- Home

- »

- Green Building Materials

- »

-

Global Green Cement Market Size & Share, Industry Report, 2018-2024GVR Report cover

![Green Cement Market Size & Trend Report]()

Green Cement Market Size & Trend Analysis Report By Application (Residential, Commercial, Industrial), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecast, 2016 - 2024

- Report ID: GVR-1-68038-113-9

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2013 - 2015

- Forecast Period: 2016 - 2024

- Industry: Advanced Materials

Industry Insights

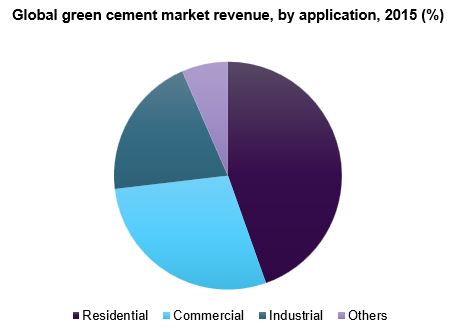

The global green cement market size was estimated at USD 19.25 billion in 2015 and is expected to grow at a growing at a CAGR of 8.5% from 2016 to 2024. Increasing demand from the expanding construction sector in the emerging economies of India, Russia, China, and Brazil is a major factor for the positive outlook of the industry.

The product is manufactured using waste materials such as recycled concrete, slag, quarrying and mining wastes, and power plant wastes. The product is gaining high demand to replace porcelain cement owing to the environmentally friendly properties associated with it. Rising attention towards carbon gas emission and its impact on the environment is expected to propel product demand over the projected period.

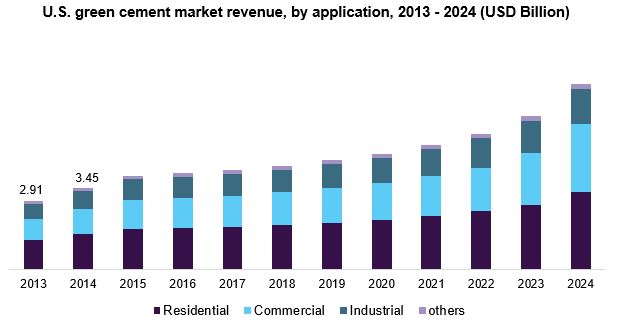

In the U.S., the residential segment emerged as a dominant segment and accounted for 43.7% of the total revenue share in 2015. This can be attributed to the increasing demand for greener and environment-friendly homes. The commercial segment is the second-largest segment accounted for 30.6% of the revenue share in 2015 owing to strict regulation policies to by Environment Protection Agency (EPA).

Increasing construction activities across the globe on account of rising urbanization and population is anticipated to boost industry growth. In addition, rising adoption of green architecture/building concept, which is certified as a Leader in Energy and Environmental Design (LEED) and easy availability of raw materials are key factors expected to boost industry demand.

This industry is expected to witness rapid technological development in near future on account of the emergence of Limestone Calcinated Clay Cement (LC3) and Frerrocrete technologies to advance the effectiveness of green cement. Encouraging performance of High Belite Cement (HBC) in China is expected to create new market opportunities by 2024.

The product is at its primary stage as several companies are still undergoing R&D activities to improve product properties and capabilities. The demand is expected to further rise over the forecast period on account of stringent environmental regulations, government initiatives to improve tax conditions, and subsidies for production of green materials.

Application Insights

In 2015, residential emerged as the largest application segment. This can be attributed to growing urbanization in emerging economies such as India and China with increasing need for environmentally safe buildings. In addition, growth of green roofs on account of eco-friendly materials from various manufacturers is also expected to fuel the market growth.

Commercial construction applications were the second largest segment accounting for 28.6% of the total revenue share in 2015. The product finds application in constructing office buildings, exterior walkways, pavements, car parking, and retail stores. Latin America and Middle East & Africa are expected to witness steady growth owing to increasing product penetration in the construction industry.

The industrial segment is another key segment for the market owing to its excellent properties such as shorter setting time and curing time, which leads to less consumption of water. This will lead to a positive outlook for market growth in the infrastructure and industrial sector over the forecast period.

Consumption of the product in industrial constructions is expected to increase owing to its properties like to solidify, stabilize, and encapsulate radioactive & metallic wastes. Longer life span and abrasive resistance offered by the product are likely to propel its demand over the projected period.

Regional Insights

North America was the largest market in 2015, owing to early adoption of the product. The global market is highly concentrated and majority of key players are located in North America. Rising stringency of regulatory frameworks is anticipated to further enhance regional demand.

The well-established cement manufacturers in the region are expected to invest in green cement production over the projected period. High amount of carbon emissions has led to formation of stern regulations prescribed by intergovernmental and regional agencies to deal with environmental degradation.

Europe has been the biggest exporter of green cement over the years. The presence of environmentally concerned organizations such as the European Commission, the region has many stringent regulations regarding carbon emissions and other greenhouse gas emissions. Directives such as EC Directive 2010/75/EU have implemented guidelines for industrial emissions.

Asia Pacific constitutes of the fastest growing economies such as India and China. Owing to high levels of economic development, increasing disposable income, and rising population, Asia Pacific is expected to witness the highest growth rate in the green cement industry.

Green Cement Market Share Insights

Major players are either new entrants that focus solely on green cement or established players who are switching to manufacturing gradually. Established players such as CEMEX and CNBM are producing traditional Portland cement. Emerging companies such as CeraTech and Kiran Global Chems are producing green and low-carbon emitting cement.

Key participants include Anhui Conch Cement Company, CNBM, CEMEX, Navrattan Blue Crete Industries Pvt., Ltd., Siam Cement Public Company (SCG), and others. Many of these manufacturers are involved in intense R&D to bring down carbon emissions and to produce stronger and durable material.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2013 - 2015

Forecast period

2016 - 2024

Market representation

Volume in Kilo Tons, Revenue in USD Million, and CAGR from 2016 to 2024

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Germany, China, India, Indonesia, Brazil

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."