- Home

- »

- Next Generation Technologies

- »

-

Government Education Market Size & Share Report, 2030GVR Report cover

![Government Education Market Size, Share & Trends Report]()

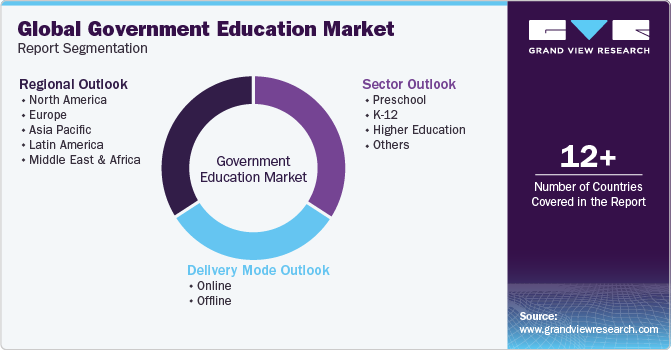

Government Education Market Size, Share & Trends Analysis Report By Sector (Preschool, K-12, Higher Education, Others), By Delivery Mode (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-186-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Government Education Market Size & Trends

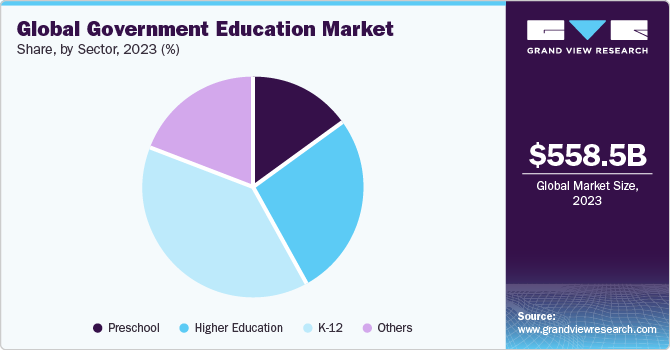

The global government education market size was estimated at USD 558.49 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 17.8% from 2024 to 2030. The market plays a key role in shaping the educational landscape of nations. Government education typically refers to the sector of education that is directly controlled, funded, or regulated by government entities. The market encompasses a wide range of educational institutions and services, from primary and secondary schools to higher education institutions and vocational training programs.

Many countries have public education where the government is directly involved in funding and providing education at various grades including funding for public schools, hiring teachers, and establishing curriculum standards. Governments often play a significant role in regulating educational institutions to ensure quality and adherence to certain standards.

Governments allocate funds to education departments at various levels, such as state, federal, or local levels. These funds are distributed to colleges, schools, universities, and other educational institutions for the construction, maintenance, and improvement of educational infrastructures. These funds are also used for building and renovating school facilities and providing laboratories, libraries, classrooms, and other conveniences essential for effective learning environments.

There are public-private partnerships where the government collaborates with private institutions to improve educational services. These partnerships often focus on integrating technology into educational practices. Private companies specializing in educational technology work with governments to provide digital learning resources, software, and infrastructure. This collaboration intends to enhance the overall quality of education and prepare learners for a technology-driven future.

Furthermore, governments often invest in educational technology as part of efforts to modernize the education system. Governments provide schools with essential tools such as computers, internet connectivity, and digital learning resources. This technological integration strives to improve teaching methods, promote interactive and engaging learning experiences, and prepare students for the demands of the digital age.

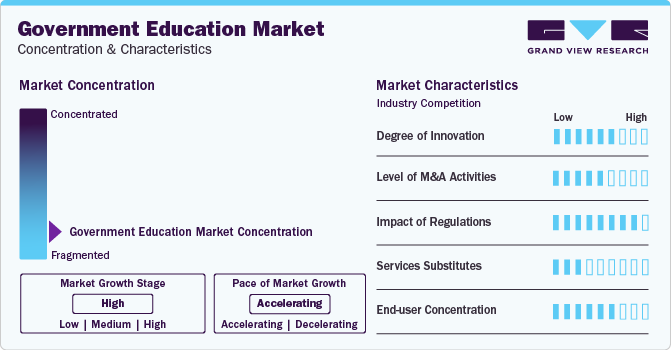

Market Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The government education market is characterized by a high degree of innovation owing to the technological advancements in the education sector. Governments worldwide are recognizing the potential of technology to revolutionize teaching and learning. Increased investments in The integration of digital tools, such as interactive whiteboards, tablets, and online learning platforms, have not only enhanced classroom experiences but also facilitated remote and flexible learning models.

The market for government education is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Large educational corporations and technology companies often engage in M&A to strengthen their market position, expand their service offerings, and enhance their capabilities in delivering educational solutions.

The government education industry is subject to growing regulatory scrutiny as policymakers and government authorities aim to ensure transparency, accountability, and the delivery of high-quality education. The integration of technology in education has led to an increased focus on data privacy and security. Regulatory frameworks are being developed to safeguard student and teacher data, ensuring that EdTech platforms comply with privacy laws and protect sensitive information.

Online learning platforms, vocational training programs, and non-traditional educational providers offer alternatives that challenge the traditional classroom setting. The rise of digital learning resources provides students with flexible and accessible options beyond conventional institutions. This substitution threat encourages educational institutions to adapt by incorporating technology, diversifying learning methods, and addressing the changing preferences of students who seek alternatives to traditional education.

End-user concentration is a significant factor in the government education industry. Tailoring programs to meet the specific needs and preferences of concentrated end-user groups allows institutions to enhance the quality of education and improve overall satisfaction. Additionally, leveraging technology to provide customized learning experiences attracts and retains students, promoting innovation and adaptability in response to concentrated demand.

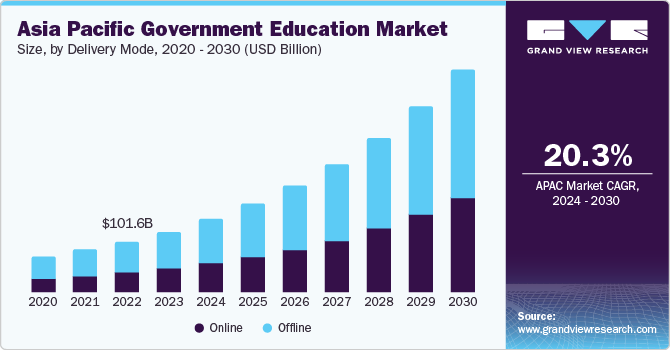

Delivery Mode Insights

The offline segment accounted for the largest market revenue share in 2023. The factors contributing to the highest share include government investments in traditional educational infrastructure, teacher training for conventional classroom settings, and the importance of physical learning environments. Additionally, the offline segment emphasizes in-person interaction between students and teachers, promoting a collaborative and social learning environment.

The online segment is projected to grow significantly over the forecast period. The widespread adoption of digital learning platforms, particularly in response to the COVID-19 pandemic, significantly contributed to the segment's growth. Increased access to the internet and advancements in EdTech facilitated the expansion of online learning opportunities. Government initiatives promoting e-learning, the convenience and flexibility offered by online education, and a growing demand for remote learning solutions all played key roles in the growth of the online segment.

Sector Insights

The K-12 segment led the market and accounted for 39.5% of the global revenue in 2023. K-12 education typically covers primary and secondary levels, representing a significant portion of the student population globally. Government allocations for primary and secondary education are substantial, and K-12 institutions often receive a significant portion of these funds. K-12 institutions increasingly incorporate technology into their educational processes. Most K-12 educators favor gamification strategies to enhance students' mathematical learning abilities, particularly when combined with hands-on, project-based activities within school settings.

The preschool segment is expected to register the fastest CAGR during the forecast period owing to the increased recognition of the importance of early childhood education, government initiatives promoting preschool enrollment, and rising awareness among parents about the benefits of early learning. Additionally, investments in curriculum development, teacher training, and infrastructure for preschool education have contributed to the growth of the segment.

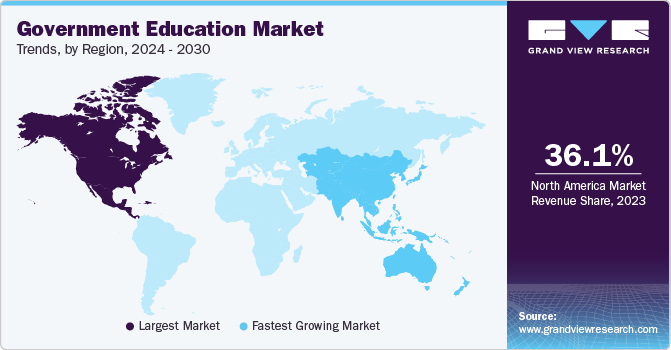

Regional Insights

North America dominated the market and accounted for a 36.1% share in 2023. The region's well-established and financially robust education systems, including primary, secondary, and higher education institutions, contribute significantly to revenue generation. Additionally, a high level of government investment in education, advanced technological infrastructure, and a strong emphasis on R&D enhance the overall competitiveness of North American educational institutions. Furthermore, the presence of prominent global universities and a diverse range of educational programs further solidify the region's dominance in the market.

Asia Pacific is anticipated to witness significant growth in the market. The Asia Pacific region is home to a large and rapidly growing population, with a substantial proportion of young students. The increasing demand for education, particularly at primary and secondary levels, is driving the market growth. Furthermore, many countries in the region are actively investing in education infrastructure and policies to enhance the quality and accessibility of education.

Key Companies & Market Share Insights

Some of the key players operating in the market include NIIT Limited.; Heidelberg University; and EducationUSA.

-

NIIT Limited is one of the prominent global talent development corporations that offers a comprehensive suite of learning and training solutions across various fields. The company has a presence in over 30 countries. It provides solutions in the areas of business process outsourcing, banking, finance and insurance, professional life skills, executive management education, communication, and EdTech.

-

EducationUSA serves as a valuable resource for students worldwide seeking information and guidance on pursuing higher education opportunities in the U.S. EducationUSA collaborates with U.S. universities and colleges, as well as with various governmental and educational organizations, to facilitate international student mobility and cross-cultural exchange.

Duolingo; Educart.co; and The National Skill Development Corporation (NSDC) are some of the emerging market participants in the government education market.

-

Duolingo is a language learning platform that offers free language education services to users globally. Its product portfolio includes tiny cards, Duolingo English tests, stories, podcasts, and a dictionary, among others. Duolingo has gained widespread popularity for its innovative approach to language education, combining technology, gamification, and accessibility.

-

The National Skill Development Corporation (NSDC) is a private-public partnership organization in India that operates under the Ministry of Skill Development and Entrepreneurship (MSDE). The corporation provides financial support and incentives to training partners and organizations involved in skill development.

Key Government Education Companies:

- NIIT Limited.

- SWAYAM

- EducationUSA

- Heidelberg University

- Humboldt University of Berlin

- Queensland University of Technology

- Australian Government Department of Education

- Ernst & Young Global Limited

- Nuri-Sejong Institute

- Info Edge (India) Limited

Recent Developments

-

In November 2023, Salesforce, Inc., an American cloud-based software company, announced its collaboration with the Ministry of Education to provide Salesforce skills training to one lakh students in India over the next three years. The program will deliver industry-relevant course content recognized by the National Occupation Standard. Additionally, it will incorporate "train-the-trainer" sessions for mentorship and educator opportunities and facilitate employment connections with Salesforce partners and customers seeking to recruit skilled talent.

-

In September 2023, a collaborative initiative titled "Education to Entrepreneurship: Empowering Students, Educators, and Entrepreneurs" was introduced jointly by the Ministry of Education, the Ministry of Skill Development & Entrepreneurship, and Meta, an American multinational technology conglomerate. This initiative is designed to foster the journey from education to entrepreneurship. The main goal of this initiative is to encourage and support young individuals in transforming their educational foundations into flourishing enterprises.

-

In May 2023, a memorandum of understanding was signed between the National Aeronautics and Space Administration (NASA) and the U.S. Department of Education. The agreement specifically focuses on initiatives aimed at widening access to high-quality education in science, technology, engineering, and math (STEM), along with space education, for students and schools throughout the U.S.

Government Education Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 655.66 billion

Revenue forecast in 2030

USD 1,755.03 billion

Growth Rate

CAGR of 17.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sector, delivery mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; Japan; India; South Korea; Australia; New Zealand; Brazil Mexico; KSA; UAE; South Africa

Key companies profiled

NIIT Limited.; SWAYAM; EducationUSA; Heidelberg University; Humboldt University of Berlin; Queensland University of Technology; Australian Government Department of Education; Ernst & Young Global Limited; Nuri-Sejong Institute, Info Edge (India) Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Government Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global government education market report based on sector, delivery mode, and region.

-

Sector Outlook (Revenue, USD Billion, 2017 - 2030)

-

Preschool

-

K-12

-

Higher Education

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global government education market size was estimated at USD 558.49 billion in 2023 and is expected to reach USD 655.66 billion in 2024.

b. The global government education market is expected to grow at a compound annual growth rate of 17.8% from 2024 to 2030 to reach USD 1,755.03 billion by 2030.

b. North America dominated the government education market with a share of 36.1% in 2023. The region's well-established and financially robust education systems, including primary, secondary, and higher education institutions, contribute significantly to revenue generation.

b. Some key players operating in the government education market include NIIT Limited.; SWAYAM; EducationUSA; Heidelberg University; Humboldt University of Berlin; Queensland University of Technology; Australian Government Department of Education; Ernst & Young Global Limited; Nuri-Sejong Institute, Info Edge (India) Limited

b. Key factors that are driving the government education market growth include increasing demand for higher education with population growth and economic development, and emphasis on skills development through government investment in vocational and technical education.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."