- Home

- »

- Medical Devices

- »

-

Hand-held Surgical Instruments Market Size Report, 2030GVR Report cover

![Hand-held Surgical Instruments Market Size, Share & Trends Report]()

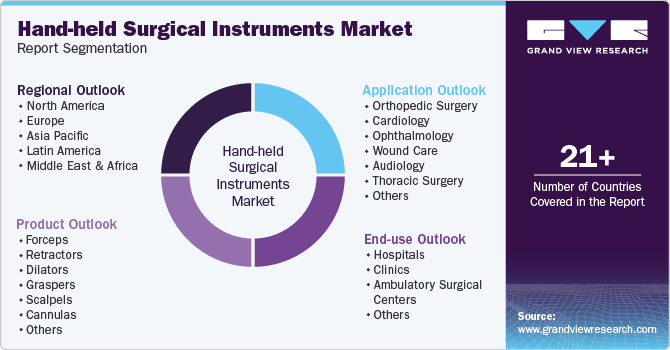

Hand-held Surgical Instruments Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Forceps, Retractors, Dilators), By Application (Orthopedic Surgery, Cardiology, Ophthalmology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-690-5

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

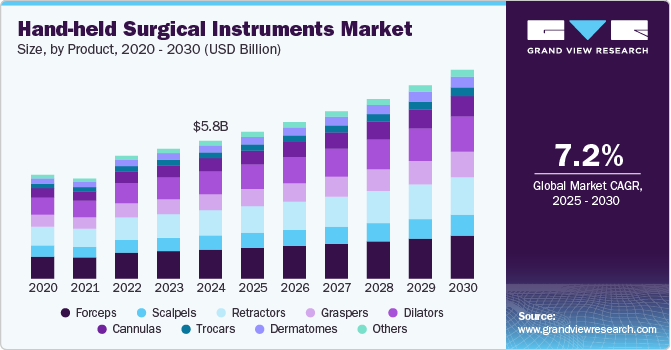

The global hand-held surgical instruments market size was estimated at USD 5.8 billion in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The market is growing, driven by rising surgical procedures globally due to aging populations, chronic diseases, and advancements in healthcare infrastructure. Instruments such as forceps, scalpels, and retractors are essential across general, orthopedic, and minimally invasive surgeries. Innovations in ergonomic designs and durable materials enhance precision and reduce surgeon fatigue. Emerging markets, such as Asia-Pacific and Latin America, contribute to growth through increased healthcare investments.

The growing number of surgical procedures, particularly aesthetic surgeries, is a key driver for the hand-held surgical instruments market. Popular procedures like breast surgery, eyelid surgery, liposuction, nose reshaping, and tummy tucks have seen increased demand in recent years, boosting the need for hand-held surgical instruments. Additionally, the global rise in heart diseases, driven by factors such as physical inactivity, obesity, smoking, poor nutrition, and family history, is contributing to market growth. The CDC reports that in 2020, approximately 20.1 million adults aged 20 and older had coronary artery disease. The aging population, especially those over 60, is more prone to cardiovascular, orthopedic, and neurological disorders, further driving demand for surgical tools. Moreover, the rising number of road accidents is another significant factor fueling the market for hand-held surgical instruments.

Innovations in surgical instruments and the increasing adoption of advanced devices by surgeons are expected to drive the hand-held surgical instruments market in the coming years. In 2021, bioengineering students at the University of Illinois introduced a new design for obstetric forceps, featuring silicone Shape Deposition Manufacturing (SDM) fingers to enhance safety and ease during delivery. Surgeons continue to prioritize high-quality instruments that enable efficient and precise surgeries without compromising patient health. An example of such innovation is the advanced powered screwdriver, designed for delicate surgeries, incorporating sensors and software to provide real-time intelligence to the surgeon.

The market also sees growing investments in research and development (R&D) to develop instruments tailored to specific surgical needs. For instance, hand-held instruments for robotic-assisted surgeries are becoming more prevalent, reflecting the trend toward automation and precision in medical procedures. Additionally, government initiatives to improve healthcare infrastructure in emerging economies are expected to create lucrative opportunities for market players.

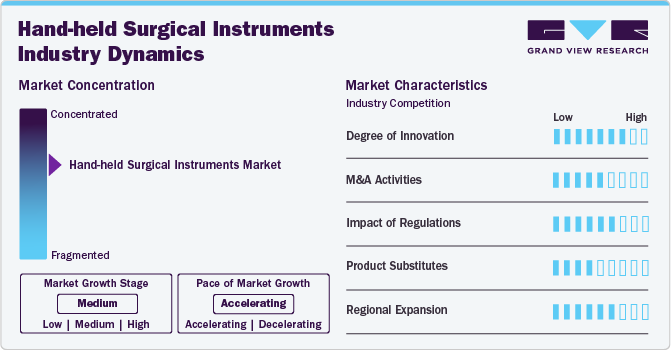

Market Concentration & Characteristics

The hand-held surgical instruments industry is moderately concentrated, with a few key players dominating the market, including Medtronic, Stryker, and Johnson & Johnson. These companies lead through extensive product portfolios, global distribution networks, and robust research and development (R&D) efforts. The industry is characterized by a focus on innovation, such as ergonomic designs, durability, and precision. It is highly regulated, with stringent quality standards ensuring safety and performance. While large manufacturers hold significant market shares, smaller players also contribute by offering specialized instruments and targeting niche markets. The industry is influenced by growing healthcare demands and technological advancements.

The hand-held surgical instruments industry is highly innovative, with manufacturers continuously introducing advanced technologies to enhance precision, safety, and efficiency. Innovations such as ergonomic designs, lightweight materials, and advanced coatings improve instrument handling and reduce surgeon fatigue. The development of specialized tools, like Wexler Surgical’s VATS Viper Forceps introduced in July 2024, highlights the trend towards creating instruments tailored for specific procedures, such as Video-Assisted Thoracoscopic Surgery (VATS). These forceps offer improved maneuverability, control, and precision, optimizing outcomes for minimally invasive surgeries. Technological advancements, including integrated sensors and powered tools, are also shaping the future of surgical instruments.

Regulations play a critical role in the hand-held surgical instruments industry, ensuring safety, effectiveness, and quality. Regulatory bodies such as the U.S. FDA and the European Medicines Agency (EMA) impose strict guidelines on the manufacturing, testing, and approval processes for surgical tools. These regulations include biocompatibility, sterilization standards, and performance benchmarks. Compliance with these standards is crucial for market entry and maintaining product safety. Additionally, ongoing regulatory changes, such as updates to sterilization protocols or material requirements, influence product development. Strict adherence to regulations ensures that only safe, effective, and high-quality instruments reach healthcare providers and patients.

Mergers and acquisitions (M&A) in the hand-held surgical instruments industry have been growing as companies seek to expand their technological capabilities, product portfolios, and market presence. In November 2024, StarFish Medical, a prominent North American medical device development company, has announced its acquisition of Omnica Corporation, a renowned medical device design and engineering firm based in Southern California. The acquisition includes Omnica's 25,000-square-foot facility in Irvine, CA, where the company develops various medical products such as disposables, diagnostic tools, hand-held instruments, monitoring equipment, point-of-care devices, and surgical instruments. Such strategic moves enable companies to improve operational efficiency and accelerate innovation, further driving competition and growth within the industry.

In the hand-held surgical instruments industry, product substitutes include robotic surgical systems, which offer greater precision, control, and minimally invasive options for procedures. These systems, such as the da Vinci Surgical System, reduce the reliance on traditional hand-held tools by offering enhanced automation and real-time imaging capabilities. Additionally, 3D-printed surgical instruments are emerging as potential substitutes, providing customized solutions that may reduce costs and improve functionality. Despite these advancements, traditional hand-held instruments remain essential for many procedures, especially in settings where high precision and manual control are crucial, keeping them highly relevant in the surgical field.

The hand-held surgical instruments industry is witnessing significant regional expansion, driven by rising healthcare demands and technological advancements. In North America and Europe, established healthcare infrastructures and the adoption of minimally invasive surgeries are key growth factors. Emerging markets in Asia-Pacific, particularly China and India, are expanding rapidly due to increasing healthcare investments and a growing patient population. Additionally, the demand for advanced surgical tools is rising in Latin America and the Middle East, where healthcare modernization is underway.

Product Insights

The forceps segment held the largest market share of 21.0% in 2024, owing to its increasing usage. Forceps are essential for grasping, holding, or manipulating tissues during surgeries, offering precision and control. The rise in usage is attributable to its advantages, such as it helps in eliminating the need for holding minute objects with hands and avoid contamination. Their versatility makes them crucial in procedures across specialties like obstetrics, cardiology, orthopedics, and neurosurgery. The growing number of surgeries, especially minimally invasive ones, further boosts the demand for forceps.

However, the graspers segment is expected to experience maximum growth with a CAGR of 9.4% over the forecast period. Graspers are essential for holding, manipulating, or removing tissue during delicate procedures, offering enhanced precision and control. The need for specialized graspers grows as the demand for MIS rises, driven by benefits like shorter recovery times and reduced complications. Technological advancements, such as robotic-assisted surgeries and ergonomic designs, are further contributing to the segment's growth.

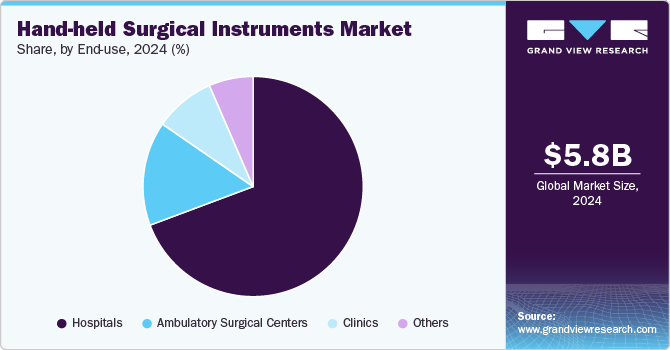

End-use Insights

The hospitals segment held for the largest revenue share of 69.4% in 2024, owing large number of cases and preventive surgeries being performed in these settings. In addition, the availability of all the types of surgical instruments and skilled professionals is expected to fuel the segment growth. The rising number of admissions due to increasing number of chronic disorders is also expected to propel the segment growth over the forecast period. With increase in the number of procedures, such as angioplasty and kidney & liver transplants, and incidence of trauma, the demand for surgical equipment has significantly increased in hospitals.

The clinics and ambulatory surgical centers segment is expected to experience rapid growth due to the increasing popularity of aesthetic and cosmetic surgeries in these centers. Ambulatory surgical centers offer advantages such as reduced costs and shorter patient stays, making them ideal for individuals who do not require extended hospital care. Additionally, the rising number of dental and orthopedic specialty clinics worldwide, along with the growing prevalence of melanoma and skin cancer, has driven more patients to dermatology clinics. Orthopedic clinics, providing specialized care for conditions like fractures, sprains, and arthritis, are also becoming more popular over general hospitals.

Application Insights

The orthopedic surgery segment held the largest market share of 20.9% in 2024 due to factors such as high incidence of Musculoskeletal (MSK) ailments and increasing developments in minimally invasive surgeries. According to a research article by WHO published in July 2022, approximately 1.71 billion people have MSK conditions globally. It is the leading cause of disability worldwide, which hampers an individual’s productivity.

The neurosurgery segment is expected to be the fastest-growing segment in the hand-held surgical instruments market, driven by the increasing prevalence of neurological disorders and advancements in surgical techniques. As conditions like brain tumors, spinal cord injuries, and neurodegenerative diseases rise globally, the demand for precise and effective surgical instruments for neurosurgery is escalating. The adoption of minimally invasive surgeries, which require specialized instruments, is also contributing to growth.

Regional Insights

North American hand-held surgical instruments market held a dominant position, capturing 40.6% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40-50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. Additionally, 702,880 heart disease deaths in 2022 highlight growing demand for minimally invasive techniques, boosting market growth.

U.S. Hand-held Surgical Instruments Market Trends

The U.S. hand-held surgical instruments market held a significant share of North America's hand-held surgical instruments market in 2024, supported by a well-developed healthcare system and advanced treatment facilities. Growth is driven by rising minimally invasive surgeries across aesthetics, dentistry, orthopedics, and more. Cosmetic surgeries grew 5% in 2023, totaling 1,575,244 procedures, fueled by self-awareness of aging and weight loss trends.

Europe Hand-held Surgical Instruments Market Trends

The European hand-held surgical instruments market, the second largest globally in 2023, is growing due to rising chronic diseases like diabetes, affecting 61 million people in Europe, projected to reach 67 million by 2030. Increased adoption of robotic-assisted surgeries and expanding outpatient clinics further drive demand for advanced handheld tools.

The UK hand-held surgical instruments market is steadily expanding, driven by factors such as high per capita income, a well-established healthcare system, a large pool of healthcare professionals, easy access to medical services, advanced device availability, and supportive reimbursement policies. These elements collectively fuel the market's growth in the region.

The France hand-held surgical instruments market is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

Germany hand-held surgical instruments market is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools.

Asia Pacific Hand-held Surgical Instruments Market Trends

The Asia Pacific hand-held surgical instruments market is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as robotic systems, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

The hand-held surgical instruments market in Japan is growing, primarily driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. Growth is further fueled by the introduction of advanced surgical tools and frequent product launches. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

The hand-held surgical instruments market in China is anticipated to grow quickly, driven by the rising prevalence of orthopedic conditions among the population. A study published by BioMed Central Ltd. in July 2023 revealed that osteoporotic fractures are prevalent in the Chinese elderly population. In addition, the study reported that the prevalence has increased significantly from 2000 - 2010 to 2012 - 2022.

The hand-held surgical instruments market in India is anticipated to grow significantly due to the increasing launch of surgical instruments. The companies operating in the country are launching advanced surgical instruments that can be used in surgeries. For instance, in August 2023, a medical technology provider, Healthium Medtech, launched India's first exclusive range of sutures, TRUMAS, to manage challenges faced during suturing in minimally invasive surgeries. Such product launches by domestic & international industry participants in India are anticipated to drive the country's market growth over the forecast period.

Latin America Hand-held Surgical Instruments Market Trends

The Latin American hand-held surgical instruments market is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050. In addition, the large number of road & traffic accidents across the region is anticipated to boost the demand for hand-held surgical instruments in Latin America.

Middle East & Africa Hand-held Surgical Instruments Market Trends

The Middle East & Africa hand-held surgical instruments market is growing due to the rising focus of industry players, robust medical infrastructure, and increasing prevalence of chronic diseases. Government initiatives to enhance healthcare manufacturing capabilities further support market expansion. The region’s emphasis on advancing its healthcare sector and demand for advanced surgical tools attract global companies. For instance, Johnson & Johnson MedTech began direct operations in Saudi Arabia in February 2024, aiming to improve healthcare with cutting-edge medical and surgical equipment. This aligns with Saudi Arabia’s Vision 2030, which prioritizes better clinical outcomes and local workforce development.

The hand-held surgical instruments market in Saudi Arabia is anticipated to grow significantly due to the increasing geriatric population and the large number of surgical procedures being performed in the country. The geriatric population is expected to boost the demand for surgical instruments as they predominantly suffer from various health conditions. According to an article published by the Arab News in October 2023, the aging population in Saudi Arabia is predicted to increase from 1.11 million in 2022 to 3.58 million by 2035. Thus, the rising geriatric population is anticipated to increase the demand for hand-held surgical instruments in the coming years.

Key Hand-held Surgical Instruments Company Insights

The competitive scenario in the hand-held surgical instruments market is highly competitive, with key players such as Zimmer Biomet, Medtronic and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Hand-held Surgical Instruments Companies:

The following are the leading companies in the hand-held surgical instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet

- B. Braun Melsungen AG

- Integra LifeSciences Corporation

- Medtronic, plc.

- Smith & Nephew

- Zimmer Biomet Holdings

- Johnson & Johnson Services, Inc.

- Becton, Dickinson and Company

- CooperSurgical, Inc.

- Thompson Surgical Instruments Inc.

- Aspen Surgical

Recent Developments

-

In August 2024, CooperSurgical, Inc acquired OBP Surgical, enhancing its portfolio of medical devices. This acquisition strengthens the company's position in women's health and expands its offerings, aiming to provide innovative solutions and improve surgical outcomes.

-

In June 2024, Zimmer Biomet announced an exclusive distribution agreement with THINK Surgical for the wireless, handheld TMINI Miniature Robotic System, designed for total knee arthroplasty. The partnership integrates Zimmer Biomet's technology into a customized TMINI robotic solution.

-

In July 2023, B. Braun Melsungen AG and Chengdu-based Borns Medical formed a strategic partnership to promote standardized robotic surgery applications. This collaboration leverages B. Braun's medical expertise and Borns' robotic technology to advance minimally invasive surgeries by integrating consumables and enhancing surgical precision.

Hand-held Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.2 billion

Revenue forecast in 2030

USD 8.8 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

B. Braun Melsungen AG; Integra LifeSciences Corporation; Medtronic; Smith & Nephew; Zimmer Biomet Holdings; Johnson & Johnson Services, Inc.; Becton, Dickinson and Company; CooperSurgical, Inc.; Thompson Surgical Instruments Inc.; Aspen Surgical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hand-held Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hand-held surgical instruments market report based on product, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Forceps

-

Retractors

-

Dilators

-

Graspers

-

Scalpels

-

Cannulas

-

Dermatomes

-

Trocars

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

Cardiology

-

Ophthalmology

-

Wound Care

-

Audiology

-

Thoracic Surgery

-

Urology and Gynecology Surgery

-

Plastic Surgery

-

Neurosurgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hand-held surgical instruments market size was estimated at USD 5.8 billion in 2024 and is expected to reach USD 6.2 billion in 2025.

b. The global hand-held surgical instruments market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 8.8 billion by 2030.

b. North America dominated the hand-held surgical instruments market with a share of 40.6% in 2024. This is attributable to the increasing incidence of chronic diseases such as cardiovascular diseases, neurological diseases, cancer, diabetes, and autoimmune diseases.

b. Some key players operating in the hand-held surgical instruments market include Zimmer Biomet Holdings; B. Braun Melsungen AG; Becton, Dickinson and Company; Integra LifeSciences Corporation; Smith & Nephew; Medtronic; CooperSurgical Inc.; Johnson & Johnson; Thompson Surgical Instruments Inc.; and Aspen Surgical.

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases, rise in the number of road and other accidents, and rise in the number of surgical procedures across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.