- Home

- »

- Pharmaceuticals

- »

-

Graft Versus Host Disease (GvHD) Treatment Market Report 2030GVR Report cover

![Graft Versus Host Disease (GvHD) Treatment Market Size, Share & Trends Report]()

Graft Versus Host Disease (GvHD) Treatment Market Size, Share & Trends Analysis Report By Disease (Acute and Chronic Graft Versus Host Disease), By Product, By End User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-192-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

GvHD Treatment Market Size & Trends

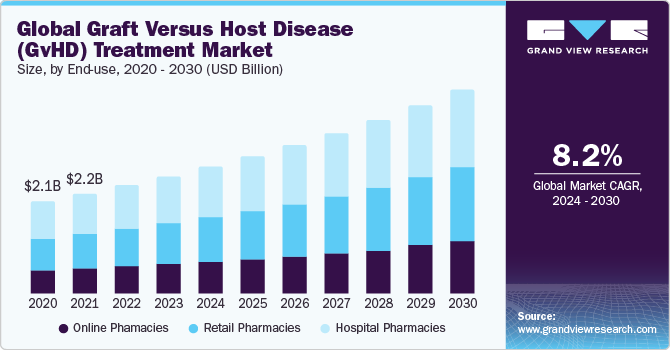

The global graft versus host disease (GvHD) treatment market size was valued at USD 2.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2030. The rise in the elderly population and an increase in the occurrence of nephrological, leukemia, myeloma, and lymphoma cancer are driving the graft versus host disease treatment market. Moreover, a spike in the number of bone marrow transplants being undertaken throughout the globe to treat particular types of malignancies is boosting growth. Furthermore, a rise in the GVHD-prevalent population, breakthroughs in the diagnostic measures of the illness, approval of innovative therapies, and a larger range of prophylactic alternative is anticipated to contribute to the market growth over a forecast period.

Significant investments in research and development capabilities made by industry stakeholders and government entities are expected to generate promising prospects within the market. For instance, in June 2021, Equillium Inc. announced the successful conclusion of an End-of-Phase 1 meeting with the U.S. FDA regarding itolizumab's utilization in the initial treatment of individuals afflicted with acute graft-versus-host disease (aGvHD). Consequently, favorable results from these clinical trials are poised to pave the way for novel therapeutic solutions, thereby likely fueling the market's expansion during the projected period.

The COVID-19 pandemic had a significant impact on the market's growth rate. The presence of COVID-19 exacerbated the severity of GvHD in patients, leading to heightened complications that posed a substantial challenge to healthcare systems worldwide during the pandemic. Consequently, there was a rise in the demand for products designed to treat graft-versus-host disease, as these were essential in addressing the additional complications arising from COVID-19.

Disease Insights

Based on the disease type, the graft versus host disease treatment market is bifurcated into acute graft versus host disease and chronic graft versus host disease. In 2023, acute GVHD dominated the market in terms of revenue share.

This can be attributed to factors like the aging population's expansion, a notable rise in graft-versus-host disease cases, and an increased number of allogeneic transplantations.

Product Insights

On the basis of product, the market is divided into corticosteroids, monoclonal antibodies, tyrosine kinase inhibitors, and other products. The corticosteroid segment held the largest share in 2023 owing to the increasing prevalence of the target disease and the number of research studies. Furthermore, owing to increased research and development efforts focused on corticosteroids and their combinations for the treatment of graft-versus-host disease in hematopoietic cell transplantation (HCT) patients, the corticosteroid segment is expected to grow over the forecast period. The market segment is also expanding as a result of research projects designed to increase the effectiveness of corticosteroids in therapy. For instance, a clinical trial was ongoing as of June 2022. The study, which was a multicenter, open-label, two-arm randomized trial, aimed to determine if corticosteroids alone or in combination with ruxolitinib were better for newly diagnosed high-risk acute gene therapy-related heart failure. Acute graft-versus-host disease (aGvHD) has been reported to respond to corticosteroid first-line therapy in about 50% of cases. This is expected to positively impact the segment growth.

End-Use Insights

Based on end use, the market is segmented into hospital, online, and retail pharmacies. Hospital pharmacies held the largest market share in 2023 due to the escalating demand for transplantation drugs due to the substantial increase in allogeneic transplantations.

For instance, many transplant patients are prescribed a regimen of 5 to 15 medications daily, with multiple doses required throughout the day. This substantial medication regimen significantly contributes to the notable growth in demand within the graft-versus-host disease market.

Regional Insights

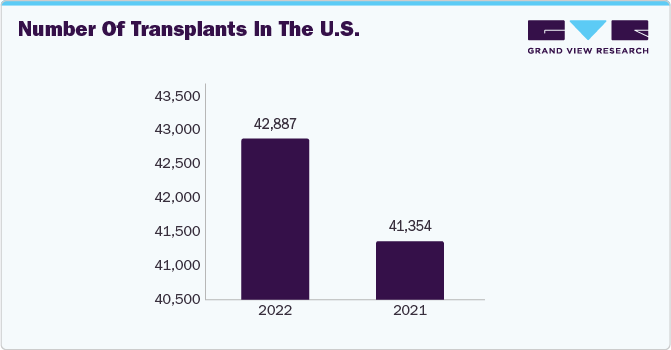

In 2023, North America held the largest market, primarily due to its well-established healthcare infrastructure, ongoing research and development activities, and a growing number of transplant procedures. As per data released by the Organ Procurement and Transplantation Network, overseen by the United States Department of Health and Human Services and updated in July 2022, there were a total of 20,663 transplant procedures conducted in the U.S. between January 2022 and June 2022. This increase in transplant cases may lead to increased demand for graft-versus-host disease treatments, driven by the immune-mediated responses occurring between the adaptive immune systems of donors and recipients, ultimately propelling market growth.

Competitive Insights

Prominent market players include Incyte Corporation, Pfizer Inc., Bristol Myers Squibb Company Abbvie Inc., Kadmon Pharmaceuticals, Sanofi (Genzyme), Genentech Inc., and Astellas Pharma US Inc. These market leaders are engaged in endeavors such as new product development, mergers and acquisitions (M&A), and strategic alliances to explore fresh market opportunities. The following examples illustrate some of these initiatives.

-

In March 2022, Equillium Inc. commenced the EQUATOR study, which is a pivotal Phase III clinical trial involving itolizumab for patients diagnosed with acute graft-versus-host disease (aGvHD). This randomized, double-blind study is designed to evaluate the effectiveness and safety of itolizumab when used as a first-line treatment for aGvHD in conjunction with corticosteroids, as compared to a placebo.

-

In May 2022, Novartis obtained approval from the European Commission (EC) for Jakavi (ruxolitinib) in the treatment of individuals aged 12 years and older experiencing acute or chronic GvHD, where corticosteroids or alternative systemic therapies have not yielded a sufficient response.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."