- Home

- »

- Medical Devices

- »

-

Health Sensors Market Size, Share & Trends Report, 2030GVR Report cover

![Health Sensors Market Size, Share & Trends Report]()

Health Sensors Market Size, Share & Trends Analysis Report By Material Type (Polyurethane, Nylon), By Application (Peripheral Artery Disease), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-385-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Health Sensors Market Size & Trends

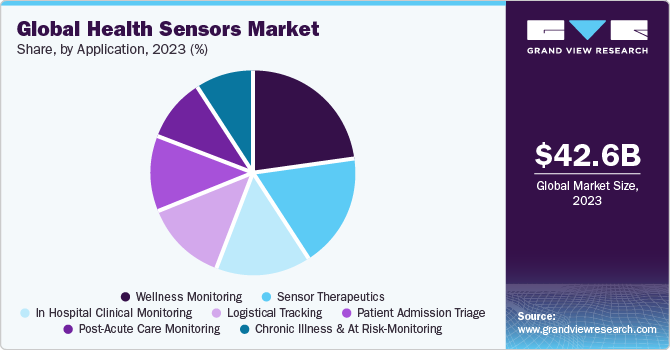

The global health sensors market size was estimated at USD 42.58 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 19.07% from 2024 to 2030. The market growth is attributed to technological advancements, rising demand for round-the-clock monitoring, increasing demand for health data tracking, and rising incidence of chronic diseases.

Increasing prevalence of chronic diseases across the globe is likely to boost the demand for health sensors. For instance, According to Front. Public Health in 2020, chronic non-communicable diseases (NCDs) account for about 80% of mortality in China among adults aged 60, with Ischemic Heart Disease, Stroke, Chronic Obstructive Pulmonary Disease (COPD), and Type 2 Diabetes being the most common.

The surge in people's interest in monitoring and recording health-related information is a major factor expected to drive market growth. This trend, propelled by the personal informatics movement, gained momentum with the introduction of mobile apps facilitating easy tracking of metrics like daily miles run and calories consumed. This phenomenon, also referred to as data journaling, life tracking, and health quantification, has become increasingly popular. The market has witnessed the launch of devices equipped with accelerometers and sensors that automatically capture health data, eliminating the need for manual input. Companies are now introducing health sensor devices that can monitor various metrics such as blood oxygen levels, respiration, heart rate, pulse rate, heat flux, galvanic skin response, and skin temperature, reflecting the growing interest in health data tracking.

In addition, the COVID-19 pandemic has led to a huge increase in health sensors demand around the world. In the current era of artificial intelligence (AI), new & advanced technologies can play a significant role in helping the world against the pandemic. The health sensors can collect a broad range of data such as blood pressure, ECG, body temperature, blood oxygen saturation level, heart rate, etc. and in turn, helps to a great extent in preventing the spread of the coronavirus. The healthcare system with this technology allows surgeons to monitor the infected or suspected patients, evaluate the health risk, and forecast the future conditions remotely. During the quarantine period, a patient or a person can be fully monitored by a doctor by health sensors wearable technology. Thus, provides an opportunity for remote treatment & reduces the risk of infection to healthcare workers.

Moreover, a study about the transmission of coronavirus with skilled nursing facilities stated that the asymptomatic rate of transmission was 56%, of which 90% shows symptoms subsequently. From this, it can be concluded that the symptom-based screening technique may fail to detect over 50% of people affected by a coronavirus. The continuous data monitoring generated by health sensors can overcome these challenges. Wearable technology to assist the patients infected with novel coronavirus (COVID-19) is expected to boost the market growth. For instance, the DETECT research, which stands for Digital Engagement & Tracking for Early Control & Treatment, was launched by the Scripps Research Translational Institute., which uses devices such as Apple Watch, Fitbit, and Garmin for tracing sleep data & heart-rate activity and corresponds them with symptom reports submitted by patients to track COVID-19 cases. According to a recent study, Fitbits can predict COVID-19 symptoms in 78% of patients.

The trend toward portability and care delivery at the patient's bedside or at home is pushing the construction of next-generation therapeutic, diagnostic, display, and monitoring equipment that is more accurate, adaptable, and small. These platforms have a consumer-driven approach to healthcare that incorporates technological advancements like personalized wearables, electronic patient records, and wireless internet-linked systems, all of which are expected to provide intelligent, convenient, and at-home healthcare.

The main reason behind the trend of portable health sensors devices at home is rapidly aging population, which is chronically ill and disabled. Hence, this is likely to encourage designers to develop medical devices that patients can carry unobtrusively even in public spaces. For instance, in July 2022, for the purpose of improving remote patient monitoring for patients at risk, BioIntelliSense and Philips forged a strategic partnership. This will make it easier for doctors to keep an eye on patients who are being treated in hospitals at home. Philips will be able to better monitor patient populations who have persistent disabilities because of this.

Market Characteristics

The market has witnessed significant innovation, with advancements in miniaturization, wireless connectivity, and integration with smart devices. These developments include biometric sensors, advanced analytics, and a focus on energy efficiency, fostering a more comprehensive and interconnected approach to health monitoring.

Several market players such as GE HealthCare, Medtronic Plc, and Danaher Corporation are involved in merger and acquisition activities. Through M&A activity, these companies employ key strategies such as continuous research and development to introduce innovative technologies, forming strategic partnerships to enhance product offerings and market reach, and prioritizing user-friendly and wearable designs to improve the overall consumer experience.

Regulations have a significant impact on the safety and quality of these devices. The FDA in the US and similar bodies globally enforce regulations that require registration and clearance before a device is marketed. These regulations ensure that the devices meet certain safety and effectiveness standards, thereby protecting user health and trust in the market.

Market players are expanding regionally through strategic partnerships, collaborations, and distribution agreements to tap into diverse healthcare ecosystems worldwide. This regional expansion strategy aims to address specific healthcare needs, comply with regional regulations, and leverage emerging market opportunities for health sensor technologies.

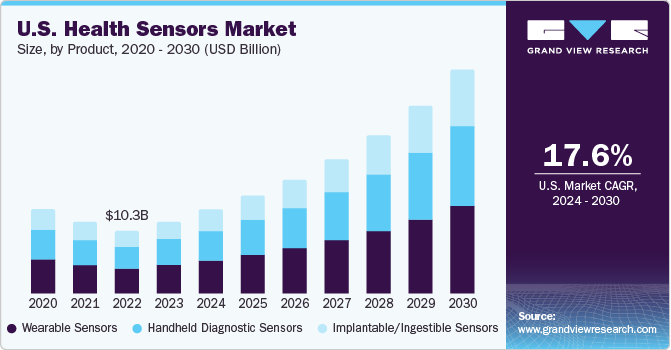

Product Insights

Based on product, the wearable sensors segment held the market with the largest revenue share of 40.57% in 2023. Wearable sensors enable devices to monitor patients’ physiological and motion activities. These sensors can be embedded in clothing, shoes, wristbands, and headbands, or attached directly to the body. These devices are used to track, monitor, and record various healthcare indicators, such as pulse, blood pressure, heart rate, calorie intake, etc. These devices can also be used in long-term monitoring, and with increasing penetration & application of big data analytics, they are being used to predict & prevent any medical emergency. Thus, due to the various advantages of wearable sensors, the demand for these devices is anticipated to increase over the forecast period. Increasing R&D investment and collaborations between companies are also expected to propel industry growth. For instance, in March 2022, a provider in healthcare technology and a global provider of communications solutions and photonics-based health monitoring, Rockley Photonics Holdings Ltd., recently announced its decision to cooperate with Medtronic on new projects. The two companies intend to collaborate to use Rockley’s recently released Bioptx biomarker sensing technology along with Medtronic’s solutions in a variety of healthcare contexts.

The implantable/ingestible sensor segment is expected to show lucrative CAGR during the forecast period. Ingestible/implantable sensors are highly accurate, miniaturized, and completely safe. These sensors are used to provide localized drug delivery, deep brain stimulation, heart stimulation, and bladder stimulation. They are also used as cochlear and retinal implants. These devices have to be biocompatible and are hence required to comply with the most stringent regulatory policies. This is anticipated to hinder industry growth. In July 2021, according to Medtronic plc, the FDA cleared the use of two LINQ II insertable cardiac monitors with the AccuRhythm AI algorithms. When the AccuRhythm AI algorithms are made accessible on the CareLink Network later this year, all LINQ II implants in the U.S. will be able to use them.

Type Insights

Based on type, the heart rate segment led the market with the largest revenue share in 2023 due to its prominent role in monitoring the health of patients. Heart rate sensors measure the heart rate of the person and can detect irregularities in heart rhythm. Cardiovascular Disease (CVD) is the primary cause of death in the world and patients suffering from CVD require continual monitoring. According to the American Heart Association, almost half of all adults in the U.S. have some form of CVD. More than 130 million adults, or 45.1% of the U.S. population, are expected to have CVD by 2035. The high prevalence of cardiovascular disease thus drives the growth of this segment.

The temperature sensors segment is expected to register the fastest CAGR during the forecast period due to increasing adoption for health monitoring. Temperature sensors measure and monitor body temperature, and can detect fever, hypothermia, or other abnormalities in temperature. The increasing hospitalization rate due to increased prevalence of chronic diseases, and increased adoption of advanced medical technologies are driving the growth of this segment.

Application Insights

In terms of application, the chronic illness & at-risk-monitoring led the market with largest revenue share of 22.75% in 2023. This is due to the increasing prevalence of chronic diseases and the demand for point-of-care testing. Chronic diseases, such as diabetes, need monitoring to check the progression as well as the regression of the disease in patients. Thus, several devices designed to track activities as well as monitor the risks associated with the health of patients are available. For instance, in June 2020, the integrated Continuous Glucose Monitoring (iCGM) FreeStyle Libre 2 system from Abbott was approved by the U.S. FDA. This device makes it possible to monitor glucose levels in adults and children (aged 4 years & above) in real-time. Furthermore, the system was offered at the same price as that of the FreeStyle Libre 14-day system, which is nearly one-third the cost of other continuous glucose monitors. Quantum Operation, Inc., a Tokyo-based startup, introduced a wearable noninvasive continuous blood glucose monitor at the 2021 CES. Thus, the introduction of such innovative and affordable systems is expected to positively impact segment growth.

Thesensor therapeutics segment is estimated to register the fastest CAGR over the forecast period. Advancements in sensor technologies have paved the way for more accurate and real-time monitoring of various health parameters, leading to increased adoption in medical applications. In addition, the growing emphasis on preventive healthcare and the increasing prevalence of chronic diseases have fueled the demand for health sensors.

End Use Insights

Based on end-use, the hospitals & clinics segment held the market with the largest revenue share in 2023. Hospitals & clinics cater to a large number of outpatients as well as inpatients. They offer a large number of healthcare services and have a larger technical staff for catering to the needs of the patients. The large patient pool and increasing adoption of advanced medical technologies are the vital drivers for the segment growth. In general wards and intensive care units, health sensors are frequently used to continually track patients' health using different human vital parameters, such as oxygen saturation, respiration rate, blood pressure, and heart rate.

The long-term care centers & nursing homes segment is expected to register the fastest CAGR during the forecast period. With the increasing geriatric population and rising incidence & prevalence of chronic diseases, such as heart problems, Alzheimer’s disease, & cancer, the need for nursing care is growing. Health sensors prove highly beneficial for patients in long-term care centers & nursing homes as they can be monitored continuously with improved health outcomes.

Regional Insights

North America dominated the market with a revenue share of 34.6% in 2023. This can be attributed to its well-established healthcare infrastructure, high healthcare expenditure, presence of dominant players, and rapid adoption of advanced technologies. North America has the most developed health sensors sector globally. The rapid adoption of patient monitoring & homecare devices for regular, continuous, and long-term monitoring of patients & reducing the frequency of hospital visits are anticipated to fuel the region’s growth over the forecast period. As per a survey conducted by Insider Intelligence, 23.4 million patients in the U.S. used remote patient monitoring (RPM) tools and services in 2020, and as per the same source, 30 million U.S. patients, or 11.2% of the population, will use RPM tools by 2024.

The U.S. accounted for the largest share of the market in North America region in 2023. The U.S. is home to a thriving healthcare industry with substantial investments in research and development, fostering innovation in sensor technologies. Major companies and startups in the health sensor sector are often based in the U.S., benefiting from a robust ecosystem of technology, healthcare infrastructure, and skilled workforce. The country's strong emphasis on technological advancements in healthcare, coupled with a favorable regulatory environment, accelerates the development and adoption of health sensor solutions.

Europe accounted for the second largest market share in 2023.Rising demand for healthcare sensors and supportive central data management systems for providing accurate information & medical services to patients are likely to fuel the market. Other factors contributing to market growth are increasing geriatric population and prevalence of diseases.

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The rising incidence of cardiac diseases has created a demand for health sensor equipment in APAC countries. Furthermore, with some of the highest diabetes rates in the world, India and China have been the most afflicted countries. In the South-East Asia (SEA) Region of the IDF, 90 million persons (20-79) suffered from diabetes in 2021, according to The International Diabetes Federation (IDF) estimates. By 2030 and 2045, this number is projected to rise to 113 million and 152 million, respectively. According to the Indian Journal of Ophthalmology, globally and in emerging nations like India, the burden of diabetes is huge and rising, primarily due to increasing cases of overweight/obesity and unhealthy lifestyles. Furthermore, the region is home to a number of major companies, which helps boost its share.

Key Health Sensors Company Insights

Some of the key players operating in the market include Medtronic Plc, GE Healthcare, and Abbott Laboratories. Company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges. For instance, in February 2021, Hill-Rom disclosed that it had paid EarlySense USD 30 million for their contactless continuous monitoring technology. With a focus on the remote patient care industry, this acquisition can assist the company in developing next-generation AI-based sensing technologies.

Varian Medical System and Sensirion AG are some of the emerging market players in health sensors. These market players are continuously focused on niche segments, leveraging specialized technologies to differentiate themselves.

Key Health Sensors Companies:

The following are the leading companies in the health sensors market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these health sensors companies are analyzed to map the supply network.

- Analog Devices Inc.

- Avago Technologies Ltd.

- Danaher Corporation

- GE Healthcare

- Honeywell International Inc.

- Medtronic Plc.

- Smith’s Medical Inc

- Koninklijke Philips

- Sensirion AG

- Stryker Corporation

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Hologic, Inc.

- Varian Medical System

Recent Developments

-

In December 2023 , Neuranics unveiled a new development kit featuring a magnetic sensor capable of detecting minute magnetic signals originating from the heart muscle

-

In October 2023 , Sibel Health, reveals the launch of Discovery, a robust physiological monitoring platform tailored for clinical trials. This advanced technology solution incorporates FDA-cleared advanced wearable sensors for continuous monitoring of vital signs and introduces innovative digital endpoints

-

In November 2023, DuPont Liveo Healthcare Solutions has partnered with STMicroelectronics, a prominent semiconductor technology leader catering to diverse electronics applications with an aim to create an innovative smart wearable device concept focused on remote bio signal monitoring

Health Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.89 billion

Revenue forecast in 2030

USD 142.18 billion

Growth rate

CAGR of 19.07% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Analog Devices Inc.; Avago Technologies Ltd.; Danaher Corporation.; GE Healthcare; Honeywell International Inc.; Medtronic Plc; Smith’s Medical Inc.; Koninklijke Philips; Sensirion AG; Stryker Corp.; Abbott Laboratories; F. Hoffmann-La Roche AG; Hologic, Inc.; Varian Medical System

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Health Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global health sensors market report based on the type, product, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature Sensors

-

Pressure Sensors

-

Blood Glucose Sensors

-

Blood Oxygen Sensors

-

Electrocardiogram (ECG) Sensors

-

Motion Sensors

-

Image Sensors

-

Flow Sensors

-

Heart Rate Sensors

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld Diagnostic Sensors

-

Chronic illness & at risk-monitoring

-

Patient admission triage

-

Logistical tracking

-

In hospital clinical monitoring

-

Post-acute care monitoring

-

-

Wearable Sensors

-

Disposable wearable sensors

-

Non-disposable wearable sensors

-

Wellness monitoring

-

Chronic illness & at risk-monitoring

-

Patient admission triage

-

Logistical tracking

-

In hospital clinical monitoring

-

Sensor therapeutics

-

Post-acute care monitoring

-

-

Implantable/Ingestible Sensors

-

Wellness monitoring

-

Chronic illness & at risk-monitoring

-

Patient admission triage

-

In hospital clinical monitoring

-

Sensor therapeutics

-

Post-acute care monitoring

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld Diagnostic Sensors

-

Chronic Illness & At Risk-Monitoring

-

Wellness Monitoring

-

Patient Admission Triage

-

Logistical Tracking

-

In Hospital Clinical Monitoring

-

Sensor Therapeutics

-

Post-Acute Care Monitoring

-

Home-based

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Long-term care centers & Nursing homes

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global health sensors market size was estimated at USD 42.58 billion in 2023 and is expected to reach USD 49.89 billion in 2024.

b. The global health sensors market is expected to grow at a compound annual growth rate of 19.07% from 2024 to 2030 to reach USD 142.18 billion by 2030.

b. North America dominated the health sensors market with a share of 34.6% in 2023. This is attributable to the presence of structured and streamlined approval processes.

b. Some key players operating in the health sensors market include Analog Devices, Inc., Avago Technologies Ltd., Danaher Corporation, GE Healthcare, Honeywell International, Inc., Medtronic PLC, Smiths Medical, Inc., Koninklijke Philips, Proteus Digital Health, and Sensirion AG.

b. Key factors that are driving the market growth include increasing demand for home healthcare settings and the rising geriatric population

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."