- Home

- »

- Advanced Interior Materials

- »

-

Grain Oriented Electrical Steel Market Size Report, 2030GVR Report cover

![Grain Oriented Electrical Steel Market Size, Share & Trends Report]()

Grain Oriented Electrical Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Transformers, Motors, Inductors, Others), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-518-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Grain Oriented Electrical Steel Market Summary

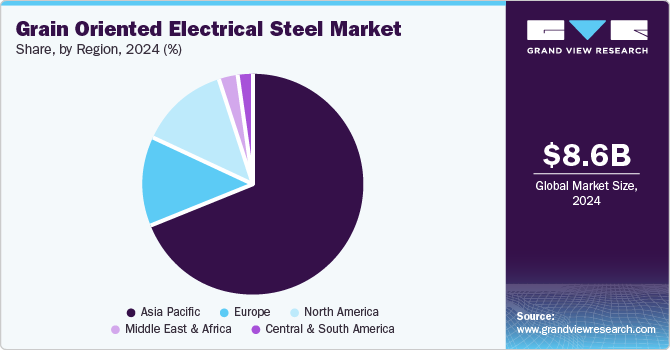

The global grain oriented electrical steel market size was estimated at USD 8.62 billion in 2024 and is projected to reach USD 11.86 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The growth of the grain oriented electrical steel (GOES) industry is primarily driven by the increasing demand for electricity and the need for efficient electrical components.

Key Market Trends & Insights

- Asia Pacific was the dominant region in the grain oriented electrical steel industry with a revenue share of over 69.0% in 2024.

- The North America grain oriented electrical steel industry is anticipated to grow at a CAGR of 6.1% over the forecast period.

- By end use, motors segment are anticipated to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8.62 Billion

- 2030 Projected Market Size: USD 11.86 Billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

GOES is a crucial material used in manufacturing transformers, which are fundamental in the distribution of electrical power. With the global rise in urbanization and industrialization, the demand for electrical infrastructure has surged.

As countries invest in power grids, renewable energy projects, and transmission networks, the demand for transformers and grain-oriented electrical steel has grown significantly. Additionally, expanding emerging markets, such as those in Asia Pacific, further propels demand as these regions continue to invest in infrastructure development and electrification efforts.

Modern technologies, such as high-efficiency transformers and smart grid solutions, demand higher-performance materials such as GOES. These technological upgrades ensure the minimization of energy losses during transmission and distribution, directly contributing to the need for high-quality electrical steel. Furthermore, advancements in material processing and manufacturing methods, such as grain-oriented steel with optimized magnetic properties, are boosting the efficiency of transformers and other electrical devices, leading to an overall increase in the material's demand.

The growing focus on energy efficiency and sustainability is driving the expansion of the GOES market. Stricter energy regulations worldwide are pushing the use of GOES to reduce power losses and enhance energy efficiency in transformers, helping to lower energy consumption and carbon emissions. Additionally, the rise of renewable energy sources like wind and solar power increases the demand for GOES, as transformers used in these systems rely on it for efficient energy conversion and distribution. As renewable energy adoption grows, the need for GOES will continue to rise.

Drivers, Opportunities & Restraints

The global demand for energy-efficient electrical devices is a key driver for the grain oriented electrical steel industry. This material is essential to produce transformers, which are critical in the transmission and distribution of electricity. The need for GOES increases as countries focus on upgrading and expanding their power infrastructure to meet growing energy demands. Furthermore, the trend toward renewable energy sources such as wind and solar power boosts demand for efficient transformers, where GOES plays a pivotal role.

With the increasing push for renewable energy adoption and electrification in transportation, there is a growing demand for highly efficient electrical systems. GOES manufacturers are investing in R&D to develop advanced alloys and coatings that offer even better efficiency and performance, catering to the evolving needs of modern transformers. Additionally, the expanding electric vehicle (EV) market, where transformers and other electrical components are crucial, presents untapped opportunities. Manufacturers can capitalize on this by developing products tailored to the needs of electric grid systems, smart grids, and charging infrastructure, further expanding the scope for GOES applications.

End Use Insights

With the rising urbanization, industrialization, and economic development, the demand for electrical energy has expanded, boosting the need for more efficient power transformers. GOES is a key material used in manufacturing transformers, as it allows for improved magnetic properties, leading to better efficiency in energy transmission and a reduction in energy losses. As the world's electrical infrastructure grows, there is a need for high-quality transformers with grain oriented electrical steel.

Motors are anticipated to register the fastest CAGR over the forecast period. As energy efficiency becomes a priority for environmental and economic reasons, the demand for electrical steels with superior magnetic properties is expected to rise. GOES helps minimize energy losses in motor systems by reducing the hysteresis and eddy current losses, making it an ideal material choice for electric motors. This shift is particularly evident in sectors like consumer electronics, home appliances, and HVAC systems, where manufacturers increasingly opt for motors that contribute to lower energy consumption and greater overall performance.

Regional Insights

Countries like China and Japan are advancing greener transportation options in response to the growing demand for EVs. Grain-oriented electrical steel plays a crucial role in the production of traction motors and other key components vital to EV performance. According to IEA report, over 14 million electric vehicles were sold globally in 2023, a substantial portion of these sales occurring in Asia Pacific. This trend is expected to continue, further propelling the demand for high-quality electrical steel used in EV manufacturing.

North America Grain Oriented Electrical Steel Market Trends

The North America grain oriented electrical steel industry is anticipated to grow at a CAGR of 6.1% over the forecast period. Governments across the region are investing heavily in renewable energy projects such as wind and solar power plants. These initiatives require efficient transformers and generators, which utilize grain oriented electrical steel due to its superior magnetic properties. The increasing focus on reducing carbon emissions and enhancing energy efficiency aligns with the growing need for advanced materials to optimize power generation and distribution systems, propelling market growth.

U.S. Grain Oriented Electrical Steel Market Trends

The demand for clean energy is expanding rapidly, and wind turbines, which rely heavily on high-quality electrical steel for their generators, are a key component of this shift. Solar energy installations reached a record 31 gigawatts (GW), a 55% increase from 2022, making it the fastest-growing power source and representing half of all new utility-scale generating capacity through Q3 2023. EV sales also hit a record of 1.2 million, accounting for 7.6% of total vehicle sales in the country, further boosting demand for GOES.

Europe Grain Oriented Electrical Steel Market Trends

Europe is a global leader in renewable energy production, especially wind power, and the demand for GOES is directly linked to this growth. Wind turbines, a core part of Europe’s renewable energy strategy, rely heavily on high-quality electrical steel for their generators. As European countries expand their renewable energy capacity, the demand for GOES in wind turbine manufacturing is projected to increase. In addition, government policies, such as the European Green Deal, which aims to accelerate the transition to clean energy, are expected further to boost investments in wind and solar energy infrastructure, driving the demand for GOES.

Central & South America Grain Oriented Electrical Steel Market Trends

Industrialization is accelerating in Central & South America, particularly in the manufacturing, mining, and transportation sectors. These industries require advanced electrical equipment to support their operations and GOES is a key material in producing high efficiency transformers and motors. As industrial processes become more energy-conscious, the demand for energy-efficient electrical equipment, and by extension GOES, is rising.

Middle East & Africa Grain Oriented Electrical Steel Market Trends

Rapid urbanization across MEA proliferates the growth of the grain oriented electrical steel industry. As cities expand, there is an increasing need for reliable electricity supply to support residential, commercial, and industrial sectors. The construction of new buildings, metro systems, and industrial parks requires efficient power distribution networks that utilize GOES in transformers.

Key Grain Oriented Electrical Steel Company Insights

Some of the key players operating in the market include ArcelorMittal and POSCO.

-

ArcelorMittal is one of the world’s leading steel and mining companies. It operates in more than 60 countries and has a presence in all major markets. It produces a wide range of steel products for various industries, including automotive, construction, and appliances. The company produces GOES, specifically designed for use in transformers and other electrical applications where high magnetic permeability is essential.

-

POSCO is a South Korean multinational steel-making company recognized as one of the largest steel producers in the world. The company operates globally, providing a wide range of steel products that cater to various industries, including automotive, construction, shipbuilding, and energy. The company specializes in producing grain oriented electrical steel with superior magnetic properties due to its uniform crystal orientation.

Key Grain Oriented Electrical Steel Companies:

The following are the leading companies in the grain oriented electrical steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Arnold Magnetic Technologies

- Baosteel Group Corporation

- Cleveland-Cliffs Inc.

- JFE Steel Corporation

- NIPPON STEEL CORPORATION

- POSCO

- Stalprodukt S.A.

- thyssenkrupp

- VIZ-Steel

Recent Developments

-

In June 2024, JFE Steel's JGreeX green steel, a grain oriented electrical steel with a reduced environmental footprint, has been selected by Eaton Corporation, a leading U.S. transformer manufacturer, for use in IT data center transformers.

-

In February 2024, JSW Steel formed a joint venture with Japan's JFE Steel to produce grain oriented electrical steel in India. The new company, JSW JFE Electrical Steel, will be based in Bellary, Karnataka, with a planned investment of INR 5,500 crore (~USD 633 million). The facility is set to begin production in 2027, addressing India's rising demand for energy-efficient transformers.

Grain Oriented Electrical Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.04 billion

Revenue forecast in 2030

USD 11.86 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; Turkey; China; India; Japan; South Korea; Brazil; Iran

Key companies profiled

ArcelorMittal; POSCO; Stalprodukt S.A.; Baosteel Group Corporation; NIPPON STEEL CORPORATION; JFE Steel Corporation; thyssenkrupp; Cleveland-Cliffs Inc.; Arnold Magnetic Technologies; VIZ-Steel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grain Oriented Electrical Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grain oriented electrical steel market report based on end use and region:

-

End Use Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Motors

-

Inductors

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global grain oriented electrical steel market size was estimated at USD 8.62 billion in 2024 and is expected to reach USD 9.04 billion in 2025.

b. The global grain oriented electrical steel market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 11.86 billion by 2030.

b. The transformers segment dominated the market with a revenue share of over 52.0% in 2024.

b. Some of the key vendors of the global grain oriented electrical steel market are ArcelorMittal; POSCO; Stalprodukt S.A.; Baosteel Group Corporation; NIPPON STEEL CORPORATION; JFE Steel Corporation; thyssenkrupp Steel; Cleveland-Cliffs Inc.; Arnold Magnetic Technologies; VIZ-Steel.

b. The key factor that is driving the growth of the global grain oriented electrical steel market is the increasing demand for efficient transformers and electric motors, alongside the growing focus on renewable energy and energy efficient technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.