- Home

- »

- Homecare & Decor

- »

-

Golf Training Aids Market Size, Share & Growth Report, 2030GVR Report cover

![Golf Training Aids Market Size, Share & Trends Report]()

Golf Training Aids Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Swing Trainer, Hitting Nets, Hitting & Putting Mats, Training Putters & Arcs), By Distribution Channel (Sporting Goods Retailer, On-Course Shops), By Region, & Segment Forecasts

- Report ID: GVR-4-68040-143-3

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Training Aids Market Summary

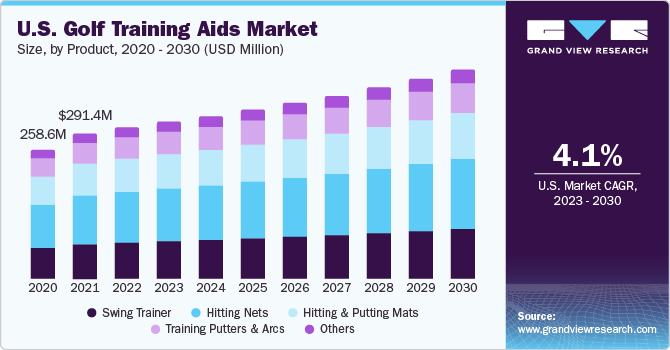

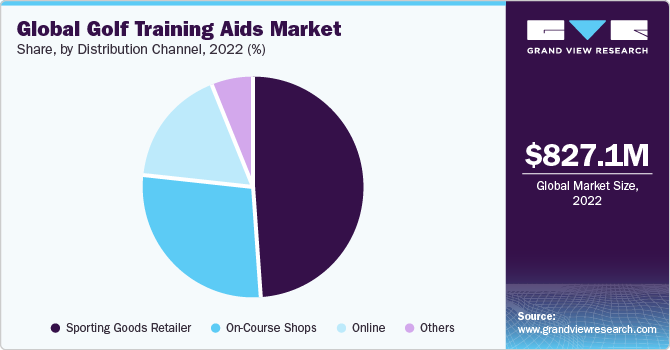

The global golf training aids market size was estimated at USD 827.1 million in 2022 and is expected to grow to USD 1,238.1 million by 2030, growing at a CAGR of 5.2% from 2023 to 2030. This growth is mainly on account of a growing interest in golf as a recreational activity and sport, with enthusiasts seeking to improve their game, along with advancements in technology leading to the development of innovative training aids that offer more effective and personalized coaching, attracting beginners as well as seasoned players.

Key Market Trends & Insights

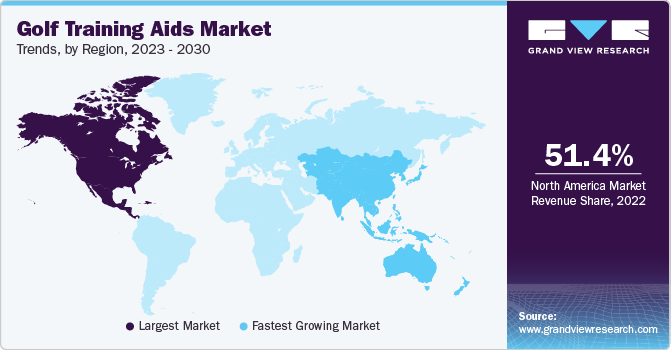

- North America golf training aids market accounted for the largest global revenue share of 51.38% in 2022.

- The Asia Pacific region is anticipated to witness a CAGR of 6.8% during the forecast period.

- By product, the hitting nets segment held the largest revenue share of 36.31% in 2022.

- By distribution channel, sporting goods retailers dominated with a 49.45% revenue share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 827.1 Million

- 2030 Projected Market Size: USD 1,238.1 Million

- CAGR (2023-2030): 5.2%

- North America: Largest market in 2022

The global reach of golf, with increasing popularity in emerging economies, is driving the customer base for golf training aids, contributing to a sustained market growth.

Rapid developments in golf technology have transformed training aids, offering data-driven improvements to golfers. Tools such as the Sportsbox AI mobile app help golfers in analyzing their swings in 3D settings, receiving real-time feedback, and comparing to professionals. The HackMotion Golf Wrist Sensor focuses on wrist angles for clubface control, offering immediate feedback and customizable features. The V1 Sports Game app allows players to track on-course statistics and improve their game, with a companion app for coaches to review and communicate remotely. These innovations make golf training more accessible and effective, thereby driving increased interest in golf as a sports activity. This is driving the growth of golf training aids with high-tech solutions.

The growth of golf's overall participation base in the U.S. has risen to 41.1 million in 2022 from 32 million in 2016. Off-course golf entertainment venues such as Drive Shack, Topgolf, and Popstroke have greatly increased golf's appeal and accessibility, particularly among younger demographics. With nearly half of all golf participants in the U.S. in 2021 falling within the 6 to 34 age group, there's a significant market for golf training aids. As more people, particularly the younger generation, engage with golf, the demand for innovative training aids to improve their game is expected to continue to rise, making it a growing market.

The Asia Pacific region has seen a noticeable surge in this sport's popularity, with research by the Royal and Ancient Golf Club of St. Andrews (R&A) and Sports Marketing Surveys in 2022 showing that more than 23.3 million people in Asia played golf in 2020, which was an 11.5% rise from 2016. Notable growth is seen in countries such as China (+43%), Malaysia (25%), Korea (31%), and India (14%). This growing interest in golf and increasing participation shows the growing demand for golf training aids as more individuals, including newcomers, seek tools to improve their game. The golf industry can capitalize on this trend by offering flexible and attractive options to retain and engage this increasing base of players.

Product Insights

The hitting nets segment held a revenue share of 36.31% in 2022 and the segment is expected to maintain this significant share over the forecast period. The segment's dominance is on account of the versatility and practicality of hitting nets, which offer golfers a convenient way to practice their ball-striking and swinging skills in different settings, including home environments and golf practice facilities. The accessibility and convenience of hitting nets make them a favored choice for golfers looking for effective training aids, contributing to their strong demand in the market.

The swing trainers segment is poised to witness a CAGR of 6.7% during the forecast period. Swing trainers are in high demand from golfers as they provide a structured approach to bettering their golf swings. These training aids offer real-time feedback and aid golfers in developing muscle memory for more accurate and consistent swings. With the increasing emphasis on improving golf skills, swing trainers have become essential tools for players of all levels, driving their popularity and demand among golfers looking to enhance their performance on the course.

Distribution Channel Insights

The sporting goods retailers segment held a dominant revenue share of 49.45% in the market in 2022. Retailers such as Burghardt Sporting Goods and Dick’s Sporting Goods offer a variety of training aids, making them highly accessible to golfers of different skill levels. These retailers generally provide expert recommendations, improving the shopping experience for customers. Moreover, the convenience of purchasing training aids in physical stores from trusted retailers boosts their market share.

The sales of golf training aids through online channels are projected to witness a CAGR of 6.7% during the forecast period. The partnership between golf training systems and retailers is driving online channel growth in the golf training aids market by providing golfers with easy access to the products via retailer’s online platforms. For instance, in October 2022, GOLFFOREVER and DICK'S Sporting Goods and Golf Galaxy underwent a collaboration to make GOLFFOREVER Swing Trainer, a key golf training aid, available for purchase through the retailer’s online channel. This collaboration taps into the rising trend of golfers seeking training aids online, offering a seamless and convenient shopping experience, thereby boosting the demand for golf training aids through digital channels.

Regional Insights

North America accounted for a significant revenue share of 51.38% in 2022 in the global market. As per the PGA Tour, a non-profit organization, golf in the United States is witnessing a resurgence in popularity, with one out of seven Americans playing the sport in 2022, leading to USD 101.7 billion in direct economic impact, which was up by 20% from 2016. Some factors include the COVID-19 pandemic driving interest, the emergence of off-course golf entertainment venues, and better accessibility to younger and diverse demographics. The PGA TOUR in America is evolving at the professional level, with a modified schedule featuring high-stakes events and larger prize money, along with embracing technology and sports betting. This evolution, as well as efforts of organizations such as the APGA Tour and First Tee to provide pathways for young players, is poised to drive demand for golf training aids in the region.

The Asia Pacific region is anticipated to expand at a CAGR of 6.8% during the forecast period. The rising popularity of golf in countries such as South Korea and Japan is projected to contribute to the strong demand for golf training aids. The number of golf courses has tripled in China in less than a decade, as per the World Golf Report 2021. Countries such as India and China have shown a high level of enthusiasm for this sport, surpassing core markets such as the United States and the UK. This growth is also driven by the increasing wealth of consumers in Asia, leading them to engage in leisure activities such as golf.

Several initiatives such as a newly subsidized junior golf initiative in countries such as Singapore aim to make golf more accessible to a wider audience. As golf becomes more accessible, it will drive a growing demand for golf training aids to support the development of new golf enthusiasts, especially among the younger generation in Asia Pacific. Golf training aid manufacturers and providers may find significant opportunities in these expanding Asian markets to cater to the rising demand for products that help golfers enhance their performance.

Key Companies & Market Share Insights

The market is moderately fragmented and characterized by the presence of major established players. They have undertaken initiatives for offering innovative training aids to help golfers improve their skills and their swing efficiency. In June 2023, GolfTrainingAids.com, a notable golf teaching and training aids supplier, introduced a training aid called "The Connector." This foam ball device, designed by the renowned teaching professional Dan Frost, enhances the arm-torso connection and alignment of golfers at impact, resulting in improved ball striking and compression. It offers immediate feedback on rotation for several golf skills, from putting to driver swings. The Connector is anticipated to cater to golfers of various skill levels, contributing to the growing demand for specialized golf training aids.

Companies such as Kavooa Golf cater to the demand for specialized golf training aids. In August 2023, Dylan Horowitz, a collegiate golfer, developed a new golf training aid known as Kavooa Pro. This innovative swing training aid has been designed to help golfers improve their ball striking consistency by stabilizing their head and hips during the swing. Kavooa Pro uses a tripod-based system with adjustable rods to offer instant feedback and improve various aspects of a golfer's skills, from swing plane to head movement. With its versatility and ease of use, Kavooa Pro has gained attention from professional instructors and will be presented at industry events like the PGA Coaches Summit and the PGA Merchandise Show.

Key Golf Training Aids Companies:

- Topgolf Callaway Brands

- Acushnet Holdings Corp.

- Honma Golf Ltd

- Mizuno USA, Inc.

- Saber Golf

- EyeLine Golf

- Implus Footcare, LLC

- Optishot Golf

- GForce Golf

- WestCoast Netting

Golf Training Aids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 865.3 million

Revenue forecast in 2030

USD 1,238.1 million

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Brazil; South Africa

Key companies profiled

Topgolf Callaway Brands; Acushnet Holdings Corp.; Honma Golf Ltd; Mizuno USA, Inc.; Saber Golf; EyeLine Golf; Implus Footcare, LLC; Optishot Golf; GForce Golf; WestCoast Netting

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Training Aids Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global golf training aids market report based product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Swing Trainer

-

Hitting Nets

-

Hitting & Putting Mats

-

Training Putters & Arcs

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Sporting Goods Retailer

-

On-Course Shops

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the golf training aids market with a share of more than 51% in 2022. The growth of the regional market is driven on account of the region's robust golfing culture, a large population of golf enthusiasts, and a well-established golf industry ecosystem.

b. Some of the key players operating in the golf training aids market include Kavooa Golf, Mizuno USA, Inc., Acushnet Holdings Corp., and Honma Golf Ltd.

b. Key factors that are driving the golf training aids market growth include increasing interest in golf as a recreational activity and sport, and the demand for tools and equipment to help golfers improve their skills and performance.

b. The global golf training aids market was estimated at USD 827.1 million in 2022 and is expected to reach USD 865.3 million in 2023.

b. The global golf training aids market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 1,238.1 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.