- Home

- »

- Consumer F&B

- »

-

Gluten-free Products Market Size, Industry Report, 2030GVR Report cover

![Gluten-free Products Market Size, Share & Trends Report]()

Gluten-free Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bakery Products, Condiments, Seasonings, Spreads), By Distribution Channel (Convenience Stores, Supermarkets & Hypermarket, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-834-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gluten-free Products Market Summary

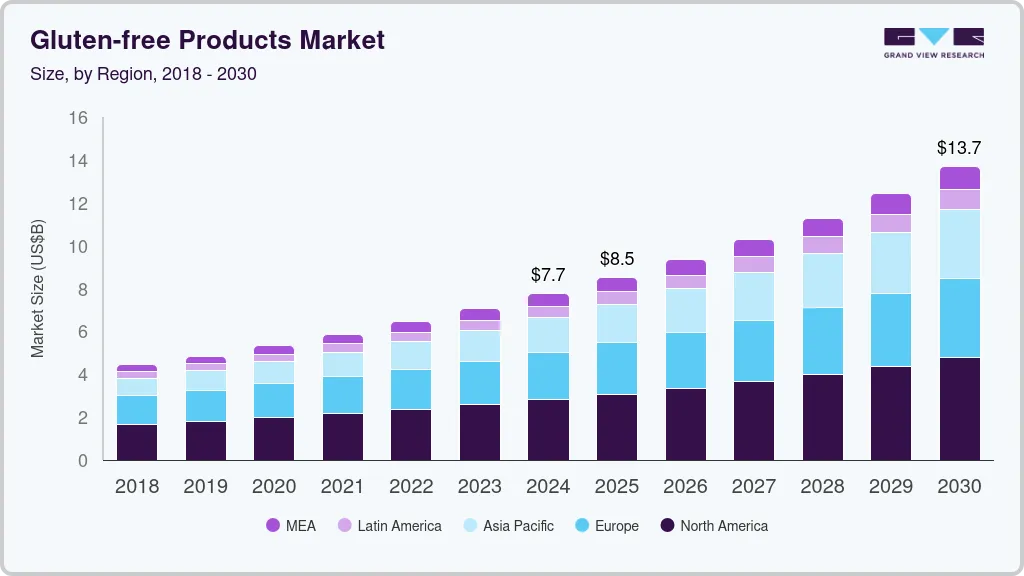

The global gluten-free products market size was estimated at USD 7.75 billion in 2024 and is projected to reach USD 13.67 billion by 2030, growing at a CAGR of 10.0% from 2025 to 2030. The gluten-free product industry has seen significant growth in recent years, driven by increasing awareness of gluten sensitivities, celiac disease, and the broader health-conscious consumer base.

Key Market Trends & Insights

- North America dominated the gluten-free products market with the largest revenue share of 35.1% in 2024.

- The gluten-free products market in the U.S. is expected to grow at the fastest CAGR of 9.7% over the forecast period.

- Based on product, the bakery products segment led the market with the largest revenue share of 30.8% in 2024.

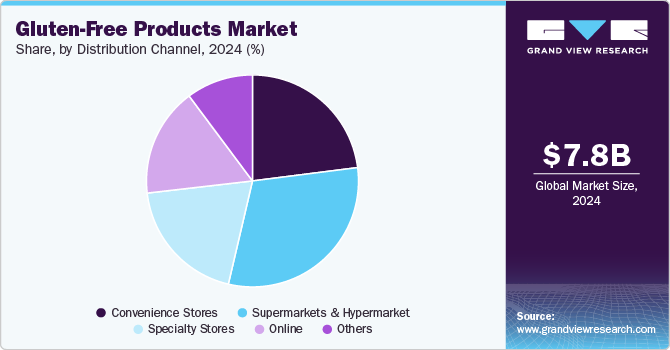

- Based on distribution channel, the supermarkets & hypermarkets segment held the largest share of 30.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.75 Billion

- 2030 Projected Market Size: USD 13.67 Billion

- CAGR (2025-2030): 10.0%

- North America: Largest market in 2024

The rising prevalence of celiac disease is encouraging consumers to adopt a gluten-free diet. Key drivers of this shift include the desire for products that support digestive health, cater to food intolerances, and offer nutritional benefits. As more individuals prioritize wellness, gluten-free options have gained popularity for their ability to provide safe and nutritious alternatives without compromising on taste, making them a preferred choice for those seeking healthier food options. According to data published in December 2024, the global demand for gluten-free products has increased by 16% between 2018 and 2022, making gluten-free products one of the top 10 food trends.

The adoption of gluten-free products has been significantly influenced by increased consumer awareness about gluten-related health issues. Conditions such as celiac disease, gluten intolerance, and wheat allergies have driven individuals to seek gluten-free alternatives. For instance, according to the data published in June 2024, celiac disease is a life-long disorder globally affecting about 0.7% and 2.9% of the population, with higher cases found in females.

The increased awareness about how gluten affects digestion and overall health has encouraged many to explore gluten-free products as a preventative or health-conscious measure. As consumers become more educated about these dietary needs, the demand for gluten-free products has grown, leading to greater availability in mainstream stores and more product options.

Moreover, a growing segment of the market believes that avoiding gluten can lead to better digestion, enhanced energy levels, and even weight loss. This perception has made gluten-free products appealing not only to those with medical needs but also to health-conscious individuals who see gluten-free diets as a lifestyle choice. The perceived benefits often encourage the initial trial and subsequent adoption of these products, even among those without formal diagnoses.

Furthermore, the increased awareness and higher adoption of gluten-free diets have caused a surge in the variety and availability of gluten-free options across food categories. Grocery stores, restaurants, and food delivery services now offer a wider range of gluten-free products, from snacks and bread to prepared meals and beverages. According to the data published, about 10% of U.S. restaurants offer gluten-free meals to entice gluten-free food consumers. The more accessible and diverse these products become, the easier it is for consumers to integrate gluten-free items into their daily lives. For instance, according to the GFFS data, nearly 74% of consumers would return to a restaurant that has achieved gluten-free validation as compared to a restaurant that has not.

Additionally, trusted brands that are known for high-quality, safe, and tasty gluten-free products build a loyal customer base, which accelerates adoption as consumers trust these brands to meet their dietary needs.

Consumer Insights

The rising prevalence of celiac disease and gluten sensitivity is a key driver in the global gluten-free products industry. Celiac disease, an autoimmune disorder triggered by gluten ingestion in genetically predisposed individuals, has seen a steady increase in diagnosed cases globally. Studies indicate that the prevalence of celiac disease has risen by 7.5% annually over the past few decades, particularly in industrialized nations such as the United States, Canada, and European countries. Improved diagnostic methods, such as advanced blood tests, have played a role in identifying non-classical symptoms, expanding the pool of diagnosed individuals.

Environmental factors and lifestyle changes have also contributed to this rise. Modern diets featuring highly processed foods and altered wheat preparation methods are suspected to disrupt gut health, leading to increased gluten intolerance. In addition, viral infections that compromise intestinal barriers have been linked to triggering celiac disease in genetically predisposed individuals. This interplay between diet and environmental triggers has fueled demand for gluten-free alternatives.

Gluten-free products, often marketed as more natural or pure, are aligning well with this demand for transparency in food labels. According to the data published in December 2024, the fastest-growing consumer demand in food products, according to industry professionals, is clean-label ingredients, with 50% of respondents highlighting this as the top trend. Gluten-free consumers are looking for transparency and high-quality ingredients in the products they buy, often preferring those that are minimally processed and free from additives and preservatives.

Another trend driving the market is the growing popularity of plant-based and organic gluten-free products. Many consumers are now seeking products that align with multiple health trends, such as veganism, vegetarianism, or organic diets. According to Awesome Health, LLC's May 2024 report states that nearly 88 million people worldwide and 9.7 million people in the U.S. identify as vegans or vegetarians. This has led to a surge in gluten-free products that also cater to these needs, including plant-based proteins and organic ingredients.

Key consumer preference is the demand for more variety and innovation in gluten-free offerings. Innovations such as gluten-free flour blends and gluten-free pizza crusts are gaining popularity, catering to both the dietary restrictions of gluten-sensitive individuals and the desire for convenience in daily meals. For instance, in January 2025, Daiya launched a new plant-based pizza line featuring a lighter, fluffier, and crispier gluten-free crust, enhanced rich tomato sauce, and Daiya's reformulated cheese made with Daiya oat cream blend. The refreshed pizzas offer a variety of options, including cheese, meatless pepperoni, supreme, fire-roasted veggie, meatless BBQ chick'n, and meatless meat lovers, all designed to provide a delicious, flavor-packed experience without dairy or gluten.

Product Insights

Based on product, the bakery products segment led the market with the largest revenue share of 30.8% in 2024. As more individuals adopt healthier lifestyles and dietary choices, demand has surged for gluten-free alternatives to traditional bread, cakes, cookies, and pastries. In addition, advancements in food technology and ingredient innovation have improved the taste and texture of gluten-free baked goods, making them more appealing to a wider audience. The increasing availability of these products in both mainstream retail and specialty stores has further driven market growth.

The desserts & ice-creams segment is expected to grow at the fastest CAGR of 10.8% from 2025 to 2030. With growing awareness of gluten intolerance and the popularity of gluten-free lifestyles, demand has surged for desserts and frozen treats made without wheat-based ingredients. Manufacturers are responding with innovative formulations that maintain the taste and texture of traditional options while being gluten-free. In addition, the rise of plant-based and clean-label trends has further boosted interest in gluten-free desserts and ice creams that offer both indulgence and health-conscious appeal.

Distribution Channel Insights

Based on distribution channel, the supermarkets & hypermarkets segment led the market with the largest revenue share of 30.7% in 2024. Supermarkets and hypermarkets are among the largest and most significant distribution channels for gluten-free products due to their wide product range and extensive consumer reach. These large retail outlets have the infrastructure to offer a diverse range of gluten-free items, including pantry staples such as bread, pasta, and flour, as well as snacks and frozen foods.

The online channels segment is expected to grow at the fastest CAGR of 11.0% from 2025 to 2030. People increasingly prefer to buy gluten-free products online due to the convenience, variety, and competitive pricing that e-commerce platforms offer. Online shopping eliminates the need to visit multiple stores, making it especially appealing for those in remote or less urbanized areas where specialized stores may not be available. Consumers increasingly prefer to shop for gluten-free products online due to the ease of browsing a vast range of items from the comfort of their homes. E-commerce platforms offer a broader selection of gluten-free products, including niche and hard-to-find items that may not be available in physical stores.

Regional Insights

North America dominated the gluten-free products market with the largest revenue share of 35.1% in 2024. North America shares a significant share in the global market due to heightened consumer awareness about gluten-related disorders such as celiac disease and non-celiac gluten sensitivity. The increasing adoption of gluten-free diets for perceived health benefits, including digestive health and weight management, has further fueled demand. In addition, the rise of clean-label diets, plant-based eating, and lifestyle choices that favor low-carb or allergen-free foods have significantly driven demand.

U.S. Gluten-free Products Market Trends

The gluten-free products market in the U.S. is expected to grow at the fastest CAGR of 9.7% from 2025 to 2030. Many Americans are choosing gluten-free options not only for medical reasons but also as part of a perceived healthier lifestyle. In addition, improved product variety and availability in mainstream grocery stores and restaurants have made gluten-free foods more accessible, further boosting demand.The U.S. Food and Drug Administration (FDA) has implemented strict labeling regulations for gluten-free products, ensuring safety and transparency for consumers. These regulatory measures have boosted consumer confidence and encouraged manufacturers to expand their gluten-free offerings. In addition, government initiatives promoting healthier eating habits have supported market growth. For instance, FDA guidelines requiring gluten-free products to contain less than 20 ppm of gluten have made these products more accessible and trustworthy.

Asia Pacific Gluten-free Products Market Trends

The gluten-free products market in Asia Pacific is expected to grow at a significant CAGR of 11.1% from 2025 to 2030. Rising disposable incomes and urbanization in the Asia Pacific have further fueled the growth of the gluten-free market. As urban populations expand, particularly in China and India, consumers are increasingly seeking healthier and specialized food options. This trend is supported by the middle class’s willingness to spend on premium products that cater to dietary preferences.

The China gluten-free products market is expected to grow at a substantial CAGR of 11.2% from 2025 to 2030. As Western eating habits and health trends influence the Chinese market, more consumers are seeking gluten-free alternatives as part of a broader pursuit of wellness and digestive health. In addition, the expanding availability of gluten-free products in supermarkets, e-commerce platforms, and health food stores, along with marketing efforts highlighting their health benefits, is boosting demand across the country.

Europe Gluten-free Products Market Trends

The gluten-free products market in Europe is expected to grow at a substantial CAGR of 10.2% from 2025 to 2030.Countries like Italy, Germany, and France have witnessed a surge in sales of gluten-free bread, cakes, cookies, and pastries due to innovations that enhance taste and texture. For instance, in 2023, Dr. Schär invested €12m ($13.2m) in its manufacturing facility in Dreihausen, Germany, to enhance biscuit production, identified as the "core product of the site." The investment included new machinery for measuring biscuit cream to improve ingredient dosing and reduce waste, along with robotics to enhance product composition and packaging.

The Germany gluten-free products market is expected to grow at a significant CAGR of 11.4% from 2025 to 2030. A growing segment of the population is also adopting gluten-free diets as part of a broader health and wellness lifestyle, even without medical necessity. The demand is further supported by the expanding availability of gluten-free offerings in supermarkets, organic stores, and online platforms, as well as improved product taste and quality. In addition, strong labeling regulations and rising interest in natural and allergen-free foods are fueling market growth in the country.

Key Gluten-free Products Company Insights

Many manufacturers in the gluten-free product industry are leveraging technology to enhance consumer experience and health tracking. By integrating IoT capabilities, some companies are developing smart packaging and mobile app connectivity that allow consumers to track product freshness, receive personalized dietary recommendations, and monitor nutritional intake in real-time. In addition, to cater to health-conscious and lifestyle-driven consumers, brands are offering customizable gluten-free options-such as build-your-own snack kits or mix-and-match baking blends-enabling greater flexibility and personalization. These innovations not only improve convenience and transparency but also deepen consumer engagement and brand loyalty.

Key Gluten-free Products Companies:

The following are the leading companies in the gluten-free products market. These companies collectively hold the largest market share and dictate industry trends.

- Conagra Brands, Inc.

- The Hain Celestial Group

- General Mills Inc.

- Kellogg Co.

- The Kraft Heinz Company

- Siete Foods

- Barilla G. e R. Fratelli S.p.A

- Seitz glutenfree

- Dr. Schär

- Ecotone

Recent Developments

-

In March 2025, Quiznos, the renowned sandwich chain known for its high-quality meats and cheeses, freshly sliced in-house daily and expertly toasted, announced the launch of new gluten-smart options across its U.S. locations. As part of this expansion, the brand introduced a limited-time offering, the Buffalo Chicken Club, featuring a spicy mayonnaise infused with Frank’s RedHot sauce, bacon, provolone cheese, tomatoes, and lettuce. The gluten-free bread is available for all sandwiches in regular and large sizes, with varying additional charges by location.

-

In December 2024, Revyve and Lallemand Bio-Ingredients Savory announced a strategic partnership in the North American market. This collaboration marked Lallemand as Revyve's exclusive distributor in the USA, Canada, and Mexico and strengthened their partnership, with Revyve sourcing a key raw material from Lallemand. Together, they aimed to set a new standard for sustainable, gluten-free, animal-free, GMO-free, and natural food innovations.

-

In October 2024, Dr. Schär launched three new gluten-free snacks: Peanut Butter Blondie Bites, Chocolate Brownie Bites, and Mini Honeygrams. The Peanut Butter Blondie Bites offer a blend of creamy and crunchy textures, while the Chocolate Brownie Bites provide a rich chocolate taste with a crispy wafer center. The Mini Honeygrams are bite-sized versions of Schär's classic graham-style cookies, lightly sweetened with honey. These snacks are designed to provide delicious, gluten-free options for various snacking occasions and are available online through the Schär Shop.

-

In August 2024, Lancaster Colony Corp. introduced its first gluten-free line of New York Bakery frozen bread, featuring Garlic Texas Toast and Five Cheese Texas Toast varieties. These products utilize a patent-pending dough recipe designed to closely mimic the texture and flavor of traditional breads, addressing common challenges associated with gluten-free alternatives. The company plans to leverage this innovative formulation as a foundation for expanding its gluten-free offerings in the future.

Gluten-free Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.50 billion

Revenue forecast in 2030

USD 13.67 billion

Growth rate

CAGR of 10.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Brazil; Argentina; South Africa

Key companies profiled

Conagra Brands, Inc.; The Hain Celestial Group; General Mills Inc.; Kellogg Co.; The Kraft Heinz Company; Siete Foods; Barilla G. e R. Fratelli S.p.A; Seitz glutenfree; Dr. Schär; Ecotone.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-free Product Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gluten-free products market report based on the product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery Products

-

Dairy/Dairy Alternatives

-

Meats/Meats Alternatives

-

Condiments, Seasonings, Spreads

-

Desserts & Ice-creams

-

Prepared Food

-

Pasta & Rice

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Convenience Stores

-

Supermarkets & Hypermarket

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gluten-free products Market market size was estimated at USD 6.45 billion in 2022 and is expected to reach USD 7.07 billion in 2023.

b. The global gluten-free products Market market is expected to grow at a compounded growth rate of 9.8% from 2023 to 2030 to reach USD 13.67 billion by 2030.

b. Bakery products dominated the global gluten-free products Market market with a share of 28.84% in 2022. This is attributed to increasing awareness of healthy eating, which encompasses natural, organic, and gluten-free foods.

b. Some key players operating in the gluten-free products market include Conagra Brands, Inc., The Hain Celestial Group, General Mills Inc., Kellogg Co., The Kraft Heinz Company, Hero Group, Barilla G. e R. Fratelli S.p.A, Seitz glutenfrei, Freedom Foods Group Limited, Ecotone.

b. Key factors that are driving the gluten-free products market growth include the rising prevalence of celiac disease and other diseases owing to unhealthy lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.