- Home

- »

- Clothing, Footwear & Accessories

- »

-

Headwear Market Size And Share, Industry Report, 2033GVR Report cover

![Headwear Market Size, Share & Trends Report]()

Headwear Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Caps, Beanies, Neckwear, Hats), By Material (Cotton, Wool, Polyester, Nylon), By End Use (Men, Women, Kids), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-035-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Headwear Market Summary

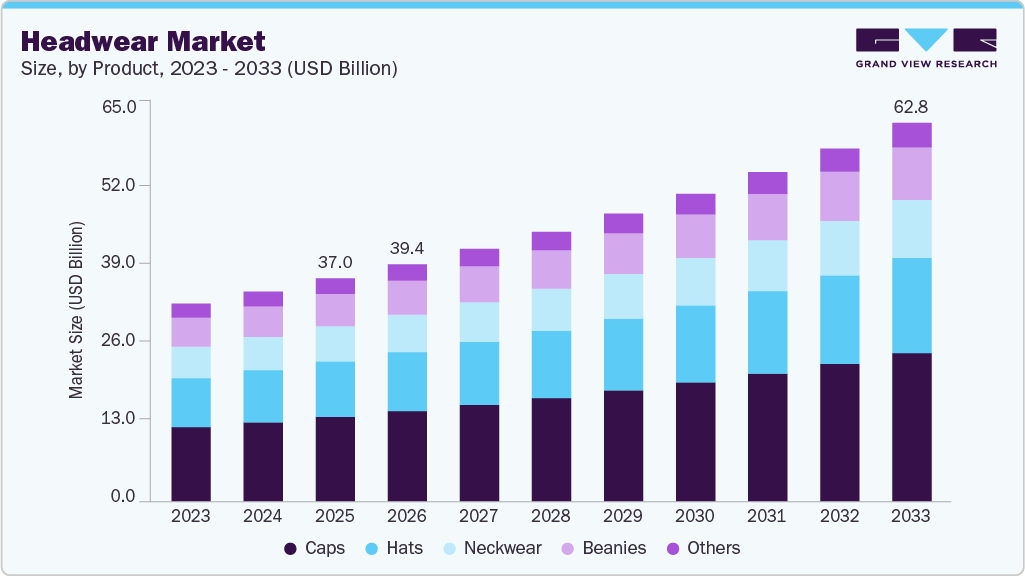

The global headwear market size was estimated at USD 37.01 billion in 2025 and is projected to reach USD 62.83 billion by 2033, growing at a CAGR of 6.9% from 2026 to 2033. The market is gaining significant momentum as apparel producers and consumer brands recognize that hats, caps, and beanies are no longer just functional accessories but strategic lifestyle items.

Key Market Trends & Insights

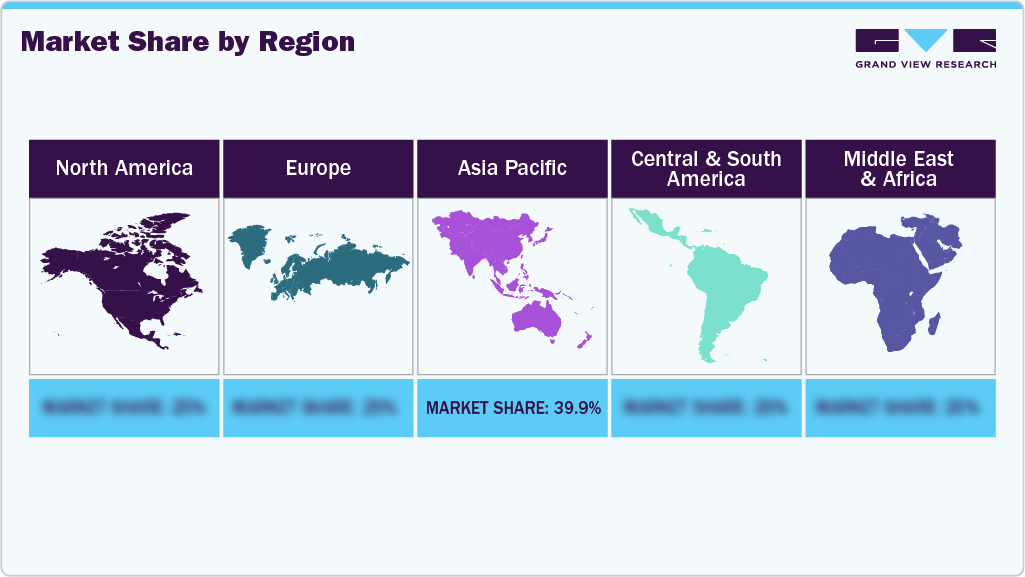

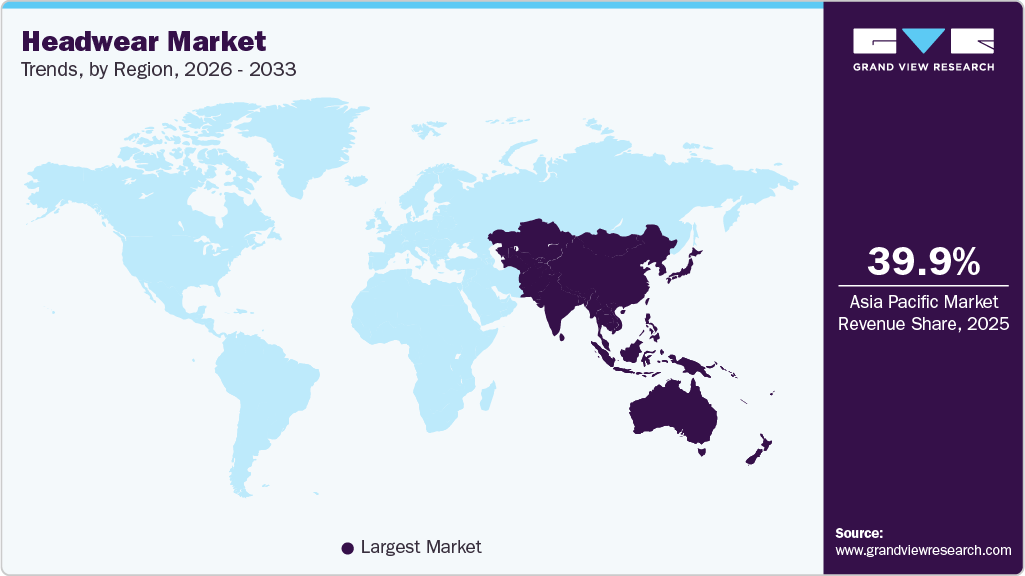

- Asia Pacific headwear industry dominated the global market and accounted for the largest market revenue share of 39.86% in 2025.

- Middle East and Africa headwear industry is anticipated to grow significantly over the forecast period.

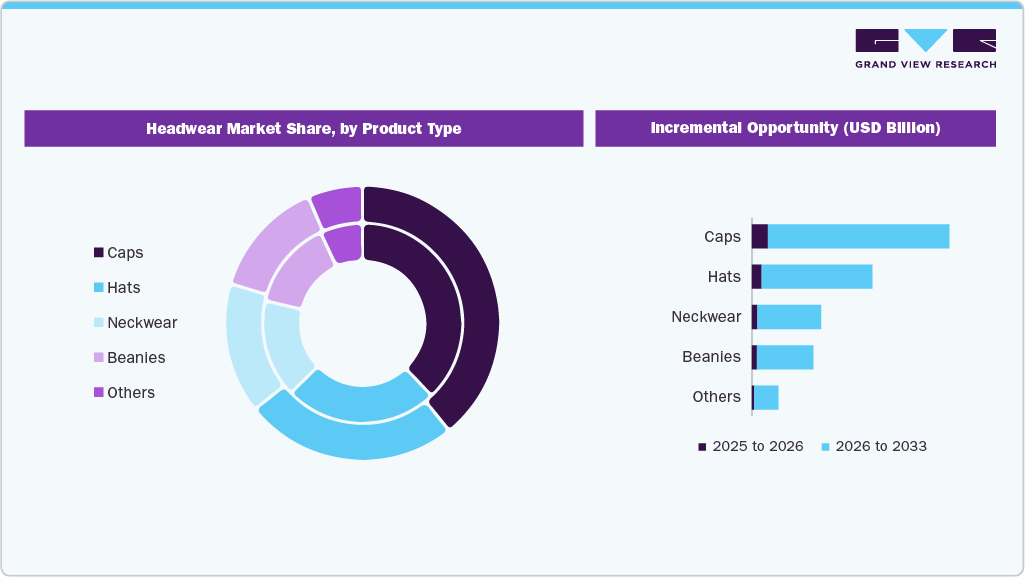

- By product, caps accounted for a revenue share of 37.87% in the year 2025.

- By material, the cotton headwear segment dominated the market and accounted for the largest market revenue share in 2025.

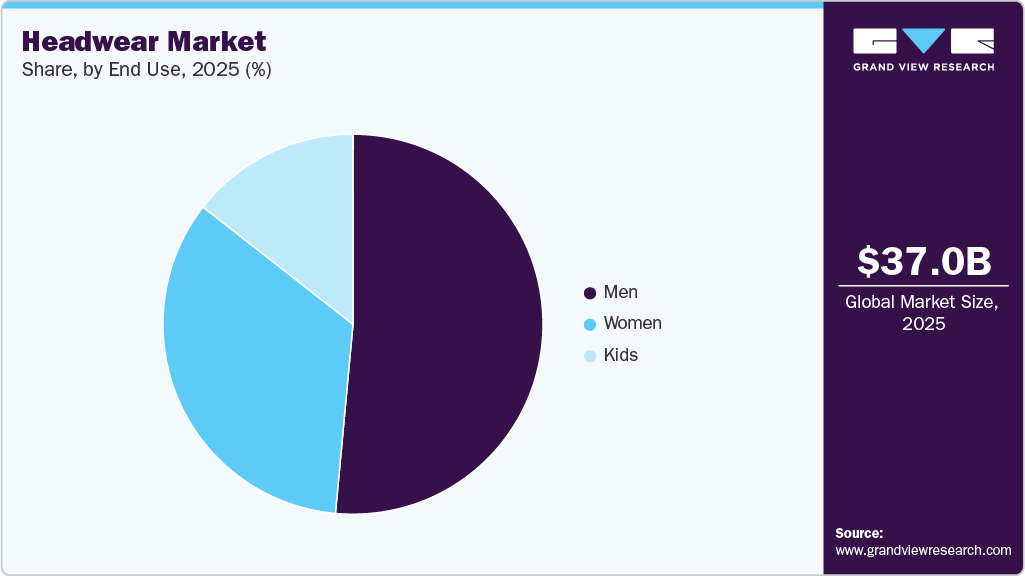

- By end use, the men’s headwear segment accounted for the largest market revenue share in 2025.

- By distribution channel, sales through e-commerce accounted for the largest market revenue share in 2025.

Key Market Trends & Insights

- 2025 Market Size: USD 37.01 Billion

- 2033 Projected Market Size: USD 62.83 Billion

- CAGR (2025-2033): 6.9%

- Asia Pacific: Largest market in 2025

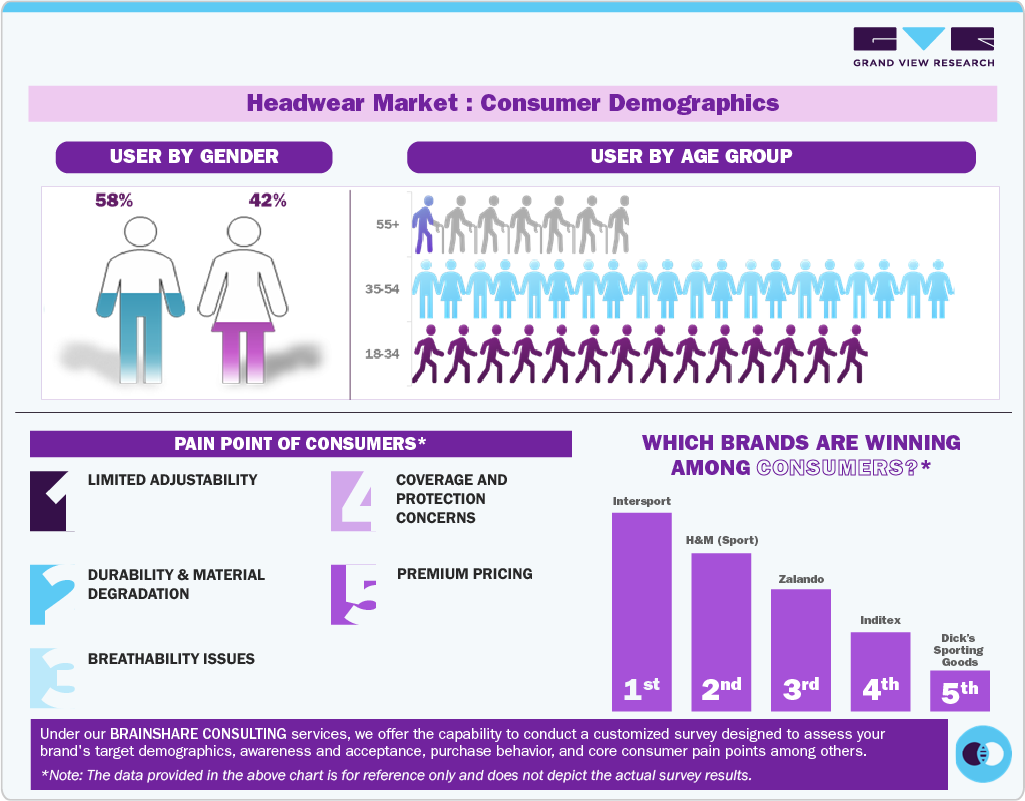

According to trend coverage, key materials such as corduroy and textured fabrics are re-emerging in headwear, and sustainable options are becoming front-of-line. At the same time, headwear aligns with broader macro drivers, including the rise of hybrid lifestyles such as commuting, remote working, and outdoor recreation; global climate awareness, which drives demand for packable, protective, and sustainable items; and an expanding addressable consumer base across age groups and occasions. This convergence means the headwear category is transitioning from a niche, seasonal accessory to a year-round strategic one.Consumers are seeking headwear that unites fashion, function, and sustainability. For instance, the 2025 trend landscape highlights “sporty-prep” caps with minimalist logos for versatile daywear, as well as recycled-fibre beanies for eco-conscious buyers. Furthermore, recent trend reports indicate that consumer acceptance of headwear by age cohort is shifting. Younger Gen Z consumers favor bucket hats and beanies, while Millennials prefer snapbacks and dad caps. Middle-aged buyers opt for classic baseball hats and fedoras, while older age groups prioritize wide-brim sun hats and traditional caps that focus on comfort and protection. These segmented preferences underscore the need for brands and retailers to tailor silhouettes, materials, and communication to specific demographic segments, rather than applying a one-size-fits-all product strategy.

Manufacturers and brands are innovating in both products and processes to capitalize on these trends. New launches feature advanced materials, including recycled fleece and organic cotton, as well as innovative construction techniques such as laser-cut mesh backs, rope-detail five-panel hats, and vintage-wash finishes. For instance, in April 2024, Under Armour introduced the UA StealthForm Hat, a performance-driven headwear option engineered for athletes and travelers alike. The hat features a fully molded design with seamless construction for a custom fit, utilizes an Iso-Chill sweat-wicking interior, and is built to be crushable and packable yet resilient, returning to its original shape after being compressed. Inspired by Under Armour’s sports‑bra and footwear innovations, the StealthForm Hat aims to bring elite‑level materials and engineering into a headwear piece that satisfies both high‑intensity performance needs and everyday carry versatility. Technology-led manufacturing and sustainability claims now underpin premium positioning. Moreover, headwear is being leveraged for self-expression through curated capsules and personalized patches. This elevates headwear beyond a simple seasonal accessory to a strategic margin driver, especially when customization, limited-edition drops, and strong brand storytelling are employed.

Consumer Insights

Headwear purchases are strongly driven by exposure conditions, sun intensity, humidity, wind, dust, or glare, making caps, hats, and protective headgear functional tools rather than secondary accessories. In sectors such as construction, logistics, agriculture, outdoor retail, and sports, headwear is often the most worn item, which places disproportionate importance on weight distribution, breathability, and pressure-point management. Among lifestyle consumers, headwear also functions as a low-commitment expression of style or affiliation, encouraging frequent replacement and multiple ownership across seasons and activities.

Fit precision and thermal comfort are the primary determinants of repeat purchase in headwear, outweighing brand loyalty in many segments. Consumers actively evaluate crown depth, visor curvature, closure systems, and internal sweatband materials, as a poor fit that leads to discomfort, overheating, or instability during movement. Demand is rising for headwear designs that accommodate longer wear cycles through features such as moisture-absorbing headbands, perforated or mesh panels, flexible brims, and low-profile seam construction.

Material selection plays a distinct role in headwear purchasing decisions because fabrics sit directly against the skin and hair. Lightweight synthetics, recycled polyester, cotton blends, and foam or composite inserts are assessed not only for durability but also for odor control, drying speed, and ease of cleaning. In warmer climates and outdoor-use scenarios, UV protection ratings and heat-reflective finishes meaningfully influence choice, while colder regions prioritise insulation without excessive weight. Sustainability considerations are gaining traction, particularly for fashion and promotional headwear, where buyers increasingly scrutinise material sourcing, dye processes, and recyclability for products that are frequently rotated.

Digital discovery is especially influential in the market due to the visual and experiential nature of fit. Consumers rely on video try-ons, head-shape comparisons, and user feedback on sizing accuracy to reduce purchase risk, particularly in online channels. Customisation capability, through embroidery, patches, or colour-blocking, has become a decisive factor for corporate buyers, sports teams, and event-driven purchases, as headwear offers high visibility branding at relatively low cost. Everyday consumers often trade up for comfort-enhanced designs, while professional users prioritise headwear that maintains shape, fit, and performance across repeated wear and environmental exposure.

Product Insights

Caps accounted for a revenue share of 37.87% in the year 2025 in the overall headwear industry. As consumers increasingly engage in running, gym training, yoga, travel, and casual commuting, caps have transitioned from basic sun-protection accessories into performance-oriented lifestyle products. Contemporary caps are engineered with lightweight and breathable materials, moisture-wicking sweatbands, ventilated panel structures, and adjustable closures that ensure comfort during prolonged wear. Brands such as Nike, Adidas, New Era, Under Armour, and Lululemon emphasise ergonomic fit and technical fabric construction to minimise heat buildup and pressure while maintaining clean, versatile aesthetics. With comfort, functionality, and style now equally prioritised, caps have become a core wardrobe staple that seamlessly supports both active routines and casual daily use.

Hats are projected to grow at a CAGR of 7.0% over the forecast period of 2026-2033, supported by rising outdoor participation, increased sun-protection awareness, and the continued blending of functional accessories with everyday fashion. Consumers are increasingly using hats for activities such as walking, hiking, travel, beachwear, and casual commuting. Demand is shifting toward lightweight constructions, breathable materials, and flexible fits that allow hats to be worn comfortably for extended periods without stiffness or pressure. At the same time, preference is growing for clean silhouettes, neutral colour palettes, and versatile designs that can move easily between leisure, outdoor activity, and casual styling, positioning hats as both a functional necessity and a lifestyle-driven wardrobe accessory.

Material Insights

Cotton headwear accounted for a revenue share of 31.75% in the year 2025 in the overall headwear industry. Cotton’s ability to absorb moisture, regulate temperature, and remain comfortable in warm climates makes it a preferred choice for caps, hats, and casual headwear used for extended periods. Its soft hand feel and durability support frequent use and washing without significant loss of shape, aligning well with everyday lifestyle needs. Rising adoption is further supported by the shift toward comfort-led, versatile accessories that can transition easily between outdoor activity, travel, commuting, and casual styling, reinforcing cotton headwear’s position as a reliable and widely accepted material segment.

Polyester headwear are projected to grow at a CAGR of 7.6% over the forecast period of 2026-2033, supported by increasing demand for lightweight, durable, and performance-oriented headwear across sports, outdoor, and athleisure applications. Consumers increasingly favour polyester-based fabrics and polyester-elastane blends that offer a balance of stretch, breathability, and shape retention, making them suitable for prolonged wear during physical activity as well as daily use. The emphasis on moisture-wicking properties, quick-drying performance, and resistance to deformation is encouraging brands to adopt engineered polyester knits and woven structures that adapt comfortably to head movement without sacrificing fit.

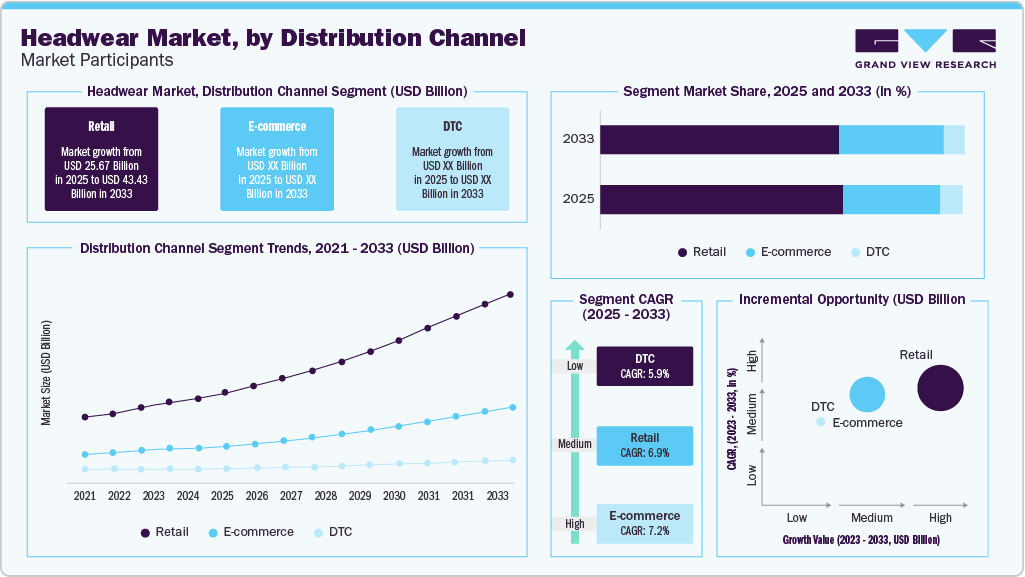

Distribution Channel Insights

Retail sales of headwear accounted for a revenue share of 69.37% in the year 2025 in the overall headwear industry. Physical retail and brand-owned outlets remain influential as headwear buyers often evaluate comfort, fit, material quality, and styling before purchase, particularly for everyday and performance use. At the same time, retail channels are increasingly integrating curated assortments, seasonal drops, and lifestyle-led merchandising that position headwear as an impulse and add-on accessory. Rising demand is further supported by the shift toward comfort-driven, versatile headwear suitable for daily wear, travel, outdoor activity, and casual styling, reinforcing retail’s continued dominance in overall headwear sales.

Headwear sales through e-commerce are projected to grow at a CAGR of 7.2% over the forecast period of 2026-2033. Shoppers are increasingly drawn to online channels for access to diverse styles, materials, and price tiers, supported by detailed product descriptions, fit guides, and lifestyle-led visuals that reduce purchase friction. Performance-oriented headwear featuring lightweight construction, moisture-management properties, and durable fabrics is gaining strong traction online, particularly among athleisure and outdoor users.

End Use Insights

Men’s headwear accounted for a revenue share of 51.48% in the year 2025 of the headwear industry. Caps, hats, and performance headwear are increasingly viewed by male consumers as functional essentials rather than purely aesthetic accessories, driven by rising participation in fitness, commuting, travel, and casual outdoor activities. Demand is closely aligned with the broader shift toward athleisure and comfort-led dressing, where headwear is expected to deliver breathability, lightweight feel, and consistent fit across long wear durations. Men increasingly prefer designs that balance utility with clean, understated styling, allowing headwear to transition seamlessly from workouts and errands to casual social settings.

Women’s headwear is projected to grow at a CAGR of 7.3% over the forecast period of 2026-2033. Female consumers increasingly seek headwear that offers lightweight comfort, breathable construction, and a secure yet non-restrictive fit suitable for extended wear across activities such as walking, workouts, travel, and casual outings. Growing awareness around sun protection, hair care, and heat management is expanding usage beyond seasonal or occasion-led purchases into regular wardrobe rotation. At the same time, design innovation in headwear, such as flexible structures, soft linings, adjustable fits, and adaptable styles, is improving comfort across diverse head shapes and styling preferences.

Regional Insights

North America headwear industry accounted for the revenue share of 25.95% in 2025. Headwear demand is closely linked to all-day wear habits, where consumers prioritise comfort, breathability, and reliable fit for activities ranging from workouts and commuting to travel and casual use. The region’s advanced retail and e-commerce ecosystem, along with the strong presence of global headwear and sportswear brands, accelerates adoption of performance-focused designs that emphasise moisture control, lightweight construction, and durability. Growing consumer awareness of fabric performance, UV protection, and long-wear comfort continues to drive repeat purchases.

U.S. Headwear Market Trends

The U.S. headwear industry led the North American market in 2025, holding the largest market share with 81.02% of the region’s total revenue. Demand is rising for designs that offer lightweight construction, breathable materials, and secure yet non-restrictive fit, particularly among individuals engaged in regular physical activity or extended work-from-home routines. Younger demographics, especially Gen Z, are accelerating this shift through digital-first shopping behaviour, high engagement with athleisure trends, and elevated expectations around product performance, fit, and value, reinforcing the U.S. as the dominant and trend-setting market within North America.

Europe Headwear Market Trends

The headwear industry in Europe accounted for the revenue share of 20.90% in 2025. Consumers are increasingly drawn to headwear that combines functional performance with a refined, fashion-forward aesthetic, reflecting the region’s broader shift toward versatile everyday accessories. Across major markets such as Germany, France, Italy, and the Nordics, shoppers are favouring caps, beanies, and bucket hats that provide lightweight comfort, breathable materials, and seasonally adaptive utility. The rise of outdoor fitness, cycling, urban commuting, and athleisure culture has further strengthened demand for headwear that balances style with comfort-driven design. As in apparel, consumers are showing a greater willingness to pay for accessories that incorporate premium craftsmanship, modern silhouettes, and high-quality construction, aligning with Europe’s design heritage.

Germany headwear industry led the Europe market in 2025, holding the largest market share with 20.0% of the region’s total revenue. Shoppers are increasingly drawn to headwear that offers comfort, breathability, and everyday versatility, reflecting the country’s strong outdoor culture and growing participation in fitness, cycling, and recreational sports. The popularity of hiking, gym training, and urban running groups is boosting demand for performance-focused caps and beanies. Consumers in cities such as Berlin and Munich are increasingly demonstrating a willingness to invest in high-quality headwear that embodies German craftsmanship, clear design, and functional aesthetics.

Asia Pacific Headwear Market Trends

Asia Pacific headwear industry dominated the global market and accounted for the largest market revenue share of 39.86% in 2025. The Asia Pacific headwear industry is projected to grow significantly at a CAGR of 7.5% from 2026 to 2033. Consumers in markets such as China, Japan, India, and South Korea are increasingly adopting headwear as a daily-use accessory that combines comfort, functionality, and style.

Growing urbanisation and athleisure influence are driving demand for versatile headwear suitable for both active and casual settings, while the region’s robust manufacturing and textile capabilities enable rapid innovation in lightweight, breathable, and climate-appropriate designs.

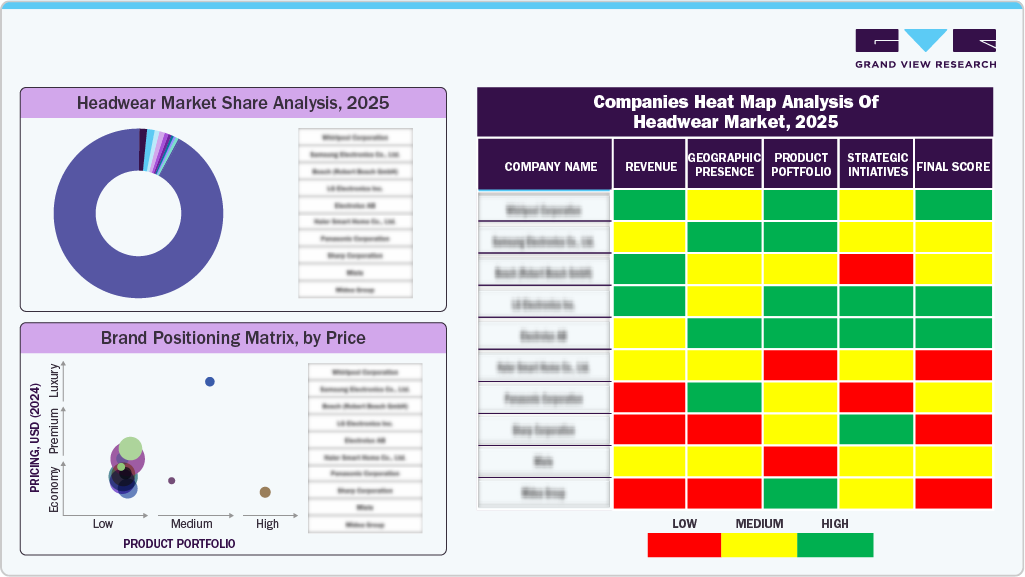

Key Headwear Company Insights

Many brands in the global market have identified untapped growth opportunities within specialised consumer and functional segments and are strategically innovating to address them. This includes the development of performance-oriented materials, climate-adaptive designs, and ergonomic fit systems tailored to activities such as sports, outdoor recreation, commuting, and extended daily wear. Brands are also expanding size adjustability, gender-inclusive designs, and style versatility to meet diverse consumer needs while refining branding and channel strategies to align with regional climate conditions, fashion preferences, and purchasing behaviours. By targeting emerging lifestyle segments and evolving expectations around comfort, protection, and aesthetics, headwear brands are strengthening differentiation, expanding reach, and enhancing their global competitiveness.

Key Headwear Companies:

The following are the leading companies in the headwear market. These companies collectively hold the largest market share and dictate industry trends.

- Intersport

- H&M (sport)

- Zalando

- Inditex

- Dick's Sporting Goods

- Lululemon

- Skechers

- New Balance

- Columbia Sportswear

- Lidl

- Hoka

- Deckers

- JD Sports

- Brooks (Brooks Sports, Inc)

- Fila

- Under Armour

- Superdry

- Asics

- Ice Breaker

- Patagonia

- Anta Group

- Li Ning

- Kari Traa

- Salomon

- Odlo

- Gymshark

- Xbionic

- On Running

Recent Developments

-

In October 2025, Wrangler and CAPX entered a multi‑year licensing agreement to launch an elevated headwear line under the Wrangler brand. The first collection will feature Wrangler’s signature design elements, such as the iconic ‘W’ stitching, copper hardware, and leather patches- and will leverage CAPX’s innovation and manufacturing platform.

-

In September 2025, Nike, Inc. launched its Holiday 2025 Headwear Collection, starting with knit beanies that feature festive motifs like snowflakes and reindeer, bold “Just Do It” branding, and contrasting pom-poms.

Headwear Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 39.37 billion

Revenue forecast in 2033

USD 62.83 billion

Growth Rate

CAGR of 6.9% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion, volume in million units,and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Poland; Czech Republic; Croatia; Hungary; China; India; Japan; Australia & New Zealand; South Korea; Indonesia; Thailand; Malaysia; Vietnam; Brazil; South America, Bahrain, Kuwait; Oman; Qatar; Saudi Arabia;

UAE

Key companies profiled

Intersport; H&M (sport); Zalando; Inditex; Dick's Sporting Goods; Lululemon; Skechers; New Balance; Columbia Sportswear; Lidl; Hoka; Deckers; JD Sports; Brooks (Brooks Sports, Inc); Fila; Under Armour; Superdry; Asics; Ice Breaker; Patagonia; Anta Group; Li Ning; Kari Traa; Salomon; Odlo; Gymshark; Xbionic; On Running

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Headwear Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the headwear market report based on product, material, end use, distribution channel, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

Caps

-

Beanies

-

Neckwear

-

Hats

-

Others

-

-

Material Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

Cotton

-

Wool

-

Polyester

-

Nylon

-

Others

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

Retail

-

E-commerce

-

DTC

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Czech Republic

-

Croatia

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

Indonesia

-

Thailand

-

Malaysia

-

Vietnam

-

-

Central & South America

-

Brazil

-

South America

-

-

Middle East & Africa

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global headwear market size was estimated at USD 37.01 billion in 2025 and is expected to reach USD 39.37 billion in 2026.

b. The global headwear market is expected to grow at a compound annual growth rate of 6.9% from 2026 to 2033 to reach USD 62.83 billion by 2033.

b. Asia Pacific dominated the headwear market with a share of 39.86% in 2025. It is driven by a rise in acceptance of wide categories of winter hats in countries such as China, India, and Japan along with a large population base in the countries of Asia Pacific.

b. Some key players operating in the headwear market include Intersport; H&M (sport); Zalando; Inditex; Dick's Sporting Goods; Lululemon; Skechers; New Balance; Columbia Sportswear; Lidl; Hoka; Deckers; JD Sports; Brooks (Brooks Sports, Inc); Fila; Under Armour; Superdry; Asics; Ice Breaker; Patagonia; Anta Group; Li Ning; Kari Traa; Salomon; Odlo; Gymshark; Xbionic; On Running

b. Key factors that are driving the headwear market growth include growth of the fashion industry which has resulted in the rise of fashion sense among the global population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.