- Home

- »

- Medical Devices

- »

-

Healthcare Finance Solutions Market Size Report, 2030GVR Report cover

![Healthcare Finance Solutions Market Size, Share & Trends Report]()

Healthcare Finance Solutions Market Size, Share & Trends Analysis Report By Equipment Type (Specialist Beds, IT Equipment), By Healthcare Facility Type (Urgent Care Clinics, Pharmacies), By Service, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-898-5

- Number of Report Pages: 225

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Healthcare Finance Solutions Market Trends

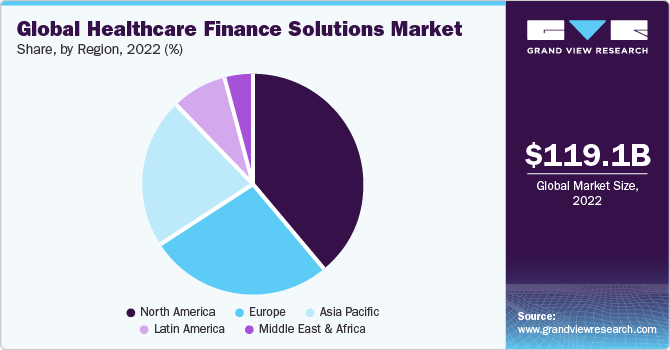

The global healthcare finance solutions market size was valued at USD 119.1 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The continuous need to improve processes and performance and the requirement for hi-tech equipment and technology are some of the factors driving industry growth. The rising cases of chronic diseases, the growing geriatric population across the globe, and advances in early diagnosis are driving global healthcare expenditures. In addition, some key providers are offering great deals to support the healthcare sector. For instance, Siemens Financial Services (SFS) is helping healthcare providers achieve their clinical and operational goals by adopting digitalization.

It is difficult for healthcare systems to succeed financially and provide high-quality care due to government budget constraints, scarce resources, and limited-to-nonexistent access to the capital market. However, decreasing cost of treatment owing to technological advancement is anticipated to drive industry growth over the forecast period. For instance, per an article published by the Equipment Leasing & Finance Association (ELFA), the equipment finance industry witnessed a volume increase of 7.4% in 2021.

Moreover, the -2.9% decline in the volume of imaging equipment finance solutions in 2020 due to the pandemic was mitigated by the ease of restrictions in 2021. The sudden spike in demand for hospital equipment mitigated the negative impact of the pandemic, and the market witnessed a drastic rebound in 2021, which is anticipated to be reflected throughout the forecast period. Healthcare is an evolving and rapidly expanding industry. Advancements in digital technology, the rising prevalence of diseases, and the introduction of advanced drugs & medicines have increased healthcare demand and expenditure.

The healthcare system is shifting from volume to value-based care to improve patient outcomes and engagement. Traditional healthcare services, referred to as “fee for service,” such as volume-based care, do not assure that patients will have a successful outcome. Whether a service is successful or necessary, healthcare providers are compensated for every service rendered. The primary objective of the value-based care delivery framework is to improve healthcare outcomes while keeping costs down. In this model, payers can designate a prime provider responsible for budget disbursement to secondary healthcare providers rather than paying healthcare providers directly.

Equipment Type Insights

Based on equipment, the industry is segmented into diagnostic/imaging equipment, specialist beds, surgical instruments, decontamination equipment, and IT equipment. The decontamination equipment segment accounted for the largest revenue share in 2022 as they are costly and need huge capital investment. Decontamination equipment is the patient care equipment. As more patients are exposed to infections, and the urgency of eradicating infections develops, the decontamination equipment segment is anticipated to grow. Surgical devices can only be considered safe to reuse after decontamination.

In addition, the increasing demand for the most appropriate care and the desired outcomes are likely to boost the demand for advanced equipment, which is anticipated to support market growth. The specialist beds segment is anticipated to grow at the fastest CAGR over the forecast period. This is due to the high demand for advanced beds in healthcare facilities. Moreover, favorable government initiatives for developing healthcare infrastructure are expected to fuel the industry growth over the forecast period. Specialist beds are produced to treat various injuries effectively. These include legacy beds, standing beds, and turning beds. These typically treat severe trauma, including back and spinal injuries.

Healthcare Facility Type Insights

Based on healthcare facility types, the healthcare finance solutions market is divided into outpatient imaging centers, hospitals & health systems, physician practices, outpatient surgery centers & outpatient clinics, diagnostic laboratories, skilled nursing facilities, urgent care clinics, pharmacies, and other healthcare providers. The hospital & health systems segment accounted for the largest revenue share in 2022, owing to a rise in the number of hospitals & health systems. Hospitals need financial support among frequently changing laws, increasing patient demands, and expanding healthcare access.

Simultaneously, healthcare facilities are expected to offer patients the most appropriate care and desired outcomes. The outpatient surgery centers segment is expected to grow at the fastest CAGR during the forecast period, owing to an increasing number of such facilities being established globally. As per an article published by Radius Anesthesia in 2021, the number of outpatient surgery centers, such as Ambulatory Surgical Centers (ASCs), has grown steadily. There has been a significant growth in the total number of outpatient surgeries performed across the ASCs. For instance, the total number of outpatient surgeries performed across the ASCs in 2008 was 32%, which has considerably grown to 80% by 2023.

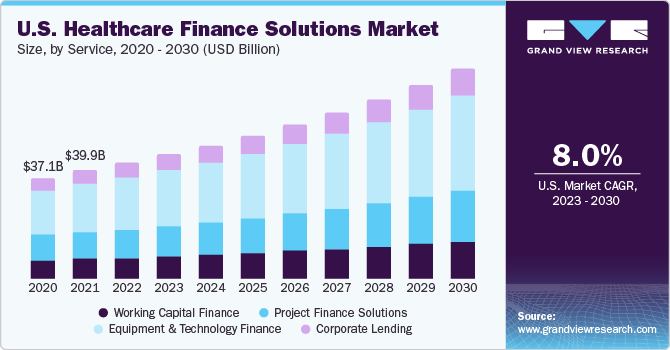

Services Insights

Based on services, the global industry has been further segmented into working capital finance, equipment and technology finance, corporate lending, and project finance solutions. The equipment and technology finance segment accounted for the largest revenue share of 45.1% in 2022. This is due to the huge capital required for the setup and the costly healthcare equipment, which requires financial support. Digital technology might evolve the patient experience by providing real-time access to medical services and related assistance.

This upgradation would require installing equipment that can handle and manage such tasks seamlessly. As technology advances and the demand for advanced healthcare increases, the cost of the devices will be a critical factor for healthcare providers. The cost of such devices would significantly impact the industry's growth. The corporate lending segment is expected to grow at the fastest CAGR of 8.2% during the forecast period. The segment's high growth is due to the increasing number of private players offering flexible solutions in terms of corporate lending, thus gaining attraction in developed and developing economies.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 38.7% in 2022. The region has a high adoption rate of advanced medical technology. Furthermore, the regional market expansion would be fueled by a growing geriatric population, an increase in chronic illness cases, and supportive government initiatives. Due to numerous key players, the region is also anticipated to experience profitable growth during the forecast period. The U.S. is one of the top producers and developers of technologically advanced products for the healthcare sector, raising the overall healthcare cost for patients.

Patients are now facing a greater financial burden as a result of this. There is a 40 to 50% increase in cost per year due to new medical technology. Asia Pacific is expected to grow at the fastest CAGR of 8.3% during the forecast period. A large patient base and an increase in healthcare expenditure are other factors to propel the market growth in the region. For instance, healthcare costs are increasing more rapidly than real wages, with increases of 3.3 times and 7.8 times in Australia and Singapore, respectively. Overall, 57% of consumers find paying for medical expenses out of pocket unaffordable, and 42% believe that private insurance premiums are out of control.

Key Companies & Market Share Insights

Industry participants invest in R&D, mergers, partnerships, etc., to strengthen their position. For instance, in July 2021, CIT Group Inc. acted as the primary arranger of a $100 million financing for the long-term acute care hospital division of Cornerstone Healthcare Group Holdings Inc. Similarly, Oxford announced the completion of a $50 million secured debt term loan with OncoResponse, a clinical-stage biotech company, in February 2022. The loan would be used to advance immunotherapies obtained from the immune function of top cancer responders. The agreement would pay for general operating capital and clinical trials for OR2805, the company's lead drug currently developing.

In June 2022, Francisco Partners acquired healthcare data and analytics resources from IBM's Watson Health unit. Merative is a new standalone firm that combines market-leading technologies that deliver value across the worldwide healthcare ecosystem and serves clients in the life sciences, employer, imaging, healthcare plan, government health, and human services industries. In April 2021, Siemens Healthineers AG completed the acquisition of Varian Medical Systems, Inc. The joint venture addresses the growing demand for personalized, data-driven cancer detection and precision cancer care, which enables fighting the world's rising cancer rates.

Key Healthcare Finance Solutions Companies:

- Koninklijke Philips N.V.

- General Electric Company

- Commerce Bancshares, Inc.

- Siemens Financial Services, Inc.

- Thermo Fisher Scientific, Inc.

- Stryker

- Gemino Healthcare Finance

- Oxford Finance LLC

- TCF Capital Solutions

- CIT Group, Inc.

Healthcare Finance Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 127.9 billion

Revenue forecast in 2030

USD 216.4 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, healthcare facility type, services, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; General Electric Company; Commerce Bancshares, Inc.; Siemens Financial Services, Inc.; Thermo Fisher Scientific; Stryker; Gemino Healthcare Finance; Oxford Finance LLC; TCF Capital Solutions; CIT Group Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Finance Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare finance solutions market report based on equipment type, healthcare facility type, service, and region:

-

Equipment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic/Imaging Equipment

-

Specialist Beds

-

Surgical Instruments

-

Decontamination Equipment

-

IT Equipment

-

-

Healthcare Facility Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Health Systems

-

Outpatient Imaging Centres

-

Outpatient Surgery Centres

-

Physician Practices & Outpatient Clinics

-

Diagnostic Laboratories

-

Urgent Care Clinics

-

Skilled Nursing Facilities

-

Pharmacies

-

Other Healthcare Providers

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Equipment And Technology Finance

-

Working Capital Finance

-

Project Finance Solutions

-

Corporate Lending

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East And Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare finance solutions market size was estimated at USD 119.1 billion in 2022 and is expected to reach USD 127.9 billion in 2023.

b. The global healthcare finance solutions market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 216.4 billion by 2030.

b. North America dominated the healthcare finance solutions market with a share of 38.7% in 2022. This is attributable to the rising high demand for advanced healthcare systems and electronic data management initiatives.

b. Some of the players operating in healthcare finance solutions market are Koninklijke Philips N.V., General Electric Company, Commerce Bankshares, Inc., Siemens Financial Services, Inc., Thermo Fisher Scientific, Inc., Stryker, Gemino Healthcare Finance, Oxford Finance LLC, TCF Capital Solutions, and CIT Group, Inc.

b. Key factors that are driving the healthcare finance solutions market growth include the continuous need to improve processes and performance and the requirement for hi-tech equipment and technology.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."