- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

GRP Pipes Market Size And Share, Industry Report, 2030GVR Report cover

![GRP Pipes Market Size, Share & Trends Report]()

GRP Pipes Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Oil & Gas, Chemicals, Sewage, Irrigation, Others), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-612-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Grp Pipes Market Summary

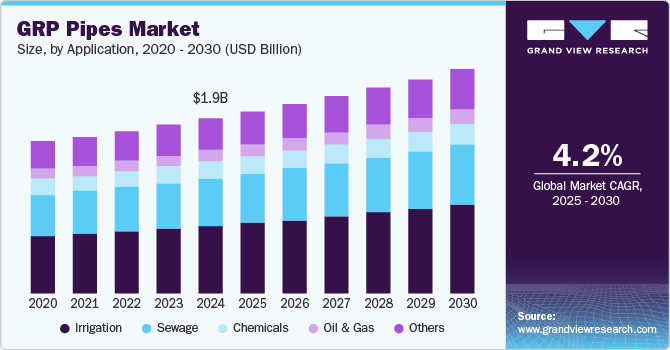

The global grp pipes market size was estimated at USD 1,868.5 million in 2024 and is projected to reach USD 2,386.4 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. Rising demand for high-strength, durable, and lightweight pipelines for water, wastewater, and chemical supply for industrial applications is expected to drive the industry growth over the forecast period.

Key Market Trends & Insights

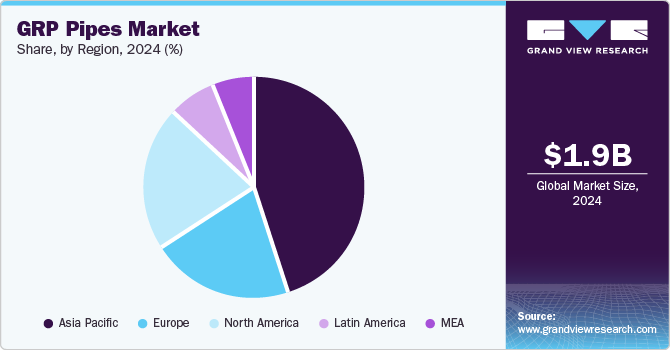

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, irrigation accounted for a revenue of USD 755.0 million in 2024.

- Irrigation is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,868.5 Million

- 2030 Projected Market Size: USD 2,386.4 Million

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

In addition, the rising demand for energy, particularly in oil and gas sectors, further propels the market as GRP pipes are ideal for transporting these resources. Furthermore, the focus on sustainable and eco-friendly materials enhances GRP's appeal, while advancements in manufacturing technologies contribute to its growing adoption across various industries.

Glass reinforced plastic (GRP) pipes, made from a polymer matrix reinforced with glass fibers, are increasingly popular due to their strength and durability. The growing need for wastewater treatment significantly drives this market, as rising water contamination and freshwater shortages prompt the implementation of water reuse and recycling initiatives. Additionally, the shift towards epoxy resins enhances GRP's appeal, as these materials offer superior resistance to abrasion and corrosion, making them ideal for the oil and gas industry where efficient resource flow is crucial.

Manufacturers tend to offer standard product lines as the costs associated with fabrication and the engineering involved in custom product manufacturing are very high. However, they also provide custom GRP pipes for specific application industries, which are usually manufactured based on the requirements presented by end-users. The centrifugal method, wherein the outer pipe diameter is constant, produces a high-quality product. However, the process is highly labor-intensive and not cost-effective, which is likely to hamper its demand.

The European Union (EU) has laid down Safety Glass Directives for GRP piping utilized in construction, water treatment, and automotive applications. The directive also covers the fitting and installation of these products. The pipes adhere to stringent regulations about mechanical and chemical strength.

Furthermore, the expansion of hydrocarbon exploration and production contributes to the demand for GRP pipes, which are utilized in offshore platforms and gas transmission systems. Their long lifespan and low maintenance requirements promote economic sustainability by minimizing the need for costly on-site welding and heavy machinery. Industries such as chemicals, oil and gas, and textiles are increasingly adopting GRP pipes due to their lightweight nature, which simplifies installation.

Application Insights

The irrigation segment dominated the global GRP pipes industry and accounted for the largest revenue share of 38.7% in 2024. GRP pipes provide numerous benefits in irrigation applications. In addition, their outstanding corrosion resistance makes them ideal for transporting water over extended periods without experiencing degradation. Furthermore, the smooth internal surface of GRP pipes minimizes frictional losses, ensuring the efficient flow of water across vast distances, and promoting an effective irrigation system. Moreover, Growth of the agricultural sector to support the rising demand for food is expected to propel the demand for well-established water infrastructure, which, in turn, is likely to positively impact the glass fiber reinforced plastic pipes market growth.

The sewage segment is expected to grow at a CAGR of 4.3% over the forecast period. GRP pipes are widely used in sewage treatment facilities on account of their ability to resist corrosion caused by toxic chemicals during the treatment. In addition, the smooth internal surface of GRP pipes prevents the buildup of debris and organic matter, reducing the risk of clogging and blockages in the system. Increasing government mandates on industrial effluent collection, processing, and recycling are expected to propel the demand for the product over the projected period. Furthermore, as sewage systems are usually spread in the shape of extensive networks covering large areas, the lightweight nature of GRP pipes becomes advantageous, making installation and maintenance activities more manageable and cost-effective.

Regional Insights

North America GRP pipes market is expected to grow at a CAGR of 4.2% over the forecast period, driven by growing investments in infrastructure upgrades, especially for water supply and wastewater management systems. In addition, aging pipelines necessitate replacement with durable materials that can withstand harsh conditions, making GRP an attractive option. Furthermore, stringent environmental regulations promote the use of corrosion-resistant materials such as GRP in various applications. Moreover, the focus on enhancing energy efficiency within utility services also supports the growing adoption of GRP pipes across diverse sectors in this region.

U.S. GRP Pipes Market Trends

The GRP pipes market in the U.S. led the North American market and held for the largest revenue share in 2024, primarily due to the urgent need to modernize aging water and sewage infrastructure. With many pipelines reaching the end of their lifespan, there is a strong push to replace them with durable and corrosion-resistant materials such as GRP. In addition, investment in advanced water treatment facilities, particularly in regions facing water scarcity or contamination issues, further drives demand. Furthermore, the growing emphasis on sustainable practices and efficient resource management also encourages the adoption of GRP piping solutions nationwide.

Asia Pacific GRP Pipes Market Trends

Asia Pacific GRP pipes market dominated the global market and accounted for the largest revenue share of 45.3% in 2024. This growth can be attributed to the availability of skilled labor, favorable government regulations, and high demand from end-users which are likely to compel manufacturers to set up their production facilities in this region. In addition, the increasing demand for lightweight, durable, and corrosion-resistant pipes across various sectors, including chemicals and oil & gas, further fuels this market. Furthermore, supportive government regulations and initiatives aimed at enhancing water infrastructure contribute significantly to the rising adoption of GRP pipes in the region.

The GRP pipes market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, owing to the presence of numerous chemical manufacturing companies in the country. High population density and the government’s focus on reducing dependency on imports are driving the agricultural sector in the country. As a result, the demand for GRP pipes for use in irrigation applications is expected to rise over the projected period. Furthermore, the agricultural sector's expansion has increased the need for efficient irrigation systems, driving demand for GRP solutions. Moreover, as environmental sustainability becomes a priority, industries are increasingly turning to GRP pipes for their durability and resistance to corrosion, further bolstering market growth.

Europe GRP Pipes Market Trends

Europe GRP pipes market is expected to be driven by increasing requirements for reliable gas transportation and efficient sewage systems. The region's commitment to sustainable development and eco-friendly solutions has led to significant investments in infrastructure upgrades. Furthermore, stringent environmental regulations promote the use of durable materials such as GRP that can withstand corrosive environments. Moreover, Europe's extensive network of infrastructure projects, industrial developments, and environmental initiatives creates a demand for reliable and cost-efficient solutions to transport fluids and waste.

The GRP pipe market in Germany led the European market and accounted for the largest revenue share in 2024. This growth can be attributed to the country's commitment to transitioning towards renewable energy sources. In addition, this shift creates substantial opportunities for GRP pipes in applications such as hydroelectric power plants and other sustainable energy projects. Furthermore, the robust manufacturing capabilities within Germany support technological advancements that enhance GRP pipe performance. Moreover, increasing investments in wastewater treatment facilities and efficient resource management initiatives contribute to the rising adoption of GRP solutions across various sectors within the country.

Key GRP Pipes Company Insights

Major players in the global GRP pipes industry include Amiblu Holding, Future Pipe Industries, Kinflare Group, and others. These companies are expected to invest in strategies such as joint ventures, mergers & acquisitions, and long-term contracts with users to gain a competitive advantage and sustain in the competitive market. In addition, increasing efforts by manufacturers toward quality enhancement and new product development are likely to trigger the demand for GRP pipes across various application industries. Furthermore, strategies such as diversified portfolio, brand reputation, and enhanced product quality are considered to be the key success factors in the market.

-

Amiblu Holding produces a wide range of products, including pressure pipes, non-pressure pipes, fittings, and couplings. Its innovative technologies, such as Hobas and Flowtite, enable the development of durable and lightweight piping solutions suitable for various applications, including water supply, irrigation, and industrial uses. The company operates primarily in the infrastructure and industrial segments, focusing on sustainable and efficient piping solutions.

-

Future Pipe Industries manufactures GRP pipes, fittings, and accessories that cater to sectors such as oil and gas, water management, and industrial processes. With a focus on high-quality materials and advanced manufacturing techniques, the company addresses the growing demand for lightweight and corrosion-resistant piping solutions. The company operates within the infrastructure and energy segments, emphasizing sustainability and innovation in its product offerings.

Key GRP Pipes Companies:

The following are the leading companies in the GRP pipes market. These companies collectively hold the largest market share and dictate industry trends.

- Amiblu Holding

- Future Pipe Industries

- Aliaxis

- Kinflare Group

- Ashirvad Pipes

- Sri Lakshmi Fibres

- Amiantit Fiberglass Industries Limited

- WIG Wietersdorfer Holding GmbH

- Graphite India Limited

- Hengrun Group Co. Ltd.

Recent Developments

-

In January 2025, Future Pipe Industries (FPI) led the way in sustainable logistics by utilizing rail transport in Egypt. This initiative aligns with the Egyptian Government's efforts to enhance transportation efficiency and reduce environmental impact. The company is now transporting GRP pipes between the Dry Port and Alexandria Sea Port. Recent shipments supporting projects in Algeria demonstrate this eco-friendly approach, which reduces carbon emissions, minimizes road congestion, and improves delivery times for GRP pipes, showcasing FPI's commitment to sustainability in the industry.

-

In January 2024, Amiblu expanded its global presence by acquiring RPC Pipe Systems in Australia. This acquisition allows Amiblu to extend its reach into the Asia-Pacific region, leveraging RPC's expertise in Flowtite GRP pipe systems, of which they have been a licensee since 2006. By integrating RPC's local manufacturing and regional knowledge, Amiblu aims to strengthen its mission to combat water scarcity with durable, long-lasting GRP pipe solutions.

-

In December 2023, Wietersdorfer Group expanded into Australia by acquiring 75.1% of RPC Pipe Systems through Amiblu Australia Ltd. This acquisition secures the Australian market and aimed at enhancing Wietersdorfer's presence in the Asia-Pacific region. RPC Pipe Systems operates two advanced facilities in Adelaide and employs around 100 skilled professionals. The move opens new growth opportunities in Australia and New Zealand.

GRP Pipes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.94 billion

Revenue forecast in 2030

USD 2.39 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; UK; Spain; Italy; China; Japan; India; South Korea; Singapore; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Amiblu Holding; Future Pipe Industries; Aliaxis; Kinflare Group; Ashirvad Pipes; Sri Lakshmi Fibres; Amiantit Fiberglass Industries Limited; WIG Wietersdorfer Holding GmbH; Graphite India Limited; Hengrun Group Co. Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global GRP Pipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global GRP pipes market report based on application, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & gas

-

Chemicals

-

Sewage

-

Irrigation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.