- Home

- »

- Clinical Diagnostics

- »

-

Hematologic Malignancies Market Size & Share Report, 2030GVR Report cover

![Hematologic Malignancies Market Size, Share & Trends Report]()

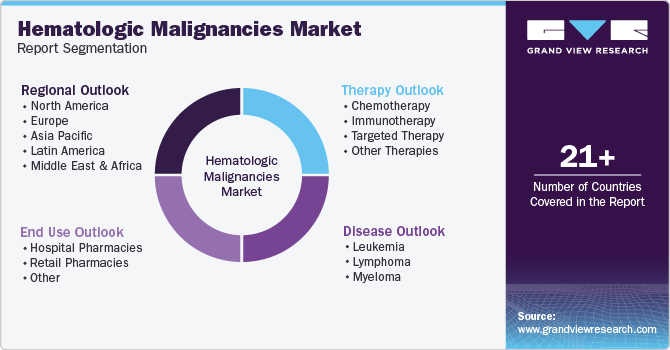

Hematologic Malignancies Market (2024 - 2030) Size, Share & Trends Analysis Report By Disease (Leukemia, Lymphoma), By Therapy (Chemotherapy, Immunotherapy), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-687-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hematologic Malignancies Market Summary

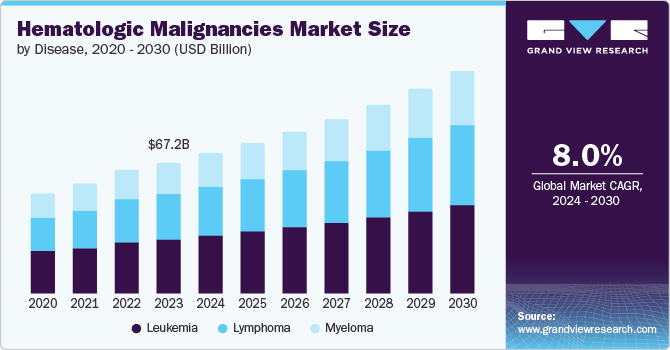

The global hematologic malignancies market size was estimated at USD 67,234.0 million in 2023 and is projected to reach USD 113,897.9 million by 2030, growing at a CAGR of 8.0% from 2024 to 2030. The growing number of cancer cases worldwide is mainly driven by changing lifestyle including, diet, increase alcohol consumption and smoking.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- The U.S. hematologic malignancies dominated the North America market with a share of 89.3% in 2023.

- By disease, the leukemia dominated the market and accounted for a share of 41.2% in 2023.

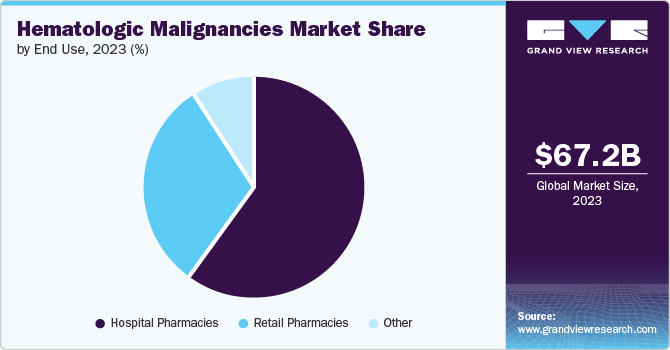

- By end use, the hospital pharmacies segment dominated the market in 2023.

- By therapy, the chemotherapy accounted for the largest market revenue share of 33.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 67,234.0 Million

- 2030 Projected Market Size: USD 113,897.9 Million

- CAGR (2024-2030): 8.0%

- North America: Largest market in 2023

Blood cancers are the fifth most common cancer around the world and ranks 2nd most causes of cancer deaths, globally. Advancement in cancer treatment and developed healthcare infrastructural facilities is likely to fuel market growth.

The global hematologic malignancies market is majorly driven by the rapid expansion of urbanization and changing lifestyle which led to lifestyle-related diseases. The physically inactive and unhealthy lifestyle of people such as junk food, smoking cigarettes and alcohol consumption is fueling the market growth. Leukemia and lymphoma are the most common types of blood cancer. Leukemia is the most common type of cancer in adolescents and children under age of 15, where as lymphoma is most common form of blood cancer in adults, accounting for over half of all diagnosed blood cancer cases.

The emergence of various hematologic malignancies therapy research and the adoption of combined therapies, incorporating chemotherapy and immunotherapy, targeted treatments, and are major factors propelling this market forward. Researchers and healthcare providers are increasingly investigating how different treatments can work together that enhances to improve effectiveness and lower resistance risks. These advancements indicate a shift away from generic treatments toward more tailored and personalized care strategies for individuals with hematologic malignancies.

Disease Insights

Leukemia dominated the market and accounted for a share of 41.2% in 2023. Leukemia is one of the most common types of blood cancer and the growth is primarily driven by the rising number of cases diagnosed every year and rise in number of Acute Myeloid Leukemia (AML). According to the American cancer society, there would be an estimated 20,800 diagnosed cases of acute myeloid leukemia and more than 11,000 deaths from AML. The other factors driving the growth are geriatric population as they are more prone to leukemia, improved healthcare infrastructure and advancement in drugs and medicines.

Lymphoma is expected to register the fastest CAGR of 9.5% during the forecast period owing to rise in geriatric population, improved diagnostics and development of new therapies for lymphoma. Non-Hodgkin lymphoma (NHL) & Hodgkin lymphoma (HL) accounts for 90% & 10% respectively. NHL is the most common type of lymphoma found in younger adults and old age people. The National Cancer Institute estimated about 80,550 new cases and more than 20,000 estimated deaths in 2023 due to NHL.

End Use Insights

The hospital pharmacies segment dominated the market in 2023, owing to improved healthcare infrastructure, rising number of hematologic cases diagnosed and improved drugs. Hematologic malignancies require specialized treatments and professional healthcare experts for treatment. Furthermore, the hospital pharmacies are equipped to handle such drugs and have an expert staff and technicians who have specialized knowledge dealing with complex medications.

The retail pharmacies segment is projected to grow at the fastest CAGR of 8.5% over the forecast period, driven by increasing availability of oral medications, rising awareness among people for treatment of blood cancer. The advancements in treatment and development of oral medications for hematologic malignancies are leading the retail pharmacies, offering patients more convenience. Moreover, the trend of specialty services in retail pharmacies such as pharmacist’s consultations, collaboration with doctors and more medication programs is likely to propel the segment.

Therapy Insights

Chemotherapy accounted for the largest market revenue share of 33.0% in 2023. The growth is driven by rising cancer diagnosed, improved healthcare access and development of new drugs in treating cancer. The recent advancements in chemotherapy such as targeted therapy and combined therapy have revolutionized cancer treatment as these therapies focus on specific molecular characteristics of cancer cells. Furthermore, ongoing research and clinical trials continue to expand the applications of chemotherapy.

Immunotherapy is expected to register the fastest CAGR of 9.5% during the forecast period. The growth can be attributed to the increasing number of cancer diagnosed, improved healthcare infrastructure and increasing adoption of targeted therapy. Rising approval of novel immunotherapies is expected to drive the market growth. For instance, in May 2024, researcher at Washington university school of Medicine in St. Louis was awarded USD 5 million from the Leukemia and Lymphoma society to fund research focused on creating innovative immunotherapies for various blood cancer.

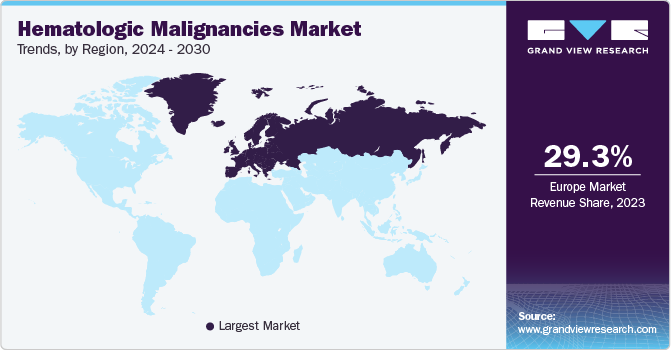

Regional Insights

North America hematologic malignancies market dominated the market in 2023. The region is home to some of the largest players, established healthcare infrastructure, increasing awareness among citizens and rising research on cancer treatments is driving the market growth. Furthermore, the existence of a large number of pharmaceutical companies that heavily invests in research and ongoing clinical trials to cure hematologic malignancies is likely to propel the market. The Canadian Cancer statistics forecasted 2,39,100 new cases of cancer to be diagnosed in 2023.

U.S. Hematologic Malignancies Market Trends

The U.S. hematologic malignancies dominated the North America market with a share of 89.3% in 2023 owing to the rising number of hematologic malignancies and the advancements in cancer treatments. According to report, more than 1,87,000 people in the U.S. are expected to be diagnosed with hematologic malignancies such as leukemia, lymphoma or myeloma in 2024.

Europe Hematologic Malignancies Market Trends

Europe hematologic malignancies market held a significant revenue share of 29.3% in 2023, owing to high number of cancer diagnosed patients, advancements in medication technology and greater healthcare expenditure of the region. The region is home to some of the largest players in the market and ongoing research and clinical trials are fueling the market growth. Countries such as UK, Germany, France is likely to boost the region due to better access to healthcare infrastructure and initiatives by government.

The hematologic malignancies market in UK dominated the region. The key drivers for the growth in the UK is attributed to rising number of cancer in young and adults, improved healthcare infrastructure and home to key market players. Blood cancer is the fifth most common cancer in the UK, with more than 40,000 new cases diagnosed every year. In 2023, The Food and Drug Administration granted approval to National Health Service England, for the use of Glofitamab-gxbm that could prove curative for blood cancer patients.

Germany hematologic malignancies market is expected to witness significant growth during the forecast period. The growth is primarily driven by the increasing number of hematologic malignancies cases and availability of improved healthcare infrastructure in the region. The increase in leukemia and lymphoma cancer in young adults and children below age 15 is fueling the market growth.

Asia Pacific Hematologic Malignancies Market Trends

Asia Pacific hematologic malignancies market is expected to witness fastest CAGR during the forecast period owing to the increase in the number of elderly people, a significant increase in patients with specific illnesses, and enhancements in healthcare facilities. Moreover, factors such as increasing awareness among people about hematologic malignancies diagnosis, availability of effective treatment in emerging countries such as India and China, growing healthcare expenditure and advancements in healthcare infrastructure are some of the factors are expected to contribute in the Asia Pacific market growth.

China hematologic malignancies market is held a significant market share in 2023, owing to rising number of blood cancer in the country and increasing geriatric population. China is one of the fastest countries with aging population, more prone to lymphoma cancer, which accounts for the largest share in China blood cancer. Moreover, the growing clinical trials & research in China is likely to contribute to the market growth.

India hematologic malignancies is expected to hold a significant share during forecast period owing to rise in disposable income, increasing awareness among people and rise in healthcare expenditure. The ongoing developments and recent advancements in the country are fueling the growth. Furthermore, the rising investments in research & developments and improving healthcare infrastructure are likely to propel the market growth during the forecast period.

Key Hematologic Malignancies Company Insights

Some of the key companies in the hematologic malignancies market include Pfizer Inc.; F.Hoffmann-LA Roche Ltd, Novartis AG.; GlaxoSmithKline PLC, Johnson & Johnson. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Pfizer Inc.; develops and produces medicines and vaccines for human and animal’s treatments such as immunology, cardiology, neurology, etc.

-

F.Hoffmann-LA Roche Ltd; commonly known as Roche operates in two divisions: Pharmaceuticals and diagnostics. Roche specialized in products such as drugs used for cancer treatment against virus and diseases.

Key Hematologic Malignancies Companies:

The following are the leading companies in the hematologic malignancies market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- F. Hoffmann-LA Roche Ltd

- Sanofi SA

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Novartis AG

- GlaxoSmithKline PLC

- Amgen Inc.

- Takeda Pharmaceutical Co. Ltd

- Johnson & Johnson

Recent Developments

-

In June 2024, Roche launched a new highly sensitive SITU hybridization test. The newly clinically approved test is designed to help pathologists differentiate a B-cell malignancy from a normal. The launch helps to test more diagnosed patients who may have B-cell lymphoma.

-

In February 2024, AbbVie Inc. acquired ImmunoGen Inc. including its flagship cancer therapy ELAHERE. The acquisition is likely to accelerates AbbVie’s commercial and clinical presence in solid tumor space.

-

In March 2022, Sanofi announced USD 322.8 million collaboration with Blackstone Life Sciences to advance an innovative treatment for multiple myeloma.

Hematologic Malignancies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.94 billion

Revenue forecast in 2030

USD 113.89 billion

Growth Rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, therapy, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

Pfizer Inc.; F. Hoffmann-LA Roche Ltd; Sanofi SA; Bristol-Myers Squibb Company; AbbVie Inc.; Novartis AG; GlaxoSmithKline PLC; Amgen Inc.; Takeda Pharmaceutical Co. Ltd; Johnson & Johnson;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hematologic Malignancies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hematologic malignancies market report based on disease, therapy, end use, and region.

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Leukemia

-

Lymphoma

-

Myeloma

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Immunotherapy

-

Targeted Therapy

-

Other Therapies

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other (Specialty pharmacy and online)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.