- Home

- »

- Medical Devices

- »

-

Healthcare Mobile Robots Market Size & Share Report, 2030GVR Report cover

![Healthcare Mobile Robots Market Size, Share & Trends Report]()

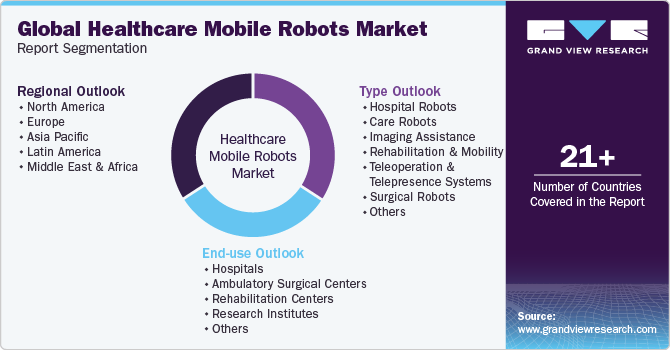

Healthcare Mobile Robots Market Size, Share & Trends Analysis Report By Type (Hospital Robots, Care Robots, Imaging Assistance), By End-use (Hospitals, Research Institutes), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-127-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Healthcare Mobile Robots Market Trends

The global healthcare mobile robots market size was estimated at USD 3.85 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.1% from 2024 to 2030. Mobile robotics involves using independent or semi-independent devices to move and perform tasks without direct human control. In healthcare, these robots are crucial for various tasks. The market growth can be attributed to introduction of technologically advanced robotic equipment in the healthcare sector, rapidly growing elderly population across the globe, shortage of skilled nurses and healthcare staff, and increasing healthcare spending.

Moreover, mobile robotics offers a significant advantage in healthcare by enhancing patient care. They can handle repetitive, time-consuming, and risky tasks, such as transporting medication and supplies, and help staff to focus on crucial responsibilities, leading to quicker responses and better patient outcomes. In addition, mobile robots boost efficiency by performing tasks precisely and quickly, reducing errors, and streamlining processes. For instance, they can accurately sort and deliver medication, preventing common mistakes in healthcare facilities.

As the aging population increases and a shortage of skilled human labor becomes persistent, governments worldwide are considering the integration of robots to address this gap. For instance, according to data published by Reliefweb in July 2022, the proportion of the global population aged 65 years or older is expected to increase from 10% in 2022 to 16% in 2050. As per the projections, the number of individuals aged 65 years or above is anticipated to be over twice the number of children under the age of 5 and roughly equal to the number of children under 12 by 2050 . Concurrently, in the U.S. alone, healthcare sector employs over 4.5 million professionals, encompassing nursing and orderly aids, home health caregivers, and personal care assistants. Owing to this, use of AI-powered robots for elderly care is becoming increasingly popular. These robots have the potential to offer companionship and aid to senior citizens, who may struggle with staying active and engaged, especially if they live independently and are retired.

In September 2022, UBTECH ROBOTICS CORP LTD organized a forum focused on "Integrating High Technology with Elderly Care Services," alongside unveiling their "Global Strategy of Smart Elderly Care." The event convened healthcare and elderly care experts to explore technology-powered smart elderly care system's creation and application, facilitating a valuable exchange of insights. Notably, UBTECH introduced robotics products tailored to healthcare and elderly care. Furthermore, noteworthy collaborations with entities such as China Academy of Transportation Sciences Group, China Merchants Health Care, and Medical Care Service Company Inc. (MCS) in Japan were announced. This initiative holds potential for enhancing elderly care through robotics and fueling progress in the healthcare mobile robots market.

In addition, the necessity for effective disinfection and cleaning within hospitals is a driving force behind the growth of healthcare mobile robots. Infections can spread rapidly in hospitals, causing huge financial losses, and putting patients at risk. For instance, according to World Health Organization (WHO) hospital infection treatment costs around USD 7.66 billion every year in Europe and USD 6.5 billion in the U.S. To combat this problem, cleaning and disinfection robots are becoming increasingly popular as they offer consistent, precise, and comprehensive sanitization, reducing the risk of hospital-acquired infections. These robots use UV light or chemical disinfectant sprays, are easy to operate, and can clean a hospital room within 10 minutes.

Furthermore, this mobile robot can navigate complex hospital environments and autonomously disinfect a wide range of surfaces, and reduce workload of healthcare staff. With growing demand for improved infection control and operational efficiency, the healthcare mobile robot market is experiencing rapid growth, with various innovative technologies.

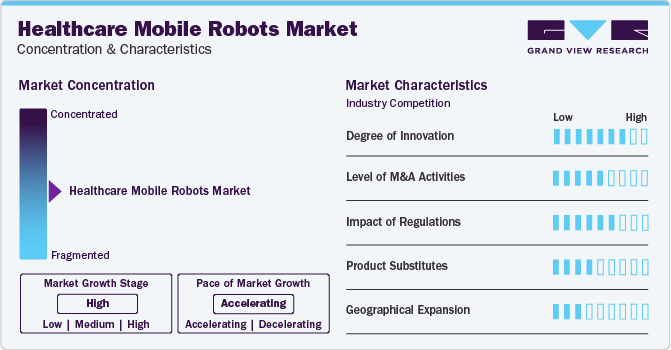

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The healthcare mobile robots market is characterized by a high degree of innovation owing to rise in adoption of robotics solutions in the healthcare industry. The application of Artificial Intelligence has played a pivotal role in enhancing this field. AI-driven software solutions for healthcare mobile robots facilitate patient monitoring and telemedicine tasks. Subsequently, innovative AI applications are constantly emerging, and creating new robotic solutions.

The healthcare mobile robots market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new robotics technologies and solutions and need to consolidate in a rapidly growing market.

The healthcare mobile robots market is also subject to increasing regulatory scrutiny. Each country has its regulatory authority for a structured regulatory framework. For instance, in the U.S. FDA regulates healthcare mobile robots. These regulations cover testing of material biocompatibility, strength, electrical system verification, using the product software under hazardous & normal conditions, testing manual controls, and clinical testing, among others.

Several market players are adopting geographical expansion strategies to strengthen their positions in the market and expand their manufacturing capacities. Due to rising awareness and increased use of robotic solutions in healthcare sector, the demand for robotic technology has increased across the globe. Thus, many companies are adopting this strategy to expand their product portfolio.

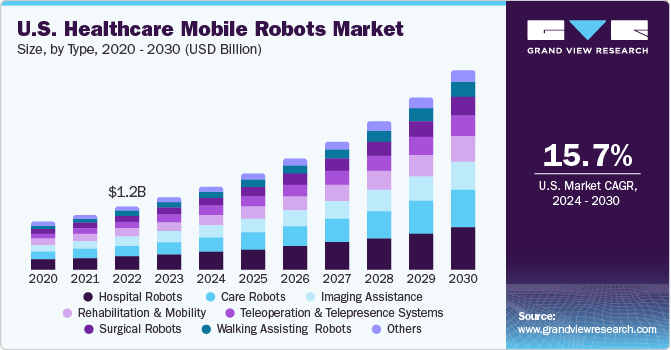

Type Insights

By type, the hospital robots segment accounted for the largest revenue share of 21.2% in 2023. Hospitals require many tasks to be performed efficiently, including medication delivery, equipment transportation, and patient assistance. Mobile robots excel in executing these tasks, contributing to the smooth functioning of hospitals. Robots enhance operational efficiency by automating routine tasks such as delivering supplies, transporting specimens, and managing logistics within the hospital. Moreover, hospital-acquired infections (HAI) are a major concern. For instance, as per the WHO report, in hospital-born infants, HAIs account for an estimated 4%-56% of all deaths during the neonatal period. This has led to a surge in demand for robots to disinfect healthcare settings, ensuring a safe & sanitized environment for patients and healthcare professionals. This streamlined workflow benefits hospital staff and patients.

The care robots segment is expected to witness the fastest CAGR growth over the forecast period. As the global population ages, there's an increasing demand for elder care and assisted living. Care robots can provide valuable support in activities of daily living, medication reminders, and companionship for the elderly, contributing to their well-being and independence. For instance, in July 2023, Changi General Hospital deployed three autonomous mobile robots, including Emergency Department innovation (EDi), Medication Delivery innovation (MEDi), and Blanket Delivery innovation (BLANKi), to complement nursing care within and around the emergency department.

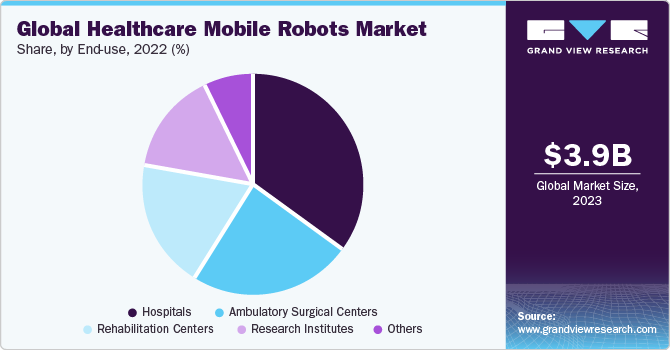

End-use Insights

Based on end-use, the hospital segment accounted for the largest revenue share in 2023 and is expected to witness the fastest CAGR over the forecast period. Hospitals operate in intricate and dynamic settings that demand various tasks to be executed efficiently. Mobile robots are well-suited to navigate these complexities and perform patient transportation and supply management tasks. They can also contribute to improved patient care by handling routine and non-clinical tasks, allowing healthcare professionals to focus on direct patient interactions and critical medical procedures.

Moreover, robots streamline hospital operations by autonomously carrying out tasks such as material transport, waste disposal, and sterilization. This leads to reduced operational bottlenecks and enhances overall efficiency. For instance, in August 2020, five hospital departments at the Zealand University Hospital in Denmark implemented MiR100, a mobile robot from Mobile Industrial Robots (MiR). The robot travels over 10 km weekly, improving service, preventing shortages, and minimizing storage space. In addition, these robots play a pivotal role in maintaining a hygienic environment by performing tasks that minimize human contact & the spread of infections. They can safely deliver medications, transport contaminated materials, and disinfect hospital rooms.

Moreover, growing recognition of robots healthcare benefits can lead to supportive regulations, fostering hospital adoption. Hospitals prioritize cost-effective care, and robots streamline operations, cutting errors and boosting efficiency. Their ability to drive efficiency, elevate patient care, and adapt to changing healthcare dynamics positions the hospital segment for a rapid growth rate in the forecast period.

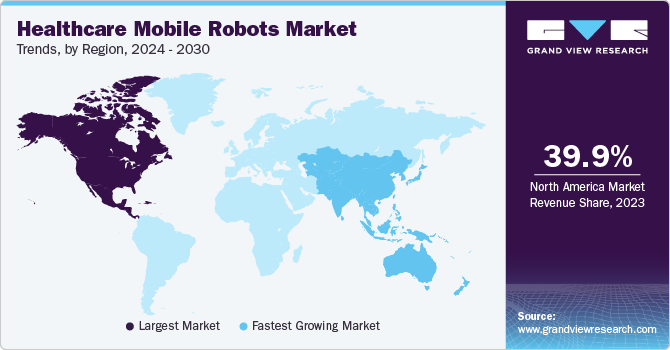

Regional Insights

North America dominated the market and held the largest revenue share of 39.9% in 2023. This is due to the presence of favorable government initiatives & highly developed healthcare infrastructure. In addition, rising disposable income levels, growing funds, increasing adoption of robotic technologies, including service robots in healthcare institutions, and product launches in the healthcare mobile robots market are some factors anticipated to support regional market growth. For instance, in September 2023, Diligent Robotics announced a fund of USD 25 million to boost R&D activities & production and triple its reach in nursing robots.

Asia Pacific region is anticipated to witness the fastest CAGR growth over the forecast period. Emerging robotics startup companies are playing a pivotal role in propelling the growth of the Asia Pacific region's healthcare mobile robots market. The region's growth is attributed to the introduction of new health tech startups that are reshaping healthcare by innovating medical technologies that optimize patient care, enhance healthcare delivery, and reduce costs. For instance, in March 2023, according to an article in the Times of India, the number of such ventures in India has increased from 452 to nearly 90,000 since 2016, with over 8,000 health tech startups valued at around USD 2 billion and growing at a rapid rate of 40%. Union Finance Minister highlighted India's status as third-largest global startup ecosystem and second in innovation quality among middle-income countries, backed by initiatives like the Startup India Seed Fund Scheme and a National Data Governance Policy. This favorable environment benefits various industries, including this market, where technological advancements from health tech startups can drive the development of enhancing patient care, healthcare processes, and advanced robotic solutions.

Key Healthcare Mobile Robots Companies Insights

Some of the key players operating in the market include Toyota Motor Corporation, ABB Ltd, Omron Corporation, Amazon.com Inc., and Medtronic.

-

Toyota Motor Corporation operates through three business segments: automotive, financial services, and others. The company markets its products in more than 170 countries. The company launched the Welwalk business, which provides assistive robots to rehabilitation hospitals in Japan

-

Omron Corporation operates in four business segments, Industrial Automation Business (IAB), Electronic and Mechanical Components business (EMC), Social Systems, Solutions, and Service Business (SSB), and Healthcare Business (HCB). The company offers products and services in over 130 countries

Aethon, Ateago Technology, Xenex Disinfection Services Inc., and Awabot are some of the emerging market participants in the healthcare mobile robots market.

-

Aethon provides mobile robotics solutions for the healthcare and hospitality industries. Aethon's Autonomous Mobile Robots (AMR) are used to move materials & supplies for hospital clients and can travel over 370 miles per week on average

-

Awabot is a French company with the aim of deploying robotic solutions that seamlessly integrate with humans. The company offers two telepresence solutions that find applications in various areas, such as distance learning for hospitalized students

Key Healthcare Mobile Robots Companies:

The following are the leading companies in the healthcare mobile robots market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these healthcare mobile robots companies are analyzed to map the supply network.- Toyota Motor Corporation

- ABB Ltd

- Aethon

- Omron Corporation

- Teradyne

- Ateago Technology

- VGo Communications, Inc.

- Awabot

- Xenex Disinfection Services Inc.

- Amazon.com, Inc.

- Medtronic

Recent Developments

-

In September 2023, the U.S. FDA granted Xenex Disinfection Services, Inc. a De Novo authorization to use a LightStrike+ UV robot to disinfect healthcare facilities

-

In April 2023, ABB Ltd. Robotics upgraded its AMRs by incorporating Visual Simultaneous Localization and Mapping (Visual SLAM) technology. This new technology was expected to help AMRs make better navigation decisions based on environmental factors

-

In December 2022, ABB Ltd. opened its advanced robotics factory in Shanghai, China. The facility spans an area of 67,000 square meters and is fully automated & flexible. ABB invested USD 150 million in this production and research center, which would employ digital & automation technologies to produce the next generation of robot

Healthcare Mobile Robots Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.44 billion

Revenue forecast in 2030

USD 10.88 billion

Growth rate

CAGR of 16.1% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Toyota Motor Corporation; ABB Ltd.; Aethon; Omron Corporation; Teradyne; Ateago Technology; VGo Communications, Inc.; Awabot; Xenex Disinfection Services Inc.; Amazon.com, Inc.; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Mobile Robots Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. For this report, Grand View Research has segmented the healthcare mobile robots market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Robots

-

Care Robots

-

Imaging Assistance

-

Rehabilitation and Mobility

-

Teleoperation and Telepresence Systems

-

Surgical Robots

-

Walking Assisting Robots

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Rehabilitation Centers

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare mobile robots market was valued at USD 3.85 billion in 2023 and is estimated to grow to USD 4.44 billion in 2024.

b. The global healthcare mobile robots market is estimated to grow at a compound annual growth rate (CAGR) of 16.1% from 2024 to 2030 to reach USD 10.88 billion in 2030.

b. North America dominated the global healthcare mobile robots market and held the largest revenue share of 39.9% in 2023. This is due to the presence of favorable government initiatives & highly developed healthcare infrastructure.

b. Some of the major players in the healthcare mobile robots market are: o Toyota Motor Corp. o ABB Ltd o Aethon o Omron Corporation o Amazon o Mobile Industrial Robots o Nordson Corp. o Teradyne o Ateago Technology o VGo Communications, Inc. o Awabot o Techcon o Xenex Disinfection Services, LLC o Intuition Robotics

b. The market’s growth can be attributed to the introduction of technologically advanced robotic equipment in the healthcare sector, the rapidly growing elderly population worldwide, the shortage of skilled nurses and healthcare staff, and the increasing healthcare spending.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."