- Home

- »

- Beauty & Personal Care

- »

-

Herbal Toothpaste Market Size, Share, Industry Report, 2030GVR Report cover

![Herbal Toothpaste Market Size, Share & Trends Report]()

Herbal Toothpaste Market (2024 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Supermarkets And Hypermarkets, Pharmacies And Drugstores, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-342-3

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Herbal Toothpaste Market Summary

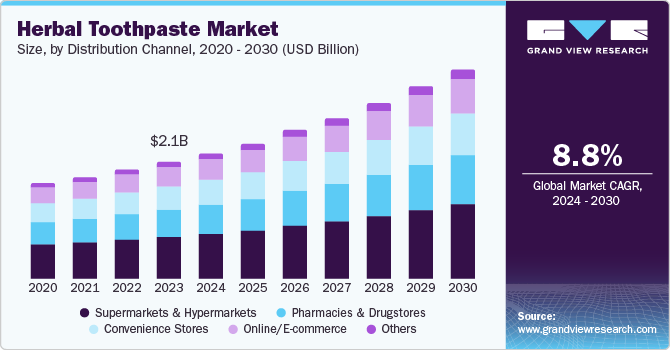

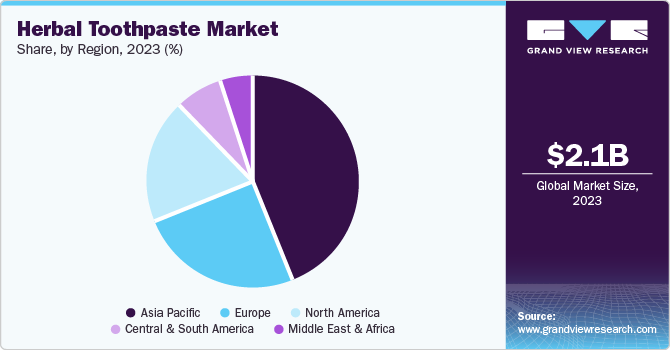

The global herbal toothpaste market size was estimated at USD 2.14 billion in 2023 and is projected to reach USD 3.84 billion by 2030, growing at a CAGR of 8.8% from 2024 to 2030. Increasing demand for natural and organic products, growing awareness of oral health, and expanding distribution channels drive the market's growth.

Key Market Trends & Insights

- Asia Pacific herbal toothpaste dominated the global industry and accounted for a revenue share of 44.1% in 2023.

- India herbal toothpaste market is expected to experience lucrative growth in 2023.

- Based on distribution channel, the supermarkets and hypermarkets segments dominated the market and accounted for the largest revenue share of over 34.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.14 Billion

- 2030 Projected Market Size: USD 3.84 Billion

- CAGR (2024-2030): 8.8%

- Asia Pacific: Largest market in 2023

Companies such as Dabur, Patanjali, and others are fueling market growth through portfolio enhancements and promotions such as influencer marketing and in-store displays to raise awareness and attract customers. The growing concern over environmental sustainability has led consumers to prefer products with eco-friendly packaging and natural ingredients, further driving the popularity of herbal toothpaste.

Increasing consumer awareness about the importance of oral health is a significant factor driving the market growth. Growing mindfulness regarding the ingredients used in personal care products has resulted in increased demand for products featuring natural ingredients such as neem, turmeric, cinnamon, and others. Organic and natural products have been among the most preferred categories of products in terms of personal care worldwide.

Furthermore, a vast network of distribution channels, including e-commerce platforms, has played a significant role in the growth of the herbal toothpaste market. Online marketplaces, supermarkets, and retail stores now feature a wide range of herbal toothpaste offerings, making it easily accessible to consumers. Increased accessibility, ease of availability, enhanced branding strategies adopted by the key market participants, the influence of social media and public opinion regarding the use of herbal toothpaste and growing disposable income levels have contributed to the rising demand for this market in recent years.

Government initiatives to promote local brands and the significance of organically developed products have also influenced this market. In addition, companies increased focus on branding, promotion, and marketing has also resulted in a rapid growth rate in this market. New product launches, improved research & development, and growing collaborations for enhanced market penetration and brand visibility are attracting a greater number of customers to this market. For instance, in May 2024, Himalaya launched a new campaign to promote oral health awareness; "It Starts With Gums".

Distribution Channel Insights

The supermarkets and hypermarkets segments dominated the global industry for herbal toothpaste and accounted for a revenue share of 34.1% in 2023. The segment is primarily driven by its widespread presence and consumer behavior trend that prefers one-stop-shop experiences to other alternatives. Supermarkets and hypermarkets in densely populated cities worldwide experience unceasing footfall, which has resulted in growth for this segment. Moreover, the rise of modern retailing, such as brick-and-click models, has also increased demand for herbal toothpaste. In addition, companies manufacturing herbal toothpaste are increasingly focusing on expanding their reach globally to improve product offerings. For instance, in October 2023, Himalaya Wellness Company LLC announced the development of its pharmaceutical company in Dubai. This state-of-art factory will produce liquid orals, herbal toothpaste, and tablets.

The online/e-commerce segment is anticipated to experience the fastest CAGR during the forecast period. The segment growth is driven by increasing disposable income levels of consumers, a growing trend of online shopping, and expanding e-commerce businesses that offer attractive discounts and value-added services. Online platforms provide access to a wider range of herbal toothpaste products, catering to different consumer needs and preferences through a single platform. Furthermore, online retailers offer several benefits, including discounts, free shipping, doorstep delivery, and cashback, making online shopping more attractive than traditional shopping. In addition, online platforms of retailers that operate chains of stores across nations have also experienced growing responses from consumers as it includes hassle-free shopping.

Regional Insights

North America herbal toothpaste market is expected to witness a significant CAGR over the forecast period. This market is primarily driven by the increasing prevalence of oral health issues, growing awareness about benefits associated with products that include natural ingredients, expanding distribution channels, and ease of availability. Consumers are becoming more conscious of the ingredients used in personal care products, driving demand for herbal toothpaste made with natural ingredients like aloe vera, tea tree oil, and essential oils. Furthermore, key regional players, R&D investments, and strategic partnerships fuel regional market growth.

U.S. Herbal Toothpaste Market Trends

The U.S. herbal toothpaste market dominated the global industry in 2023. The market is primarily driven by increasing consumer awareness and growing adoption of natural and herbal products influenced by increasing oral health consciousness. The well-established presence of online and offline distribution networks utilized by manufacturers, marketers, and retailers has improved market penetration. Furthermore, the region boasts major key players such as Colgate-Palmolive Company and Procter & Gamble Co., which further drives the region by introducing products in natural and herbal lines and expanding their distribution networks.

Europe Herbal Toothpaste Market Trends

Europe herbal toothpaste market held a noteworthy revenue share of global industry in 2023. Rising consumer preference for natural products coupled with increasing awareness of potential oral health risks and expanding E-commerce distribution networks are the major factors propelling the region’s growth. The increasing shift towards natural and herbal toothpaste over chemical-based products, driven by the rising awareness of potential risks associated with synthetic ingredients and the strong tradition of herbal remedies, is driving the region’s growth.

Germany herbal toothpaste market dominated the regional industry in 2023. The growing awareness about oral health, the increasing demand for chemical-free consumer goods, and environmental consciousness are the major factors driving the growth of this market. Furthermore, the availability of a wide range of domestic and international brands in physical stores and online platforms further supports the growing demand.

Asia Pacific Herbal Toothpaste Market Trends

Asia Pacific herbal toothpaste dominated the global industry and accounted for a revenue share of 44.1% in 2023. Unceasing population growth with rising disposable income levels and focused efforts by major market participants to enhance regional market share, including Dabur, Patanjali, Himalaya, and others, have driven the growth. The area has a rich cultural heritage of Ayurved and traditional medicines, emphasizing natural ingredients such as neem, turmeric, and ginseng for oral care. Furthermore, increasing awareness about the harmful chemicals used in personal care products and growing demand for natural and organic products have driven the regional market for herbal toothpaste.

India herbal toothpaste market is expected to experience lucrative growth in 2023. Increasing consumer awareness regarding the benefits of natural and organic products, growing health consciousness, and concerns about chemical-based care products are driving the growth of this market. Traditional Ayurvedic practices, which emphasize using natural ingredients in health and wellbeing routines, significantly influence the industry. For instance, Patanjali Ayurved Limited, one of the prominent brands in the herbal toothpaste market, offers a Dant Kanti range of products. The company states that it entails variety of key ingredients such as akarkara, babool, loung, pudina, pippali, vidang, bajranti, majuphal, mesvak, and others.

Key Herbal Toothpaste Company Insights

Some key companies involved in the herbal toothpaste market include Patanjali Ayurved Limited, Colgate-Palmolive Company, Procter & Gamble, Himalaya Wellness Company, Dabur India Limited and others. To address growing competition, the major industry participants have adopted strategies such as vast distribution through multiple channels, geographical expansions, continuous R & D, new product launches, collaborations, endorsements that feature influencers, and others.

-

Patanjali Ayurved Ltd., a prominent consumer goods brand from India, manufactures multiple Herbomineral preparations. It offers a wide range of products, including personal care solutions, food and beverage products, health supplements, Ayurvedic solutions, and more. The company provides a range of herbal and ayurvedic toothpaste, including Patanjali Dant Kanti sensitive toothpaste, Dant Kanti aloe vera, Dant Kanti natural, and others.

-

Dabur India Limited. is a multinational consumer goods company renowned for its focus on multiple portfolio features such as hair care, health care, oral care, home care, skin care, and more. The company offers a variety of toothpaste in its oral care segment, including Dabur red paste, Dabur Meswak and Dabur Herbal toothpaste, and Dabur Lal Dant Manjan, among others.

Key Herbal Toothpaste Companies:

The following are the leading companies in the herbal toothpaste market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- Procter & Gamble

- Himalaya Wellness Company

- Dabur India Limited

- The Clorox Company (Burt’s Bees)

- Sensodyne (GSK plc)

- Vicco Laboratories

- Unilever

- Amway Corp.

- Patanjali Ayurved Limited

Recent Developments

-

In July 2024, Patanjali Ayurved Limited launched its new toothpaste, Patanjali Dant Kanti Fresh Active Gel, accompanied by a marketing campaign titled #FullFullFresh. The newly launched product is a gel-based toothpaste formulated with natural ingredients such as clove, mini crystals, and mentha, which are traditionally known for their dental benefits. The campaign aims to influence younger consumers who value natural ingredients and modern freshness.

Herbal Toothpaste Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.31 billion

Revenue Forecast in 2030

USD 3.84 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Distribution Channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Colgate-Palmolive Company; Procter & Gamble; Himalaya Wellness Company; Dabur India Limited; The Clorox Company (Burt’s Bees); Sensodyne (GSK plc); Vicco Laboratories; Unilever; Amway Corp.; Patanjali Ayurved Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Herbal Toothpaste Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the herbal toothpaste market report based on distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Pharmacies and Drugstores

-

Convenience Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.