- Home

- »

- Medical Devices

- »

-

Healthcare Additive Manufacturing Market Size Report, 2030GVR Report cover

![Healthcare Additive Manufacturing Market Size, Share & Trends Report]()

Healthcare Additive Manufacturing Market Size, Share & Trends Analysis Report By Technology (Laser Sintering, Deposition Modeling), By Application, By Material, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-693-6

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

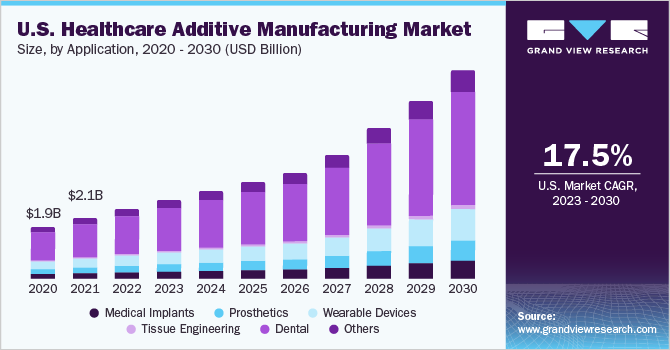

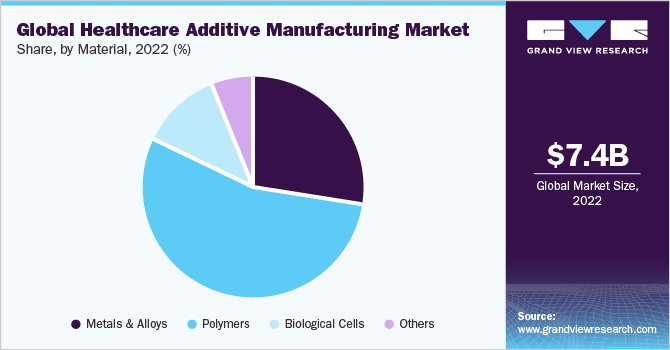

The global healthcare additive manufacturing market size was valued at USD 7.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.1% from 2023 to 2030. The market is growing due to the increase in demand for customized medical items, such as implants, and the advent of new technologies to manufacture a variety of products with simple and complicated designs. Additive manufacturing is being hailed as the next industrial revolution in manufacturing, with the potential to produce sophisticated and customized medical parts & components such as tissues, organs, dental prostheses, and orthopedic and cranial implants. The high demand and unmet needs in the healthcare sector, which have been identified as a result of an increase in the number of surgeries and the rising frequency of chronic illnesses, are expected to boost the market growth through the forecast period.

There was a fall in the market growth in the first half of 2020 due to the COVID-19 pandemic, but the market picked up a healthy pace in the second half of the year and produced several pieces of equipment required to fight against coronavirus, hence contributing to the growth of the market. Additive manufacturing enables the production of more complicated designs that would be impossible or prohibitively expensive to produce with traditional machines, molds, milling, and dies.

It also significantly assists in quick prototyping, enabling a more dynamic and design-driven workflow. Furthermore, it swiftly provides prototypes using 3D CAD, as it eliminates the time-consuming procedure and high expenses associated with traditional prototyping. Additive manufacturing uses a wide variety of materials such as polymers, metal alloys, and biological cells. The most widely used materials are polymers and metal alloys as they are biocompatible, non-corrosive, and have good strength.

Polymers are usually used in making prosthetics, medical implants, limbs, and related accessories. Metals and alloys are extensively used in spinal and surgical implants. The COVID-19 pandemic initially reduced the growth of the market due to the economic slowdown, disruptions in the supply chain, and stay-at-home orders issued by governments to prevent the disease. However, the market gained momentum by manufacturing medical supplies that were required to prevent coronavirus.

For instance, in April 2020, 3T company along with EOS produced more than 100,000 face shields for healthcare workers across NHS and the U.K. healthcare system to defend against the COVID-19 pandemic. In addition, in November 2020, Allevi, Inc collaborated with The Wistar Institute. The main aim of this collaboration was to use 3D printing to fight against coronavirus. Allevi Inc. used bioprinting technology to produce a model of the lungs of an infected person with SARS-CoV-2, which was used as study material by researchers at the Wistar Institute to find ways to contain this infection.

Technology Insights

The laser sintering segment dominated the market and accounted for a revenue share of 30.4% in 2022. Laser sintering is an advanced technology that uses lasers to amalgamate material layers into the final product. Snap fittings, live hinges, and other mechanical joints are among the practical applications where LS is the technology of choice. The main drivers of this market are advanced machinery, software, and materials that have made this technology available to a wide range of biotechnology firms. It can produce multiple pieces at one time and does not require support to build an object.

The deposition modeling segment is expected to register the fastest CAGR of 20.4% during the forecast period. This technology allows items to be made from a variety of thermoplastics such as rigid, transparent, or elastomer polymers. This is leading to a shortening of the lead time and speeding up the prototyping process. It uses a wide variety of materials to produce desired medical products and can fabricate them on demand. Moreover, it is a budget-friendly technology and it produces good resolution and precise medical products.

Application Insights

The dental segment accounted for the maximum revenue share of 34.1% in 2022. This segment will retain its position during the forecast period, as 3D printing dentistry has established a strong position in today’s dental products due to a combination of state-of-the-art 3D printing technology with a potential footprint. The design and development of advanced products such as invisible aligners, the use of advanced fabrication to provide an aesthetic look, and better delivery positioning are some of the factors that are increasing the demand and adoption of dental 3D printers.

The wearable devices segment accounted for the second-highest revenue share of 23.6% in 2022. This is due to the rising demand for wristbands and fitness devices that are used for monitoring individual health. There is also a rise in the use of technologically advanced products for patient monitoring and disease management. They help in improving the quality of patient care and reducing the cost of care.

Material Insights

The polymers segment emerged with the largest revenue share of 54.7% in 2022. Medical instruments, prosthetic limbs, and related accessories have all been made with polymer-based additive manufacturing for decades. Polymers have been the most widely used class of materials for additive manufacturing processes due to their synthetic plasticity and adaptability, and a variety of features. They also have a wide range of uses in the healthcare business, from instructional objectives to medical implants and wearable gadgets. The mentioned reasons are expected to fuel market expansion.

The biological cells segment is expected to expand at the fastest CAGR of 19.9% during the forecast period. The main drivers of this market segment are the growing geriatric population with chronic diseases and the limited number of organ donors. In addition, technological advancements, rising R&D investments, and increasing demand for medical pills that are formed using additive manufacturing are fueling the growth.

Regional Insights

North America dominated the healthcare additive manufacturing market and accounted for a revenue share of 38.1% in 2022. The major factors contributing to the regional growth include a rise in the geriatric population, high purchasing power, strong government support for quality healthcare, and supportive reimbursement policies in the U.S. and Canada.

For instance, in the U.S., the Patient Protection and Affordable Care Act (PPACA), also known as Obamacare, provides residents with affordable, high-quality health insurance plans. Furthermore, favorable government measures to assist research and development in the concerned industry are driving the adoption of products made with additive manufacturing, furthering market advancement.

Asia Pacific is projected to be the fastest-growing regional market, with a CAGR of 19.4% during the forecast period. Lower costs, a competent workforce, quickly improving healthcare infrastructure, the rising prevalence of arthritis, promising economic development, and the significant unmet medical requirements of a large population pool are expected to drive the regional market. Dental 3D printing is also in high demand due to the growing number of patients who are having their teeth replaced.

Key Companies & Market Share Insights

Mergers, acquisitions, and collaborations are the techniques adopted by key firms to maintain their market share. For example, in February 2023, Stratasys announced the launch of the J3 DentaJet 3D printer. This printer allows dental laboratories to produce highly precise mixed applications in a single tray instantaneously. Moreover, in November 2021, Stratasys collaborated with RICOH 3D for Healthcare to employ its 3D printing technology to provide more medical professionals and hospitals with 3D-printed, patient-specific anatomic models as part of its service offering. Some prominent players in the global healthcare additive manufacturing market include:

-

3D Systems, Inc.

-

EnvisionTEC

-

RegenHU

-

Allevi, Inc.

-

EOS GmbH

-

Materialise N.V.

-

Stratasys Ltd.

-

Nanoscribe GmbH

-

GPI Prototype and Manufacturing Services, LLC

-

3T Additive Manufacturing Ltd

-

Fathom Manufacturing

-

General Electric

Healthcare Additive Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.5 billion

Revenue forecast in 2030

USD 27.3 billion

Growth rate

CAGR of 18.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Market representation

Revenue in USD Billion & CAGR from 2023 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Technology, application, material, region

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3D Systems, Inc.; EnvisionTEC; RegenHU; Allevi, Inc.; EOS GmbH; Materialise N.V.; Stratasys Ltd.; Nanoscribe GmbH; GPI Prototype and Manufacturing Services, LLC; 3T Additive Manufacturing Ltd; Fathom Manufacturing; General Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

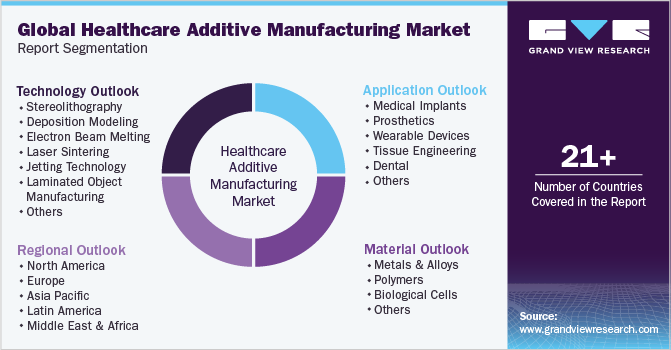

Global Healthcare Additive Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare additive manufacturing market report based on technology, application, material, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stereolithography

-

Deposition Modeling

-

Electron Beam Melting

-

Laser Sintering

-

Jetting Technology

-

Laminated Object Manufacturing

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Implants

-

Prosthetics

-

Wearable Devices

-

Tissue Engineering

-

Dental

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metals and Alloys

-

Steel

-

Titanium

-

Others

-

-

Polymers

-

Nylon

-

Glass-filled Polyamide

-

Epoxy Resins

-

Photopolymers

-

Plastics

-

Biological Cells

-

Others

-

-

Biological Cells

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare additive manufacturing market size was estimated at USD 7.4 billion in 2022 and is expected to reach USD 8.5 billion in 2023.

b. The global healthcare additive manufacturing market is expected to grow at a compound annual growth rate of 18.1% from 2023 to 2030 to reach USD 27.3 billion by 2030.

b. Laser Sintering dominated the healthcare additive manufacturing market with a share of 30.4% in 2022. This is due to its ability to produce a number of pieces at a time. Moreover, it does not require any support to build the objects, which is anticipated to drive the demand for this technology in the near future.

b. Some of the key healthcare additive manufacturing market players are GE Additive; 3D Systems, Inc.; EnvisionTEC; regenHU; Allevi, Inc.; EOS GmbH; Materialise N.V.; Stratasys Ltd.; Nanoscribe GmbH; GPI Prototype; and Manufacturing Services, LLC.

b. Key factors that are driving the healthcare additive manufacturing market growth include the increasing need for customized medical products such as implants coupled with the introduction of advanced technologies to produce simple as well as complex designs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."