate market was the most dominant market in 2023 with a global market share of 31.1%. Europe has a large awareness of gut health, and preference for the health trend is rising continuously, which is the main reason for the market's growth. In addition, the presence of large food companies such as Nestle is further propelling the market by launching products in the segment. For instance, in August 2023, LOVO Chocolate, a plant-based brand, launched vegan and gluten-free milk chocolate bars in four flavors: almond, coconut, hazelnut, and oat milk chocolate.

The UK gluten-free chocolate market is expected to grow significantly over the forecast period; the factors influencing the growth of the market are the increase in gut-related patient population, increasing health awareness and widespread awareness about the benefits of gluten-free chocolate, and increasing trends of new generations, such as the younger generation, who prefer luxury and healthy products. For instance, in February 2022, Chocoladefabriken Lindt & Sprüngli AG launched two new vegan truffles-oat milk and dark chocolate-replicating their classic truffles with a dairy-free oat milk chocolate shell and a melt-in-your-mouth center. This builds on their vegan options, such as the Lindt Classic Recipe oat milk bars, previously available in Canada and the UK.

Asia Pacific Gluten-free Chocolate Market Trends

Asia Pacific gluten-free chocolate market is expected to grow at the fastest CAGR of 8.9% over the forecast period. The rising consumption of cocoa-based products is a key driver for the market in the region. Increasing health awareness, changing dietary preferences, and the growing popularity of premium and specialty chocolates contribute to this trend. Due to rising gluten sensitivity and demand for healthier alternatives, consumers are increasingly seeking gluten-free options. For instance, in 2021, Japan imported USD 1 billion of cocoa and cocoa products (267,200 tonnes). The top suppliers were Malaysia (15.9%), Singapore (15.6%), and Ghana (10.3%). Japan mainly imported chocolate bars, followed by cocoa beans, and cocoa butter.

India gluten-free chocolate market is thriving due to growing awareness of celiac disease, which creates a clear need for these products. Moreover, a general perception of gluten-free as healthier fuels broader consumer interest. The manufacturers are responding with a wider range of gluten-free chocolates, including premium and organic options, to cater to this expanding market.

Key Gluten-Free Chocolate Company Insights

Some of the key companies in the global gluten-free chocolate market are THE HERSHEY COMPANY, nib mor, Endangered Species Chocolate, Chocoladefabriken Lindt & Sprüngli AG, Ferrero, Taza Chocolate, Stivii Corp., Nature's Path Foods, Mondelēz International, and Dr. Schär AG/Spa. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

THE HERSHEY COMPANY is one of the largest chocolate manufacturers across the globe. It manufactures cookies, cakes, and chocolate and has new expertise in gluten-free chocolate manufacturing.

-

nib mor is in the business of manufacturing smooth and sweet chocolates for both snacking and drinking. It is one of the most popular manufacturers in the gluten-free market.

Key Gluten-Free Chocolate Companies:

The following are the leading companies in the gluten-free chocolate market. These companies collectively hold the largest market share and dictate industry trends.

- THE HERSHEY COMPANY

- nib mor

- Endangered Species Chocolate

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero

- Taza Chocolate

- Stivii Corp.

- Nature's Path Foods

- Mondelēz International

- Dr. Schär AG/Spa

Recent Developments

-

In May 2024, Mondelēz International announced the launch of gluten-free chocolate sandwich cookies. The new product is anticipated to have one of the best chocolate tastes.

-

In January 2024, Endangered Species Chocolates launched its eco-friendly Valentine series of non-GMO, gluten-free, kosher, and vegan dark chocolate products.

Gluten-free Chocolate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.79 billion

Revenue forecast in 2030

USD 2.88 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product , region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, UAE

Key companies profiled

THE HERSHEY COMPANY; nib mor; Endangered Species Chocolate; Chocoladefabriken Lindt & Sprüngli AG; Ferrero; Taza Chocolate; Stivii Corp.; Nature's Path Foods; Mondelēz International; Dr. Schär AG/Spa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-free Chocolate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gluten-free chocolate market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dark

-

Milk

-

White

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."