- Home

- »

- Medical Devices

- »

-

Healthcare Analytical Testing Services Market Report, 2030GVR Report cover

![Healthcare Analytical Testing Services Market Size, Share & Trends Report]()

Healthcare Analytical Testing Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Medical Device Analytical Testing Services, Pharmaceutical Analytical Testing Services), By Region (North America, Europe, Latin America), And Segment Forecasts

- Report ID: GVR-4-68039-297-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Analytical Testing Services Market Summary

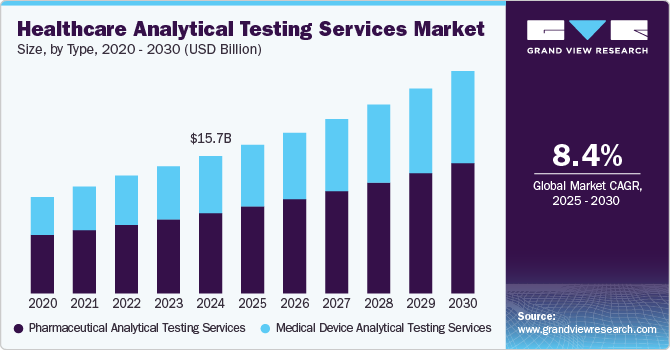

The global healthcare analytical testing services market size was estimated at USD 15.7 billion in 2024 and is projected to reach USD 25.47 billion by 2030, growing at a CAGR of 8.41% from 2025 to 2030. The main drivers of the industry include a rise in outsourcing activities of analytical testing services by pharmaceutical/medical devices companies, an increasing number of clinical trials that require analytical testing, and a growing focus on biosimilars.

Key Market Trends & Insights

- North America dominated the global market in 2024 with the largest share of 38.51%.

- The U.S. accounts for the highest share of the North America.

- On the basis of type segment, in 2024, the pharmaceutical analytical testing services segment dominated the market, accounting for a revenue share of 58.44%.

Market Size & Forecast

- 2024 Market Size: USD 15.7 Billion

- 2030 Projected Market Size: USD 25.47 Billion

- CAGR (2025-2030): 8.41%

- North America: Largest market in 2024

The COVID-19 pandemic has also helped in the growth of the industry. Besides, post-pandemic, the market has witnessed rapid development in drugs and therapeutics for its prevention, leading to a rise in analytical testing services.

Also, the rise in innovations and the development of new products is directly linked to the demand for testing services. There has also been an increase in outsourcing of these services due to pricing concerns, lead time to market, and competitive pressure. The development of biosimilars, vaccine combination products, and other innovative medicines has increased the demand for various analytical testing. Moreover, when companies diversify their business to a new location, it is mandatory to follow local standards, which may require conducting various tests. The U.S. market is expected to grow as chronic disease cases rise.

Analytical testing establishes the physicochemical characterization to prove the “sameness” of the biosimilar to the reference molecule throughout the development of biosimilars. As a result, the demand for healthcare analytical testing services is anticipated to increase in the coming years. For instance, in March 2024, LGM Pharma announced an advancement of its analytical testing services. In addition, the company has increased capacity by 50% for CDMO and invested USD 2 million. This advancement of the services will offer new suppository manufacturing expertise to its portfolio. Such an initiative is anticipated to drive the market.

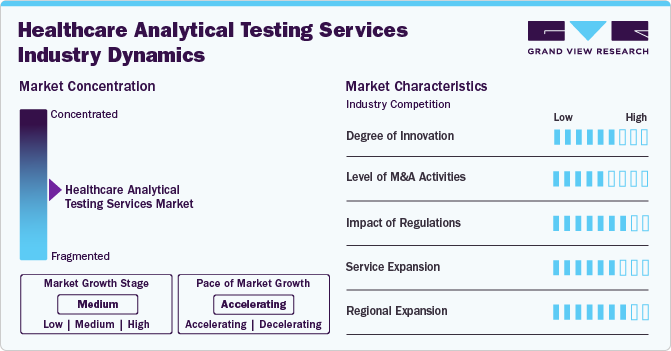

Market Concentration & Characteristics

The healthcare analytical testing services market growth stage is medium, and growth is accelerating. The market is characterized by the level of degree of innovation, M&A activities, regulatory impact, service expansions, and regional expansions.

Healthcare analytical testing services have observed rising demand due to increasing focus on regulation, safety, quality, in drug and medical device production that have increased the need for testing services in pharmaceutical/medical devices companies

Stringent regulations are anticipated to provide an advantage for healthcare analytical testing services that offer services according to regulatory standards. Regulatory bodies and other authorities ensure compliance with quality standards, which can positively impact the healthcare analytical testing services market.

Increasing research and development activities on the safety and quality of pharmaceutical products and the growing number of drug launches can have a positive impact on market dynamics.

Changing dynamics across the globe, and increased demand for complex pharmaceutical drugs and medical devices have increased the market demand. Increasing market expansions and service adoption can influence market dynamics positively.

The increase in R&D expenditure, the existence of technologically advanced service providers, and the rising requirement for new testing services fuel market growth.

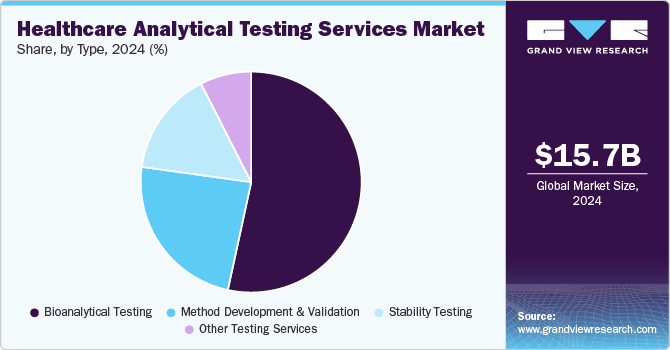

Type Insights

On the basis of type segment, the market includes medical device analytical testing services, and pharmaceutical analytical testing services. Medical device analytical testing services are further segmented into extractable and leachable, material characterization, physical testing, bioburden testing, sterility testing, and other tests. Pharmaceutical analytical testing services include bioanalytical testing, method development and validation, stability testing, and other testing services. In 2024, the pharmaceutical analytical testing services segment dominated the market, accounting for a revenue share of 58.44%. This growth can be attributed to the increasing demand from raw material suppliers and pharmaceutical manufacturers, innovation of new products that are directly linked to the demand for testing services, and a rise in complexity & number of standards, by which a single product may have to comply. In December 2023, Sterling Accuris Diagnostics mentioned the acquisition of Vaibhav Analytical Services. The acquisition will expand the company's range of services, such as pharmaceutical analytical testing. Such factors are anticipated to drive the segment.

The medical device analytical testing services segment is anticipated to grow substantially over the forecast period. Constant developments in new technologies, increasing expertise in difficult analytical measurements, stringent regulations, and an increasing number of small-scale manufacturers of medical devices that have to go through testing services are among the major factors responsible for the growth of this segment. Analytical testing services for medical devices are further categorized into physical, bioburden, and sterility testing, extractable & leachable, material characterization, and other tests.

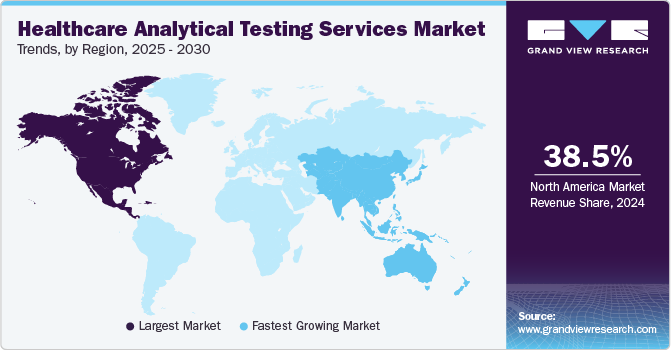

Regional Insights

North America dominated the global market in 2024 with the largest share of 38.51%, as most pharmaceutical and medical devices businesses in the U.S. perform most of their business in this region. This market will likely grow due to the region’s top manufacturing facilities that provide complex, highly reliable, and high-end pharmaceuticals & medical device products. In addition, increasing focus on consumer safety and rising requirements for highly regulated drug product processes to meet the health standards drive the market need. Besides, technological advancements certainly support to improve analytical instruments, making them selective, sensitive, and efficient further contributing to the market growth. Also, biopharmaceutical companies are focusing on the U.S. market through investments due to the rapidly growing healthcare sector and favorable regulatory reforms. For instance, in March 2024, LGM Pharma mentioned that the company had enhanced its capabilities with a 50% expansion & an investment exceeding USD 2 million in its standalone offering for analytical testing services by introducing new suppository manufacturing capabilities to its CDMO portfolio.

U.S. Healthcare Analytical Testing Services Market Trends

The U.S. accounts for the highest share of the North America healthcare analytical testing services market owing to the presence of established market players, increasing demand for a variety of analytical testing services, growing a broad array of industry verticals ranging from pharmaceutical to medical devices companies, increasing focus on legal and regulatory frameworks further drive the market needs. In addition, the country has an increased number of market players offering healthcare analytical testing services, assuring quality results for pharmaceutical and medical device products, further contributing to market growth.

The healthcare analytical testing services market in Canada is driven by an increased trend of healthcare analytical testing services, growing adoption of advanced analytical techniques for safety and effectiveness of novel medical treatments and medical devices. In addition, growing expansion of capabilities and services leveraged by the companies is anticipated to drive the market over the estimated time period. For instance, in September 2023, Cerba HealthCare announced the acquisition of CIRION, a Canadian company that is recognized for its integrated bioanalytical & global central laboratory services. Such initiatives are expected to drive market growth over the estimated period.

Europe Healthcare Analytical Testing Services Market Trends

Europe healthcare analytical testing services market is driven by increased stringent regulation for the safety of product and services, rising favorite sites for clinical trials, a growing pharmaceutical/medical devices industry, and emerging research and development activities are expected to stimulate market growth. For instance, in March 2024, Element launched its Rapid Response Pharmaceutical Testing Service from its Manchester Life Sciences laboratory, UK. The service will support the pharmaceutical industry by providing comprehensive testing solutions for customers across globe to meet the demands of fast-paced market.

Germany accounts for the highest share of the healthcare analytical testing services in the European market owing to the presence of established market players specializing in analytical testing, focusing on pharmaceuticals and medical devices to ensure the quality, and compliance of pharmaceutical products and medical devices. In addition, continuous demand for pharmaceutical/medical device products contributes to its prominence in this field, fueling market growth.

The UK's healthcare analytical testing services market is driven by growing demand for advanced drug formulation, increasing regulatory requirements for quality control, cost-effective services, and technological advancements. Such factors are expected to drive market growth.

Asia Pacific Healthcare Analytical Testing Services Market Trends

Asia Pacific healthcare analytical testing services Market is expected to grow at the highest CAGR over the forecast period. The increasing investments by companies from developed economies in enhancing regional analytical services, amendments made by regulatory bodies for changing evaluation standards to align with the global standards, and establishment of new facilities & alliances to increase the reach of their offerings to various regional locations. For instance, in September 2023, Labcorp mentioned the expansion of bioanalytical service offerings in the Asia Pacific region with an integrated laboratory in Singapore.

The healthcare analytical testing services market in Japan is driven by the growing burden of diseases, expanding clinical trials, technological advancements, and the requirement for high-quality analytical testing that supports the characterization of parameters, biological testing, impurity detection, and stability studies, which contribute to rapid & accuracy in analytical testing complying with pharmaceutical/medical devices companies’ requirements and clients’ specifications. Such factors are anticipated to drive the Japanese market.

The healthcare analytical testing services market in China is driven by the burden of chronic diseases and the presence of highly skilled professionals performing analytical testing with state-of-the-art equipment and facilities. Besides, the increase in the number of clinical trials, cost-effective testing, growing approval of new drugs, and technological advancement are boosting the growth of the Asia Pacific market. In addition, a focus on producing high-quality products with quality, safety, purity, and strength is anticipated to boost the country's market.

India's healthcare analytical testing services market is driven by the presence of key players offering comprehensive testing services for pharmaceutical and medical device companies to focus on their core area of R&D and Manufacturing. In addition, current demand for therapeutics, vaccines and medical devices has led to the rise in the requirement for various healthcare analytical testing services that comply with global regulatory requirements. For instance, in July 2023, Recipharm had announced the opening of a new analytical lab in India to enhance its testing capabilities for nitrosamines, extractables & leachable, and elemental impurity testing. The investment in the new lab responds to the increasing demand for a trusted testing services partner, further ensuring regulatory compliance, consumer protection & patient well-being.

Key Healthcare Analytical Testing Services Company Insights

The key market players implement several strategic initiatives, such as acquisitions, expansion, partnerships & agreements, collaborations, etc., to increase market presence and gain a competitive edge, driving the market growth. For instance, in August 2024, Eurofins CDMO Alphora Inc., mentioned its expansion for its drug product analytical services laboratory, increasing its footprint.

Key Healthcare Analytical Testing Services Companies:

The following are the leading companies in the healthcare analytical testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- ICON plc

- LabCorp

- Charles River Laboratories International, Inc.

- Syneos Health

- SGS SA

- Eurofins Scientific

- Pace Analytical Services, LLC

- Toxikon, Inc.

- Intertek Group

Recent Developments

-

In January 2024, Kindeva Drug Delivery expanded its analytical services, with the launch of a business unit offering integrated & stand-alone analytical support to the wider pharmaceutical, biopharmaceutical, and medical device industry.

-

In November 2023, RSSL announced its new analytical testing facility on the University of Reading Whiteknights campus in the UK. The new facility will enhance the company’s capacity to meet demand across the healthcare, life science, food, and consumer goods industries.

Healthcare Analytical Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.01 billion

Revenue forecast in 2030

USD 25.47 billion

Growth rate

CAGR of 8.41% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc., ICON plc, LabCorp, Charles River Laboratories International, Inc., Syneos Health, SGS SA, Eurofins Scientific, Pace Analytical Services, LLC, Toxikon, Inc., Intertek Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Healthcare Analytical Testing Services Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the healthcare analytical testing services market report on the basis of type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Analytical Testing Services

-

Extractable and Leachable

-

Material Characterization

-

Physical Testing

-

Bioburden Testing

-

Sterility Testing

-

Other Tests

-

-

Pharmaceutical Analytical Testing Services

-

Bioanalytical Testing

-

Method Development and Validation

-

Stability Testing

-

Other Testing Services

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare analytical testing services market size was estimated at USD 15.73 billion in 2024 and is expected to reach USD 17.01 billion in 2025.

b. The global healthcare analytical testing services market is expected to grow at a compound annual growth rate of 8.41% from 2025 to 2030 to reach USD 25.47 billion by 2030.

b. North America dominated the healthcare analytical testing services market with a share of 38.51% in 2024, owing to the growing presence of established manufacturers that provide complex, highly reliable, and high-end healthcare analytical testing services. In addition, increasing focus on consumer safety and rising requirements for highly regulated drug product processes to meet the health standards drive the market need in the region.

b. Some key players operating in the healthcare analytical testing services market include Thermo Fisher Scientifc Inc., ICON plc, LabCorp, Charles River Laboratories International, Inc., Syneos Health, SGS SA, Eurofins Scientific, Pace Analytical Services, LLC, Toxikon, Inc., Intertek Group.

b. Key factors driving the healthcare analytical testing services market growth include the rise in outsourcing activities of analytical testing services by pharmaceutical/medical devices companies, an increasing number of clinical trials that require analytical testing, and a growing focus on biosimilars.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.