- Home

- »

- Next Generation Technologies

- »

-

Green Technology & Sustainability Market Size Report, 2030GVR Report cover

![Green Technology & Sustainability Market Size, Share & Trend Report]()

Green Technology & Sustainability Market (2025 - 2030) Size, Share & Trend Analysis Report By Component, By Technology (IoT, Digital Twin, Cloud Computing, Blockchain), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-945-7

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Technology & Sustainability Market Summary

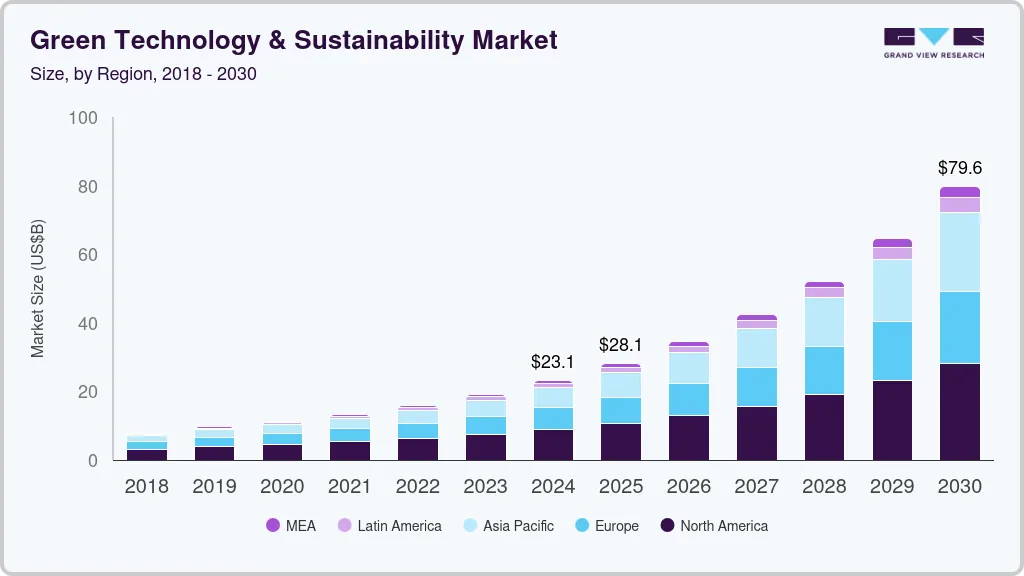

The global green technology & sustainability market size was estimated at USD 23.10 billion in 2024 and is projected to reach USD 79.65 billion by 2030, growing at a CAGR of 23.1% from 2025 to 2030. Investments in renewable energy, corporate sustainability initiatives, waste management solutions, and urban infrastructure projects are driving growth.

Key Market Trends & Insights

- North America dominated the green technology & sustainability market with the largest revenue share of 38.2% in 2024.

- The green technology & sustainability market in the U.S. is expected to grow at a significant CAGR during the forecast period.

- Based on component, the solution segment led the market with the largest revenue share of 67.5% in 2024.

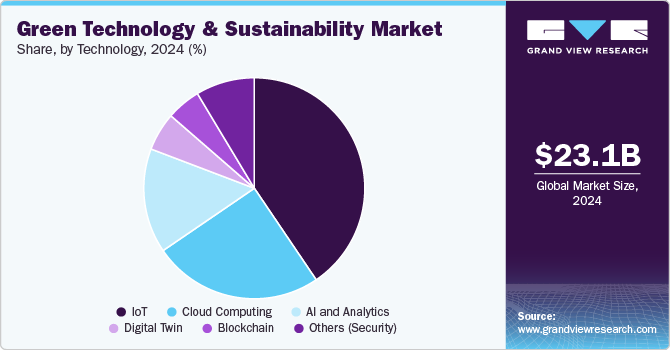

- Based on technology, the Internet of Things (IoT) segment accounted for the largest market revenue share in 2024.

- Based on application, the green building segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.10 Billion

- 2030 Projected Market Size: USD 79.65 Billion

- CAGR (2025-2030): 23.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, rising fuel prices and increasing pollution levels are pushing businesses and governments to adopt green technologies, such as solar panels and wind turbines, to reduce environmental impact. These factors contribute to the market's ongoing expansion as companies seek to enhance energy efficiency and comply with environmental regulations.

Consumer demand for sustainable products and services is increasing, leading to greater adoption of circular economy models and energy-efficient technologies. Corporate commitments to sustainability and climate change mitigation efforts are also significant drivers. The integration of technologies such as Artificial Intelligence (AI), IoT, and blockchain is enhancing the market by providing real-time monitoring and reporting tools for carbon emissions and resource usage. These technologies support businesses in achieving ESG compliance and optimizing resource management.

Moreover, the ongoing expansion of the green technology and sustainability market is further supported by regulatory mandates and technological advancements. Stricter ESG reporting requirements and carbon pricing mechanisms are compelling companies to invest in green technologies. The use of digital solutions such as smart grids and predictive analytics is transforming energy distribution and management. Additionally, the rise of sustainable finance options, including green bonds, is providing necessary funding for low-carbon innovations. These developments are driving businesses to integrate climate strategies into their core operations, ensuring continued market growth.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 67.5% in 2024. Advances in emerging technologies provide new opportunities for green technology implementation and sustainable development, considering social, economic, and environmental factors. The rising adoption of smart technologies and the integration of digital solutions in environmental management are also contributing to the segment's expansion. Corporate sustainability goals and growing consumer preference for eco-friendly products are creating additional demand for advanced solutions. Strategic investments in research and development are advancing the capabilities of green technologies, making them more efficient and cost-effective.

The services enablement tools segment is expected to grow at the fastest CAGR during the forecast period. The increasing emphasis worldwide on rolling out sustainable practices and working toward environmental conservation has spurred the demand for expert services to guide organizations in implementing green technologies and sustainability solutions. These services include consulting, system integration, and maintenance, which are essential for the effective deployment and optimization of green technologies. In addition, governments worldwide are drafting stringent regulations and pursuing policies and initiatives to promote sustainability, prompting businesses to seek professional services to opt for the incentives offered and ensure compliance.

Technology Insights

Based on technology, the Internet of Things (IoT) segment accounted for the largest market revenue share in 2024. The adoption of IoT in various industries, such as manufacturing, healthcare, and agriculture, to enable real-time monitoring, efficient resource management, and data-driven decision-making, enhance operational efficiencies, and reduce costs is gaining traction. Rapid advancements in wireless technologies and the proliferation of connected devices have made IoT solutions more accessible and affordable. The growing focus on sustainability and energy efficiency has led to the integration of IoT in energy management systems, thereby optimizing energy consumption and reducing the carbon footprint. Continued advances in sensing technology, data analytics, and cloud computing further propel IoT implementation, enabling more sophisticated and scalable applications.

The cloud computing segment is expected to grow at the fastest CAGR during the forecast period. Cloud computing can be considered a cornerstone for green technology initiatives, given the growing demand for scalable and efficient data storage and processing solutions. Cloud computing enables businesses to reduce their carbon footprint by optimizing resource utilization and minimizing energy consumption through more efficient data center operations. The flexibility and scalability of cloud solutions allow organizations to dynamically adjust their computing resources, leading to significant cost savings and reduced environmental impact.

Application Insights

Based on application, the green building segment accounted for the largest market revenue share in 2024. The growing awareness about environmental issues and the urgent need to reduce the carbon footprint have propelled the demand for green buildings, which are typically designed to be energy-efficient, use sustainable materials, and minimize waste, thereby significantly lowering environmental impact. The implementation of stringent building regulations and sustainability standards worldwide has further accelerated the adoption of green building practices. Governments and regulatory bodies are increasingly mandating energy efficiency and sustainability in construction. Green building projects are also being encouraged by providing incentives. The growing preference for sustainable living and working environments is pressurizing developers to incorporate green building practices.

The carbon footprint management segment is anticipated to exhibit at the fastest CAGR over the forecast period. The rising awareness about climate change and the need to curb greenhouse gas emissions have emphasized the importance of carbon footprint management. Organizations across various industries are increasingly recognizing the need to measure, monitor, and reduce their carbon emissions to comply with environmental regulations and achieve sustainability goals. Technological advancements have significantly contributed to this trend. Advanced software and tools for tracking and analyzing carbon emissions enable businesses to assess the environmental impact of their operations and implement effective carbon reduction strategies accurately. These technologies also facilitate reporting and compliance with regulatory standards, enhancing transparency and corporate accountability.

Regional Insights

North America dominated the green technology & sustainability market with the largest revenue share of 38.2% in 2024. This high share is attributed to the rising number of investments and initiatives in the green environment. For instance, in June 2023, the U.S. Department of Energy (DOE), under the leadership of the Biden-Harris Administration, announced an investment of around USD 30 million to accelerate the sustainability of federal buildings and clean energy technologies. In another instance, the North American Climate, Energy, and Environment Partnership has encouraged governments to adopt more sustainable policies and to purchase more renewable energy and electric vehicles as needed. Additionally, in partnership with the International Renewable Energy Agency, as part of a long-term global initiative, Mexico, Canada, and the U.S. are launching a Trilateral North American initiative to assist isolated, remote, and indigenous communities in transitioning to clean, renewable, and reliable energy sources.

U.S. Green Technology & Sustainability Market Trends

The green technology & sustainability market in the U.S. is expected to grow at a significant CAGR during the forecast period. The U.S. government and various state authorities have implemented stringent regulations and ambitious sustainability goals aimed at reducing carbon emissions, promoting renewable energy, and improving energy efficiency, which drive investments in green technologies. Technological advancements and innovations in renewable energy sources, such as solar and wind power, along with developments in energy storage and electric vehicles, are fueling market expansion.

Europe Green Technology & Sustainability Market Trends

The green technology & sustainability market in the Europe is expected to witness at a significant CAGR over the forecast period. The European Union's ambitious climate goals, including achieving carbon neutrality by 2050 and implementing the European Green Deal, provide a strong regulatory framework and incentive for investments in green technologies. These initiatives prioritize renewable energy adoption, energy efficiency improvements, and sustainable practices across industries. In February 2024, the EU Council and European Parliament reached a provisional agreement on the 'Net-Zero Industry Act' (NZIA). This regulation is designed to strengthen Europe's manufacturing ecosystem for net-zero technology products, thereby boosting the deployment of these technologies to meet the EU's climate goals.

Asia Pacific Green Technology & Sustainability Market Trends

The green technology & sustainability market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. Increasing environmental concerns and stringent government regulations aimed at reducing carbon footprints are compelling businesses and governments to adopt green technologies. Rapid urbanization and industrialization in emerging economies are further boosting the demand for sustainable solutions. In addition, the rise in corporate sustainability initiatives and consumer preference for eco-friendly products are also contributing to the market's expansion. Investments in research and development, coupled with favorable policies and incentives, are accelerating innovation and adoption of green technologies across the region.

Key Green Technology & Sustainability Company Insights

Key green technology & sustainability companies include General Electric Company, Microsoft, Cority, and Schneider Electric SE.

-

Microsoft provides various software, services, devices, and solutions. The company’s services include licensing and support services. The company’s product/solution portfolio spans multiple domains, including software, PCs & devices, entertainment, business, developer & IT, and others. Windows apps, OneDrive, Outlook, Skype, and OneNote fall under the software domain; PCs, tablets, and related accessories fall under the PCs & devices domain; Xbox games, PC games, Windows digital games, and movies & TV fall under the entertainment domain. For the green technology and sustainability market, the company provides various products, such as Microsoft Cloud for Sustainability, and Emissions Impact Dashboard, among others.

-

Schneider Electric SE provides digital automation and energy management solutions by integrating energy technologies with real-time automation, software, and services. The company serves various industries and industry verticals, including residential and commercial buildings, data centers, and infrastructure. For the green technology and sustainability, the company offers various software and services, such as Low-Voltage Products and Systems, Critical Power, Cooling and Racks, and Solar and energy Storage, among others.

Key Green Technology & Sustainability Companies:

The following are the leading companies in the Green Technology & Sustainability Market. These companies collectively hold the largest market share and dictate industry trends:

- Cority

- CropX Inc.

- ENGIE Impact

- General Electric Company

- LO3 Energy

- Microsoft

- Salesforce, Inc.

- Schneider Electric SE

- Xylem Inc.

- Wolters Kluwer N.V.

Recent Developments

-

In April 2025, China Petroleum & Chemical Corporation (Sinopec) and Contemporary Amperex Technology Co., Limited signed a strategic cooperation agreement in Beijing. This partnership is focused on developing a comprehensive nationwide battery swap network, positioning China at the forefront of green infrastructure innovation. By combining Sinopec's extensive energy infrastructure with Contemporary Amperex Technology Co., Limited's advanced battery technology, the collaboration aims to create a seamless and efficient energy replenishment system for electric vehicles, aligning with China's national goals for low-carbon transportation and new infrastructure development.

-

In March 2024, Adani Tradecom Limited (ATL), a wholly-owned subsidiary of Adani Enterprises, completed the acquisition of the remaining 49% stake in Adani Green Technology Limited (AGTL) from Adani Trading Services LLP (ATS LLP). This strategic move resulted in AGTL becoming a step-down wholly-owned subsidiary of Adani Enterprises, streamlining the group's renewable energy operations and enhancing its control over green energy initiatives. The acquisition aligns with Adani Group's broader strategy to consolidate and strengthen its presence in the renewable energy sector.

-

In June 2024, Wolters Kluwer N.V. launched CCH Tagetik ESG & Sustainability for Carbon Emissions, a new solution that reports direct and indirect carbon emissions and aligns with the Corporate Sustainability Reporting Directive (CSRD).

Green Technology & Sustainability Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.13 billion

Revenue forecast in 2030

USD 79.65 billion

Growth rate

CAGR of 23.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

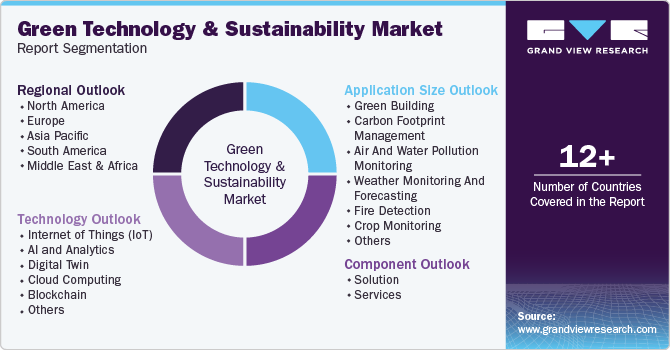

Component, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil

Key companies profiled

Cority; CropX Inc.; ENGIE Impact; General Electric Company; LO3 Energy; Microsoft; Salesforce, Inc.; Schneider Electric SE; Xylem Inc.; Wolters Kluwer N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Technology & Sustainability Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global green technology & sustainability market report based on component, technology, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

Consulting

-

Integration and Component

-

Support and Maintenance

-

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Internet of Things (IoT)

-

AI and analytics

-

Digital twin

-

Cloud computing

-

Blockchain

-

Others

-

-

Application Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Green building

-

Carbon footprint management

-

Air and water pollution monitoring

-

Weather monitoring and forecasting

-

Fire detection

-

Crop monitoring

-

Soil condition/moisture monitoring

-

Forest monitoring

-

Sustainable mining and exploration

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global green technology & sustainability market size was estimated at USD 23.09 billion in 2024 and is expected to reach USD 28.13 billion in 2025.

b. The global green technology & sustainability market is expected to grow at a compound annual growth rate of 23.1% from 2025 to 2030 to reach USD 79.65 billion by 2030.

b. North America dominated the market in 2024, accounting for over 38% share of the global revenue. The region's growth can be attributed to the investments and initiatives in the green environment.

b. Some key players operating in the green technology and sustainability market include General Electric, Wolters Kluwer N.V., Salesforce, Inc., Microsoft, Schneider Electric, Engie Impact, Sensus, LO3 Energy, and CropX Inc.

b. Key factors that are driving green technology & sustainability market growth include the growing environmental awareness and concern about global warming and increasing spending on clean technology worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.