- Home

- »

- Medical Devices

- »

-

Healthcare Contract Sales Organizations Market Report, 2030GVR Report cover

![Healthcare Contract Sales Organizations Market Size, Share & Trends Report]()

Healthcare Contract Sales Organizations Market Size, Share & Trends Analysis Report By Service (Personal Promotion), By End-use (Pharmaceutical Companies, Biopharmaceutical Companies), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-042-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global healthcare contract sales organizations market size was valued at USD 11.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The healthcare contract sales organizations market is witnessing growth due to various factors. One of the key factors driving the growth is the increasing number of new drug launches and the increase in pharmaceutical R&D activities. The biopharmaceutical pipeline is also growing, with over 45% of the total drugs in the pipeline being biopharmaceuticals. Lastly, the growing demand to reduce the cost associated with in-house sales is also driving the adoption of contract sales services. Contract sales organizations provide a cost-effective solution for pharmaceutical companies to promote and sell their products without incurring the high cost of maintaining an in-house sales team. All these factors are supporting the growth of the Healthcare CSO Market.

The COVID-19 pandemic has led to significant changes in the way that pharmaceutical sales activities are carried out, due to restrictions on physical visits to healthcare professionals' offices. As a result, remote communication channels such as web conferences, phone, email, and website engagement have become increasingly important for facilitating sales. This has led to an increase in the adoption of new technologies in pharmaceutical contract sales. According to a Hexaware survey from 2020, 43% of healthcare professionals limited or prevented visits from pharma representatives, with 28% indicating that these restrictions for medical representative visits would be permanent. Looking ahead, it is projected that more than 70% of activities will occur through digital mediums in a post-COVID-19 world. To stay competitive in this changing landscape, Healthcare Contract Sales Organizations must adapt to this new engagement model by equipping their sales teams with the necessary digital tools and technology to better understand customer needs in a hybrid or remote setting. Additionally, CSOs must operate within agile, self-sustaining feedback loops to remain competitive.

As the COVID-19 pandemic continues to recede, healthcare CSOs are facing a new reality. The post-COVID-19 world has ushered in a new era of remote sales activities, which require organizations to adapt their engagement models and sales strategies. In a hybrid or remote setting, digital tools and technologies have become essential for CSOs to gain a deeper understanding of customer needs, deliver effective communication and collaboration, and foster strong customer relationships. Therefore, organizations need to focus on investing in technology solutions that enable them to optimize their sales processes, analyze customer data, and provide personalized and effective experiences.

Over the last five years, the pharmaceutical industry has seen a surge in drug launches, coupled with regulatory scrutiny and increased competition among healthcare companies. Consequently, the demand for intense sales has grown, even as the traditional model of sales representatives visiting individual doctors is changing due to shifting promotional preferences and evolving provider habits. These factors are expected to drive the demand for contract sales services among healthcare companies, thereby promoting market growth.

Service Insights

The personal promotion segment dominated the market and accounted for the largest revenue share of 45.0% in 2022. Pharmaceutical companies are investing heavily in R&D activities and launching new products to increase their revenue year-on-year. Thus, commercial sales and marketing are crucial for their overall revenue, which supports the demand for personal promotion services.

The non-personal promotion segment is expected to advance at the highest CAGR of 7.9% over the forecast period. It includes medical affairs solutions, nurse (clinical) educators, remote medical science liaisons, and other services. There is a growing need to educate healthcare professionals about medical affairs and the side effects of medications to improve patient care. Medical science liaison services also inform pharmaceutical companies about business strategies in product development and market access. The importance of these services is expected to support the growth of the non-personal promotion segment.

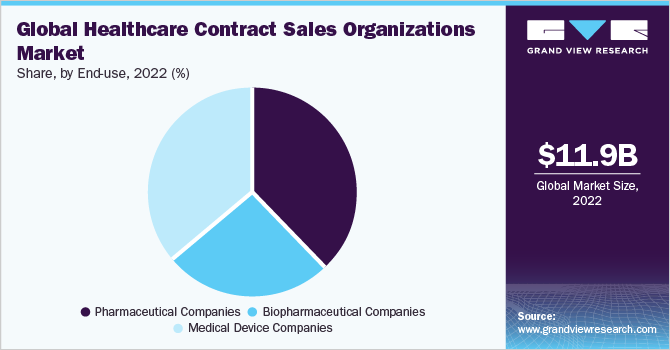

End-use Insights

The pharmaceutical companies segment dominated the market and accounted for the largest revenue share of 37.6% in 2022. The demand for contract sales services among pharmaceutical companies is primarily driven by the increase in the number of new small molecule drug launches globally, as well as the presence of numerous pharmaceutical companies offering similar products. Additionally, recruiting and retaining efficient sales professionals for pharmaceutical companies is challenging, further supporting the demand for CSO services in this segment.

The biopharmaceutical companies segment is expected to expand at the fastest CAGR of 8.7% over the forecast period. Biopharmaceutical companies are now focusing on improving their research capabilities, with over 45% of the total drugs in the pipeline being biopharmaceuticals, according to the Pharma R&D annual review in 2022. As these companies prioritize research, it is expected that they will increasingly outsource their sales activities to CSOs, promoting the segment's market growth.

Regional Insights

North America dominated the healthcare contract sales organization market and accounted for the largest revenue share of over 40.0% in 2022. The presence of several well-established CSOs such as Syneos Health, UDG Healthcare plc., and IQVIA, Inc. in the region has been one of the key reasons supporting the growth of the North American healthcare Contract Sales Organizations market. Additionally, the adoption of new technologies for pharmaceutical sales and a significant number of new drug launches in the region have further boosted the demand for pharmaceutical contract sales services.

The Asia Pacific region is expected to advance at a growth rate of 8.8% across the forecast period. This region has a significant number of pharmaceutical and biopharmaceutical companies that are consistently investing in novel therapeutics, leading to an increase in demand for contract sales activities. The cost of providing contract sales services in the region is lower than in other developed regions, which is expected to boost contract sales activities in the region and support the segment market.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives such as collaborations, partnerships, geographic expansions, and mergers and acquisitions aiming to strengthen their service portfolio, to provide a competitive advantage. For instance, Arecor Therapeutics plc's subsidiary, Tetris Pharma Ltd, announced a service agreement with Syneos Health in December 2022 to expand its commercial platform across Europe. Through this partnership, Syneos Health will provide outsourced contract sales services to support the launch of Tetris Pharma's flagship product, Ogluo, for diabetes patients in the initial launch territories. The collaboration is expected to increase healthcare practitioner awareness of the product and support its commercial success in the region. Some prominent players in the global healthcare contract sales organizations market are:

-

CMIC HOLDINGS Co., LTD.

-

Axxelus

-

EPS Corporation.

-

IQVIA, Inc.

-

Publicis Group

-

UDG Healthcare plc.

-

Syneos Health.

Healthcare Contract Sales Organizations Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.9 billion

Revenue forecast in 2030

USD 21.8 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; South Arabia; UAE; Kuwait

Key companies profiled

CMIC HOLDINGS Co., LTD.; Axxelus; EPS Corporation; QFR SOLUTIONS; MaBico; Mednext Pharma Private Limited; Peak Pharma Solutions Inc.; IQVIA, Inc.; Promoveo Health; UDG Healthcare plc.; Publicis Group; Syneos Health

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Contract Sales Organizations Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare contract sales organizations market report on the basis of service, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Promotion

-

Promotional sales team

-

Key account management

-

Vacancy Management

-

-

Non-Personal Promotion

-

Medical affairs solutions

-

Remote medical science liaisons

-

Nurse (Clinical) educators

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical companies

-

Biopharmaceutical companies

-

Medical device companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare contract sales organizations market size was estimated at USD 11.9 billion in 2022 and is expected to reach USD 12.9 billion in 2023.

b. The global healthcare contract sales organizations market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 21.8 billion by 2030.

b. By services, the non-personal promotion segment held a market share of 53.4% in 2022. The increasing rate of pharmaceutical, biopharmaceutical and MedTech companies outsourcing their commercial services will support the segment's growth.

b. Some key players operating in the healthcare contract research organizations market include CMIC HOLDINGS Co., LTD., Axxelus, EPS Corporation, IQVIA, Syneos Health, and a few others.

b. High adoption of new technologies for contract sales by healthcare contract sales organizations, an increase in the interest among end users to maximize the sales of biopharmaceutical and small molecule drugs, a need for cost reduction associated with in-house sales, a rise in regulatory scrutiny, evolving provider habits, growing demand for personalized medicine, and increasing competition among healthcare companies are some of the key factors supporting the growth of the Healthcare Contract Sales Organizations market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."