- Home

- »

- Beauty & Personal Care

- »

-

Hair Color Market Size, Share & Trends, Industry Report 2033GVR Report cover

![Hair Color Market Size, Share & Trends Report]()

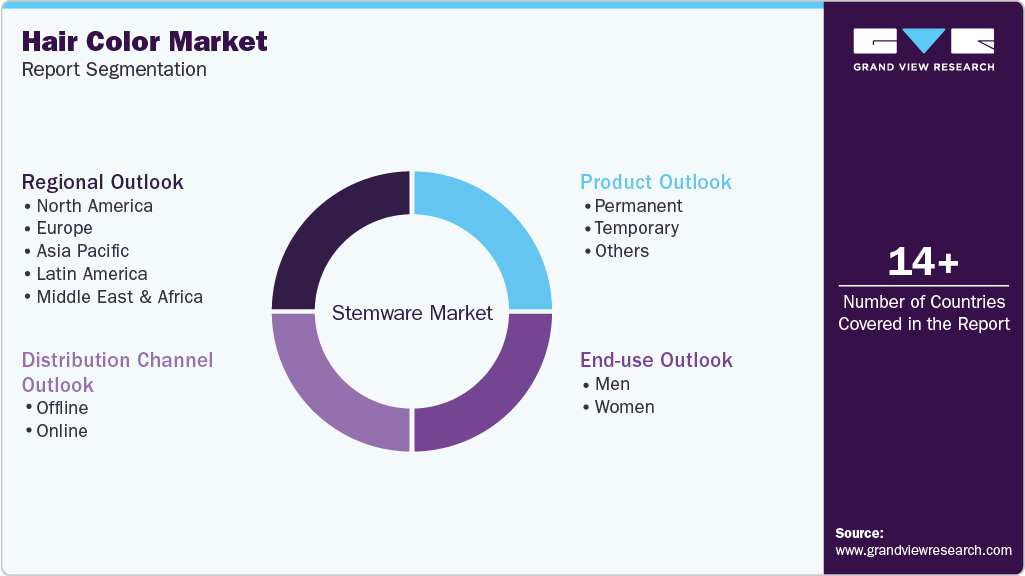

Hair Color Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Permanent, Temporary), By End User (Men, Women), By Distribution Channel (Offline, Online), By Region (Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-933-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hair Color Market Summary

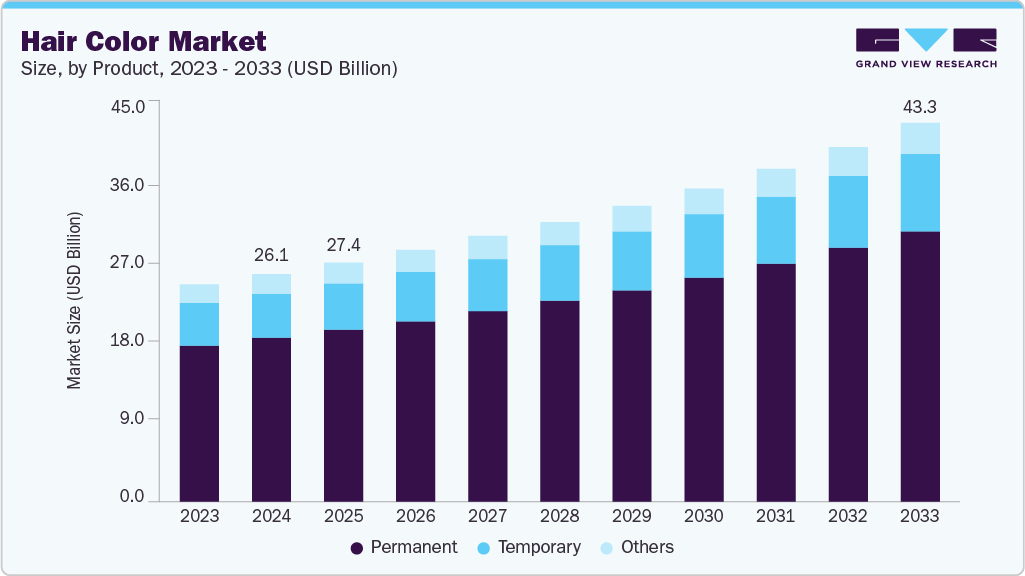

The global hair color market size was estimated at USD 26,097.6 million in 2024 and is projected to reach USD 43,338.1 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The significant increase in the demand for hair coloring, alongside the expanding global aging population, represents a key driver fueling market growth.

Key Market Trends & Insights

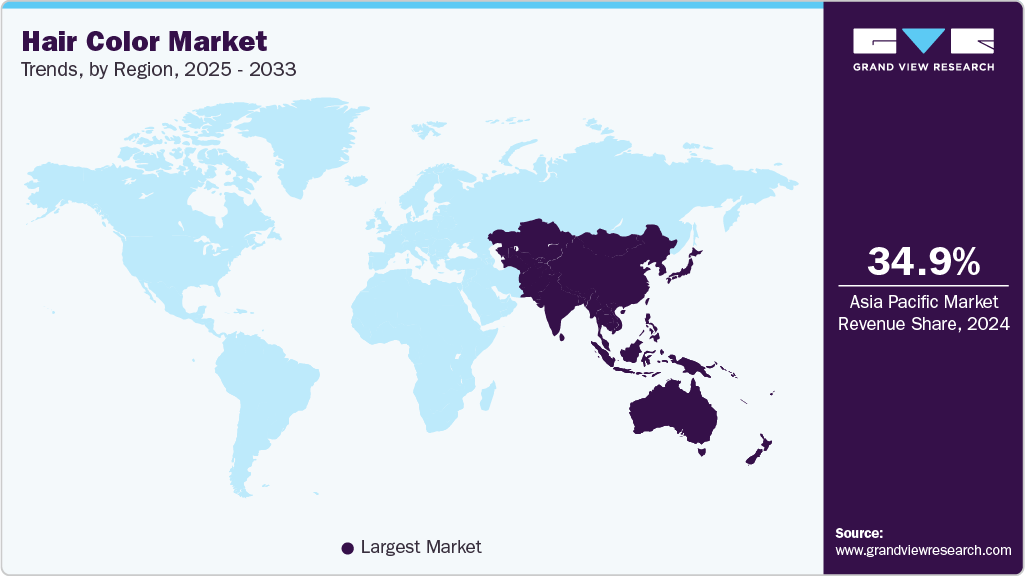

- The Asia Pacific hair color market held the major share of 34.97% of the global hair color market in 2024.

- The hair color industry in China is expected to grow significantly over the forecast period.

- By product, the permanent hair color segment held the highest market share of 71.77% in 2024.

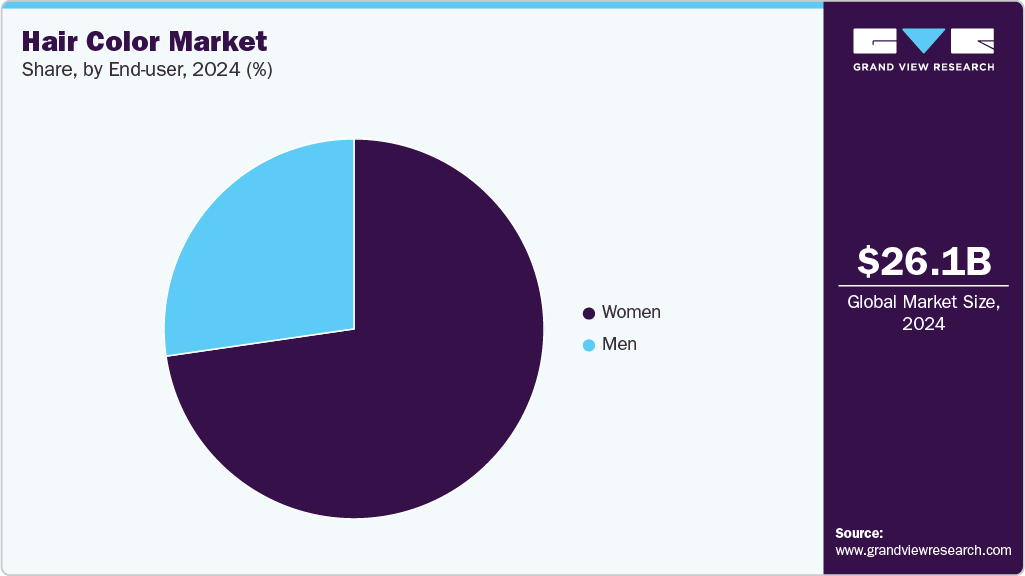

- Based on the end user, the women segment held the highest market share in 2024.

- Based on the distribution channel, the offline channel segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26,097.6 Million

- 2033 Projected Market Size: USD 43,338.1 Million

- CAGR (2025-2033): 5.9%

- Asia Pacific: Largest market in 2024

Increasing awareness and emphasis on personal grooming and style have significantly contributed to the growth of the hair coloring market. Consumers adopt hair color as a fashion statement and a means of self-expression, driving demand for innovative and diverse product offerings. Social media platforms have become powerful catalysts in shaping beauty trends. Influencers and digital campaigns are pivotal in promoting hair coloring products, enhancing brand visibility, and encouraging trials among younger demographics. The global rise in the aging population has expanded the demand for hair coloring solutions. Older consumers actively seek products that help maintain a youthful appearance, supporting sustained market growth.

Rapid urbanization and evolving lifestyles have increased disposable incomes and greater access to beauty and personal care products. Busy urban consumers prioritize convenient and effective hair coloring solutions that align with their fast-paced lives. The growing brand visibility and the expanding influence of hair coloring products across social media platforms are expected to accelerate market growth. Rising consumer awareness regarding hair color ingredients and their potential effects has also contributed to a stronger preference for informed product choices, thereby supporting market expansion.

For instance, consumer preferences are increasingly influenced by environmental concerns and the demand for healthier hair care solutions, leading to a rising focus on eco-friendly hair dyes. In September 2024, Rové Hair Salon in South Florida introduced sustainable hair dye offerings that prioritize both hair health and environmental responsibility. These advanced formulations are free from harsh chemicals, reducing the risk of hair damage and allergic reactions, while aligning with the growing market demand for clean and sustainable beauty products.

Consumer Surveys & Insights

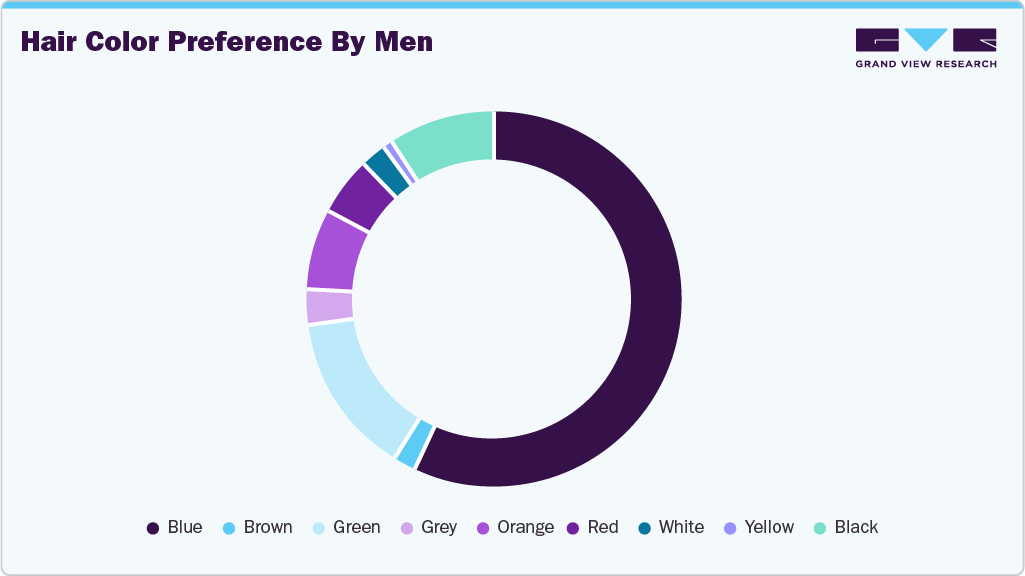

Consumer interest in hair color products is experiencing significant growth, driven by an expanding palette of available shades that empower individuals to express personal style preferences. According to data published by Enterprise Apps Today in 2023, 57% of male consumers favor blue hair color, followed by green (14%), red (7%), black (9%), and other shades such as orange (5%), grey (3%), brown (2%), white (2%), and yellow (1%).

These preferences highlight a shift toward bolder, unconventional color choices among male consumers, reflecting evolving beauty standards and increasing demand for self-expression through hair aesthetics.

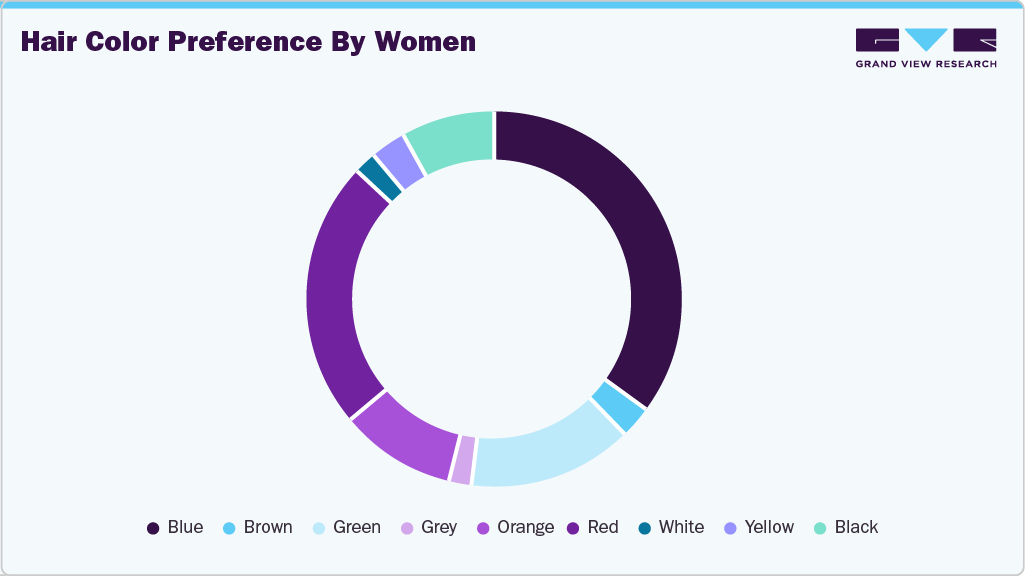

According to a survey conducted by Enterprise Apps Today in 2023, 35% of female consumers prefer blue hair color, followed by red (23%), green (14%), orange (10%), black (8%), brown (3%), yellow (3%), grey (2%), and white (2%). These figures indicate a clear trend among women toward vibrant and unconventional hair color choices.

The shift underscores a broader transformation in consumer behavior, where hair color is increasingly embraced as a form of personal expression and fashion. The growing preference for bold shades presents a strategic opportunity for brands to innovate and expand their product lines to cater to this evolving market demand.

Trump Tariff Impact

In June 2025, President Trump issued an executive order escalating tariffs on imported goods to 30 %. This tariff adjustment directly affects manufacturers reliant on foreign-sourced products, including products such as braiding hair, wigs, and hair care products from other countries. Small American brands such as Royal Creations, Brittany Deen & Co. beauty salon, and Tame Hair Studio, which import hair care products from China, Vietnam, and Cambodia, have cautioned that although immediate price increases have been avoided via absorbing costs, prolonged policy implementation may compel consumer retail pricing to rise or provoke a shift to domestic sourcing channels.

Many hair care products are sourced from China, including synthetic braiding hair, human hair extensions, wigs, weaves, styling tools, and packaging materials. The imposition of a 30% tariff on Chinese imports has led to notable price increases across these categories. For example, the cost of a braiding hair box has risen from $250 to $300, creating financial pressure for salon operators and their clientele.

Product Insights

The permanent hair color category accounted for a revenue share of 71.77% of the overall hair color market in 2024. The growing consumer preference for permanent hair color is a key driver behind its dominant market share. This trend is influenced by the increasing availability of natural-looking shades and formulations that offer long-lasting results. Permanent hair color is widely perceived to deliver a more authentic and polished appearance compared to semi-permanent or temporary alternatives, making it the preferred choice for consumers seeking consistent coverage, especially for gray hair.

The temporary hair color category is expected to grow at a CAGR of 6.3% from 2025 to 2033. The growing global trend of frequent hair color experimentation, driven by evolving fashion and self-expression, is a key factor contributing to the expansion of the temporary hair dye market. Temporary hair color allows consumers to trial bold or seasonal shades without a long-term commitment, as the color can be easily washed out if unsatisfactory.

Additionally, the convenience of direct application requiring no pre-mixing enhances user accessibility, particularly among younger, style-conscious demographics and DIY beauty enthusiasts. This ease of use, combined with the rising popularity of social media-driven beauty trends, is expected to fuel sustained growth in the temporary hair color segment over the coming years.

End User Insights

The hair color adoption by women accounted for a revenue share of 72.71% of the overall hair color market in 2024. The strong inclination among women toward hair coloring remains a key factor driving the segment’s dominant market share. Women spend more on hair care and beauty products than men, reinforcing their leading role in market demand.

The hair color adoption by men is expected to grow at a CAGR of 6.2% from 2025 to 2033. The increasing adoption of haircare products among men is a key driver fueling market growth. Additionally, the rising popularity of fashionable hairstyles featuring diverse hair colors within the male demographic is expected to accelerate market expansion further during the forecast period. High-profile celebrity endorsements have also played a significant role in normalizing and promoting hair color usage among men, presenting substantial growth opportunities for industry stakeholders.

Distribution Channel Insights

The sale of hair color through offline channels accounted for a revenue share of 70.04% of the hair color industry in 2024. A primary driver of substantial market share is the strong consumer preference for purchasing cosmetics and hair care products through offline retail channels. The widespread accessibility of these products in brick-and-mortar outlets such as department stores, specialty multi-brand retailers, salons, and spas has significantly contributed to revenue growth within the offline distribution segment.

The sale of hair color through online channels is expected to grow at a CAGR of 6.2% from 2025 to 2033. A key driver of market growth is the rapid expansion of the e-commerce sector in emerging economies. In markets such as China and India, online platforms are increasingly becoming the preferred channel for browsing and purchasing cosmetic products. Furthermore, strategic collaborations between leading e-commerce companies and hair care product manufacturers in these regions are expected to unlock significant growth opportunities.

Regional Insights

The Asia Pacific hair color market held the largest revenue share of 34.97% in 2024. Rising consumer expenditures on hair care products and the growing popularity of premium hair color brands endorsed by celebrities within the region are factors driving market growth. Additionally, increasing per capita income in emerging markets such as China and India will bolster expansion throughout the forecast period. The robust development of the personal care industry in these countries further creates substantial opportunities for sustained growth in the hair color segment.

The hair color market in China is expected to grow at a significant CAGR from 2025 to 2033. Market drivers include rising disposable incomes, urbanization, and a growing youthful population keen on experimenting with hair color trends. Additionally, the influence of social media and celebrity endorsements is accelerating the adoption of diverse and vibrant hair color options.

Consumers in the region are increasingly favoring premium, natural-ingredient hair color products, aligning with the global clean beauty movement. Moreover, the convenience of e-commerce platforms and retail infrastructure expansion facilitates easier access to various hair color offerings.

North America Hair Color Market Trends

The North America hair color market is experiencing growth driven by evolving consumer preferences and increasing demand for personalized beauty solutions. Rising awareness around self-expression and style experimentation encourages consumers to explore a wider range of hair color products, including permanent, semi-permanent, and temporary options. Technological advancements in product formulations, such as ammonia-free, organic, and vegan hair dyes, are meeting consumer demand for safer and environmentally friendly options. Robust retail and e-commerce channels across the U.S. and Canada provide widespread accessibility, enhancing consumer reach.

Europe Hair Color Market Trends

The Europe hair color market is expected to grow at the fastest CAGR of 6.0% during the forecast period. Well-established markets in developed countries such as Germany, the UK, and France are making significant contributions to regional market revenue. The growth is primarily driven by strong sales of hair color products from leading brands including Coty Inc., L'Oréal S.A., Estée Lauder Companies Inc., and Revlon, Inc., complemented by innovative product launches from key players like Procter & Gamble, Combe Inc., and Henkel AG & Co. KGaA. Furthermore, the robust presence of established offline retail networks for hair cosmetics across Europe is a critical factor supporting sustained market expansion in the region.

Key Companies & Market Share Insights

The hair color industry is always changing and updating. To stay head-on in the market, players tend to launch new strategies more frequently. Market players are focusing on increasing investments in advertisements through social sites to increase awareness regarding hair color in the market. Moreover, major players such as Coty Inc., L'Oréal S.A.,Estée Lauder Companies Inc., Revlon, Inc., Avon Products Inc., Unilever PLC, Combe Inc., etc. are targeting new regions and demography to increase the consumer base and expand their number of offerings by either entering the new market solely or by collaborating with local companies across the globe.

-

Coty Inc., founded in 1904 by François Coty, is a multinational beauty company headquartered in New York City. As of 2024, Coty operates three primary divisions: Consumer Beauty, Luxury, and Professional Beauty, offering a diverse range of products including fragrances, cosmetics, skincare, and hair care. The company owns approximately 40 brands, with notable names such as CoverGirl, Rimmel, Max Factor, Sally Hansen, and Wella. Coty's hair color offerings are primarily under the Wella and Clairol brands. Wella, a German company founded in 1880, specializes in professional hair care, styling, and colorants. Clairol, a U.S.-based brand established in 1931, is renowned for its at-home hair color products.

-

L'Oréal S.A., established in 1909 and headquartered in Clichy, France, stands as the world's largest cosmetics and beauty company. With a diverse portfolio encompassing skincare, haircare, makeup, and fragrances, L'Oréal operates across various segments, including Consumer Products, Professional Products, and Luxe. The company owns 36 brands, such as Maybelline, Garnier, NYX Professional Makeup, Redken, and CeraVe. L'Oréal offers a comprehensive range of hair color products catering to both professional salons and at-home users

Key Hair Color Companies:

The following are the leading companies in the hair color market. These companies collectively hold the largest market share and dictate industry trends.

- Coty Inc.

- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Revlon, Inc.

- Avon Products Inc.

- Unilever PLC

- Shiseido Company, Limited

- Godrej

- Procter & Gamble

- Combe Inc.

- Henkel AG & Co. KGaA

- Kao Corp

- Hoyu Co., Ltd.

- Cadiveu

Recent Developments

-

In September 2024, Streax Professional Launches Huemagic - The Next Generation of No-ammonia Hair Colour, helping Streax Professionals to push the boundaries of hair color technology and deliver cutting edge products for hair stylists and consumers.

-

In July 2024, L'Oréal Paris announces the exclusive launch of its new hair color device, Colorsonic, at Target.com and Target stores nationwide. Developed and incubated by L'Oreal, Colorsonic is the first home hair color device with patents. Designed for all hair types, lengths, and textures, it makes hair coloring easier by automatically mixing dye and developer in a perfect 1:1 ratio with the press of a button.

Hair Color Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 27,397.3 million

Revenue forecast in 2033

USD 43,338.1 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

Coty Inc.; L'Oréal S.A.; Estée Lauder Companies Inc.; Revlon, Inc.; Avon Products Inc.; Unilever PLC; Combe Inc.; Shiseido Company, Limited; Godrej; Procter & Gamble; Henkel AG & Co. KGaA; Kao Corp; Hoyu Co., Ltd.; Cadiveu

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hair Color Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hair color market based on product, end user, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Permanent

-

Temporary

-

Others

-

-

End user Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global hair color market size was estimated at USD 26,097.6 million in 2024 and is expected to reach USD 27,397.3 million in 2025.

b. The global hair color market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 43,338.1 million by 2033.

b. The Asia Pacific dominated the hair color market with a share of 35.0% in 2024. This is attributable to growing consumer spending on hair care products and the increasing trend of premium hair color products among celebrities in the region.

b. Some key players operating in the hair color market include Coty Inc.; L'Oréal S.A.; Estée Lauder Companies Inc.; Revlon, Inc.; Avon Products Inc.; and Unilever PLC.

b. Key factors that are driving the hair color market growth include substantial growth in the popularity of hair coloring coupled with the rise in the aging population across the globe and rising fashion trends and significant product innovation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.