- Home

- »

- Alcohol & Tobacco

- »

-

Global Hard Tea Market Size, Share & Trends Report, 2030GVR Report cover

![Hard Tea Market Size, Share & Trends Report]()

Hard Tea Market (2022 - 2030) Size, Share & Trends Analysis Report By ABV (%) (2%-5%, More Than 5.1%), By Flavor (Lemon, Raspberry, Peach, Orange), By Distribution Channel (Supermarket/Hypermarket, Online), By Regions, And Segment Forecasts

- Report ID: GVR-4-68039-943-0

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hard Tea Market Summary

The global hard tea market size was estimated at USD 1.99 billion in 2021 and is projected to reach USD 14.50 billion by 2030, growing at a CAGR of 24.7% from 2022 to 2030. Rising demand for better-for-you beverages coupled with growing awareness towards low content alcoholic beverages among the younger populace is driving the demand for hard teas.

Key Market Trends & Insights

- In 2021, North America held the majority of the regional market share.

- Europe is anticipated to grow at a CAGR of 27.2% over the forecast period in terms of revenue.

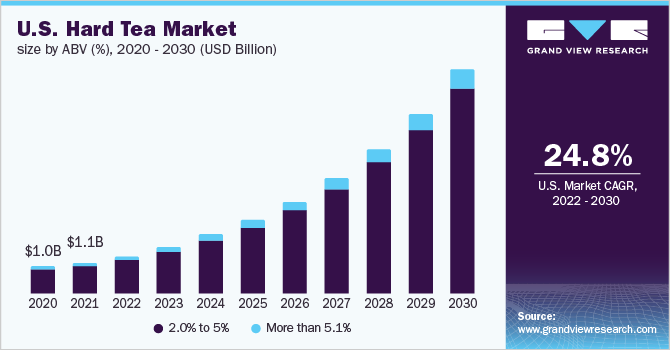

- Based on ABV (%), the 2%-5% ABV segment held the majority of the share owing to the demand for low-content alcoholic beverages.

- Based on flavor, the wide availability of flavors in hard teas segment in both online and offline marketplaces is fueling the demand.

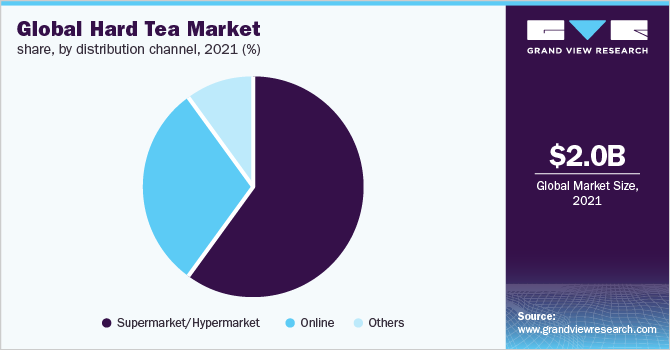

- Based on distribution channel, the supermarket/hypermarket channel segment accounted for the largest share of 60.0% in 2021

Market Size & Forecast

- 2021 Market Size: USD 1.99 Billion

- 2030 Projected Market Size: USD 14.50 Billion

- CAGR (2022-2030): 24.7%

- North America: Largest market in 2021

The COVID-19 pandemic has altered the consumption pattern of alcoholic beverage consumers. Countries such as New Zealand, the U.S., and Australia are adopting the use of low alcoholic beverages owing to a rise in health concerns. In addition, the pandemic has also increased the demand for online delivery applications such as Instacart and Drizly. Several players in the market have partnered with these platforms to drive the sales of the product.

The pandemic has spiked the awareness of the stay-at-home trend. The trend has proliferated the demand for cocktails and other DIY kits. For instance, Drizly, an online delivery platform for alcohol, has reported that the sales for hard alternatives skewed during the pandemic. The platform also reported that close to 73% of the hard alternative consumers are under the age of 42 years. Additionally, the buzz for tea beverages such as hard kombucha, cold brew tea, and other hard beverages is also driving the demand for healthy beverages.

ABV (%) Insights

Based on ABV (%), the hard tea market is segmented into 2%-5% and more than the 5.1% ABV. The 2%-5% ABV segment held the majority of the share owing to the demand for low-content alcoholic beverages. A growing number of the health-conscious populace is driving the demand for beverages to fall under 5% ABV. Millennials hold the largest consumption of low alcoholic beverages owing to awareness of a holistic view of drinking. Consumers in the market are conscious of clean labels, carbohydrates, and sugar content in alcoholic beverages. Easy availability of hard teas in Costco, Walmart, and Tesco are also driving the sales of hard teas which have 4%-5% ABV.

In the U.K., alcohol consumption is on a long-term decline owing rise in the number of people participating in Dry January. The younger populace in the range of 16-24 years has started to adopt the trend of less drinking. Additionally, as per the UK Office for National Statistics, the proportion of adults drinking alcohol hit its lower record at 57% in 2018 as compared to 64% in the year 2005.

The U.S. craft brewer industry has grown to 8,000 breweries in more than four decades. Several breweries are offering drinks with lower calories such as hard lemonade, ales, IPA, and Belgian-style quads. Heineken and Brooklyn Brewery are also offering low alcoholic varieties during Sober October and Dry January.

Flavor Insights

The wide availability of flavors in hard teas in both online and offline marketplaces is fueling the demand for the hard tea market. The rising importance of immunity-rich food and drinks is driving the demand for lemon-flavored hard teas. Holistic health is at the forefront of consumers’ minds owing to the pandemic. Citrus flavors are perceived positively by consumers as they are the best fit for better-for-you alcoholic beverages. For instance, as per Archer Daniels Midland (ADM) Company, the pandemic has caused close to 31% of consumers to purchase items that are good for nutrition and health.

In addition, citrus-flavored compliment alcoholic beverages as they help in creating a refreshing beverage that is favored by a large consumer base. The growing demand for margarita, mojito, and ready-to-drink cocktails is also driving the demand for lemon-flavored drinks. Additionally, companies are experimenting with other teas such as white, green, and oolong with lemonade.

On the other hand, peach-flavored hard teas are anticipated to garner the fastest growth rate of a CAGR of 27.4% in the forecast period. Peach-flavored drinks are becoming popular as peaches can be used in different ways such as fermented, squeezed, and processed forms. These flavored drinks are also popular as summer drinks. Additionally, the trend for peach-flavored hard kombucha and teas in different formats is also helping the segment to gain a decent market share in the hard tea market.

Distribution Channel Insights

The global market for distribution channels is categorized into supermarkets/hypermarkets, online, and other channels. The supermarket/hypermarket channel segment accounted for the largest share of 60.0% in 2021, and the online segment is expected to witness the fastest growth at a CAGR of 26% over the forecast period.

Shifting consumer preferences towards liquor coupled with rising health concerns are leading to the growth of the segment. Supermarkets offer a wide variety of canned cocktails, ales, and other hard alternatives on a separate shelf which makes it easier for consumers while purchase. The pandemic has shifted the landscape of alcohol through online stores and mobile applications.

However, factors such as regulations and skewed delivery networks are acting as an opportunity for local brick and mortar stores and supermarkets. Supermarkets and hypermarkets have a license for the selling of alcoholic beverages. Additionally, the rise of frequency in purchases of alcoholic beverages has also scaled the demand for supermarkets. Several retailers in the market are utilizing marketing initiatives to sell newer products and services.

On the other hand, the COVID-19 crisis has driven the adoption of an e-commerce platform for alcoholic beverages. The stay-at-home orders have accelerated the demand for home delivery services for alcohol. The relaxation of regulations in the U.S. has increased the number of retailers shifting their businesses online.

The trend for online shopping is also supported by the trend of the customer’s digital lifestyle. Consumers are increasingly aware of the product and are gradually adopting the trend of online delivery for alcohol. For instance, Spirits Network membership increased by 500% since the pandemic.

Regional Insights

In 2021, North America held the majority of the regional market share. The demand for hard teas in the region is driven by the presence of market players in the region. Several new hard tea brands have emerged during the pandemic in the region. Manufacturers in the region are offering beverages with low alcohol. Further, search results for ‘Dry January’ in the region have also gone up during the period 2019-2020. The ongoing drinking less trend is anticipated to drive the sales of hard tea in the region.

Europe is anticipated to grow at a CAGR of 27.2% over the forecast period in terms of revenue. Factors such as improved consumer awareness towards alcohol coupled with consumption of low-abv alcoholic beverages are driving the demand for hard teas in the region. Local and major players in the region are innovating their products by providing variations of beer, kombucha, and wine with a low abv. The pandemic has also accelerated the demand for botanical ingredients in alcoholic beverages. Consumers are preferring beverages that include citrusy ingredients such as lemon and orange

Awareness of health risks associated with heavy consumption of alcohol has also proliferated the sales of hard tea in the region. For example, as per the Society of Independent Brewers (SIBA), the number of youngsters who don’t drink between the age range of 18 to 24 has increased from 6% to 23% in the year 2020. Further, as per BMC health, approximately 46% of the consumers under the age of 35 in the U.K. prefer mocktails over cocktails.

Key Players & Market Share Insights

The global hard tea market is categorized by the presence of established players and emerging players. The players in the market are adopting social media marketing and e-commerce platform to expand their consumer base. The firms are also working on reducing the calories in the product and introducing bolder flavors to attract consumers. Recent developments in the market primarily include new product launches, mergers, and acquisitions, as well as opening new stores to increase customer reach. [t1]

100 Thieves, a North American esports organization, announced a partnership with Twisted Tea Hard Iced Tea and Truly Hard Seltzer in March 2021. The company has collaborated with 100 Thieves for various activations across its platforms. In July 2020, Pabst Brewing Company launched peach hard tea in 26 states in the U.S. The launch will help the company to increase traction among consumers. In October 2018, Craft Brew Alliance Inc. entered into distribution and brewing partnerships with Wynwood Brewing Co., Appalachian Mountain Brewery (AMB), and Cisco Brewers via 3 different purchase agreements. Some of the prominent players in the hard tea market include

-

The Boston Beer Company

-

Pabst

-

Two Chicks Drinks, LLC.

-

Cisco Brewers

-

Blue Point Brewing (Anheuser-Busch InBev)

-

LoverBoy Inc.

-

Double Brew, LLC

-

Crook & Marker LLC

-

Nude Beverage

-

Molson Coors Beverage Company

-

Bold Rock Hard Cider

Hard Tea Market Report Scope

Report Attribute

Report Details

Market size value in 2022

USD 2.47 billion

Revenue forecast in 2030

USD 14.50 billion

Growth rate

CAGR of 24.7% from 2022 to 2030

Base year for estimation

2021

Historic data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million & CAGR from 2021 to 2028

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

ABV(%), flavor, distribution channel, region

Regional scope

North America; Europe; Rest of the World

Country scope

U.S; Canada; UK; Germany; New Zealand; Australia; China

Key companies profiled

The Boston Beer Company; Pabst; Anheuser-Busch Companies LLC (Blue Point Brewing); Cisco Brewers; Nude Beverages

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hard tea market based on ABV (%), flavor, distribution channel, and region:

-

ABV (%) Outlook (Revenue, USD Million, 2017 - 2030)

-

Others

-

Online

-

Supermarkets/Hypermarket

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Lemon

-

Raspberry

-

Peach

-

Orange

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2017 - 2030)

-

More than 5.1%

-

2%-5%

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Rest of World

-

New Zealand

-

Australia

-

China

-

Others

-

-

Frequently Asked Questions About This Report

b. The global hard tea market size was estimated at USD 1.99 billion in 2021 and is expected to reach USD 2.47 billion in 2022.

b. The global hard tea market is expected to grow at a compound annual growth rate of 24.7% from 2022 to 2030 to reach USD 14.50 billion by 2030

b. North America dominated the hard tea market with a share of 78.3% in 2021. The demand for hard teas in the region is driven by the presence of market players in the region. Several new hard tea brands have emerged during the pandemic in the region. Manufacturers in the region are offering beverages with low alcohol. Further, search results for ‘Dry January’ in the region have also gone up during the period 2019-2020. The ongoing trend of drinking less is anticipated to drive the sales of hard tea in the region.

b. Some key players operating in the hard tea market include The Boston Beer Company; Pabst; Anheuser-Busch Companies LLC (Blue Point Brewing); Cisco Brewers; and Nude Beverages.

b. The key factor driving the hard tea market growth includes rising demand for better-for-you beverages coupled with growing awareness towards low content alcoholic beverages among the younger population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.