- Home

- »

- Medical Devices

- »

-

Healthcare Insurance Market Size, Industry Report, 2030GVR Report cover

![Healthcare Insurance Market Size, Share & Trends Report]()

Healthcare Insurance Market Size, Share & Trends Analysis Report By Provider (Public, Private), By Coverage Type, By Health Insurance Plans, By Level Of Coverage, By Demographics, By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-090-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global healthcare insurance market size was estimated at 2.4 trillion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2020 to 2027. The market is majorly driven by the high cost of healthcare, rising prevalence of chronic diseases as well as increasing disposable income. Besides, the federal government has a principal role in shaping all aspects of the health care sector. For instance, the Affordable Care Act (ACA) implemented in the U.S., focuses on expanding health coverage to individuals with low income. The act aims to improve the quality of healthcare services and reduce the cost of care, thereby expanding the coverage of insurance.

The COVID-19 has created a positive impact on the healthcare insurance industry as more and more people have started investing in healthcare plans. There has been a rise of 50.0% in the queries related to health policies due to the global pandemic. The outbreak of coronavirus is most likely to boost healthcare insurance growth in a relatively under-insured market by increasing the penetration rate of health coverage. People have timely realized the fact that during this pandemic situation, the only way to stay financially protected is by purchasing a health policy.

Service providers are focusing on offering customized policies owing to increasing competition in the industry as well as to attract the younger generation for maintaining their market share. Delivery of personalized services improves customer experience, attracting customers, and retaining loyal customers. Globally, most life insurance startups are trying to address the demand for customizable on-demand insurance.

The policy providers are using digital tools, artificial intelligence, and advanced analytics to gradually move towards an efficient and digitally-integrated ecosystem. This is allowing payers to implement innovative payment models & tailor care delivery for patients. Online portals, telemedicine, predictive & behavioral analytics are allowing health insurers to meet evolving customer expectations and reduce the cost of healthcare. Greater transparency of information &mounting out-of-pocket costs is encouraging consumers to take a more active role in determining the health services they receive.

Provider Insights

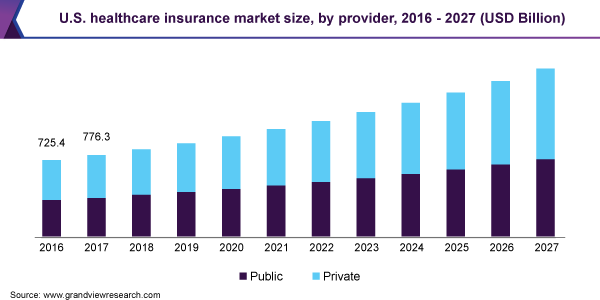

The public segment dominated the market for healthcare insurance and accounted for the largest revenue share of 55.6% in 2019. The state or federal government is the main insurer and direct provider of healthcare services. The federal government is playing a major role in healthcare since the establishment of Medicare and Medicaid in 1965. Besides, public healthcare insurance is more affordable as compared to the private one, as it generally requires no co-pays or deductibles and also has lower administrative costs.

The private segment is projected to register the fastest CAGR of 7.0% during the forecast period. There has been an increase in the number of private insurers that offer customizable products. In fact, in 2016, private healthcare insurance coverage was 67.5% among U.S. people. Also, many of the Affordable Care Act provisions involve an expansion of the private insurance market. It generates incentives for employers to provide health coverage and requires that people who are not covered by their government or employer insurance program purchase private healthcare insurance, thereby contributing to the growth of private payers.

Coverage Type Insights

The life insurance segment dominated the market for healthcare insurance and accounted for the largest revenue share of 53.3% in 2019. It is projected to dominate the market in terms of revenue and market share during the forecast period. This is attributed to various advantages offered by life policies such as permanent coverage and guaranteed death benefit. Besides, it also helps working professionals to save taxes by investing in these types of plans.

The term insurance segment is anticipated to grow at a lucrative rate of 7.4% over the forecast period. This is largely due to its lost cost and high coverage. It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

Health Insurance Plans Insights

The Preferred Provider Organization (PPO) segment led the market for healthcare insurance and accounted for the largest revenue share of 28.0% in 2019. They are the most common health plans and offer a large network of healthcare providers so that the insured person has many hospitals and doctors to choose from. Also, there is little or no paperwork required which creates a preference for preferred provider organization, thereby boosting the market growth.

The point of service segment is anticipated to witness the fastest growth rate of 7.1% in the market for healthcare insurance over the forecast period. It is a combination of preferred provider organization (PPO) and Health Maintenance Organization (HMO) plans. It gives more freedom to choose healthcare providers as compared to HMO. In the case of an out-of-network provider, a moderate amount of paperwork is required.

Level of Coverage Insights

The silver health plans segment dominated the market for healthcare insurance and accounted for more than 55.0% of revenue share in 2019. Silver plans are most popular in the federal marketplace and state exchanges with 70.0% of the stock consumers choosing them. They are usually for those with one or two mild health conditions & require some medication.

The gold plans segment is anticipated to register the fastest growth rate of 7.6% during the forecast period. This may be attributed to the increasing prevalence of chronic diseases and the need to visit doctors very often and requires expensive medications that would be impossible to afford out of pocket.

Demographics Insights

The adult segment dominated the healthcare insurance market with a revenue share of 59.8% in 2019. The segment is also anticipated to retain its position over the forecast period. There is a high prevalence of lifestyle disease in the adult population that can increase health risk in the future. The population is more prone to cardiac and other diseases that require hospitalization. Also, around 57.0% of the U.S. had life insurance in 2019, thereby boosting the market growth.

The senior segment held a second-largest CAGR of 6.6% in the market for healthcare insurance over the forecast period. It includes people over 65 years of age who are more susceptible to chronic diseases and thus lead to an increased rate of hospitalization. The healthcare insurance plans for seniors are more of a necessity especially in case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

End-use Insights

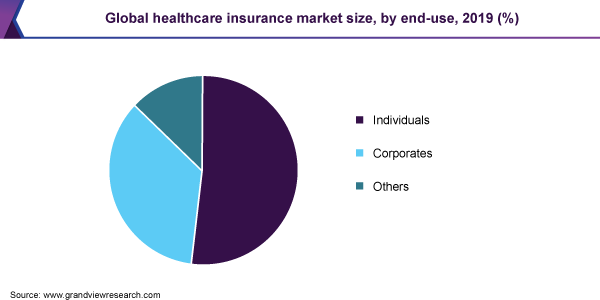

The individual segment led the market for healthcare insurance with 51.7% of the revenue share in 2019. A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

The corporate segment is expected to grow at a lucrative rate of 7.1% over the forecast period. This may be due to the low cost associated with corporate plans as compared to the individual health plans. They offer cheaper coverage for better conditions and it is easier to gain coverage for pre-existing conditions. But they are applicable only until the employee is on the job.

Regional Insights

North America healthcare insurance market dominated the market and accounted for the largest revenue share of 41.0% in 2019. The region is anticipated to continue to lead over the forecast period. This can be attributed to the presence of a large number of insurance companies offering health and life products. Also, the Affordable Care Act in the U.S. makes it mandatory to have coverage. The states that did not obey were to be penalized by the federal government.

Asia Pacific Healthcare Insurance Market Trends

The Asia Pacific healthcare insurance market is anticipated to witness a lucrative growth of 8.9% during the forecast period. This would be largely due to an increase in the public and private health expenditures, penetration of insurance services in the rural and urban centers, along with favorable government policies. The rapidly growing middle-class population in developing countries of the region is boosting the demand for insurance. Life insurers in the region are moving toward protection-based products, with a large focus on accident and health policies, rather than fee-based products.

Key Companies & Market Share Insights

The market for healthcare insurance is highly competitive in nature. Significant factors affecting competitive nature are the quick adoption of advanced technology for improved healthcare as well as the introduction of new products. Besides, players are adopting various strategies such as expansion, merger and acquisition, partnership, and collaboration to gain market share.

For instance, in June 2018, Allianz Group and UniCredit signed an agreement in Central and Eastern Europe. The partnership combined UniCredit’s robust banking franchise with Allianz’s deep insurance expertise. Through the partnership, UniCredit’s customers in Slovakia, Slovenia, Romania, Hungary, Czech Republic, Croatia, and Bulgaria can access Allianz’s insurance solutions via UniCredit’s broad branch network and digital platforms. The partnership also strengthens Allianz’s expansion in growing insurance markets.

Key Healthcare Insurance Companies:

The following are the leading companies in the healthcare insurance market. These companies collectively hold the largest market share and dictate industry trends.

-

Anthem, Inc.

-

Allianz

-

Centene

-

Cigna

-

CVS Health Corporation

-

Humana

-

Kaiser Foundation

-

Bupa

View a comprehensive list of companies in the Healthcare Insurance Market

Healthcare Insurance Market Report Scope

Report Attribute

Details

Market Size value in 2020

USD 2.5 trillion

Revenue forecast in 2027

USD 4.0 trillion

Growth Rate

CAGR of 6.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Provider, coverage type, health insurance plans, level of coverage, demographics, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; India; Japan; China; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Key companies profiled

United Healthcare; Aetna; Anthem, Inc.; Aviva; Allianz; Centene; Cigna; CVS Health Corporation; Humana; Kaiser Foundation; Bupa

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global healthcare insurance market report on the basis of provider, coverage type, health insurance plans, level of coverage, demographics, end-use, and region:

-

Provider Outlook (Revenue, USD Billion, 2016 - 2027)

-

Public

-

Private

-

-

Coverage Type Outlook (Revenue, USD Billion, 2016 - 2027)

-

Life Insurance

-

Term Insurance

-

-

Health Insurance Plans Outlook (Revenue, USD Billion, 2016 - 2027)

-

Health Maintenance Organization (HMO) plans

-

Preferred Provider Organization (PPO)

-

Exclusive Provider Organization (EPO)

-

Point of Service (POS)

-

High Deductible Health Plan (HDHP) plans

-

-

Level of Coverage Outlook (Revenue, USD Billion, 2016 - 2027)

-

Bronze

-

Silver

-

Gold

-

Platinum

-

-

Demographics Outlook (Revenue, USD Billion, 2016 - 2027)

-

Minors

-

Adults

-

Seniors

-

-

End-use Outlook (Revenue, USD Billion, 2016 - 2027)

-

Individuals

-

Corporates

-

Adults

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global healthcare insurance market size was estimated at USD 2.3 trillion in 2019 and is expected to reach USD 2.5 trillion in 2020.

b. The global healthcare insurance market is expected to grow at a compound annual growth rate of 6.7% from 2020 to 2027 to reach USD 4.0 trillion by 2027.

b. North America dominated the healthcare insurance market with a share of 41.0% in 2019. This can be attributed to the presence of a large number of insurance companies offering health and life products. Also, the Affordable Care Act in the U.S. makes it mandatory to have coverage. The states that did not obey were to be penalized by the federal government.

b. Some key players operating in the healthcare insurance market include Aetna; Aviva; Allianz; CVS Health Corporation; Kaiser Foundation; and Bupa.

b. Key factors that are driving the healthcare insurance market growth include the high cost of healthcare, rising prevalence of chronic diseases as well as increasing disposable income.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."