- Home

- »

- Consumer F&B

- »

-

Greek Yogurt Market Size, Share & Trends Report, 2021-2028GVR Report cover

![Greek Yogurt Market Size, Share & Trends Report]()

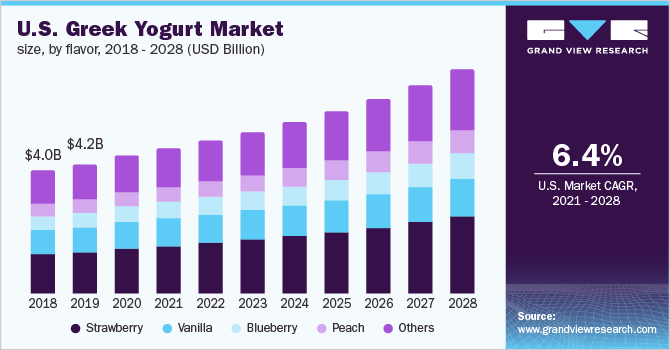

Greek Yogurt Market Size, Share & Trends Analysis Report By Flavor (Strawberry, Vanilla, Blueberry, Peach), By Distribution Channel (Supermarkets, Convenience Stores, Online), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-948-6

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

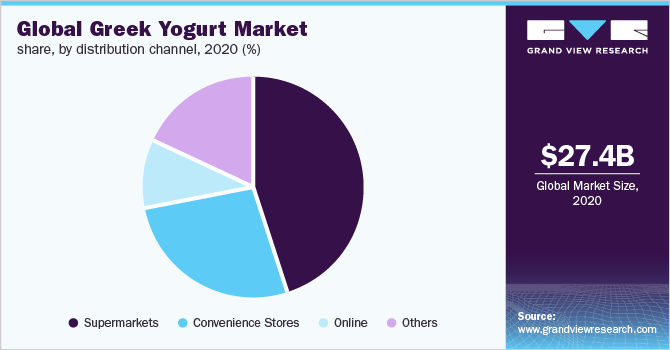

The global greek yogurt market size was valued at USD 27.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.0% from 2021 to 2028. A change in consumer preferences and high demand for clean label foods are the key factors driving the growth of the market. The COVID-19 pandemic has led to an increase in sales of dairy products such as yogurt and cheese leading to high demand for the products. Lockdowns caused by the COVID-19 pandemic in several parts of the world led to stockpiling of essential food products. The pandemic has also shifted consumer preference toward organic foods as several customers are looking for clear ingredient lists.

The growing awareness among consumers regarding transparency in the ingredient list in food products is driving the demand for clean label products. According to the Institute for Food Technologists, a clean label means producing a product with the least number of ingredients and making sure the ingredient lists are recognized as wholesome by the customers. Furthermore, the stringent rules and regulations authorized by regulatory bodies such as the Food and Drug Administration (FDA) are proliferating the demand for clean-label foods.

According to a study published by Lindberg International, 73% of consumers would buy organic dairy products if they were widely available. The demand for clean label products is on the rise across several regions with an emphasis on the usage of natural products. According to Cargill Inc., eight of 10 customers prefer clean label products. The increasing focus of the manufacturers on producing clean-label yogurt is anticipated to bode well for the overall growth of the Greek yogurt market.

Flavor Insights

The strawberry segment held the largest revenue share of more than 30% in 2020. The demand for strawberry-flavored Greek yogurt can be attributed to an increasing preference for berry-based Greek yogurts. Strawberry is one of the most popular flavors of yogurts across the globe. The year-on-year sales of strawberry-flavored yogurt are nearly 2.5 times higher than that of vanilla. The associated health benefits of combining berries and yogurt are the major contributing factors fueling the growth of the segment. The trend of replacing nutrient-deficient snacks and high-calorie foods with flavored yogurts is anticipated to bode well for growth.

Several companies in the industry are formulating and marketing new flavors to gain traction among millennials and health enthusiasts. For instance, in 2020, Chobani launched a line of lactose-free Greek yogurts in unique flavors like lemon meringue pie, banana cream pie, and super berry rocket. Such innovations are projected to create growth opportunities for the market in near future.

Distribution Channel Insights

The supermarket sector held the largest revenue share of more than 40% in 2020. A rise in the consumption of dairy-based products is one of the major factors driving the preference for supermarkets. For instance, as per ERS, dairy per capita consumption across products is steadily growing every year, with the number in 2019 up 6% over the past 5 years, 10% over the past fifteen years, and 16% over the past thirty years. Furthermore, the advent of modern technology such as Artificial Intelligence (AI) is transforming the role of supermarkets and hypermarkets in the dairy industry. For example, Walmart is utilizing AI to help customers track their online grocery orders.

The online segment is anticipated to register the fastest CAGR during the forecast period. The pandemic has ushered the demand for e-commerce channels owing to the imposed lockdowns in several regions. For instance, according to WebGrocer data, more than 90% of online provision orders include orders for dairy products. This percentage has increased yearly by more than 14%. In brief, there is a key prospect for dairy providers to create major revenue through e-commerce platforms. According to Danone, a leading player in the dairy industry, there is a massive shift in consumer preference for digital commerce.

Regional Insights

In 2020, Europe held a majority of the regional market share of over 30%. The regional market is driven by several untapped opportunities for the Greek yogurt industry. Furthermore, the emerging Eastern Europe region is expected to outpace Western European markets, where dairy sales are suffering due to the rising popularity of dairy-free alternatives. Several yogurt producers in Europe are modernizing plants consisting of automated production lines for fresh milk. Moreover, in 2021, General Mills sold its Yoplait business in Europe. The firm has sold its controlling interest of 51% to a dairy cooperative Sodiaal.

Asia Pacific is anticipated to be the fastest-growing region in the coming years owing to shifting consumer preference toward healthy snacking. For instance, according to Marvelous Foods, there is a high market opportunity for snacking in China. The increasing usage of yogurt as a snack in the country is driving the growth of the overall market.

Key Companies & Market Share Insights

Some of the companies operating in the market are Nestle S.A, Hain Celestial Group, Chobani, and Fage International S.A. Companies in the industry are constantly launching and innovating new flavors. The new entrants are experimenting by launching premium flavors and targeting millennials to try yogurt with granola and other snacks. The key players are concentrating on introducing new flavors with natural ingredients and are partnering with universities to expand the product reach.

For instance, in 2021, Chobani became the foremost company in the U.S. dairy industry to be validated with the Fair Trade seal of approval. The certification indicates that the company is working with farms and cooperatives to improve the conditions of the employees. Some of the key players in the global greek yogurt market include:

-

Chobani Holdings LLC

-

Danone

-

Fage International S.A

-

Nestle S.A

-

General Mills, Inc.

-

Parmalat S.p.A

-

Muller UK & Ireland Group

-

The Kroger Co.

-

Wallaby Yogurt Company

-

The Hain Celestial Group

-

Stonyfield

Greek Yogurt Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 28.95 billion

Revenue forecast in 2028

USD 46.5 billion

Growth rate

CAGR of 7.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2018

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million & CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; France; Spain; Denmark; Russia; China; Japan; India; Brazil; Argentina; South Africa

Key companies profiled

Chobani Holdings LLC; Danone; Fage International S.A; Nestle S.A; General Mills, Inc.; Parmalat S.p.A; Muller UK & Ireland Group; The Kroger Co.; Wallaby Yogurt Company; The Hain Celestial Group; Stonyfield

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the global Greek yogurt market report based on flavor, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2016 - 2028)

-

Strawberry

-

Vanilla

-

Blueberry

-

Peach

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Rest of North America

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Denmark

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Rest of Asia Pacific

-

-

Central & South America

-

Brazil

-

Argentina

-

Rest of Central and South America

-

-

Middle East & Africa

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global greek yogurt market size was estimated at USD 27.4 billion in 2020 and is expected to reach USD 28.95 billion in 2021.

b. The global greek yogurt market is expected to grow at a compound annual growth rate of 7.0% from 2021 to 2028, to reach USD 46.5 billion by 2028.

b. Europe dominated the greek yogurt market with a market share of over 30% in 2020. The dominance of the European region is attributable to the growing preference among consumers for healthy snacking alternatives.

b. Key players operating in the greek yogurt market include Chobani Global Holdings LLC, Danone, Fage International S.A., Nestle S.A., General Mills Inc., Parmalat S.p.A, Muller UK & Ireland Group, and Wallaby Yogurt Company.

b. Key factors that are driving the greek yogurt market growth include rising health consciousness and the growing consumer preferences for healthy snacking options and clean-label products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."