- Home

- »

- Medical Devices

- »

-

Healthcare Staffing Market Size, Share & Trends Report, 2030GVR Report cover

![Healthcare Staffing Market Size, Share & Trends Report]()

Healthcare Staffing Market Size, Share & Trends Analysis Report By Service Type (Travel Nurse, Per Diem Nurse, Locum Tenens, Allied Healthcare), By End-use, By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-245-7

- Number of Report Pages: 117

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

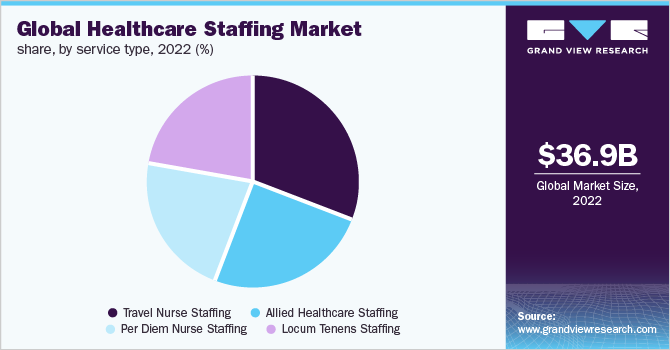

The global healthcare staffing market size was valued at USD 36.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.93% from 2023 to 2030. Some of the factors driving market growth include increased knowledge of the benefits of temporary employment, job-related incentives, and the availability of opportunities across the country. Technology is currently one of the major drivers of increased healthcare employment. Advancements in medical devices have led to various innovations, such as medical informatics and telehealth, increasing the need for a skilled labor force to handle both the technical and non-technical aspects of these devices.

One of the important factors driving the market is the benefits and advantages of becoming a per diem nurse, travel nurse, or locum tenens. In addition, to their passion to serve others, physicians, and nurses give high importance to flexible work schedules. Temporary staffing solutions enable medical professionals to choose when they are willing to work or are ready to take on new assignments. Higher flexibility of working hours and greater exposure to various healthcare systems across different locations are the factors expected to result in an increase in the number of individuals choosing allied healthcare, per diem, travel nurse, or locum tenens as a career option.

Significant growth in the number of government and non-government hospitals, long-term care centers, acute care centers, and other types of health institutions is expected to considerably drive market progression. Improving healthcare infrastructure and increasing investment in public health is leading to an increase in the number of hospitals. New laws are expected to provide allied staff, especially nurses, the authority to act as patients’ primary advocates by initiating health plans to facilitate better care. Such laws protect and promote patients’ right to make informed care decisions.

The high surge of COVID-19 infections resulted in restrictions on operation in most long-term care facilities. The cancellation of elective procedures resulted in a decline in the demand for locum tenens specialists and allied health workers. The demand for nurses at care services facilities also reduced. During the COVID-19 pandemic, there was a significant surge in demand for travel nurse staffing services and workforce technology solutions. The rising number of COVID-19 infections has increased the demand for travel and per diem nurses.

Post-COVID-19 pandemic the demand for healthcare staffing is expected to rise as long-term care facilities & hospitals will require new staff for the pending elective treatment procedures and specialized nursing care. It also impacted the medical device providers to keep up with the rising demand. Bryan Hanson, CEO, Zimmer Biomet, stated that “Make no mistake, supply is a real problem. And it's putting pressure on the business.” Further, the demand for travel nurses & per diem nurses is expected to be higher due to the growing in-home nursing services. The opening of more options during the COVID-19 pandemic is boosting the scope for temporary staffing. An increase in the retirement rate of medical staff due to the COVID-19 burden is also propelling the demand for staffing services.

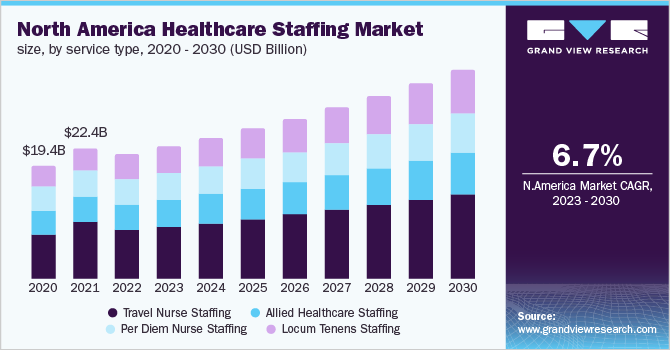

COVID-19 healthcare staffing market impact: 16.03% growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The high surge of COVID-19 infection resulted in restrictions on operation in most long-term care facilities. Elective & nonemergency treatments were canceled. The cancellation of elective procedures resulted in a decline in the demand for locum tenens specialists and allied health workers. The demand for nurses at care services facilities also reduced

Post-COVID-19 pandemic the demand for healthcare staffing is expected to rise as long-term care facilities & hospitals will require new staff for the pending elective treatment procedures and specialized nursing care. The pandemic has increased healthcare awareness resulting in a high surge in demand for healthcare staffing services.

During the COVID-19 pandemic, there was a significant surge in demand for travel nurse staffing services and workforce technology solutions. The rising number of COVID-19 infections has increased the demand for travel and per diem nurses. According to an Avant Healthcare Professionals study, 90% of medical facilities in 2020 agreed to use travel nurses to manage COVID-19 patients. Similar was continued during the devastating 2021 second wave

Post-COVID-19 as well the demand for travel nurses & per diem nurses is expected to be higher due to the growing in-home nursing services. The opening of more options during the COVID-19 pandemic is boosting the scope for temporary staffing. An increase in the retirement rate of healthcare staff due to the COVID-19 burden is also propelling the demand for staffing services.

Upcoming regulatory reforms will disperse the concentration of influence held by physicians and specialists, allowing markets to target multiple members of the healthcare value chain. For instance, in 2021, National Commission for Allied and Healthcare Professions bill was approved in India aimed at regulating and standardizing the education and practice of allied and healthcare professionals. Governments in developing countries are investing in improving their health infrastructure, which is expected to improve access to health services. This may increase the demand for medical staff. The increasing prevalence of chronic diseases such as cancer and diabetes in developing countries is opening important prospects for the global industry.

Service Type Insights

In terms of revenue share, the travel nurse segment dominated the market in 2022 with a revenue share of 31.3%. The rapid rise of the travel nurse staffing segment can be ascribed to quick service, cost-effectiveness, and nurse shortage. This scenario is anticipated to continue in the coming years.

Locum tenens is expected to witness the fastest growth rate during the forecast period. Employers’ cost-effectiveness and physicians’ demand for locum tenens work are key factors driving the market growth. Locum tenens are preferred by hospitals, groups, and clinics during peak seasons and when a permanent physician is on vacation or a sabbatical because it is more cost-effective. Furthermore, due to the shorter period of the assignment, flexible schedule, travel opportunities, and diversified clinical experience, medical doctors/physicians choose to serve as locum tenens.

Per diem nurses are paid daily and are hired for short-term assignments through specialized job placement firms or hospital staffing pools. The major reasons nurses choose per diem are the relatively high earnings and work flexibility. Due to spontaneous leaves, vacations, or high acuity, clinics, outpatient facilities, and hospital groups face both last-minute and temporary staffing demands. Per diem shifts can be scheduled through a staffing agency or with a hospital directly. Furthermore, some nurses take per diem jobs as a way to gather work experience in various hospital settings before accepting a permanent post.

End-use Insights

Based on end-use, the market has been segmented into hospitals, ambulatory facilities, clinics, and others. The hospitals segment dominated the market with a revenue share of 42% in 2022. The segment is anticipated to register maximum market growth. A majority of hospitals are building their workforce as per the regulations imposed by the government. Various government bodies have set norms for standard nurse-to-patient ratio, which needs to be maintained by hospitals. Patient-centric regulations and laws are boosting the number of staff members in hospitals to meet the high demand.

Furthermore, the dearth of skilled professionals and nurses in hospitals affects patient care as well as clinical outcomes. As per the U.S. Bureau of Labor Statistics, from 2020 to 2030, the need for medical staff is expected to rise and around 275,000 additional nurses will be required. Employment opportunities for nurses are expected to increase at a rapid rate (9%) than all other occupations from 2016 to 2026.

The clinics segment is expected to have a significant growth rate during the forecast period. Rising demand for physicians and the increasing number of a large network of clinics are anticipated to drive the segment. Furthermore, the COVID-19 pandemic led to a dearth of nurses in clinics. As a result, clinics were facing challenges in hiring qualified medical professionals.

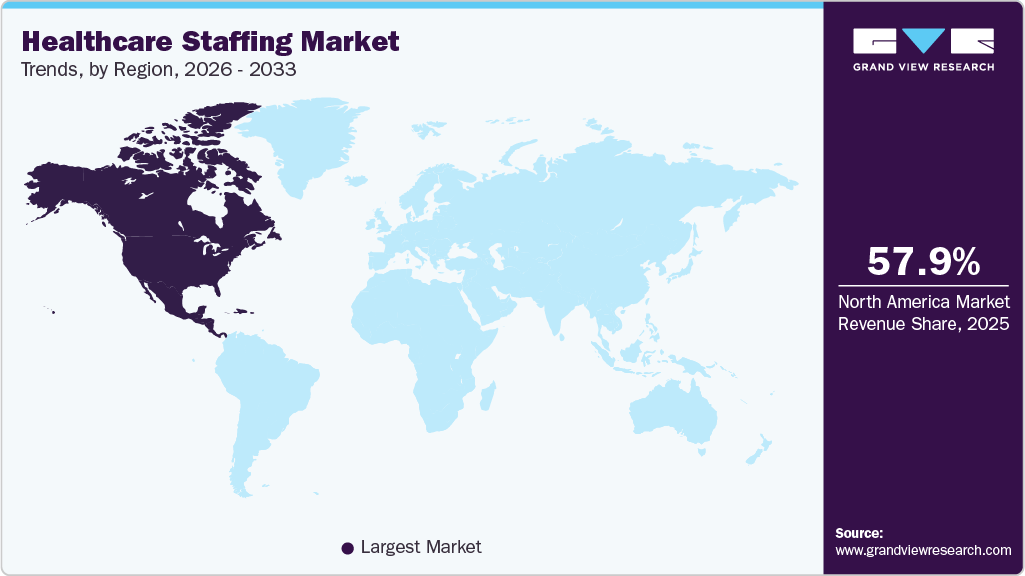

Regional Insights

North America dominated the global market in 2022 and accounted for the largest revenue share of 58.0%. The local presence of key market players, a rise in the geriatric population, and the increase in demand for medical staff by hospitals owing to financial setbacks associated with hiring permanent staff are some of the major factors contributing to the largest share held by this region.

Asia Pacific is expected to attain the fastest CAGR during the forecast timeline, as demand for a contract workforce rises in the region. The increased demand might be linked to the fact that contract hire does not carry the obligations that are traditionally connected with permanent employees. Furthermore, the recruitment process is faster, and recruiters have access to a bigger pool of prospects.

Europe has been witnessing a severe shortage of care professionals in the past few years. The omicron waves of 2021 further worsened the scenario. According to the European Public Service Union’s January 2022 estimates, Europe has a shortage of 2 million healthcare workers. Furthermore, according to the European Commission, employment in the healthcare sector is expected to rise to 24,009,000 professionals by 2025 with over half of the medical professionals expected to retire or leave the sector for other reasons. All these factors are likely to drive the market in the coming years.

Key Companies & Market Share Insights

To improve their market share, key market players are pursuing strategies, such as mergers and acquisitions, to broaden their service offerings and geographical reach. For example, in May 2021, AMN Healthcare acquired the virtual care management startup Synzi for USD 42.6 million. Some of the prominent players in the global healthcare staffing market include:

-

Envision Healthcare Corporation

-

AMN Healthcare

-

CHG Management, Inc

-

Maxim Healthcare Group

-

Cross Country Healthcare, Inc.

-

Aya Healthcare

-

Trustaff

-

TeamHealth

-

Adecco Group

-

LocumTenens.com

Healthcare Staffing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 39.3 billion

Revenue forecast in 2030

USD 62.8 billion

Growth Rate

CAGR of 6.93% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Envision Healthcare Corporation; AMN Healthcare; CHG Management, Inc; Maxim Healthcare Group; Cross Country Healthcare, Inc.; Aya Healthcare; Trustaff; TeamHealth; Adecco Group; LocumTenens.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Staffing Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the healthcare staffing market report based on service type, end-use, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Travel Nurse Staffing

-

Per Diem Nurse Staffing

-

Locum Tenens Staffing

-

Allied Healthcare Staffing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Facilities

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global healthcare staffing market size was estimated at USD 36.9 billion in 2022 and is expected to reach USD 39.3 billion in 2023.

b. The global healthcare staffing market is expected to grow at a compound annual growth rate of 6.93% from 2023 to 2030 to reach USD 62.8 billion by 2030.

b. North America dominated the healthcare staffing market with a share of 58% in 2022. This is attributable to the presence of major players, lack of skilled professionals as compared to demand, and an increasing geriatric population.

b. Some of the key players in the market are Almost Family; Adecco Group; CHG Management, Inc.; AMN Healthcare; Cross Country Healthcare, Inc.; Envision Healthcare Corporation; inVentiv Health; TeamHealth; and Maxim Healthcare Services, Inc.

b. Key factors that are driving the healthcare staffing market growth include a significant rise in the geriatric population, increasing awareness regarding the benefits of temporary staffing, job-related perks, and availability of opportunities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."