- Home

- »

- Clothing, Footwear & Accessories

- »

-

Golf Shoes Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Golf Shoes Market Size, Share & Trends Report]()

Golf Shoes Market (2024 - 2030) Size, Share & Trends Analysis Report By Shoe Type (Spiked Golf Shoes, Spikeless Golf Shoes, Golf Boots, Golf Sandals), By Gender (Men, Women, Kids), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-439-6

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Shoes Market Summary

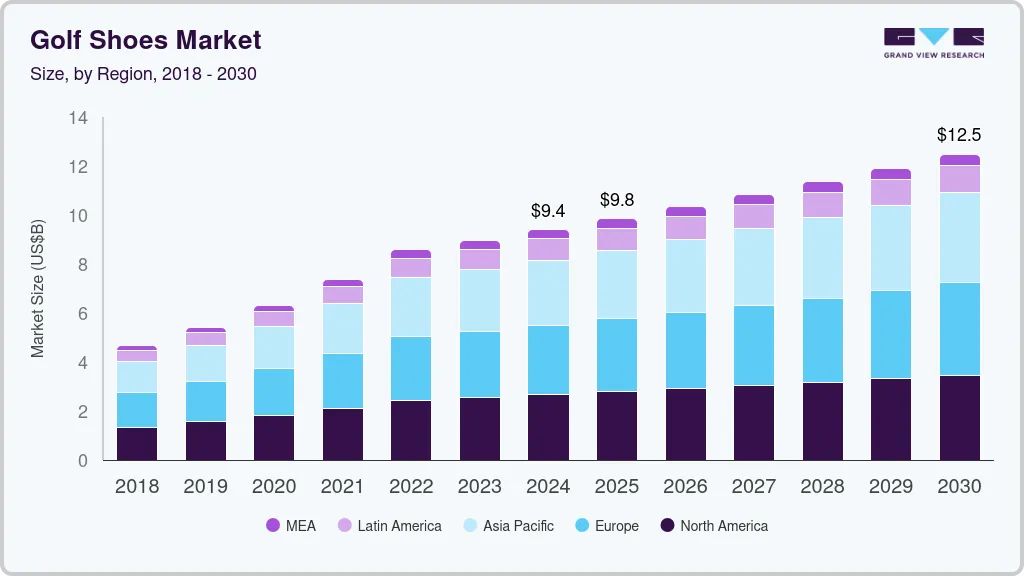

The global golf shoes market size was estimated at USD 8.96 billion in 2023 and is projected to reach USD 12.48 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. As golf grows in popularity worldwide, with increased accessibility through public courses and inclusive programs, the demand for golf apparel and accessories, including shoes, is set to rise.

Key Market Trends & Insights

- The golf shoes market in North America captured a revenue share of over 28.85% in the market.

- The golf shoes market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.

- By shoe type, the spiked golf shoes segment accounted for a share of 32.90% of the global revenue in 2023.

- By gender, the men’s golf shoes segment accounted for a share of 39.89% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.96 Billion

- 2030 Projected Market Size: USD 12.48 Billion

- CAGR (2024-2030): 4.8%

- Europe: Largest market in 2023

The COVID-19 pandemic also led to a surge in golf as a preferred outdoor activity, with many new players entering the sport. High-profile events such as the Masters, U.S. Open, and Ryder Cup generate significant attention and interest in golf equipment, including shoes. Sponsorships, endorsements, and visibility through professional golfers wearing specific brands provide crucial marketing leverage, driving consumer interest and sales.The integration of technology into golf shoes has greatly influenced the market. Features such as improved traction, waterproof materials, lightweight construction, and enhanced comfort have become essential. Manufacturers are increasingly using advanced materials such as Gore-Tex, breathable mesh, and synthetic leathers to enhance performance and durability.

The focus on sustainability is transforming the golf shoe market. Environmentally conscious consumers are driving demand for products made with sustainable materials and processes. Brands are investing in eco-friendly practices, from sourcing recycled materials to designing shoes that can be fully recycled at the end of their lifecycle.

The increasing participation of women in golf is noteworthy, leading to a rising demand for women's golf shoes. Manufacturers are expanding their product lines to cater to this demographic, offering stylish and functional options that combine performance with fashion.

The golf shoes market is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global golf shoes market.

Marketing and branding strategies adopted by manufacturers to differentiate themselves in a crowded market. Collaborations with high-profile athletes, limited-edition releases, and leveraging social media influencers are some of the ways brands are capturing consumer attention. By appealing to both athletes and fashion enthusiasts, manufacturers are broadening their customer base and expanding market potential.

Many manufacturers are ramping up their investments in marketing, R&D, and product development, recognizing the lucrative potential of the golf footwear segment. This is leading to increased competition and a wider array of product offerings for consumers.

Shoe Type Insights

Spiked golf shoes segment accounted for a share of 32.90% of the global revenue in 2023. Spiked golf shoes are footwear specifically designed for use on the golf course, incorporating detachable or permanent spikes on the soles to provide superior traction and stability. These shoes are engineered to enhance performance, allowing golfers to have secure footing during their swings, which can be critical for achieving consistent shots. The spikes penetrate the ground, preventing slipping and enabling golfers to execute powerful swings with confidence. This stability is especially beneficial in wet or uneven conditions, where maintaining footing could mean the difference between a successful shot and a misfire.

Spikeless golf shoes segment is expected to grow at a CAGR of 5.0% from 2024 to 2030. Modern golfers are embracing a more casual and versatile approach to the game, leading to changes in their footwear preferences. Spikeless golf shoes, characterized by their flat soles and rubber nubs, offer a blend of comfort and functionality that appeals to a broad range of players. Spikeless options allow for greater flexibility and ease of movement both on and off the course. This trend reflects a lifestyle choice, where players seek versatile footwear that can be worn in various settings, not just while playing golf. Many contemporary spikeless designs feature advanced materials and technologies that enhance breathability, cushioning, and support.

Gender Insights

Men’s golf shoes segment accounted for a share of 39.89% of the global revenue in 2023. The men's segment often has a broader range of styles, designs, and brands to choose from. This variety caters to different preferences, from traditional leather shoes to more modern athletic designs, appealing to a wider audience. Many innovations in golf shoe technology, such as improved traction, waterproofing, and comfort, are first introduced in the men's segment. These features are often prioritized due to the larger market, making men's golf shoes more attractive to consumers focused on performance.

Women’s golf shoes segment is expected to grow at a CAGR of 5.1% from 2024 to 2030. There has been a significant increase in the number of women taking up golf, driven by initiatives to make the sport more inclusive and accessible. Programs specifically targeting female golfers have encouraged more women to participate, leading to higher demand for women's golf shoes. The growing popularity of women's golf tours, such as the LPGA, has brought more visibility to female golfers, inspiring more women to take up the sport and invest in appropriate gear. Manufacturers are increasingly focusing on developing golf shoes specifically designed for women, offering better fit, comfort, and style. These innovations cater to the unique anatomical needs of women, making the products more appealing.

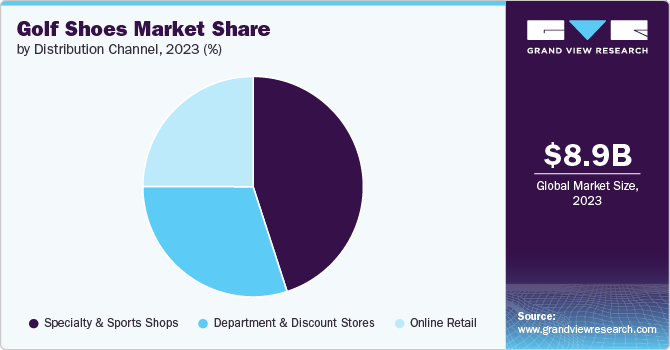

Distribution Channel Insights

The sales of golf shoes through specialty & sport shops accounted for a revenue share of 45.01% in 2023. These shops typically offer a wide range of golf shoes, including the latest releases, exclusive models, and signature athlete lines. This variety attracts both serious athletes and enthusiasts who want access to the newest and most specialized products, which may not be as readily available in general retail stores. Moreover, these stores often engage in targeted marketing efforts, such as sponsoring local golf events, hosting in-store athlete appearances, or offering promotions tied to major golf tournaments. Such initiatives not only attract customers but also create a strong connection between the brand and the sport, boosting sales through these channels.

The sales of golf shoes through online retail is expected to grow at a CAGR of 5.5% from 2024 to 2030. Online platforms feature customer reviews and ratings, which help shoppers make informed decisions based on the experiences of other buyers. This peer feedback can be a significant influence, especially for consumers who are unsure about which golf shoes to purchase. Many golf shoe brands are increasingly adopting direct-to-consumer strategies, selling their products exclusively through their own online stores. This approach allows brands to offer exclusive products, build stronger customer relationships, and control their branding and pricing, all of which boost online sales.

Regional Insights

The golf shoes market in North America captured a revenue share of over 28.85% in the market. The North American market is a hub for innovation in golf shoe technology, with manufacturers focusing on advanced materials, improved traction, comfort, and waterproofing. These innovations cater to the performance needs of golfers, making the region a key market for premium golf shoes. Companies are increasingly offering customized golf shoes tailored to individual preferences, which is particularly appealing to the North American consumer who values comfort and performance.

U.S. Golf Shoes Market Trends

The golf shoes market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.There has been a noticeable increase in female golfers in the U.S., which has led to a growing demand for women’s golf shoes. This segment is expected to grow rapidly as more women take up the sport. Leading brands such as FootJoy, Nike, Adidas, and Under Armour have a strong following in the U.S., with many consumers showing high brand loyalty. This loyalty is often driven by the brands' consistent delivery of quality and performance.

Europe Golf Shoes Market Trends

The golf shoes market in Europe is expected to grow at a CAGR of 4.9% from 2024 to 2030. European consumers are increasingly concerned about environmental impact, leading to a growing demand for golf shoes made from sustainable materials, such as recycled fabrics and eco-friendly leathers. Major brands are responding to this trend by introducing sustainable product lines and adopting greener manufacturing processes, which resonate well with European consumers who prioritize sustainability. Efforts to attract younger players to golf, including junior golf programs and youth tournaments, are contributing to the expansion of the market, as younger golfers tend to prioritize stylish and functional footwear.

Asia Pacific Golf Shoes Market Trends

The golf shoes market in Asia Pacific is expected to witness a CAGR of 5.1% from 2024 to 2030. Countries such as China and India are witnessing a surge in golf participation as the sport becomes more accessible. Golf courses, driving ranges, and golf clubs are expanding in these regions, contributing to the growth of the golf shoes market. The success of professional golf tours, such as the Asian Tour, has raised the profile of golf in the region. The visibility of professional golfers wearing specific brands and styles of shoes influences consumer preferences.

Key Golf Shoes Company Insights

The golf shoes market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the golf shoes market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace golf footwear.

Key Golf Shoes Companies:

The following are the leading companies in the golf shoes market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- Adidas AG

- Mizuno Corporation

- Puma SE

- Skechers USA, Inc.

- Under Armour, Inc.

- ECCO Sko A/S

- Callaway Golf Company

- New Balance Athletics, Inc.

- ASICS Corporation

Recent Developments

-

In June 2024, Nike released special edition golf shoes for major tournaments, including the Masters and PGA Championship, each featuring unique designs. The three launches include the Nike Air Zoom Victory Tour 3 NRG Golf Shoes, Nike Air Zoom Infinity Tour Next% 2 Golf Shoes, and Nike Air Pegasus 89 G NRG Golf Shoes.

-

In April 2024, FootJoy revealed its latest television advertisement titled "Joy Ride," showcasing PGA Tour sensation Max Homa as he takes to the skies after a powerful tee shot in the brand's innovative Pro/SLX golf shoes. Tailored specifically for golfers, the Pro/SLX Carbon and Pro/SLX models showcased in the ad are made from high-quality “ChromoSkin” leather.

Golf Shoes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.39 billion

Revenue forecast in 2030

USD 12.48 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Shoe type, gender, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Nike, Inc.; Adidas AG; Mizuno Corporation; Puma SE; Skechers USA, Inc.; Under Armour, Inc.; ECCO Sko A/S; Callaway Golf Company; New Balance Athletics, Inc.; ASICS Corporation

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Shoes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global golf shoes market report based on shoe type, gender, distribution channel, and region:

-

Shoe Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Spiked Golf Shoes

-

Spikeless Golf Shoes

-

Golf Boots

-

Golf Sandals

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Retail

-

Specialty & Sports Shops

-

Department & Discount Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global golf shoes market size was estimated at USD 8.96 billion in 2023 and is expected to reach USD 9.39 billion in 2024.

b. The global golf shoes market is expected to grow at a compounded growth rate of 4.8% from 2024 to 2030 to reach USD 12.48 billion by 2030.

b. The spiked golf shoes segment dominated the golf shoes market with a share of 32.90% in 2023. Spiked golf shoes are footwear specifically designed for the golf course, incorporating detachable or permanent spikes on the soles to provide superior traction and stability. These shoes are engineered to enhance performance, allowing golfers to have secure footing during their swings, which can be critical for achieving consistent shots.

b. Some key players operating in the golf shoes market include Nike, Inc.; Adidas AG; Mizuno Corporation; Puma SE; Skechers USA, Inc.; Under Armour, Inc.; ECCO Sko A/S; and Callaway Golf Company

b. Key factors that are driving the market growth include high-profile events such as the Masters, U.S. Open, and Ryder Cup generate significant attention and interest of people in golf equipment, including golf shoes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.