- Home

- »

- Medical Devices

- »

-

Healthcare Creditor Insurance Market Size Report, 2030GVR Report cover

![Healthcare Creditor Insurance Market Size, Share & Trends Report]()

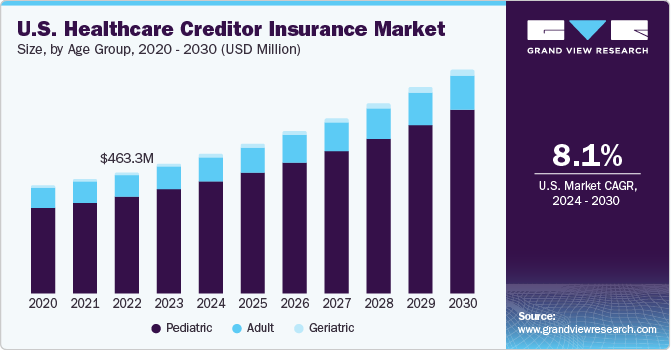

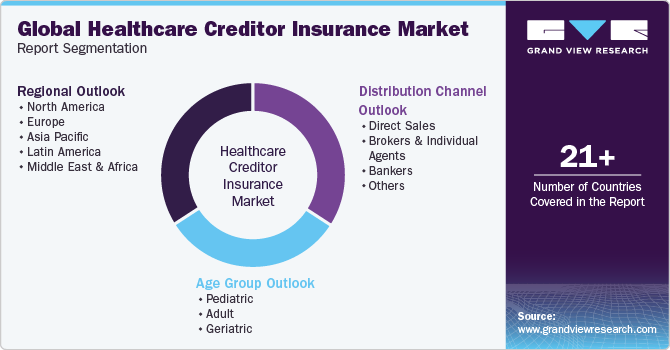

Healthcare Creditor Insurance Market Size, Share & Trends Analysis Report By Age Group (Pediatric, Adult, Geriatric), By Distribution Channel (Direct Sales, Brokers & Individual Agents, Bankers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-260-6

- Number of Report Pages: 133

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Healthcare Creditor Insurance Market Trends

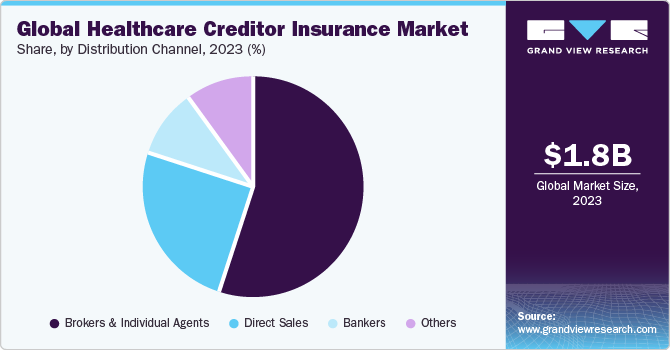

The global healthcare creditor insurance market size was estimated at USD 1.84 billion in 2023 and is projected to grow at CAGR of 7.94% from 2024 to 2030. Rising penetration owing to associated benefits such as financial stability and debt protection from unexpected events are key growth drivers of this market. Moreover, increasing healthcare costs, and growth in healthcare services have contributed to the growth of this market.

Escalating healthcare expenses worldwide drives healthcare providers to seek insurance solutions to mitigate financial risks associated with unpaid debts. As healthcare costs continue to rise due to factors like technological advancements, increased demand for services, and inflation, healthcare creditor insurance becomes increasingly essential for providers to safeguard their revenue streams. Economic fluctuations and uncertainties can affect individuals' ability to pay for healthcare services, leading to higher default rates on medical debts. In response, healthcare providers turn to creditor insurance to protect themselves against financial losses stemming from unpaid bills during economic downturns or periods of financial instability.

Increasing consumer awareness about the importance of healthcare creditor insurance in safeguarding their financial well-being drives demand for such products. As individuals become more informed about the risks associated with medical debt and the benefits of insurance coverage, they are more likely to seek out creditor insurance policies, fueling market expansion. Insurers that effectively educate consumers about the value proposition of creditor insurance can capitalize on this growing demand and gain a competitive edge in the market.

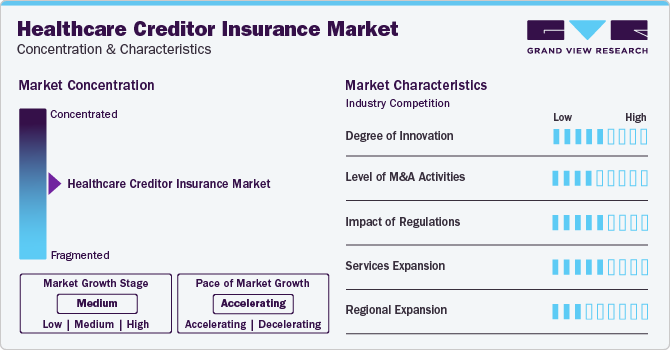

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation. Technology plays a significant role in driving innovation in the healthcare creditor insurance market. Digital platforms, mobile applications, and online tools are transforming how individuals plan for and manage healthcare creditor insurance.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by a key player. There is a medium level of merger and acquisition (M&A) activity, with key players engaging in strategic transactions to expand their market presence, diversify their offerings, and achieve growth objectives.

Regulations have a significant impact on the healthcare creditor insurance industry, influencing various aspects such as service offerings, pricing structures, consumer protections, and industry standards.

The market for healthcare creditor insurance is characterized by a low impact of regional expansion. Each region often has its own set of regulatory frameworks governing healthcare financing and insurance. Navigating these complex and diverse regulations can be challenging for insurers looking to expand into new regions.

The market is characterized by a high impact of service expansion. With healthcare costs consistently on the rise globally, there's a growing need for insurance solutions to mitigate financial risks associated with unpaid medical debts. Service expansion allows insurers to offer a wider range of coverage options tailored to meet the evolving needs of healthcare providers and consumers.

Age Group Insights

The adult segment dominated the market with the largest share of over 80% of the overall revenue in 2023. Adults typically make up the largest segment of the population in most countries. With aging populations in many parts of the world, the adult segment represents a significant portion of the insured population. Adults generally require more healthcare services compared to other age groups due to factors such as chronic diseases, preventive care, and routine medical check-ups. As a result, they are more likely to seek comprehensive health insurance coverage to manage their healthcare costs.

However, the pediatric segment is expected to witness a higher CAGR of 8.91% over the forecast period. As healthcare systems continue to evolve, there's a growing focus on pediatric healthcare needs. Children require specialized medical care, including preventive check-ups, vaccinations, and treatments for various ailments. This drives demand for health insurance coverage tailored specifically for pediatric care.

Distribution Channel Insights

The brokers and individual agents segment dominated the market in 2023 and accounted for the largest share of the overall revenue. Brokers and individual agents typically provide more personalized service compared to larger insurance companies. They can offer customized solutions and one-on-one support to healthcare providers, helping them navigate the complexities of healthcare creditor insurance. Moreover, brokers and agents often have extensive networks and relationships within the healthcare industry. They may have long-standing relationships with healthcare providers, which can give them a competitive advantage in the market.

The banker’s segment is expected to witness a higher CAGR of 6.59% over the forecast period.Banks are increasingly partnering with healthcare providers to offer insurance solutions to patients. This collaboration enables banks to offer tailored insurance products to healthcare clients, which can include creditor insurance to cover medical debts. As awareness of the importance of creditor insurance grows among healthcare providers and consumers, banks are expanding their offerings in this space to meet the rising demand. This increased awareness could contribute to the significant CAGR observed in the banker segment.

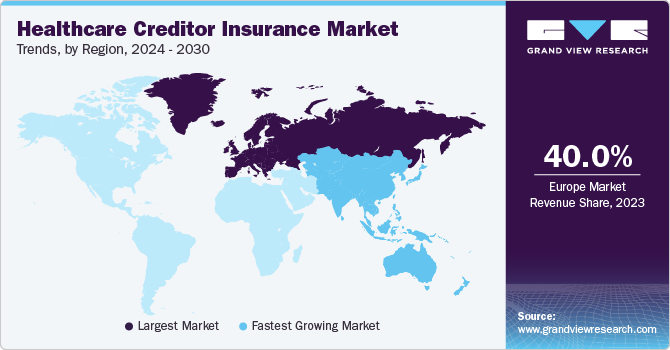

Regional Insights

The healthcare creditor insurance market in North America is expected to grow from 2024 to 2030. North America generally has high healthcare expenditure per capita compared to other regions. This high spending indicates a significant investment in healthcare services and infrastructure, which creates a demand for insurance products to mitigate financial risks associated with healthcare expenses.

U.S. Healthcare Creditor Insurance Market Trends

The healthcare creditor insurance market in the U.S. held the largest share in North America. Healthcare costs in the U.S. are notoriously high. Many individuals and families face financial strain due to medical bills, making creditor insurance an attractive option to protect against debt in case of illness or injury.

Europe Healthcare Creditor Insurance Market Trends

Europe dominated the global market in 2023 and accounted for the largest share of over 40% of the overall revenue. Many European countries have well-developed and established healthcare systems with a strong emphasis on universal coverage and comprehensive services. This creates a conducive environment for the growth of healthcare creditor insurance, as there is already a high level of demand for healthcare services.

The healthcare creditor insurance market in the UK held the largest share in Europe. The UK has a well-established regulatory framework for insurance, providing stability and confidence to both insurers and customers. Regulatory oversight ensures that insurance products meet certain standards and provides protection for policyholders.

The Spain healthcare creditor insurance market held a significant share in Europe. Spain has a competitive insurance market with numerous providers vying for market share. This competition can drive innovation and efficiency, leading to better products and services for consumers.

Asia Pacific Healthcare Creditor Insurance Market Trends

Asia Pacific is expected to witness a CAGR of 10.33% over the forecast period. As income levels rise and awareness about the importance of health insurance grows, more individuals in the Asia Pacific region are purchasing health insurance policies. However, not all health insurance plans cover the full cost of medical treatments, leaving patients responsible for certain expenses. Healthcare creditor insurance can help cover these gaps in coverage, making it an essential component of the healthcare ecosystem.

The healthcare creditor insurance market in China held the largest share in Asia Pacific. China's population is aging rapidly, leading to increased healthcare needs. As people age, they are more susceptible to health issues and require more medical care. Healthcare creditor insurance can help cover the costs of medical treatment and alleviate financial burdens on individuals and families.

The India healthcare creditor insurance market is expected to grow significantly in recent years. The Indian government has been taking steps to promote insurance coverage and improve healthcare accessibility. Initiatives like Ayushman Bharat, which aims to provide health insurance coverage to economically vulnerable sections of society, have significantly increased awareness and adoption of health insurance products.

Latin America Healthcare Creditor Insurance Market Trends

Latin America is expected to witness a significant CAGR over the forecast period. Many countries in Latin America are experiencing growth in healthcare expenditure due to factors such as population aging, increasing prevalence of chronic diseases, and improving healthcare infrastructure. As healthcare spending rises, there's a greater need for insurance coverage to manage financial risks associated with healthcare expenses.

The healthcare creditor insurance market in Mexico is expected to grow significantly in recent years. Mexico has been experiencing growth in its healthcare sector, driven by factors such as increasing healthcare expenditure, government initiatives to improve healthcare infrastructure, and rising demand for healthcare services due to a growing population and aging demographics.

Key Healthcare Creditor Insurance Company Insights

The key companies are undertaking various market strategies, such as merger & acquisition, collaboration, regional expansion, service portfolio expansion, and competitive pricing, to sustain in the competitive environment and acquire a higher market share. For instance, in October 2023, Atradius is further extending its reach into Eastern and Central Europe by inaugurating its latest office in Ljubljana, the capital of Slovenia. This move reflects Slovenia's increasing economic significance within Europe and underscores the company's dedication to global growth and delivering top-notch services with optimal client accessibility.

Key Healthcare Creditor Insurance Companies:

The following are the leading companies in the healthcare creditor insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Atradius N.V

- Coface

- Zurich Insurance Group

- Chubb Limited

- Tokio Marine HCC

- Allianz

- Securian Financial Group, Inc.

- Euler Hermes Group

Recent Developments

-

In November 2023, Zurich Insurance Group revealed a strategic collaboration with Kotak Mahindra Bank Limited, intending to acquire a 51% ownership in Kotak Mahindra General Insurance Company Limited for USD 488 million.

-

In January 2023, Coface acquired Rel8ed intended to strengthen its trade credit insurance using the latter’s analytical capabilities and improving business information.

Healthcare Creditor Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.98 billion

Revenue forecast in 2030

USD 3.13 billion

Growth rate

CAGR of 7.94% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Atradius N.V.; Coface; Zurich Insurance Group; Chubb Limited; Tokio Marine HCC; Allianz; Securian Financial Group, Inc.; Euler Hermes Group

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Creditor Insurance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare creditor insurance market report based on age group, distribution channels, and region:

-

Age Group Outlook (Revenue, USD Million/Billion, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Million/Billion, 2018 - 2030)

-

Direct Sales

-

Brokers and Individual Agents

-

Bankers

-

Others

-

-

Regional Outlook (Revenue, USD Million/Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare creditor insurance market size was estimated at USD 1.84 billion in 2023 and is expected to reach USD 1.98 billion in 2024.

b. The global healthcare creditor insurance market is expected to grow at a compound annual growth rate of 7.94% from 2024 to 2030 to reach USD 3.13 billion by 2030.

b. The brokers and individual agents segment dominated the market in 2023 and accounted for the largest share in the overall revenue. Brokers and individual agents typically provide more personalized service compared to larger insurance companies.

b. key players include Atradius N.V., Coface, Zurich Insurance Group, Chubb Limited, Tokio Marine HCC, Allianz, Securian Financial Group, Inc., Euler Hermes Group

b. Rising penetration owing to associated benefits such as financial stability and debt protection from unexpected events are key growth drivers to this market. Moreover, increasing healthcare costs, and growth in healthcare services have contributed to the growth of this market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."