- Home

- »

- Petrochemicals

- »

-

Heat Transfer Fluids Market Size And Share Report, 2030GVR Report cover

![Heat Transfer Fluids Market Size, Share & Trends Report]()

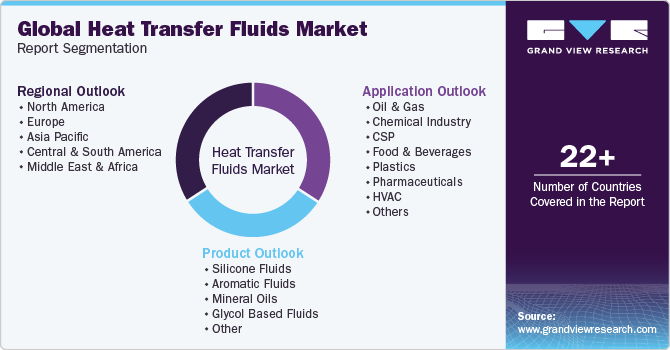

Heat Transfer Fluids Market Size, Share & Trends Analysis Report By Product (Silicone Fluids, Aromatic Fluids), By Application (Oil & Gas, Chemical Industry), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-511-3

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Heat Transfer Fluids Market Size & Trends

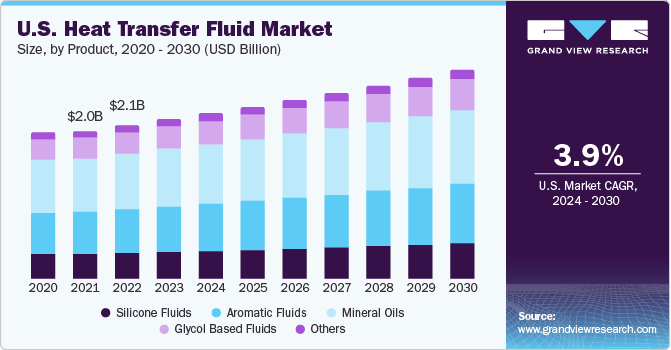

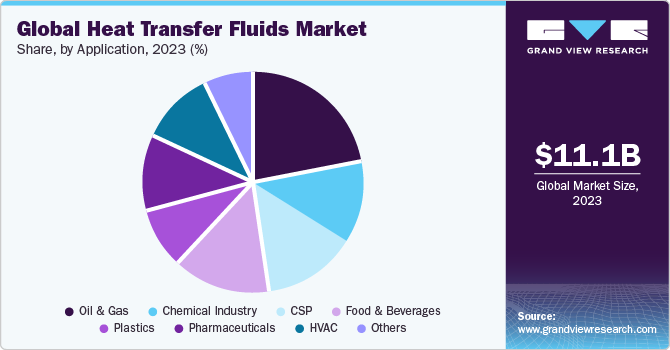

The global heat transfer fluids market size was estimated at USD 11.06 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2030. The rapid adoption of concentrated solar power globally is one of the major factors driving demand. Heat transfer fluids are industrial products derived from petroleum sources that prevent overheating and store thermal energy. The primary raw materials involved in production are crude oil, silica, and base oils. The essential characteristics that define a heat transfer fluid are low viscosity, non-corrosive nature, high thermal conductivity and diffusivity, and extreme phase transition temperatures.

Heat transfer fluids are traditionally used for the sole purpose of transferring heat to the process stream. However, the selection of the right HTF is a multi-dimensional complication wherein factors such as pumpability, thermal stability, and pressure requirements are put into consideration. Heat transfer fluids are gaining significant importance in their applications, such as extracting heat from the sun in concentrated solar panels to processing gas & oil in cold climatic conditions.

The COVID-19 pandemic caused severe disruption in businesses and supply chains. The negative impact of a pandemic on the oil & gas industry also hampered the growth of the heat transfer fluid market growth. The decrease in supply and demand for oil & gas, especially in North America and Europe, halted the onshore and offshore production processes, impacting the growth of the heat transfer fluids market. The suspension of new solar power projects installation work and disruption in activities of operational plants also obstructed the market.

The U.S. is one of the critical contributors to the global installed CSP capacity. The country strategically delivers its power outputs using CSP units when the demand is exceptionally high. Heat transfer fluids have been identified as one of the crucial components used to improve the efficiency of concentrated solar power plants. They play an essential role in the collection of energy from the solar field and transport it to the energy storage systems.

This stored energy is later utilized for generating electricity after sunset or even in cloudy weather conditions. Compared to PV systems, CSP plants possess capabilities to add storage capacity of an extra six hours, which leads to the operational value of USD 35.8/MWh. The increasing scope of CSP and its competitive advantages over other renewable energy sources is responsible for the high growth and significant penetration of heat transfer fluids in the segment.

Heat transfer fluids are used in the oil and gas industry, a key contributor to the U.S. economy. The country is projected to up its liquids and natural gas production over the foreseeable future as a result of shale resource development, thereby boosting product demand.

Major manufacturers are involved in the captive consumption of these thermal oils. Others distribute them to target markets through third-party suppliers. Some significant suppliers of heat transfer fluids in the industry are Paratherm, Hubbard Hall, Thermic Fluids Pvt. Ltd., and Inlet Petroleum Co. (IPC).

Most of these suppliers offer multi-brand fluids and have a separate internet-based portal for selling their products. With heavy investments in research and development activities, major industry participants are shifting toward bio-based thermic oils to comply with government regulations. The shift from synthetic to bio-based thermic oils is anticipated to be a disrupting trend fueled by stringent regulations and strict scrutiny of available products in the marketplace.

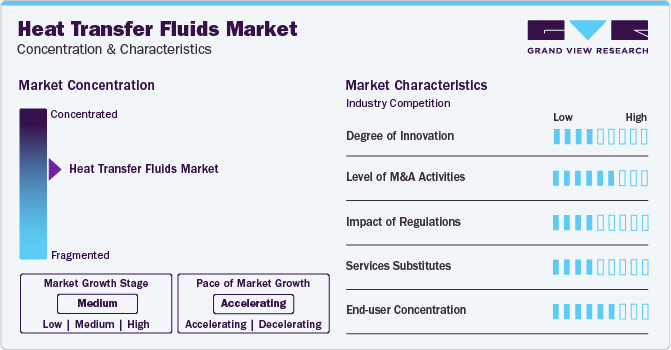

Market Concentration & Characteristics

The heat transfer fluids market is moderately consolidated in nature with the presence of large players like Dow Inc, Exxon Mobil Corporation, British Petroleum, Eastman Chemical Company and Royal Dutch Shell operating in the market. Market players are adopting the product differentiation strategy that insulated them from price wars.

The merger and acquisition activity in the market has been high for the past few years. For instance, Indian oil and gas producer Oil & Natural Gas Corp (ONGC) completed the acquisition of Hindustan Petroleum Co. Ltd. (HPCL) by purchasing 51.11% shares to become the country’s first vertically integrated oil manufacturer. These varied strategic implementations worldwide by key companies reflect their operational strategies to remain sustainable key players in the global heat transfer fluids ecosystem. Some prominent players in the global heat transfer fluids market include:

Companies operating in the heat transfer fluids market sphere are highly competitive and integrated along the value chain. Based on a comprehensive analysis of 24 leading producers across the globe, it has been identified that nearly 55% of the producers of heat transfer fluids are also involved in captive manufacturing of basic raw materials and allied feedstock.

A notable aspect of the industry competition is product offerings. It has been identified that on average company offer seven different variants of heat transfer fluids with Dynalene, Dow, Radco Industries, BASF and Eastman bringing the highest number of products to the market space. Though companies operating on a smaller-scale have specialized offerings with their HTF products catering to larger range of temperature performance and broader customer-base at national levels.

Product Insights

Glycol-based heat transfer fluids form the fastest-growing product category as they exhibit excellent antifreeze properties; the segment is anticipated to exhibit a revenue CAGR of 4.1% over the forecast period. Bio-based glycols are increasingly gaining significance as one of the critical ingredients in heat transfer fluid formulations, as they are compatible with high and low-temperature applications.

Mineral oils are generally utilized in diverse convenient radiator heaters, which are used broadly for commercial and residential applications. These oils have a high level of resistance toward chemical oxidation and thermal cracking and are simultaneously non-toxic and non-corrosive. They provide high thermal conductivity and specific heat, which helps them efficiently transfer heat. Mineral oils are also used in multiple heat transfer mediums but have a high degradation rate when exposed to higher temperatures.

Alkylated aromatic compounds are typically formulated for closed-loop heating systems based on the Rankine cycle. Major operational areas include asphalt plants, gas processing, tank cleaning, and plastic production. These aromatic HTFs are utilized in both the vapor phase and liquid phase and possess excellent fluid properties and heat transfer properties for applications involving low temperatures.

Application Insights

The oil and gas segment dominated the market with a revenue share of 22.2% in 2023. The oil & gas processing dynamics require very specific heat transfer fluids that are formulated to suit desired temperatures and compatibility. These products find application in processes such as recycling, production, refining, and transportation. Offshore platforms utilize heat transfer liquid in the aqueous phase for regenerating glycols and facility heating, which eventually removes water from the produced natural gas.

In the chemical industry, reboilers are heat exchangers to provide heat to distillation column bottoms. Reboilers boil the liquids from the bottom of the distillation column to form vapors that drive the distillation column separation. Heat transfer fluids or steam are used to heat the vaporization process. The products also find application in components such as tubes, pipes, bushes, and gaskets that carry chemicals, fluids, and acids owing to their properties, such as inertness to chemicals and high thermal stability.

Heat transfer fluids are extensively used to manufacture PET, polyester, nylon, and other synthetic fibers. The products are formulated to provide optimum efficiency across a diverse range of temperatures. Refined heat transfer fluids provide optimum stability at high temperatures, which eventually helps avoid premature degradation of fluids when exposed to high temperatures. Owing to stagnating plastic production in developed countries, the application segment accounted for a meager share of around 9.26% of the market in 2023.

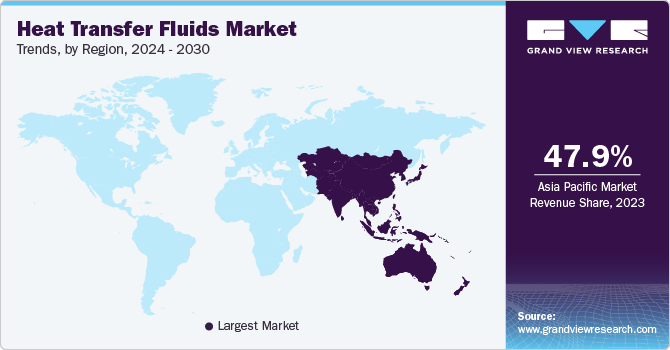

Regional Insights

Asia Pacific heat transfer fluid market is the dominant market with key macroeconomic indicators, such as high per capita income and manufacturing output, supporting market growth. The region accounted for a market share of 47.9% in 2023. The use of heating, ventilation, and air conditioning (HVAC) systems is growing tremendously in the Asia Pacific region because of the increasing population, changing climatic conditions, increasing urbanization, and demographic changes in the two economic giants, India and China. These two factors are likely to drive the growth of the Asia Pacific heat transfer fluid market.

The chemical industry in Mexico has observed multiple high-level investments as well as constant sourcing of diverse raw materials to strengthen its core. Rapid industrialization, coupled with the growing export of chemicals to NAFTA countries, is expected to drive demand for heat transfer fluids. The country also has a strong presence in the plastic manufacturing industry.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In September 2023, Valvoline invested in a European manufacturer of heat transfer fluids in order to broaden its product portfolio and cater to the consumers globally.

-

In May 2023, ORLEN Południe announced the completion of the first operational year of its BioPG plant, involving the conversion of glycerol into renewable propylene glycol. BASF provided its BioPG technology for the purpose, while Air Liquide Engineering & Construction contributed with the licensing, proprietary equipment, and basic engineering services

-

In February 2022, Chevron announced the agreement to acquire Renewable Energy Group which further helped the company in delivering lower carbon energy.

-

In May 2023, ORLEN Południe announced the completion of the first operational year of its BioPG plant, involving the conversion of glycerol into renewable propylene glycol. BASF provided its BioPG technology for the purpose, while Air Liquide Engineering & Construction contributed with the licensing, proprietary equipment, and basic engineering services

Key Heat Transfer Fluids Companies:

- Dynalene, Inc.

- Indian Oil Corporation Ltd. (IOCL)

- KOST USA, Inc.

- Hindustan Petroleum Corporation Ltd. (HPCL)Delta Western, Inc. (DWI)

- British Petroleum (BP)

- Huntsman Corporation

- Royal Dutch Shell Plc

- Eastman Chemical Company

- Phillips 66

- Chevron Co.

- BASF SE

- Exxon Mobil

- DowDuPont Chemicals

- Dalian Richfortune Chemicals Ltd.

- GJ Chemical

- Radco Industries Inc.

- LANXESS AG

- Schultz Chemicals

- Sasol Limited

- Evermore Trading Corporation

- Tashkent Industrial Oil Corporation

- Shaeffer Manufacturing Co.

- Paras Lubricants Limited.

Heat Transfer Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.46 billion

Revenue forecast in 2030

USD 14.22 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; South Korea; Malaysia; Thailand; Australia; Brazil, Argentina; South Africa; Saudi Arabia

Key companies profiled

Dynalene, Inc., Indian Oil Corporation Ltd. (IOCL)

, KOST USA, Inc.,Hindustan Petroleum Corporation Ltd. (HPCL), Delta Western, Inc. (DWI)

, British Petroleum (BP), Huntsman Corporation, Royal Dutch Shell Plc, Eastman Chemical Company

Phillips 66, Chevron Co., BASF SE, Exxon Mobil, DowDuPont Chemicals, Dalian Richfortune Chemicals Ltd., GJ Chemical, Radco Industries Inc.

LANXESS AG, Schultz Chemicals, Sasol Limited, Tashkent Industrial Oil Corporation, Shaeffer Manufacturing Co., Paras Lubricants Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Transfer Fluids Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides a heat transfer fluid market analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat transfer fluid market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silicone Fluids

-

Oil & Gas

-

Chemical Industry

-

CSP

-

Food & Beverages

-

Plastics

-

Pharmaceuticals

-

HVAC

-

Others

-

-

Aromatic Fluids

-

Oil & Gas

-

Chemical Industry

-

CSP

-

Food & Beverages

-

Plastics

-

Pharmaceuticals

-

HVAC

-

Others

-

-

Mineral Oils

-

Glycol based Fluids

-

Other (including molten salts & HFPE)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemical Industry

-

CSP

-

Food & Beverages

-

Plastics

-

Pharmaceuticals

-

HVAC

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Malaysia

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heat transfer fluids market size was estimated at USD 10.7 billion in 2022 and is expected to reach USD 11.1 billion in 2023.

b. The global heat transfer fluids market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 14.2 billion by 2030.

b. The Asia Pacific dominated the heat transfer fluids market with a share of 47.7% in 2022. This is attributable to the rising focus on the development of the manufacturing sector in the region.

b. Some key players operating in the heat transfer fluids market include Dow Chemicals, Eastman Company, Exxon Mobil, Shell, and BP.

b. Key factors that are driving the heat transfer fluids market growth include the growing concentrated solar power industry globally, FDA Approval of food-grade heat transfer fluids, and growing natural gas production in GCC countries.

Table of Contents

Chapter 1. Heat Transfer Fluids Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Heat Transfer Fluids Market: Executive Summary

2.1. Market Summary

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Heat Transfer Fluids Market: Variables, Trends & Scope

3.1. Global Synthetic Lubricants Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.1.1. Crude Oil

3.2.1.2. Mineral Oil

3.2.1.3. Benzene, Toluene, Xylene

3.2.1.4. Diphenyl Oxide, Biphenyl, Terephenyl

3.2.2. Manufacturing/Technology Trends

3.2.3. Sales Channel Analysis

3.3. Profit Margin Analysis

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunity

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Heat Transfer Fluids Market: Product Outlook Estimates & Forecasts

4.1. Heat Transfer Fluids Market: Product Movement Analysis, 2023 & 2030

4.2. Silicones

4.2.1. Silicones Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3. Aromatics

4.3.1. Aromatics Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.4. Mineral Oils

4.4.1. Mineral Oils Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.5. Glycol-Based Fluids

4.5.1. Glycol-Based Fluids Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.6. Other Products

4.6.1. Other Products Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Heat Transfer Fluids Market: Application Outlook Estimates & Forecasts

5.1. Heat Transfer Fluids Market: Application Movement Analysis, 2023 & 2030

5.2. Oil & Gas

5.2.1. Heat Transfer Fluids Market estimates and forecast, in Oil &Gas, 2018 - 2030 (USD Million) (Kilotons)

5.3. Concentrated Solar Power Generation

5.3.1. Heat Transfer Fluids Market estimates and forecast, in Concentrated Solar Power Generation, 2018 - 2030 (USD Million) (Kilotons)

5.4. Chemical

5.4.1. Heat Transfer Fluids Market estimates and forecast, in Chemical, 2018 - 2030 (USD Million) (Kilotons)

5.5. Food & Beverages

5.5.1. Heat Transfer Fluids Market estimates and forecast, in Food & Beverages, 2018 - 2030 (USD Million) (Kilotons)

5.6. Plastics

5.6.1. Heat Transfer Fluids Market estimates and forecast, in Plastics, 2018 - 2030 (USD Million) (Kilotons)

5.7. Pharmaceuticals

5.7.1. Heat Transfer Fluids Market estimates and forecast, in Pharmaceuticals, 2018 - 2030 (USD Million) (Kilotons)

5.8. HVAC

5.8.1. Heat Transfer Fluids Market estimates and forecast, in HVAC, 2018 - 2030 (USD Million) (Kilotons)

5.9. Other Applications

5.9.1. Heat Transfer Fluids Market estimates and forecast, in Other Applications, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Heat Transfer Fluids Market Regional Outlook Estimates & Forecasts

6.1. Regional Snapshot

6.2. Heat Transfer Fluids Market: Regional Movement Analysis, 2023 & 2030

6.3. North America

6.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.3.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.3.4. U.S.

6.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.3.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.3.5. Canada

6.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.3.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.3.6. Mexico

6.3.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.3.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4. Europe

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

6.4.5. Germany

6.4.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.6. France

6.4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.7. UK

6.4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.8. Russia

6.4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.9. Italy

6.4.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.9.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.10. Spain

6.4.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.10.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.4.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5. Asia Pacific

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.4. China

6.5.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.5. India

6.5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.6. Japan

6.5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.7. South Korea

6.5.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.8. Malaysia

6.5.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.9. Thailand

6.5.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.9.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.10. Australia

6.5.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.10.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.5.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.6. Central & South America

6.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.6.4. Brazil

6.6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.6.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.6.5. Argentina

6.6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.6.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7. Middle East & Africa

6.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7.4. South Africa

6.7.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.7.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7.5. Saudi Arabia

6.7.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

6.7.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share Analysis, 2023

7.4. Company Heat Map Analysis

7.5. Vendor Landscape

7.5.1. List of channel partners and distributors

7.5.2. List of potential end-users

7.6. Strategy Mapping

7.7. Company Profiles/Listing

7.7.1. Dynalene, Inc.

7.7.1.1. Company Overview

7.7.1.2. Financial Performance

7.7.1.3. Product Benchmarking

7.7.2. Indian Oil Corporation Ltd. (IOCL)

7.7.2.1. Company Overview

7.7.2.2. Financial Performance

7.7.2.3. Product Benchmarking

7.7.3. KOST USA, Inc.

7.7.3.1. Company Overview

7.7.3.2. Financial Performance

7.7.3.3. Product Benchmarking

7.7.4. Hindustan Petroleum Corporation Ltd. (HPCL)Delta Western, Inc. (DWI)

7.7.4.1. Company Overview

7.7.4.2. Financial Performance

7.7.4.3. Product Benchmarking

7.7.5. British Petroleum (BP)

7.7.5.1. Company Overview

7.7.5.2. Financial Performance

7.7.5.3. Product Benchmarking

7.7.6. Huntsman Corporation

7.7.6.1. Company Overview

7.7.6.2. Financial Performance

7.7.6.3. Product Benchmarking

7.7.7. Royal Dutch Shell Plc

7.7.7.1. Company Overview

7.7.7.2. Financial Performance

7.7.7.3. Product Benchmarking

7.7.8. Eastman Chemical Company

7.7.8.1. Company Overview

7.7.8.2. Financial Performance

7.7.8.3. Product Benchmarking

7.7.9. Phillips 66

7.7.9.1. Company Overview

7.7.9.2. Financial Performance

7.7.9.3. Product Benchmarking

7.7.10. Chevron Co.

7.7.10.1. Company Overview

7.7.10.2. Financial Performance

7.7.10.3. Product Benchmarking

7.7.11. BASF SE

7.7.11.1. Company Overview

7.7.11.2. Financial Performance

7.7.11.3. Product Benchmarking

7.7.12. Exxon Mobil

7.7.12.1. Company Overview

7.7.12.2. Financial Performance

7.7.12.3. Product Benchmarking

7.7.13. DowDuPont Chemicals

7.7.13.1. Company Overview

7.7.13.2. Financial Performance

7.7.13.3. Product Benchmarking

7.7.14. Dalian Richfortune Chemicals Ltd.

7.7.14.1. Company Overview

7.7.14.2. Financial Performance

7.7.14.3. Product Benchmarking

7.7.15. GJ Chemical

7.7.15.1. Company Overview

7.7.15.2. Financial Performance

7.7.15.3. Product Benchmarking

7.7.16. Radco Industries Inc.

7.7.16.1. Company Overview

7.7.16.2. Financial Performance

7.7.16.3. Product Benchmarking

7.7.17. LANXESS AG

7.7.17.1. Company Overview

7.7.17.2. Financial Performance

7.7.17.3. Product Benchmarking

7.7.18. Schultz Chemicals

7.7.18.1. Company Overview

7.7.18.2. Financial Performance

7.7.18.3. Product Benchmarking

7.7.19. Sasol Limited

7.7.19.1. Company Overview

7.7.19.2. Financial Performance

7.7.19.3. Product Benchmarking

7.7.20. Tashkent Industrial Oil Corporation

7.7.20.1. Company Overview

7.7.20.2. Financial Performance

7.7.20.3. Product Benchmarking

7.7.21. Shaeffer Manufacturing Co.

7.7.21.1. Company Overview

7.7.21.2. Financial Performance

7.7.21.3. Product Benchmarking

7.7.22. Paras Lubricants Limited

7.7.22.1. Company Overview

7.7.22.2. Financial Performance

7.7.22.3. Product Benchmarking

List of Tables

Table 1. Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 2. Heat Transfer Fluids Market Estimates And Forecasts, By Silicone Fluids, 2018 - 2030 (USD Million) (Kilotons)

Table 3. Heat Transfer Fluids Market Estimates And Forecasts, By Aromatic Fluids, 2018 - 2030 (USD Million) (Kilotons)

Table 4. Heat Transfer Fluids Market Estimates And Forecasts, By Mineral Oils, 2018 - 2030 (USD Million) (Kilotons)

Table 5. Heat Transfer Fluids Market Estimates And Forecasts, By Glycol Based Fluids, 2018 - 2030 (USD Million) (Kilotons)

Table 6. Heat Transfer Fluids Market Estimates And Forecasts, By Others, 2018 - 2030 (USD Million) (Kilotons)

Table 7. Heat Transfer Fluids Market Estimates And Forecasts, In Oil & Gas, 2018 - 2030 (USD Million) (Kilotons)

Table 8. Heat Transfer Fluids Market Estimates And Forecasts, In Chemical Industry, 2018 - 2030 (USD Million) (Kilotons)

Table 9. Heat Transfer Fluids Market Estimates And Forecasts, In CSP, 2018 - 2030 (USD Million) (Kilotons)

Table 10. Heat Transfer Fluids Market Estimates And Forecasts, In Food & Beverages, 2018 - 2030 (USD Million) (Kilotons)

Table 11. Heat Transfer Fluids Market Estimates And Forecasts, In Plastics, 2018 - 2030 (USD Million) (Kilotons)

Table 12. Heat Transfer Fluids Market Estimates And Forecasts, In Pharmaceuticals, 2018 - 2030 (USD Million) (Kilotons)

Table 13. Heat Transfer Fluids Market Estimates And Forecasts, In HVAC, 2018 - 2030 (USD Million) (Kilotons)

Table 14. Heat Transfer Fluids Market Estimates And Forecasts, In Other Applications, 2018 - 2030 (USD Million) (Kilotons)

Table 15. North America Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 16. North America Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 17. North America Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 18. North America Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 19. North America Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 20. U.S. Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 21. U.S. Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 22. U.S. Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 23. U.S. Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 24. U.S. Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 25. Canada Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 26. Canada Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 27. Canada Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 28. Canada Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 29. Canada Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 30. Mexico Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 31. Mexico Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 32. Mexico Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 33. Mexico Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 34. Mexico Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 35. Europe Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 36. Europe Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 37. Europe Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 38. Europe Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 39. Europe Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 40. Germany Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 41. Germany Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 42. Germany Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 43. Germany Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 44. Germany Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 45. France Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 46. France Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 47. France Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 48. France Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 49. France Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 50. U.K. Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 51. U.K. Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 52. U.K. Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 53. U.K. Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 54. U.K. Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 55. Russia Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 56. Russia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 57. Russia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 58. Russia Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 59. Russia Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 60. Italy Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 61. Italy Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 62. Italy Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 63. Italy Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 64. Italy Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 65. Spain Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 66. Spain Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 67. Spain Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 68. Spain Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 69. Spain Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 70. Asia Pacific Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 71. Asia Pacific Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 72. Asia Pacific Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 73. Asia Pacific Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 74. Asia Pacific Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 75. China Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 76. China Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 77. China Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 78. China Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 79. China Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 80. Japan Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 81. Japan Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 82. Japan Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 83. Japan Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 84. Japan Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 85. India Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 86. India Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 87. India Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 88. India Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 89. India Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 90. Malaysia Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 91. Malaysia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 92. Malaysia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 93. Malaysia Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 94. Malaysia Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 95. Thailand Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 96. Thailand Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 97. Thailand Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 98. Thailand Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 99. Thailand Heat Transfer Fluids Market Estimates And Forecasts, By Applications, 2018 - 2030 (Kilotons)

Table 100. Australia Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 101. Australia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 102. Australia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 103. Australia Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 104. Australia Heat Transfer Fluids Market Estimates And Forecasts, By Applications, 2018 - 2030 (Kilotons)

Table 105. Central & South America Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 106. Central & South America Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 107. Central & South America Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 108. Central & South America Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 109. Central & South America Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 110. Brazil Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 111. Brazil Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 112. Brazil Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 113. Brazil Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 114. Brazil Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 115. Argentina Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 116. Argentina Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 117. Argentina Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 118. Argentina Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 119. Middle East & Africa Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 120. Middle East & Africa Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 121. Middle East & Africa Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 122. Middle East & Africa Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 123. Middle East & Africa Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons)

Table 124. Saudi Arabia Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 125. Saudi Arabia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 126. Saudi Arabia Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 127. Saudi Arabia Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

Table 128. South Africa Heat Transfer Fluids Market Estimates And Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 129. South Africa Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (USD Million)

Table 130. South Africa Heat Transfer Fluids Market Estimates And Forecasts, By Product, 2018 - 2030 (Kilotons)

Table 131. South Africa Heat Transfer Fluids Market Estimates And Forecasts, By Application, 2018 - 2030 (USD Million)

List of Figures

Fig 1. Market segmentation

Fig 2. Information procurement

Fig 3. Data analysis models

Fig 4. Market formulation and validation

Fig 5. Market snapshot

Fig 6. Segmental outlook- Product, and application

Fig 7. Competitive outlook

Fig 8. Heat transfer fluids market, 2018-2030 (USD Million) (Kilotons)

Fig 9. Value chain analysis

Fig 10. Market dynamics

Fig 11. Porter’s Analysis

Fig 12. PESTEL Analysis

Fig 13. Heat transfer fluids market, by product: Key takeaways

Fig 14. Heat transfer fluids market, by product: Market share, 2023 & 2030

Fig 15. Heat transfer fluids market, by application: Key takeaways

Fig 16. Heat transfer fluids market, by application: Market share, 2023 & 2030

Fig 17. Heat transfer fluids market, by region: Key takeaways

Fig 18. Heat transfer fluids market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Heat Transfer Fluids Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Heat Transfer Fluids Application Outlook (Volume, Kilotons; Revenue, Usd Million, 2018 - 2030)

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Heat Transfer Fluid Regional Outlook (Volume, Kilotons; Revenue, Usd Million, 2018 - 2030)

- North America

- North America Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- North America Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- U.S.

- U.S. Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- U.S. Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- U.S. Heat Transfer Fluids Market, By Product

- Canada

- Canada Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Canada Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Canada Heat Transfer Fluids Market, By Product

- Mexico

- Mexico Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Mexico Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Mexico Heat Transfer Fluids Market, By Product

- North America Heat Transfer Fluids Market, By Product

- Europe

- Europe Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Europe Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Germany

- Germany Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Germany Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Germany Heat Transfer Fluids Market, By Product

- U.K.

- U.K. Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- U.K. Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- U.K. Heat Transfer Fluids Market, By Product

- France

- France Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- France Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- France Heat Transfer Fluids Market, By Product

- Italy

- Italy Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Italy Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Italy Heat Transfer Fluids Market, By Product

- Spain

- Spain Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Spain Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Spain Heat Transfer Fluids Market, By Product

- Russia

- Russia Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Russia Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Russia Heat Transfer Fluids Market, By Product

- Europe Heat Transfer Fluids Market, By Product

- Asia Pacific

- Asia Pacific Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Asia Pacific Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- China

- China Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- China Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- China Heat Transfer Fluids Market, By Product

- Japan

- Japan Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Japan Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Japan Heat Transfer Fluids Market, By Product

- India

- India Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- India Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- India Heat Transfer Fluids Market, By Product

- South Korea

- South Korea Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- South Korea Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- South Korea Heat Transfer Fluids Market, By Product

- Malaysia

- Malaysia Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Malaysia Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Malaysia Heat Transfer Fluids Market, By Product

- Thailand

- Thailand Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Thailand Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Thailand Heat Transfer Fluids Market, By Product

- Australia

- Australia Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Australia Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Australia Heat Transfer Fluids Market, By Product

- Asia Pacific Heat Transfer Fluids Market, By Product

- Central & South America

- Central & South America Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Central & South America Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Brazil

- Brazil Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Brazil Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Brazil Heat Transfer Fluids Market, By Product

- Argentina

- Argentina Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Argentina Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Argentina Heat Transfer Fluids Market, By Product

- Central & South America Heat Transfer Fluids Market, By Product

- Middle East & Africa

- Middle East & Africa Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Middle East & Africa Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Saudi Arabia

- Saudi Arabia Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- Saudi Arabia Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- Saudi Arabia Heat Transfer Fluids Market, By Product

- South Africa

- South Africa Heat Transfer Fluids Market, By Product

- Silicone Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Aromatic Fluids

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others

- Mineral Oils

- Glycol Based Fluids

- Other (Including Molten Salts & HFPE)

- Silicone Fluids

- South Africa Heat Transfer Fluids Market, By Application

- Oil & Gas

- Chemical Industry

- CSP

- Food & Beverages

- Plastics

- Pharmaceuticals

- HVAC

- Others North America Heat Transfer Fluids Market, By Grade

- South Africa Heat Transfer Fluids Market, By Product

- Middle East & Africa Heat Transfer Fluids Market, By Product

- North America

Heat Transfer Fluids Market Dynamics

Drivers: Growing Concentrated Solar Power Industry Globally

CSP systems concentrate the solar rays on a small area by using mirrors or collectors and facilitate electricity generation by converting light into heat energy using steam turbines. The global CSP industry has been witnessing significant growth over the past few years owing to technological advancements in thermal storage system, commercialization of molten salt fluid technologies, and adjustable to moderate weather conditions. It is one of the most cost-efficient sources of power generation, with reduced levels of CO2 emissions as compared to other sources. CSPs are preferred over conventional PV solar panels owing to added advantage of thermal storage with enhanced longevity.

Heat transfer fluids are identified as crucial players in improving the efficiency of concentrated solar power plants as they have a high capacity of heat storage and thereby increase the total plant's power generation capacity. Not only do HTFs have high capacity of thermal storage, but they also have an edge of storing thermal energy. This stored energy is later utilized for generating electricity after sunset or even in cloudy weather conditions. Compared to PV systems, CSP plants can add storage capacity for an extra 6 hours, leading to the operational value of USD 35.8/MWh.

FDA Approval Of Food-Grade Heat Transfer Fluids

Food and beverage processing is one of the major emerging applications of heat transfer fluids. HTFs find multiple applications in the industry, including dehumidifying, heating, and cooling applications across sectors such as wineries, dairies and breweries. The companies operational in these segments utilize HTFs, where the food articles and water come in contact with the fluids during processing. Hence, there is a high requirement for non-toxic food-grade heat transfer fluids. USDA approves the ingredients that are used in food-grade HTFs through HT1 applications and complies with FDA 178.3570 requirements.

Food-grade thermic fluids are a safe and non-hazardous option for various food and beverage processing companies. These fluids do not produce carbon in their downstream and offer low maintenance. Their wide temperature range makes them a preferred choice among many companies in the industry. Approval of these thermal fluids by FDA and international regulatory agencies is estimated to drive the demand for grade thermic oils which are more efficient than water or steam when used as a heat transfer medium.

Restraints: Stringent Government Regulations

The heat transfer fluids industry is subject to multiple government regulations across the globe at both global and regional levels. Thermal oils are typically formulated from petrochemicals and mineral oils, which affect the environment in terms of toxicity, biodegradability, recyclability, and more. One of the major issues faced is the disposal of used heat transfer fluids. Since most of the additives used in thermal fluids are petrochemical derivatives, they seriously threaten water pollution. This has led to stringent regulations being formulated by U.S. EPA. A series of tests conducted by the agency found that mineral oil-based HTOs are highly toxic, exhibit low biodegradability, and have the potential for bioaccumulation. Bioaccumulation is defined as the tendency of chemicals to build-up on organisms' tissues over time. Since most mineral oils are water insoluble, they tend to accumulate on organisms and have adverse biological effects.

What Does This Report Include?

This section will provide insights into the contents included in this heat transfer fluids market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Heat transfer fluids market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Heat transfer fluids market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the heat transfer fluids market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for heat transfer fluids market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of heat transfer fluids market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-