- Home

- »

- Pharmaceuticals

- »

-

Gout Therapeutics Market Size, Share, Industry Report, 2030GVR Report cover

![Gout Therapeutics Market Size, Share & Trends Report]()

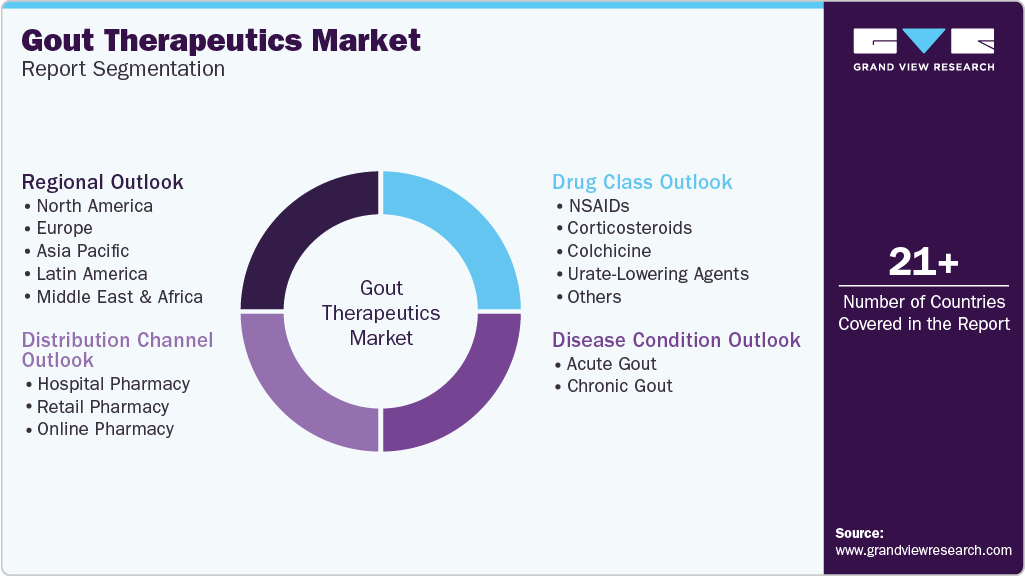

Gout Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (NSAIDs, Corticosteroids, Colchicine, Urate-Lowering Agents), By Disease Condition, By Distribution Channel (Hospital Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-717-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gout Therapeutics Market Summary

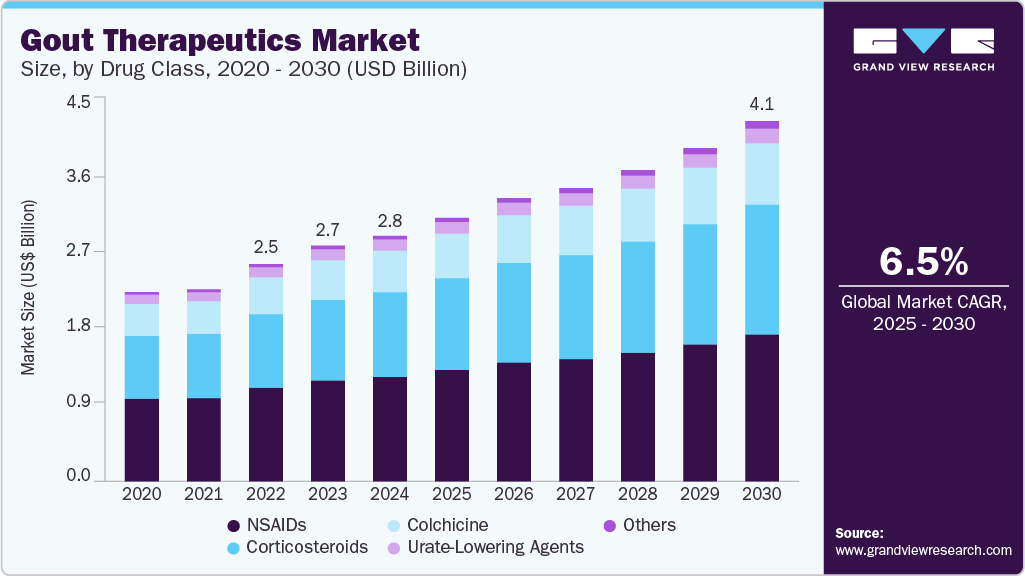

The global gout therapeutics market size was estimated at USD 2.82 billion in 2024 and is projected to reach USD 4.13 billion by 2030, growing at a CAGR of 6.45% from 2025 to 2030. The rising prevalence of gout and advancements in treatment options are expected to drive the demand for gout therapeutics.

Key Market Trends & Insights

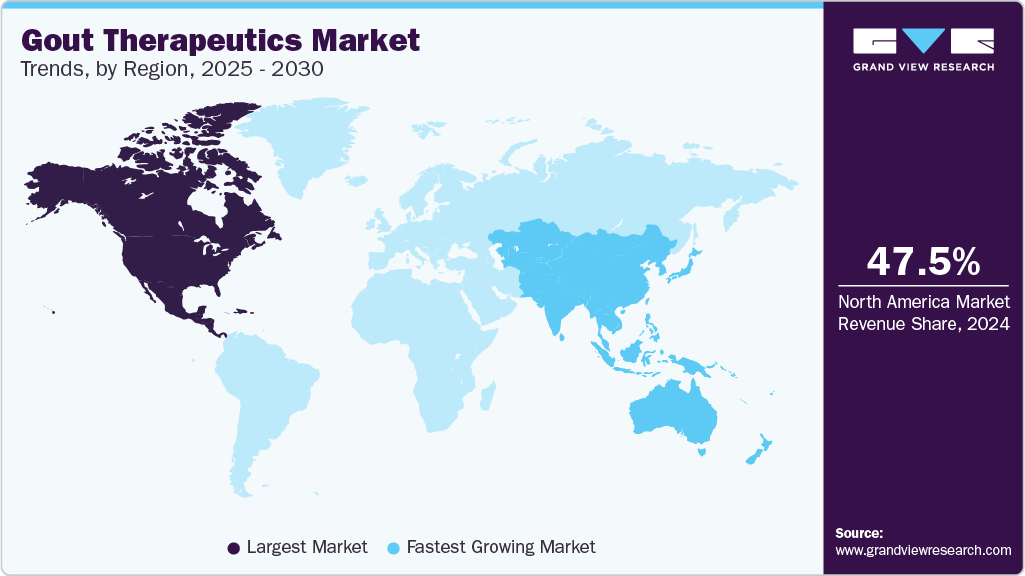

- North America gout therapeutics market dominated the global market with a 47.51% share in 2024.

- The U.S. gout therapeutics industry dominated the North America market in 2024.

- By drug class, the NSAIDs segment dominated the gout therapeutics industry with a 42.55% share in 2024.

- By disease condition, the acute condition segment dominated the market in 2024.

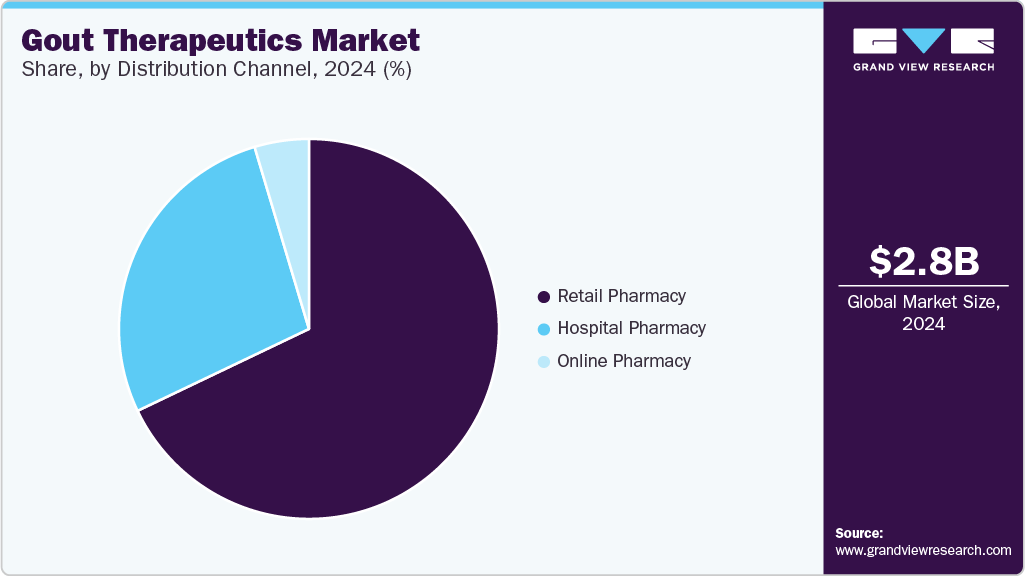

- By distribution channel, the retail pharmacy segment held the largest market share of 67.91% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.82 Billion

- 2030 Projected Market Size: USD 4.13 Billion

- CAGR (2025-2030): 6.45%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, growing awareness of the disease and efforts to raise awareness about gout among healthcare professionals and the general population propel the market growth further. Aging population, sedentary lifestyle, unhealthy diet, obesity, and conditions like hypertension and diabetes are significant factors impelling the growth of the gout therapeutics industry. According to the Rheumatology Advisor in 2024, the global age-standardized prevalence rate of gout was 659.3 per 100,000 population in 2020. In the same year, the prevalence rate in men and women was 1030.8 and 316.4 per 100,000 population, respectively. It was 3.36 times higher in men, highlighting a significant gender disparity.

In addition, technological advancements, innovative treatment options, and an increased understanding of the disease's pathophysiology further drive the market growth. The integration of personalized medicine, guided by genomic research, enables more tailored treatment plans based on individual genetic profiles. This approach helps enhance treatment efficacy and minimizes adverse effects, marking a significant shift toward precision medicine in gout management.

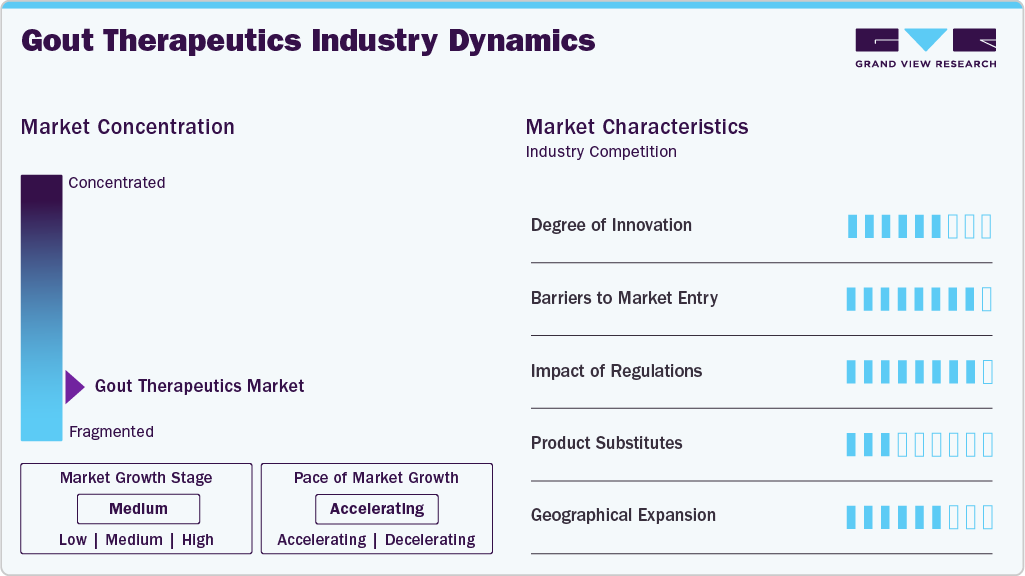

Market Concentration & Characteristics

The gout therapeutics market is evolving with a shift toward targeted therapies and biologics aimed at long-term uric acid control and inflammation management. Innovative agents such as interleukin-1 inhibitors (e.g., anakinra) and novel xanthine oxidase inhibitors are being developed to overcome the limitations of traditional treatments like allopurinol and febuxostat. Advances in formulation, such as once-daily oral doses and improved tolerability, are enhancing adherence and therapeutic outcomes.

Although generic drugs dominate initial gout treatment, market entry for novel therapies faces moderate to high challenges. These include extensive clinical validation requirements, post-marketing surveillance, and pricing pressure in cost-sensitive markets. Regulatory scrutiny around cardiovascular safety and long-term efficacy further limits rapid entry. Nonetheless, firms with innovative mechanisms of action or improved safety profiles may leverage fast-track approvals to gain market presence.

The regulatory landscape plays a critical role in shaping the gout therapeutics market. For instance, FDA warnings about cardiovascular risks associated with febuxostat have influenced prescribing patterns. Regulators emphasize comprehensive risk-benefit evaluations, particularly for chronic-use therapies. Ongoing pharmacovigilance and post-market safety studies are essential to maintain approvals and physician trust, impacting both existing and upcoming products.

Substitutes for gout therapies include NSAIDs, corticosteroids, and colchicine for acute flare management, as well as lifestyle interventions for long-term control. Biologics such as canakinumab and off-label use of IL-1 inhibitors present alternative options for refractory gout cases. However, their cost and immunosuppressive profile restricts broader use. Uricosuric agents like probenecid are also considered in patients intolerant to xanthine oxidase inhibitors.

The gout therapeutics market is expanding across regions such as Asia Pacific, Latin America, and Eastern Europe due to rising prevalence linked to aging populations, dietary habits, and comorbidities like obesity and metabolic syndrome. Companies like Horizon Therapeutics, Takeda, and Teijin Pharma are actively pursuing regional partnerships, localized clinical trials, and pricing adaptations to support access. Government healthcare initiatives and growing awareness contribute to the market’s penetration into previously underserved areas.

Drug Class Insights

The NSAIDs segment dominated the gout therapeutics industry with a 42.55% share in 2024. High market penetration of NSAID drugs, their use as first-line treatment, lower costs, and high usage in combination therapy are factors responsible for the high segment share. Indomethacin, celecoxib, and naproxen are major drugs used for managing acute gout attacks, with high doses of short-acting drugs providing better symptom relief. In addition, practitioners often prefer combination therapy in cases of chronic gout, prescribing NSAIDs alongside febuxostat, colchicine, or allopurinol. Despite the emergence of newer drug classes, NSAIDs remain a cornerstone in gout management due to their efficacy and affordability.

Urate-lowering agents segment is anticipated to grow at a significant CAGR over the forecast period, driven by the increasing adoption of xanthine oxidase inhibitors such as febuxostat and uricosuric agents. The development of novel drugs, such as arhalofenate, which possess both anti-inflammatory and urate-lowering properties, enhances their therapeutic value and is expected to boost segment adoption. The introduction of new therapies such as dotinurad and pegadricase, which were expected to enter the market from 2025 onward, is expected to drive the market further. These advances underline the changing gout treatment landscape, emphasizing the crucial role of urate-lowering therapies in managing hyperuricemia and inflammation.

Disease Condition Insights

The acute condition segment dominated the market in 2024, primarily due to the high prevalence of acute gout attacks, which necessitate immediate medical intervention. Sudden and severe flare-ups often result in patients seeking prompt treatment, which drives the demand for fast-acting therapeutics such as corticosteroids, NSAIDs, and colchicine. Furthermore, improved diagnostic tools and increased awareness have resulted in better identification and treatment of acute cases.

The chronic disease condition is the fastest-growing segment in the gout therapeutics market, driven by the increasing number of patients requiring long-term urate-lowering therapy to prevent recurrent gout flares and complications such as tophi and joint damage. Rising awareness of the need for continuous management, improved access to treatment, and the launch of targeted biologics and safer long-term therapies are fueling segment growth. This trend reflects a shift from acute to sustained treatment strategies.

Distribution Channel Insights

The retail pharmacy segment held the largest market share of 67.91% in 2024, driven by its easy & immediate accessibility and convenience. They serve as the first point of contact for many individuals seeking over-the-counter and prescription treatments for acute gout attacks. In addition, the expansion of organized pharmacy chains and the integration of digital platforms have enhanced patient engagement and streamlined medication management. For instance, in India, the retail pharmacy sector is experiencing significant growth, driven by the expansion of store networks and the rising popularity of private labels. Apollo HealthCo has merged its offline and online pharmacy operations in West Bengal, India, strengthening its presence and improving its healthcare service offerings.

The online pharmacy distribution channel is anticipated to grow at the fastest CAGR over the forecast period, driven by increasing consumer demand for convenience, the proliferation of digital health technologies, and the integration of telehealth services. Patients, especially those with chronic conditions like gout, find online pharmacies attractive because of their 24/7 accessibility, home delivery services, and personalized approach to medication management. Technological advancements, including AI-driven prescription management and secure digital payment systems, have further enhanced user experience and trust in these platforms.

Regional Insights

North America gout therapeutics market dominated the global market with a 47.51% share in 2024, owing to the high prevalence of gout, robust healthcare infrastructure, and the presence of key pharmaceutical players. The region's advanced healthcare systems facilitate early diagnosis and prompt treatment, contributing to market growth. In addition, ongoing research and development activities, along with the introduction of novel therapies, have significantly improved patient treatment options.

U.S. Gout Therapeutics Market Trends

The U.S. gout therapeutics industry dominated the North America market in 2024, closely followed by Canada. Several dedicated organizations, such as the Gout & Uric Acid Educational Society (GUAES), are creating awareness about the condition and its health implications. GUAES organizes annual awareness initiatives, including National Gout Awareness Day on May 22 annually, to educate the public on early diagnosis and effective management. In addition, high-profile collaborations have further amplified outreach efforts. As per an article in Takeda, July 2013, NFL Hall of Famer Emmitt Smith partnered with Takeda Pharmaceuticals U.S.A. for the “Champion for Gout Awareness” campaign to destigmatize gouty arthritis and motivate those at risk to consult healthcare providers.

Europe Gout Therapeutics Market Trends

Europe gout therapeutics industry was identified as a lucrative regional market in 2024, driven by factors such as a rising prevalence of gout, an aging population, and the adoption of advanced treatment options. In addition, the integration of digital health technologies and personalized medicine approaches improves patient engagement and treatment adherence, further propelling market growth.

The UK gout therapeutics market is expected to experience significant growth over the forecast period. This growth can be attributed to enhanced healthcare initiatives and increased patient awareness about gout management. The introduction of novel urate-lowering therapies, such as febuxostat and pegloticase, further contributes to market expansion, offering improved efficacy for patients unresponsive to traditional treatments.

The gout therapeutics market in Germany held the largest regional share in 2024, fueled by a robust healthcare infrastructure, high healthcare expenditures, and an increased geriatric population, highly predisposed to chronic conditions like gout. The government’s emphasis on early diagnosis and preventive care, coupled with strong reimbursement frameworks, supports widespread adoption of novel therapies. Moreover, key pharmaceutical companies and ongoing clinical trials in biologics and urate-lowering agents positively impact the market dynamics.

France gout therapeutics market is expanding due to a growing focus on chronic disease management and public health initiatives to reduce lifestyle-related disorders. Rising obesity and alcohol consumption rates have increased gout prevalence, prompting demand for effective treatment solutions. The increasing adoption of telemedicine for rheumatology consultations, along with the integration of AI in diagnostic tools, and rising government support for innovative drug development contribute to market growth.

Asia Pacific Gout Therapeutics Market Trends

The Asia Pacific gout therapeutics industry is anticipated to grow at the fastest CAGR from 2025 to 2030, driven by the increasing prevalence of gout, rising awareness about the disease, and improving healthcare infrastructure in the region. Changing dietary habits, sedentary lifestyles, and a growing aging population contribute to the rising incidence of gout in countries like India, China, and Thailand, impelling market growth. In addition, expanding healthcare access and the availability of advanced treatment options facilitate early diagnosis and effective management of the condition.

Japan gout therapeutics market held the highest share of the Asia Pacific gout therapeutics industry. It is a mature and technologically advanced market, driven by an aging population and increased awareness of hyperuricemia-related complications. The country’s proactive healthcare policies and widespread use of electronic health records facilitate early diagnosis and personalized treatment plans. In addition, strong pharmaceutical R&D capabilities and regulatory support for fast-tracking novel therapies, such as selective xanthine oxidase inhibitors, accelerate innovation in the gout treatment landscape.

The gout therapeutics market in China is growing rapidly due to urbanization, changing dietary habits, and a rising incidence of metabolic disorders. Government efforts to expand healthcare access, especially in rural regions, and the national push for generic drug production improve treatment availability. Better diagnosis and treatment in the country, driven by increased investment in digital health and partnerships with global pharmaceutical companies, fuels further expansion.

Latin America Gout Therapeutics Market Trends

The Latin America gout therapeutics industry is gradually expanding, driven by an aging population, rising incidence of obesity, and increasing awareness of gout as a chronic metabolic condition. Growing government investment in public health and chronic disease management drive the adoption of urate-lowering therapies in countries such as Brazil. Despite challenges such as limited access to specialty care and high treatment costs, the availability of cost-effective generics and educational campaigns led by healthcare providers improve diagnosis and treatment adherence. Collaborations with international pharmaceutical firms are also improving drug availability across the region.

Brazil gout therapeutics market held the highest share of the regional market due to the significant demand from the growing middle class, adoption of urban lifestyles, and a rise in the burden of noncommunicable diseases. The expansion of the public healthcare system (SUS) and government-driven pharmaceutical subsidies enable broader access to urate-lowering treatments. Moreover, local production of generic drugs and increased physician education initiatives improve the management of gout and associated comorbidities.

Middle East & Africa Gout Therapeutics Market Trends

The Middle East & Africa gout therapeutics industry is fueled by changing dietary patterns, a rising prevalence of lifestyle-related diseases, and increased healthcare spending across Gulf countries and key African economies. Government healthcare reforms, expanding insurance coverage, and a growing number of specialized rheumatology clinics are helping improve access to care. In addition, public health initiatives focusing on metabolic and lifestyle disorders have raised awareness and encourage early intervention for gout management.

Saudi Arabia gout therapeutics market is expected to grow over the forecast years, driven by factors such as rising obesity rates, growing adoption of sedentary lifestyles, and an increasing elderly population. The country’s Vision 2030 healthcare transformation plan has enhanced access to advanced medical care and boosted investments in chronic disease treatment. The widespread adoption of mobile health apps and digital prescription systems supports improved patient adherence, while collaborations with international pharma companies aid the introduction of innovative therapies into the local market.

Key Gout Therapeutic Company Insights

Some key companies in the gout therapeutics industry include Takeda Pharmaceutical Company Ltd., Novartis Pharmaceuticals Corporation, and Regeneron Pharmaceuticals Inc. These organizations are actively working to expand their market presence and strengthen their customer base in an increasingly competitive landscape. To achieve this, key players are undertaking strategic initiatives such as mergers and acquisitions, collaborations with biotechnology firms, and partnerships aimed at co-developing or commercializing novel therapies. Such moves improve research capabilities, accelerate product development, and improve global reach within the gout therapeutics market.

Key Gout Therapeutics Companies:

The following are the leading companies in the gout therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Takeda Pharmaceutical Company Limited

- Novartis AG

- Regeneron Pharmaceuticals Inc.

- AstraZeneca

- Arrowhead Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Teijin Pharma Ltd.

- GSK plc.

- Zydus Group

Recent Developments

-

In February 2025, Pharmacy Times highlighted significant advancements in gout treatment, emphasizing the evolving role of pharmacists in addressing unmet needs. Traditional therapies like allopurinol, febuxostat, and pegloticase remain the cornerstone for long-term treatment; however, challenges persist in maintaining target serum urate levels below 6 mg/dL. Emerging treatments, notably SEL-212, a combination of pegadricase and an immune tolerance agent, have shown promise in phase 3 trials by effectively reducing uric acid levels and minimizing anti-drug antibody formation. In March 2024, SEL-212 was granted FDA fast track designation, representing a potential paradigm shift for patients with chronic refractory gout.

-

In July 2024, Novartis revealed positive phase III trial data for LNP023, a new drug designed to treat chronic gout by addressing a key inflammatory pathway, demonstrating substantial uric acid reduction and gout flare control.

Gout Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.02 billion

Revenue forecast in 2030

USD 4.13 billion

Growth rate

CAGR of 6.45% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, disease condition, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Takeda Pharmaceutical Company Limited; Novartis Pharmaceuticals Corporation; Regeneron Pharmaceuticals Inc.; AstraZeneca; Arrowhead Pharmaceuticals Inc.; Merck & Co., Inc.; Teijin Pharma Ltd.; GSK plc.; Zydus Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gout Therapeutics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2030. For this study, Grand View Research has segmented the global gout therapeutics market report based on drug class, disease condition, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

NSAIDs

-

Corticosteroids

-

Colchicine

-

Urate-Lowering Agents

-

Others

-

-

Disease Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Gout

-

Chronic Gout

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gout therapeutics market size was estimated at USD 2.82 billion in 2024 and is expected to reach USD 3.02 billion in 2025.

b. The global gout therapeutics market is expected to grow at a compound annual growth rate of 6.45% from 2025 to 2030 to reach USD 4.13 billion by 2030.

b. Based on drug, NSAIDs segment dominated the gout therapeutics industry with a 42.55% share in 2024. High market penetration of NSAID drugs, their use as first-line treatment, lower costs, and high usage in combination therapy are factors responsible for the high segment share.

b. Key players operating in the market are Takeda Pharmaceutical Company Limited, Novartis Pharmaceuticals Corporation, Regeneron Pharmaceuticals Inc., AstraZeneca, Arrowhead Pharmaceuticals Inc., Merck & Co., Inc., Teijin Pharma Ltd., GSK plc., Zydus Group.

b. The gout therapeutics market driven by factors such as rising disease burden, growing awareness of the disease, and increasing healthcare expenditure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.