- Home

- »

- Healthcare IT

- »

-

Healthcare Customer Data Platform Market Size Report, 2028GVR Report cover

![Healthcare Customer Data Platform Market Size, Share & Trends Report]()

Healthcare Customer Data Platform Market (2021 - 2028) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Mode (On-premise, Cloud-based), By Organization Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-648-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global healthcare customer data platform market size was valued at USD 215.4 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 27.2% from 2021 to 2028. Customer data platforms integrate a variety of information, structured as well as unstructured, and work with various data sets to transform the results into useful insights to drive the growth of the business. Customer data platforms draw out the insights with the help of sources such as personally identifiable information, third-party data, and streaming data of customer journey. The customer journey sources include user-level data, email cookies, contact numbers, social media profiles, purchase history, website trackers, emails, and CRM data.

The COVID-19 pandemic has had a dampening effect on business operations. Customer data platform offers potential solutions for businesses to recover from the impact of the pandemic. The pandemic has raised interest in information technology solutions to manage patient data. The social distancing and stay-at-home norms encouraged customer interactions B2B as well as B2C. Marketers are interested in technologies to collect customer data from digital channels. Customer data platforms work on the collection, unification, and workable data insights.

In response to the pandemic, customer needs and behavior patterns have shifted, especially in the healthcare industry. As the current scenario continues to impact customer behavior worldwide, brands must establish a process to keep up with the change. Hence, businesses need to re-evaluate their data analytics practices to keep pace with changing business environment. Customer data platforms are now offering COVID-19 impact strategies to help businesses in assessing their shifts and understand customer insights. Understanding customer preferences through predictive modeling of their data is key to success for businesses.

According to the estimates, over 90% of the data was created in the past few years alone. The huge data also presents some challenges such as storage issues, increased security risks, and privacy threats. In recent times, data security has become a crucial issue as many employees are now working from home due to the ongoing pandemic, on potentially unsecured networks.

In addition, customers use a variety of channels to interact with businesses. For instance, hospitals generate huge volumes of patient data through various departments. Customer data platforms create a widespread view of the individual customers by capturing information from multiple channels, linking data from those channels related to the same customer, and storing the data to track customer behavior over time. Hence, the information on those channels needs to be tracked carefully to unify the profile for individual customers. Otherwise, it can result in multiple profiles for the same patient and can be challenging for the customer data platform to draw insights.

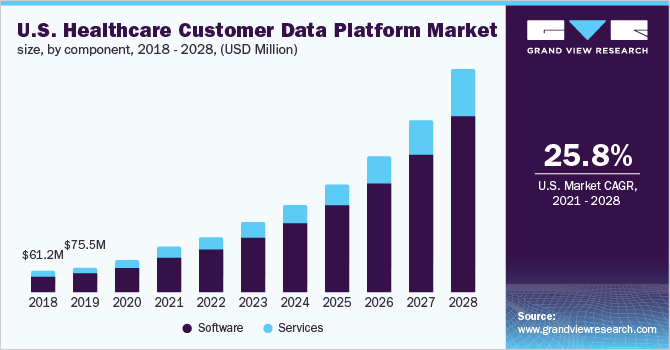

Component Insights

In 2020, the software segment dominated the market and held the largest revenue share of 77.6%. The segment is anticipated to showcase the fastest CAGR over the forecast period from 2021 to 2028. Customer data platforms are packaged software that assembles a comprehensive view of each customer and unifies the data for analysis. They fill the gap between missing data points, by acquiring fragments of customer data from various source channels. Some customer data platform systems go beyond just assembling customer data to include analysis and offer campaign functions of their own.

Deployment Mode Insights

The cloud-based deployment model dominated the market and accounted for the largest revenue share of 72.1% in 2020. The segment is likely to witness the fastest CAGR over the forecast period due to the quick access, higher flexibility, easier data back up, and lower handling costs. The real-time data tracking and storing, large storage spaces for humongous data, and remote access from any location and device are likely to drive the growth of the segment.

Application Insights

In 2020, the predictive analytics segment dominated the market and accounted for the largest revenue share of 24.9%. With the help of predictive modeling, customer data platforms can turn big volumes of data into usable insights that can guide business marketing decisions. Predictive analytics helps in identifying patterns from the processed customer data, which in turn, helps businesses in understanding what is most likely to happen next in a customer journey.

The personalized recommendations segment is anticipated to witness the fastest growth rate over the forecast period from 2021 to 2028. The delivery of meaningful, tailored, and relevant insights from customer data are crucial for brands to understand their customer preferences. Over the past few years, expectations of customers have increased. Hence, the brands are focusing on personalized customer data to understand individual customer patterns.

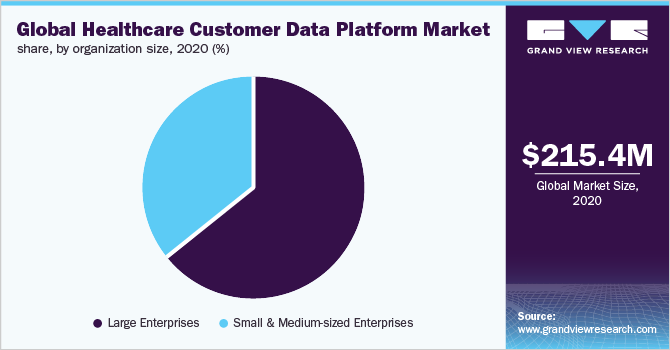

Organization Size Insights

In 2020, the large enterprises segment dominated the market and held the largest revenue share of 64.2%. This is owing to the growing demand for data platforms by larger organizations. Larger enterprises, such as big hospitals, deal with a huge volume of patient data and they require data being tracked across various channels. Moreover, as the scale of customer data continues to grow, the demand for sorting and unifying customer information is likely to grow at a significant rate.

The small and medium-sized enterprises segment is anticipated to witness the highest CAGR over the forecast period.

Regional Insights

In 2020, North America dominated the healthcare customer data platform market and accounted for the largest revenue share of 50.0%. The segment is likely to maintain its position throughout the forecast period. The market growth can be attributed to the higher adoption of technology, growing digital literacy, development of information technology infrastructure, and the presence of key market players in the region. On the other hand, Asia Pacific is expected to witness the fastest CAGR over the forecast period pertaining to the rising adoption of advanced healthcare IT solutions.

Key Companies & Market Share Insights

The market is becoming diverse as customer data platform deployment has the potential to provide huge gains in the healthcare industry by increasing operational efficiencies. It can offer an incremental lift for every stage of the customer/patient lifecycle. In the coming years, the customer data platform providers are most likely to rely on mergers and acquisitions to strengthen their market positions. It will be challenging for the market players to operate as individual entities in the future as the number of customer data platform vendors is high. The market players will be dependent on multichannel marketing, data personalization, and consent management for customer data. Some of the prominent players in the healthcare customer data platform market include:

-

Microsoft

-

Mercury Healthcare, Inc.

-

Tealium, Inc.

-

Innovaccer Inc.

-

Adobe

-

Treasure Data, Inc.

-

Skypoint Cloud Inc.

-

Solix Technologies, Inc.

-

Salesforece.com, Inc.

-

Reltio

Recent Developments

- In September 2021, Salesforce launched Health Cloud 2.0, a new platform to deliver improved health and safety for their communities, customers, and employees. The connected platform includes vaccination, testing, tracing, and wellness assessments.

Healthcare Customer Data Platform Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 298.3 million

Revenue forecast in 2028

USD 1.6 billion

Growth rate

CAGR of 27.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Component, deployment mode, organization size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Microsoft; Mercury Healthcare, Inc.; Tealium, Inc.; Innovaccer Inc.; Adobe; Treasure Data, Inc.; Skypoint Cloud Inc.; Solix Technologies, Inc.; Salesforece.com, Inc.;Reltio

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the global healthcare customer data platform market report based on component, deployment mode, organization size, application, and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2028)

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Million, 2016 - 2028)

-

On-premise

-

Cloud-based

-

-

Organization Size Outlook (Revenue, USD Million, 2016 - 2028)

-

Large Enterprises

-

Small & Medium-sized Enterprises

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Personalized Recommendations

-

Predictive Analytics

-

Marketing Data Segmentation

-

Customer Retention and Engagement

-

Security Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

- Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global healthcare customer data platform market size was estimated at USD 215.4 million in 2020 and is expected to reach USD 298.3 million in 2021.

b. The global healthcare customer data platform market is expected to grow at a compound annual growth rate of 27.2% from 2021 to 2028 to reach USD 1.6 billion by 2028.

b. North America dominated the healthcare customer data platform market with a share of 50.9% in 2020. This is attributable to the higher adoption of technology, growing digital literacy, development of information technology infrastructure, and the presence of key market players in the region.

b. Some of the key players operating in the healthcare customer data platform market are Microsoft; Mercury Healthcare, Inc.; Tealium, Inc.; Innovaccer, Inc.; Treasure Data, Inc.; Solix Technologies, Inc.; SkyPoint Cloud, Inc.; among others.

b. Key factors that are driving the healthcare customer data platform market growth include the integration of a variety of information into one data set, CDP insights with personally identifiable information & third-party data. Healthcare CDPs also help in understanding changed customer behaviors due to the Covid-19 pandemic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.