- Home

- »

- Beauty & Personal Care

- »

-

Hairstyling Products Market Size, Share, Growth Report 2030GVR Report cover

![Hairstyling Products Market Size, Share & Trends Report]()

Hairstyling Products Market Size, Share & Trends Analysis Report By Product (Pomade, Hair Spray), By End-use (Men, Women), By Distribution Channel (Hypermarkets & Supermarkets, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-157-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Hairstyling Products Market Size & Trends

The global hairstyling products market size was valued at USD 27.30 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Factors pushing the use of hairstyling products include social trends, personal grooming preferences, and the will to achieve desired hair aesthetics. According to a 2022 survey conducted by Advanced Dermatology involving more than 1,000 American participants, individuals allocate an annual expenditure of $722 toward their personal grooming expenses, with hair-related products emerging as the primary category in this spending, despite the inclusion of other items such as skincare, makeup, and gym memberships.

The era of accepting natural curls marks a significant transformation in people's perspectives toward embracing their inherent curly hair. While the acceptance of natural hair has been steadily growing in recent years, it has seen a substantial acceleration during the recent periods of lockdown restrictions, giving rise to the use of hairstyling products for curly hair. According to a YouGov survey, more than one in five American women with curly or wavy hair (21%) use a range of hair serums. Dry shampoo (14%), hair crème (10%), mousse (17%), hair spray (16%), and hair gel (15%) are the top hair styling products used by curly and/or wavy-haired women in the U.S.

The growth of e-commerce is driving an increased purchase of hairstyling products due to convenience, wider product selection, and access to reviews and recommendations. The “India Retail and E-commerce Trends” report by Unicommerce revealed the beauty and personal care segment showing maximum growth across all digital shopping platforms with respective growth rates of 143% in order volumes in 2022, as compared to the previous financial year. The pandemic pivoted cosmetics brand L'Oreal Groupe’s digital sales channel during 2020, accounting for the highest growth of consolidated sales in e-commerce. As of 2020, more than a quarter of its sales were generated through e-commerce. This share was only at 15.6% in 2019. The company's online share of sales kept growing, reaching 28.9% in 2021.

The demand for sustainability and natural ingredients has influenced the hairstyling products industry by driving a shift toward eco-friendly and organic formulations. In April 2022, the U.S.-based brand Bulldog introduced three hairstyling products - cream, salt spray, and pomade, which have obtained vegan certification and are packaged using post-consumer recycled or plant-based plastic packaging. These products were simultaneously launched through multiple distribution channels, including Boots stores in UK, and exclusive availability through Monoprix in France, and Scandinavia.

The premiumization trend in the beauty industry has manifested through the introduction of high-end products, luxury branding, advanced formulations, and upscale packaging, catering to consumers seeking elevated quality and experiences. This trend has prompted stores to offer premium hair-related products to meet the demands of discerning consumers seeking top-tier quality and experiences in their haircare routines. For example, thepharmacy chain Boots, which is owned by Walgreens, added 400 hair care and styling items from ten professional and salon brands, such as L'Oréal Professionnel, Redken, Ouai, and Briogeo, to its website in October 2023.

Investments in R&D are pivotal in the hairstyling products industry, fueling innovation, advanced formulation development, and improved product performance, thereby influencing market competitiveness and growth. For instance , L'Oréal Groupe allocated USD 1.18 billion to R&D, out of its USD 33.9 billion revenue in 2020-21. In September 2021, it filed a patent on a sugar-based natural curly hair styling formulation composed of sugar compounds and plant fiber, offering a lightweight, natural alternative to conventional film-forming polymer and silicone hairstyling products.

Product Insights

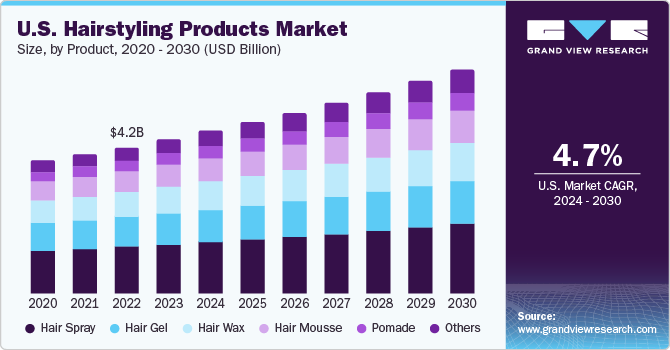

Hair sprays accounted for a maximum share of 31.8% of the market in 2023. Robust product innovation, by new entrants, related to hair styling range is providing the necessary boost for such products. In September 2021, actress Jennifer Aniston launched her hair care brand LolaVie. The brand debuted with a multitasking, lightweight hair spray that is designed to detangle and smoothen hair. It is formulated with lemon extract, vegetable ceramides, and chia seeds that protect from damage.

Pomade is anticipated to register a CAGR of 7.3%. Hair pomades are preferred by many because they provide a stronghold and a shiny finish, allowing for versatile and long-lasting hairstyling, making them especially popular for classic and slicked-back hairstyles. Zenn Hair Care, a Philadelphia, Pennsylvania-based company that saw a fourfold increase in revenue in 2022, provides a line of organic products designed specifically for Black people with naturally occurring hair. In 2020, the firm debuted its first product, a hair growth pomade composed of only natural and pure components.

End-use Insights

Female consumers dominated the market with a share of 57.22% in 2023. As more women enter the workforce and face longer hours and imbalanced work-life demands, the use of hairstyling products becomes a convenient way to maintain a polished and professional appearance amidst their busy schedules. Unilever collaborates with Black Women through its Polycultural Center of Excellence salon to comprehend their hair care and styling preferences and develop products tailored to textured hair, targeting a share of the USD 1.8 billion Black hair care market, where women often use twice as many products for their hair needs.

Demand of hairstyling products for men is set to expand at a CAGR of about 6.3%. The growing awareness of personal well-being and beauty among male consumers is the main driver of the market. The most notable growth areas in men's grooming sector, according to Dr. Caroline Brooks, creator of The Glass House, an inclusive salon and spa located in Dubai, are hairstyling, customized grooming sets, and beard care. Furthermore, men's interest in personal care goods, such as hairstyling, has significantly expanded due to social media's growing prevalence.

Distribution Channel Insights

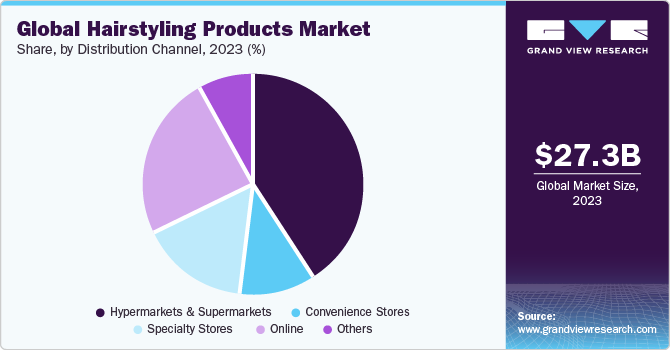

Hypermarkets and supermarkets dominated the industry with a share of 41.10% in 2023. This is due to their wide product variety, accessibility, and ability to cater to diverse consumer preferences in one convenient location. In January 2023, customizable products brand Function of Beauty launched its new hair styling products exclusively at Target. The line includes a texturizing spray, mousse, curl cream, and styling gel. These channels will continue to dominate due to their established brand relationships and the trust consumers have in finding reputable hairstyling products, further solidifying their market presence.

The online/e-commerce channel is expected to witness a strong CAGR of 6.4% during the forecast period. Online platforms have enabled manufacturers to gain potential customers, improve their communication, track finances, and boost brand awareness in a cost-effective manner. According to a report conducted by German performance marketing solutions provider Admitad, the amount of beauty product sales made online worldwide increased by 11% in 2022 and has already surpassed 15% in the first half of 2023. Online sales of hairstyling products are set to grow as consumers seek convenience, a wide selection, and the ability to compare prices and reviews from the comfort of their homes.

Regional Insights

Asia Pacific dominated the industry with a share of 31% in 2023 due to its large and diverse consumer base, rapid urbanization, and increasing disposable income. In order to increase their market share and maintain their competitiveness, companies have been increasing their presence in this region. German Henkel Consumer Brands stated in June 2023 that it planned to introduce its international hairstyling brand Taft in India in order to increase the size of its hairstyling product line in that nation. The business announced the release of eighteen products in four different formats-wax, gel, mousse, and hairspray-as part of a unisex line emphasizing male customers.

Middle East and Africa is set to grow at a CAGR of about 6.2%. The demand is poised to grow due to a rising trend in personal grooming and beauty consciousness, coupled with a growing population and an expanding middle-class demographic. Retailer of omnichannel beauty and lifestyle products Nykaa stated that it has inked a deal with the Middle East's Apparel Group to establish an omnichannel beauty retail platform in nations including Bahrain, Oman, Kuwait, Qatar, and others, in an effort to increase its footprint in the GCC (Gulf Cooperation Council).

Key Companies & Market Share Insights

The industry is characterized by the presence of several established players and new entrants. Players in the market are diversifying and expanding their operations, adopting new product launches, and other strategies such as merger & acquisition, partnerships, expansion, etc. in order to maintain market share.

Key Hairstyling Products Companies:

- Procter & Gamble

- L'Oréal Groupe

- Revlon, Inc.

- Kao Corporation

- Unilever

- Shiseido Company, Limited

- Henkel AG & Co. KGaA

- Mandom Corporation

- Amorepacific

- Flora and Curl

Recent Developments

-

In September 2022, the Professional Products Division of L'Oréal Canada introduced a no-cost online Diversity and Inclusion training initiative accessible to hairstylists across Canada. This program, named "Power of the Collective," aims to enlighten hairstylists about the diversity of hair types, promoting an inclusive and trustworthy salon environment for both stylists and clients. The first-year curriculum comprises six modules with a focus on haircutting, led by international professionals specializing in specific hair types. Subsequent years will concentrate on styling in the second year and hair coloring in the third year.

-

In December 2021, Procter & Gamble has entered into an acquisition agreement for celebrity hairstylist Jen Atkin's haircare and styling brand, Ouai, as part of its strategic foray into the prestige haircare sector, a thriving segment in the beauty industry. Notably, Ouai will maintain its independent operation, remaining distinct from the broader P&G business.

Hairstyling Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.10 billion

Revenue forecast in 2030

USD 43.05 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; Brazil; UAE, South Africa

Key companies profiled

Procter & Gamble; L'Oréal Groupe; Revlon, Inc.; Kao Corporation; Unilever; Shiseido Company, Limited; Henkel AG & Co. KGaA; Mandom Corporation; Amorepacific; Flora and Curl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hairstyling Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hairstyling products market report based on product, end-use, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hair Gel

-

Hair Wax

-

Hair Mousse

-

Hair Spray

-

Pomade

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets and Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hairstyling products market was estimated at USD 27.30 billion in 2023 and is expected to reach USD 29.10 billion in 2024.

b. The global hairstyling products market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 43.05 billion by 2030.

b. Asia Pacific dominated the hairstyling products market with a share of about 31% in 2023. The growth of the regional market is mainly due to factors like urbanization, a rising middle-class demographic, and evolving beauty standards, as consumers increasingly seek to embrace a diverse range of hairstyles and grooming practices, fueling the growth of the hairstyling products market.

b. Some of the key players operating in the hairstyling products market include Procter & Gamble; L'Oréal Groupe; Revlon, Inc.; Kao Corporation; Unilever; Shiseido Company, Limited; Henkel AG & Co. KGaA; Mandom Corporation; Amorepacific; Flora and Curl.

b. Key factors that are driving the hairstyling products market growth include evolving fashion trends, a growing emphasis on personal grooming, the influence of social media, and an increasing awareness of eco-friendly and sustainable product options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."