- Home

- »

- Medical Devices

- »

-

Hearing Aids Market Size, Share And Trends Report, 2030GVR Report cover

![Hearing Aids Market Size, Share & Trends Report]()

Hearing Aids Market Size, Share & Trends Analysis Report By Product Type (BTE, Canal Hearing Aids), By Technology (Digital, Analog), By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-166-5

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hearing Aids Market Size & Trends

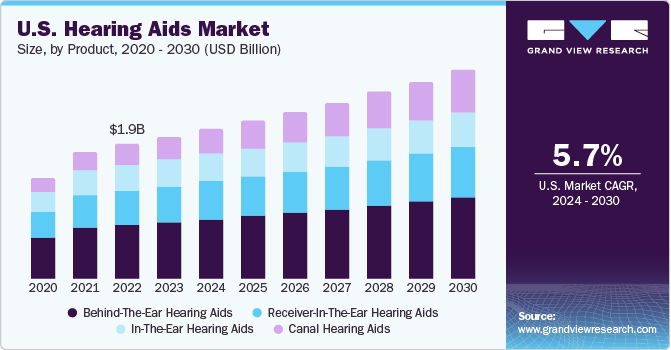

The global hearing aids market size was estimated at USD 7.96 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.78% from 2024 to 2030. The market growth can be attributed to the increasing adoption of hearing aids devices, growing awareness regarding technologically advanced devices for auditory impairment, and the increasing prevalence of hearing loss due to the growing geriatric population.

The market is a highly technologically-driven industry that has seen the emergence of novel products including invisible, smart linked, AI and Bluetooth enabled aids. Companies are improving patients' experiences with new features and technology, which is expected to fuel market growth in the coming years.

In the U.S. approximately 15% of adult population suffer from hearing loss as per the National Institute on Deafness and Other Communicable Disorders. Government and regulatory support are projected to have a long-term positive impact on the aid sector in the U.S. Moreover, general healthcare service associations of local governments in both developed and developing economies are emphasizing early screening of deafness. As the healthcare sector in developing economies is moving towards privatization, healthcare infrastructure in these countries is undergoing rapid development. Education and increased awareness regarding health among people are also playing an important role in increasing the demand for these devices and their diagnostic services.

The COVID-19 outbreak had a significant impact on the healthcare industry. Several clinics and audiology shops had to take special measures to ensure safety, which led to delays in less severe hearing loss-related procedures. Manufacturers were trying to meet the rising demand and improve their product portfolio to acquire a substantial market share by launching new products that the consumers prefer. For instance, in August 2020, GN Store Nord A/S launched a hearing aid, ReSound ONE. The purpose of the aid is to solve challenges faced by people with auditory impairment. These advanced product launches made by market players across the market during the COVID-19 and post-pandemic period are expected to increase their revenue and sales by meeting the growing demands of the patients in the market.

Market Concentration & Characteristics

The global market is characterized by a high degree of innovation owing to the rapid technological advancements and increasing demand for hearing aids devices. Subsequently, the integration of direct streaming capabilities and sound processing algorithms optimizes sound quality & clarity, leading to improved hearing outcomes. Smartphone compatibility and remote programming are other technologies.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in March 2023, EssilorLuxottica acquired Nuance Hearing, an Israel-based start-up. This acquisition is expected to help EssilorLuxottica to expand in the hearing aids business with the development of lenses fitted with acoustic technology. This is due to several factors, including the desire to gain access to new technologies and, need to consolidate in a rapidly growing market.

The market is also subject to increasing regulatory scrutiny. Governments are collaborating with healthcare institutions to raise awareness about hearing health and promote early intervention, further propelling the market.

Regional expansion by key market players in different regions is expected to increase due to growing awareness about auditory impairment among developing countries, and investment in development of innovative hearing aids. This strategic focus enhances the effectiveness of solutions tailored to specific geographic areas.

Sales Channel Insights

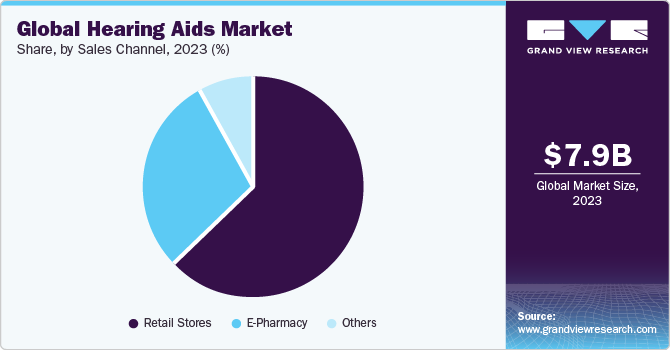

Based on sales channel, the retail stores segment led the market with the largest revenue share of 71% in 2023. This is attributable to manufacturing companies opening their retail stores for rapid expansion and improved consumer experience. Retail stores are further segmented into company-owned and independent retail stores. Independent retail stores dominated the market owing to the low entry barriers for new retail outlets, high-profit margin, and high level of interaction with customers.

E-Pharmacy sales segment is projected to witness a significant CAGR over the forecast period. The internet plays a significant role in making a purchase decision and acquiring information about hearing aids, especially for young adults and millennials. These players help the wearer to get screened for auditory loss and acquire more information on technology. Their website also helps the wearer to make product and price comparisons, thus helping in making a purchase decision. These E-Pharmacy sales channels also help to increase the affordability and availability of aids in the global market.

Regional Insights

Europe dominated the market with a revenue share of 38% in 2023. This is attributed to an increase in the prevalence of deafness and rising awareness regarding technological advancements. According to the WHO's 2021 report, 196 million people in the WHO area of Europe had some hearing impairment, with 57.3 million (6.2%) having a severe or higher degree of hearing impairment. Until 2050, 236 million individuals in Europe will suffer from hearing impairment in some form. Due to the increase in the aging population in Europe, hearing impairment is expected to rise, which, in turn, is expected to drive the market in Europe.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period. Moreover, technological advancements and partnerships among market players are expected to drive market growth in Asia Pacific. China has one of the largest geriatric populations. As per the Population Reference Bureau 2023, the Chinese geriatric population is expected to reach 366 million by 2050. Furthermore, the market in China is poised to benefit from increased product launches and strategic partnerships. For instance, in September 2022, Tencent Holdings launched an innovative hearing aid device incorporating artificial intelligence (AI) technology. Consequently, the expanding elderly population, coupled with the surge in product development and collaborative efforts, plays a pivotal role in fostering the market growth.

Product Type Insights

Based on product type, the behind-the-ear hearing aids segment led the market in 2023 with the largest revenue share of 40%. BTE aids consist of a small curved case that comfortably fits behind the ear. Modification of these products is possible by connecting them to external sound sources, such as infrared listening systems and auditory training equipment. Various BTE models are Bluetooth compatible, and they enable better wireless connectivity, thus driving the market.

These devices also provide a higher sound amplification owing to a strong amplifier and a large battery. Furthermore, behind-the-ear (BTE) devices are easy to handle and clean and are preferred by the younger population as they can fit into various ear molds. Moreover, they don’t need device replacement as the child grows. With technological advances, new products such as the Mini BTE are developed, which are smaller in size and provide more comfort. These factors are responsible for the growth of these BTE products in the market.

The canal hearing aids segment is anticipated to grow at the fastest CAGR over the forecast period. Canal devices are discreet devices, which is one of the critical success factors for their rapid growth. Wearing hearing aids comes with a stigma, therefore, young adults prefer canal devices over other devices. In addition, these devices are technologically advanced and significantly cancel external voices and reduce tinnitus. The above-mentioned factors are responsible for the growth of canal devices in the coming years.

Technology Insights

Based on technology, the digital hearing aids segment held the largest market revenue share of 93% in 2023 and iswa anticipated to grow at the fastest CAGR over the forecast period. This is attributable to the increased preference and technological advancements in digital devices compared to analog devices. These devices offer enhanced flexibility in programming for matching the transmitted sound to meet the needs of a specific pattern of auditory impairment

Analog hearing aids segment is expected to witness the moderate CAGR during the forecast period. These devices work by increasing the intensity of continuous sound waves. All sounds, including speech & noise, are uniformly amplified by them. Due to low cost and a small number of resistant customers, manufacturers have been making and selling analog audiology devices.

Key Companies & Market Share Insights

Some of the key players operating in the market include Sonova, GN Store Nord A/S, SeboTek Hearing Systems, LLC, and WS Audiology.

-

Sonova with its focus on innovation, diverse brand portfolio, and global reach, stands as a prominent player in the field of hearing care solutions, offering a comprehensive range of products to enhance the quality of life for individuals with auditory impairments

-

WS Audiology offers a comprehensive range of devices designed to address different levels of hearing loss. The products aim to provide users with improved sound quality, comfort, and customization

-

MDHearing, Foshan Vohom Technology Co., Ltd., and Eargo, Inc. are some of the emerging market participants in the market.

-

Foshan Vohom Technology Co., Ltd. specializes in the design, development, and distribution of hearing aids and hearing solutions.Their products aim to provide users with enhanced sound quality, comfort, and personalized hearing solutions.

-

Eargo, Inc. offers individuals with mild to moderate hearing loss. The company's focus on discreet and technologically advanced hearing aids appeals to consumers looking for modern and user-friendly solutions

Key Hearing Aids Companies:

- Audicus

- Audina Hearing Instruments, Inc.

- Eargo, Inc.

- GN Store Nord A/S

- Horentek Hearing Diagnostics

- MDHearing

- SeboTek Hearing Systems, LLC

- Sonova

- Starkey Laboratories, Inc.

- WS Audiology

Recent Developments

-

In October 2023, GN Store Nord A/S launched its next-generation hearing aid product range, ReSound Nexia, which includes two RIE models, which are non-rechargeable and Micro RIE, which is rechargeable

-

In March 2023, JIUYEE announced the launch of JIUYEE Real Pro. This launch will enable the firm to expand its product offerings. The product features with cutting-edge technology to offer users clear and natural sound quality

-

In March 2022, Sonova acquired the consumer division of Sennheiser electronic GmbH & Co. KG. This will enhance Sonova's product portfolio while also expanding its geographical footprints

Hearing Aids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.48 billion

Revenue forecast in 2030

USD 12.57 billion

Growth rate

CAGR of 6.78% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Audicus; Audina Hearing Instruments, Inc.; Eargo, Inc.; GN Store Nord A/S; Horentek Hearing Diagnostics; MDHearing, SeboTek Hearing Systems; LLC; Sonova; Starkey Laboratories, Inc.; Vision, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hearing Aids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global hearing aids market report based on product type, technology, sales channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-the-Ear Hearing Aids

-

Receiver-in-the-Ear Hearing Aids

-

Behind-the-Ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Sales

-

Company Owned

-

Independent Retail

-

-

E-Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hearing aids market size was estimated at USD 7.96 billion in 2023 and is expected to reach USD 8.48 billion in 2024.

b. The global hearing aids market is expected to grow at a compound annual growth rate of 6.78% from 2024 to 2030 to reach USD 12.57 billion by 2030.

b. Behind-the-ear hearing aid dominated the hearing aids market with a share of 40.1% in 2023. This is attributable to the fact that various BTE models are Bluetooth-compatible and enable better wireless connectivity.

b. Some key players operating in the hearing aids market include Sonova, GN Store Nord A/S, Starkey Laboratories, Inc., WS Audiology, Audina Hearing Instruments, Inc., Eargo, Inc., Horentek Hearing Diagnostics, Jabra, MDHearing, Audicus, SeboTek Hearing Systems, LLC

b. Key factors that are driving the hearing aids market growth include the increasing adoption of these devices, growing awareness about technologically advanced devices for the treatment of deafness, and the increasing prevalence of hearing loss due to the growing geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."