- Home

- »

- Food Additives & Nutricosmetics

- »

-

Gum Rosin Market Size Report, 2030GVR Report cover

![Gum Rosin Market Size, Share & Trends Report]()

Gum Rosin Market Size, Share & Trends Analysis Report By Application (Softener, Binder in Adhesives, Paper, Thermoplastic Coating, Food, Ink Industry), By Product, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-163-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Report Overview

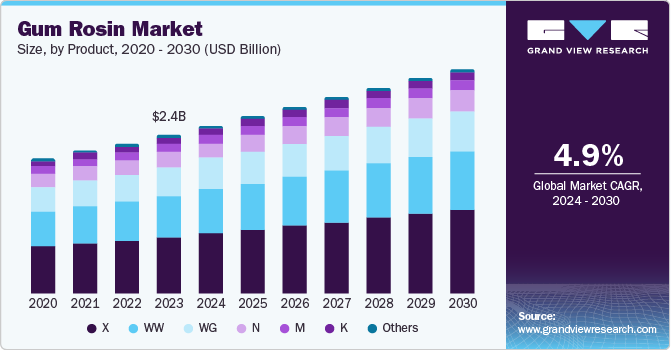

The global gum rosin market size was valued at USD 2.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030. The current trends in the gum rosin market show that the demand for gum rosin in various industries, including adhesives, printing inks, personal care products, and food packaging, is expected to rise. The shift in consumers towards using environmentally friendly solutions boosted by technology advancements makes it even more attractive to manufacturers.

China gum rosin market volume, by product, 2013 - 2024 (Tons)

The increasing preference for bio-based adhesives and sealants has led to a significant surge in demand for gum rosin, particularly in packaging, construction, and automotive applications. This trend is expected to continue as consumers and manufacturers increasingly opt for natural resins over synthetic alternatives, driven by growing awareness of environmental impacts.

Another significant driver of the gum rosin market is the expansion of the paper packaging industry. The rise in e-commerce and the need for sustainable packaging solutions have led to a burgeoning demand for paper packaging materials, which rely heavily on gum rosin as a key component. Moreover, the growth in printing inks and coatings has also contributed to the demand for gum rosin, as its properties enhance adhesion, viscosity, and drying times, making it essential for high-quality printing applications.

The global growth in construction activities, particularly in developing regions, also contributes to the demand for adhesives and sealants, which rely on gum rosin as a key ingredient. Furthermore, the increased adoption of e-commerce and packaging sectors has led to new developments in adhesive products that improve the gum rosin market. The improved extraction and processing technologies have also enhanced the yield and quality of gum rosin, enabling better purification procedures that produce pure products for various uses across different sectors. Emerging economies such as India, Brazil, and China also drive growth in the gum rosin market as they rapidly industrialize and increase their demand for sustainable materials.

Product Insights

The X segment led the market with a revenue share of 35.8% in 2023 due to robust demand from industries such as construction and printing. As these industries expand, the demand for high-quality gum rosin products increases. Furthermore, consumer awareness of environmental sustainability has shifted towards natural resins, including gum rosin, over synthetic alternatives.

The WW segment is expected to register the second-fastest CAGR of 5.2% over the forecast period. Worldwide, gum rosin is a key component in sizing paper, enabling the retention of patterns and colors. The growth prospects in the adhesive and synthetic rubber industries drive demand for WW gum rosin, which is also a critical intermediate in high-quality products for the automotive and building & construction sectors.

Application Insights

The binder in adhesives held the largest market share of 46.9% in 2023 driven by increasing demand from construction, automotive, and packaging industries. As these sectors expand, the demand for high-quality adhesives, which often contain gum rosin, is also rising. Manufacturers continuously improve adhesive properties through innovative chemical formulations, such as bonding strength and durability.

Softners are expected to register the second-fastest CAGR of 5.1% during the forecast period. Gum rosin is a versatile ingredient used as a softener in various products, including adhesives, coatings, inks, and rubber compounds. Its ability to enhance flexibility and workability makes it essential in formulations requiring softness. The growing demand for softeners, driven by industries such as construction, automotive, packaging, and personal care, is also fueling the demand for gum rosin.

Regional Insights

Asia Pacific gum rosin market dominated the global gum rosin market with a market share of 64.0% in 2023 driven by the rapid industrialization, urbanization, and economic expansion in countries such as China, India, and Japan. The increasing demand from construction, automotive, and packaging industries and the growing utilization of gum rosin in various applications is expected to drive market growth in the region.

China Gum Rosin Market Trends

The gum rosin market in China dominated the Asia Pacific gum rosin market with a market in 2023. China, a leading producer of gum rosin, leverages its vast pine forests to maintain a consistent supply chain, meeting domestic and international demand. As infrastructure and construction projects flourish, driven by significant funding, the demand for adhesives and sealants has increased, further bolstering China’s gum rosin production.

Europe Gum Rosin Market Trends

Europe gum rosin market is expected to register a CAGR of 4.4% in the forecast period. The market is mature and highly regulated, with key consumers in Germany, France, and the UK driving demand in consumer segments such as paints, coatings, and adhesives. The region’s emphasis on environmental sustainability has prompted the development of new gum rosin products, catering to the growing demand for eco-friendly solutions.

The gum rosin market in Germany held a significant market share in 2023. Germany’s central location in Europe facilitates seamless access to major markets, with efficient transportation and distribution networks for its gum rosin products. Leveraging its strong industrial foundations, including advanced chemical and manufacturing sectors, Germany produces high-quality gum rosin derivatives that cater to diverse applications, solidifying its position as a leading player in the industry.

North America Gum Rosin Market Trends

North America gum rosin market is expected to grow in the forecast period. The region’s market is prominent due to the large manufacturing industry and high demand for gum rosin in the industrial sector. The US and Canada are key players, driven by advanced industries and technologies. Growing industries such as construction, automotive, and consumer goods also contribute to increased demand for gum rosin products in the region.

The gum rosin market in the U.S. has a substantial market share in 2023. The country features prominent players, commanding a significant share of production capacities and investing in R&D to develop novel applications. As consumers increasingly favor natural solutions, the demand for gum rosin is growing in industries such as cosmetics, food, and pharmaceuticals, driving innovation and market expansion.

Key Companies & Market Share Insights

Some key companies in the gum rosin market include CV. INDONESIA PINUS; Eastman Chemical Company; Midhills; MEGARA RESINS; Harima Chemicals Group, Inc.; and others. Market players are adopting new product introductions, expanded distribution channels, geographic expansion, and other initiatives to gain a competitive edge and drive growth.

-

Eastman Chemical Company, a global specialty materials provider, offers a comprehensive portfolio of products, including the Eastman Rosin Resins line, which provides high-performance tackifiers to applications such as adhesives, coatings, and printing inks.

-

MEGARA RESINS, a Greek producer and exporter of gum rosin and gum turpentine, sources raw materials from sustainably managed pine forests and utilizes advanced processing techniques to ensure product quality and consistency. The company offers a range of gum rosin grades for various applications, with a focus on environmental responsibility and customer satisfaction.

Key Gum Rosin Companies:

The following are the leading companies in the gum rosin market. These companies collectively hold the largest market share and dictate industry trends.

- CV. INDONESIA PINUS

- Eastman Chemical Company

- Midhills

- MEGARA RESINS

- Harima Chemicals Group, Inc.

- Guangxi Jinxiu Songyuan Forest Products Co.,Ltd.

- Wuzhou Sun Shine Forestry and Chemicals Co., Ltd.

- PINOPINE (Grupo Resinas Brasil)

- Forestar Chemical Co., Ltd.

- IRANI PAPEL E EMBALAGEM S.A.

- FLORPINUS

Recent Developments

-

In March 2024, Grupo Resinas Brasil (RB) acquired a controlling stake in Portugal-based Pinopine, a gum rosin derivatives producer. This acquisition allowed Grupo Resinas Brasil to gain access to European markets and enhance its competitive position.

-

In July 2023, Eastman launched Advantis adhesion promoters, a new generation of products designed to ensure compliance with regulatory changes and mitigate materials of concern, catering to the needs of paint and coatings users.

Gum Rosin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.49 billion

Revenue forecast in 2030

USD 3.33 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, China, Japan

Key companies profiled

CV. INDONESIA PINUS; Eastman Chemical Company; Midhills; MEGARA RESINS; Harima Chemicals Group, Inc.; Guangxi Jinxiu Songyuan Forest Products Co.,Ltd.; Wuzhou Sun Shine Forestry and Chemicals Co., Ltd.; PINOPINE (Grupo Resinas Brasil); Forestar Chemical Co., Ltd.; IRANI PAPEL E EMBALAGEM S.A.; FLORPINUS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gum Rosin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gum rosin market report based on product, application, and region.

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Softener

-

Binder in Adhesives

-

Paper

-

Thermoplastic Coating

-

Food

-

Ink Industry

-

Other

-

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

X

-

WW

-

WG

-

N

-

M

-

K

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."