- Home

- »

- Nanoparticles

- »

-

Graphene Nanoplatelets Market Size, Industry Report, 2030GVR Report cover

![Graphene Nanoplatelets Market Size, Share & Trends Report]()

Graphene Nanoplatelets Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Composites, Energy & Power, Conductive Inks & Coatings, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-619-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphene Nanoplatelets Market Trends

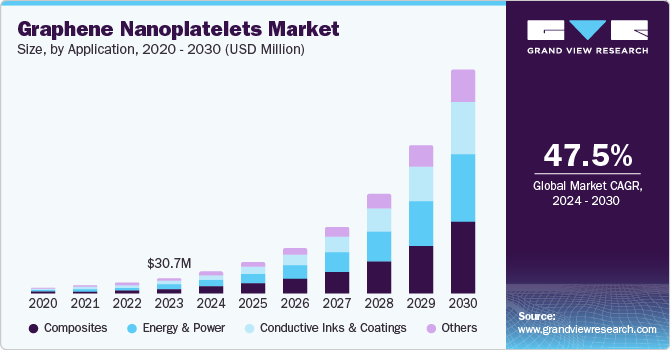

The global graphene nanoplatelets market size was valued at USD 30.7 million in 2023 and is projected to grow at a CAGR of 47.5% from 2024 to 2030. The outstanding characteristics of graphene nanoplatelets (GNPs) fuel substantial expansion in the market. GNPs' properties, such as high electrical conductivity, thermal conductivity, mechanical strength, and large surface area, make them perfect for various applications. GNPs can improve the effectiveness of transistors, sensors, and flexible displays in electronics, resulting in faster, more productive, and more adaptable devices. GNPs can enhance battery and super capacitor performance in energy storage by increasing energy density, charging/discharging rates, and cycle life, meeting the increasing need for eco-friendly energy solutions.

The factor contributing to the growth of the market is the rising demand for lightweight, high-performing materials across various industries. Moreover, incorporating GNPs into composites can improve their mechanical properties, electrical conductivity, and thermal conductivity, making them ideal for aerospace, automotive, and construction applications. In the automobile sector, GNPs have the potential to develop components that are both lighter and more durable, leading to enhanced fuel efficiency and decreased emissions, and in aerospace, graphite nanoparticles are utilized to create high-tech materials for aircraft components and electronics, improving efficiency and security.

The growing awareness of the potential benefits of graphene nanoplatelets also contributes to market growth. Research and development efforts are concentrated on exploring new applications and improving production processes, leading to increased commercialization of graphene-based products. Additionally, favorable government policies and initiatives support developing and adopting graphene nanoplatelets, including funding for research projects, tax incentives, and infrastructure development. The market is expected to experience continued growth and widespread adoption in various industries.

Application Insights

The composites segment accounted for the revenue share of 31.5% in 2023. The exceptional properties of GNP, such as a strong, high strength-to-weight ratio, excellent electrical conductivity, and heat resistance, greatly improve the effectiveness of composite materials. GNPs incorporated into composites can enhance mechanical properties, electrical conductivity, and thermal conductivity. This quality makes them perfect for various uses such as aerospace, automotive, electronics, and energy storage. Furthermore, the increasing need for lightweight, high-performance materials across multiple industries is fueling the expansion of the composites application sector.

The energy & power sector is expected to register the fastest CAGR during the forecast period. The expected growth of the energy & power sector is attributed to the potential impact of graphene nanoplatelets (GNPs) on transforming energy storage and generation. The outstanding electrical conductivity and large surface area of GNPs make them perfect for improving the effectiveness of batteries, supercapacitors, and fuel cells. Enhancements in energy density, charging/discharging rates, and cycle longevity can result in more effective and durable energy storage solutions. Furthermore, GNPs have applications in enhancing the effectiveness and minimizing the expenses of solar cells and wind turbines. The significant growth of the energy & power segment is propelled by the rising demand for clean and renewable energy sources and the technological progress in graphene-based energy solutions.

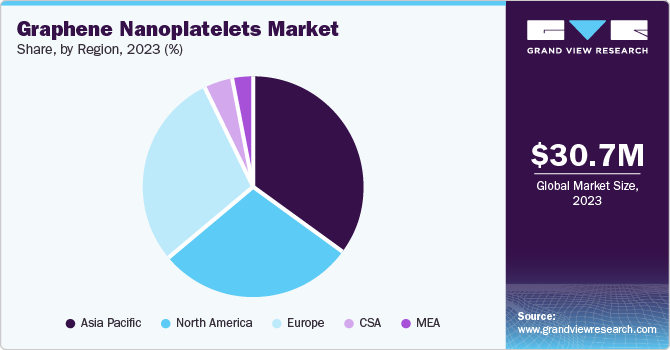

Regional Insights

The Asia Pacific graphene nanoplatelets market dominated the global market with a revenue share of 31.5% in 2023. The region's increasing industrialization and focus on technological advancements have established a conducive environment for accepting graphene nanoplatelets. The growing demand for high-performance materials in various industries has expanded the market. Furthermore, significant investments in research and development and governmental support for graphene-related projects have fostered innovation and accelerated the commercialization of graphene nanoplatelets.

China Graphene Nanoplatelets Market Trends

The China graphene nanoplatelets market dominated the Asia Pacific market in 2023 due to the country's advanced manufacturing capacity and cost-effective production. Additionally, the increasing demand for graphene nanoplatelets is fueled by the country's expanding electronics, automotive, and energy storage industries, which rely heavily on high-performance materials. Moreover, China's strong supply chain infrastructure and abundant raw materials have provided a solid foundation for its graphene nanoplatelets market growth.

Europe Graphene Nanoplatelets Market Trends

Europe's graphene nanoplatelets market was identified as a lucrative region in 2023. The region's strong focus on research and development, along with a well-established scientific and technological framework, has led to progress and improvements in the applications of graphene nanoplatelets. Additionally, the European Union's backing of graphene R&D projects and emphasis on enhancing industrial competitiveness has created a favorable setting for expanding the graphene nanoplatelets market.

The UK graphene nanoplatelets market is expected to grow rapidly in the coming years due to the nation's robust research and development infrastructure and an emphasis on technological advancements, which have created a favorable environment for innovation in graphene. The UK government's support of graphene-related initiatives, such as financial support for research and development projects, has further accelerated the market's expansion. Additionally, the UK's manufacturing capabilities and highly skilled labor force offer a strong base for expanding graphene nanoplatelet production and incorporating them into different industrial uses.

North America Graphene Nanoplatelets Market Trends

The North American graphene nanoplatelets market is expected to grow significantly in the coming years. The North American market is advantaged by a strong supply chain that provides access to raw materials and manufacturing capabilities, enabling the production and commercialization of graphene nanoplatelets. Moreover, the favorable regulatory conditions in the area, combined with government backing for new technologies, have established an environment that promotes the expansion of the graphene nanoplatelets industry.

The U.S. graphene nanoplatelets market is expected to grow rapidly in the coming years due to the nation's strong emphasis on technological innovation, supported by a solid research and development infrastructure. This has created a favorable atmosphere for the progress of graphene. The increasing need for advanced materials in electronics, aerospace, and energy storage, along with the U.S.'s focus on sustainability and energy efficiency, has led to a positive setting for graphene nanoplatelets.

Key Graphene Nanoplatelets Company Insights

Some of the key companies in the graphene nanoplatelets market include CVD Equipment Corporation, Global Graphene Group, XG Sciences, Inc., ACS Materials, NanoXplore Inc., and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, partnerships, and expansion with other major companies.

-

CVD Equipment Corporation is a leading manufacturer of chemical vapor deposition (CVD) systems, a critical technology for producing high-quality graphene nanoplatelets. Their systems are designed to offer precise control over the growth process, enabling the production of graphene with desired properties like thickness, size, and defect density.

-

Global Graphene Group is a vertically integrated company, controlling the entire value chain from graphene production to its integration into products. Their focus on graphene nanoplatelets, a specific form of graphene with unique properties, has positioned them as a leader in this market segment.

Key Graphene Nanoplatelets Companies:

The following are the leading companies in the graphene nanoplatelets market. These companies collectively hold the largest market share and dictate industry trends.

- Global Graphene Group

- Graphene Laboratories Inc.

- NanoXplore Inc.

- CVD Equipment Corporation

- ACS Materials

- XG Sciences, Inc.

- Thomas Swan & Co. Ltd.

- Directa Plus S.p.A.

- Xiamen Knano Graphene Technology Co., Ltd.

- HAYDALE GRAPHENE INDUSTRIES PLC

Recent Developments

-

In December 2023, NanoXplore, a top graphene company worldwide, declared the successful launch of two pilot lines for anode material, showcasing impressive energy density and product validation. This signifies a crucial moment in NanoXplore’s continued dedication to promoting eco-friendly energy storage solutions.

-

In November 2022, CVD Equipment Corporation, a top supplier of chemical vapor deposition systems, stated it had secured a USD 3.7M order for a Production Chemical Vapor Infiltration (CVI) System. The system is intended to produce ceramic composite materials (CMCs) for aerospace gas turbine engines.

Graphene Nanoplatelets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.8 million

Revenue forecast in 2030

USD 450.8 million

Growth rate

CAGR of 47.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil

Key companies profiled

CVD Equipment Corporation; Global Graphene Group; XG Sciences, Inc.; ACS Materials; NanoXplore Inc.; Thomas Swan & Co. Ltd.; Directa Plus S.p.A.; Graphene Laboratories Inc.; Xiamen Knano Graphene Technology Co., Ltd.; HAYDALE GRAPHENE INDUSTRIES PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphene Nanoplatelets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global graphene nanoplatelets market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Composites

-

Energy & Power

-

Conductive Inks & Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.