- Home

- »

- Homecare & Decor

- »

-

Heritage Tourism Market Size, Share & Trends Report, 2030GVR Report cover

![Heritage Tourism Market Size, Share & Trends Report]()

Heritage Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Cultural Heritage, Natural Heritage, Intangible Heritage), By Age Group, By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-959-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Heritage Tourism Market Summary

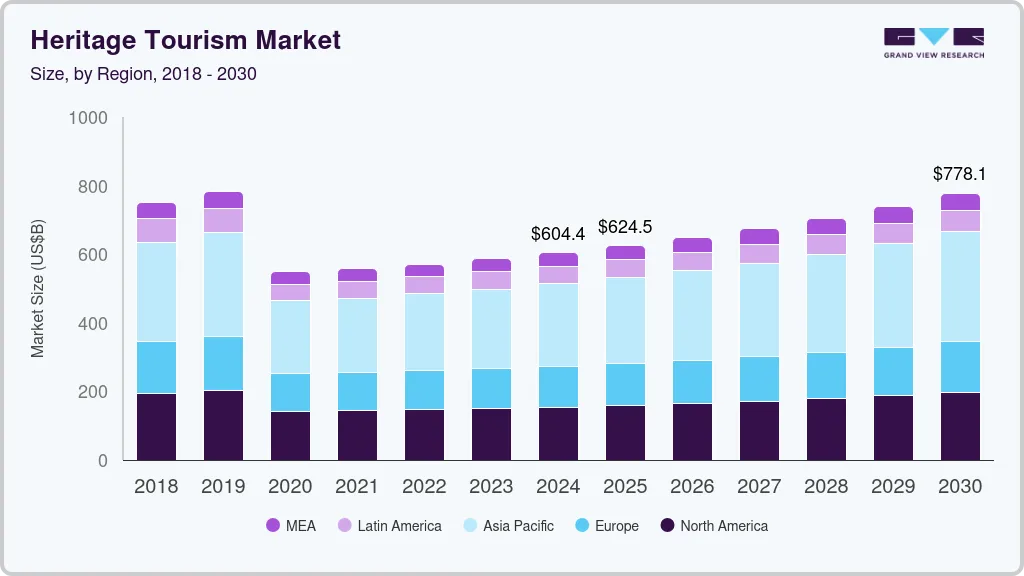

The global heritage tourism market size was estimated at USD 604.38 billion in 2024 and is projected to reach USD 778.07 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The market has seen remarkable growth over recent years, driven by a rising global interest in cultural preservation and an increased inclination among travelers to connect with history and traditions.

Key Market Trends & Insights

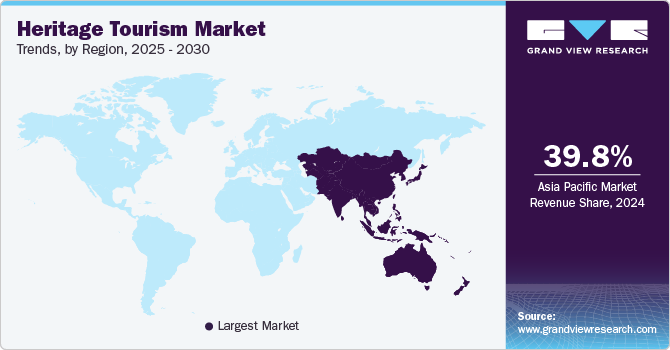

- Asia Pacific accounted for a revenue share of around 39.76% in the year 2024.

- The heritage tourism market in the U.S. is expected to grow at a CAGR of 4.2% from 2025 to 2030.

- By type, the cultural heritage tours segment accounted for a market share of 55.62% in 2024.

- By age group, the demand for heritage tours among travelers aged 51 to 70 captured a market share of 58.42% in 2024.

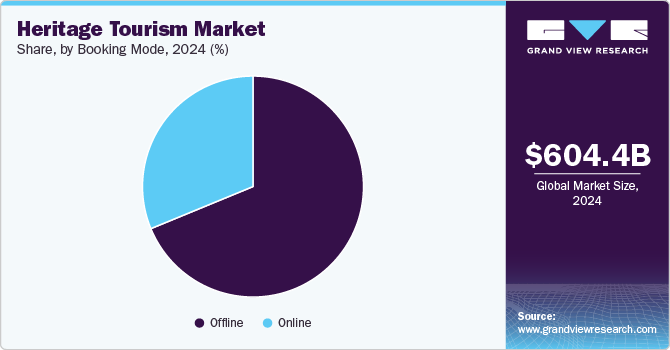

- By booking mode, offline bookings segment accounted for a market share of 68.78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 604.38 Billion

- 2030 Projected Market Size: USD 778.07 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest Market in 2024

This expansion is underpinned by a diverse array of factors, including heightened awareness around historical conservation, government and international initiatives aimed at preserving cultural sites, and the popularity of experiential travel. Heritage tourism enables travelers to experience a destination’s cultural essence, enriching tourism portfolios in destinations worldwide, from ancient ruins and monuments to traditional communities and practices. As travelers, especially younger demographics, seek more than just leisure, they are drawn to immersive cultural encounters that foster a deeper appreciation for global heritage, creating a substantial and growing market.

In September 2023, the United Nations Educational, Scientific and Cultural Organization (UNESCO) World Heritage Committee expanded its esteemed World Heritage List, adding 42 new sites that reflect both cultural and natural significance across continents-from Europe and Africa to North America. This update, undertaken during the Committee’s 45th session in Riyadh, Saudi Arabia, introduced 33 new cultural sites alongside nine natural sites, reinforcing the diversity and global reach of UNESCO’s conservation efforts. With these additions, the World Heritage List now encompasses 1,199 sites across 168 countries. This recognition of additional heritage sites is expected to invigorate the heritage tourism market by drawing greater international interest and fostering a deeper understanding of cultural and ecological treasures. The designation of these sites elevates their global profile, making them attractive destinations for tourists seeking meaningful cultural and natural experiences. As these locations gain visibility, they also stand to benefit from increased tourism-related infrastructure investment, enhancing their accessibility and appeal.

Numerous governments have introduced policies and funding dedicated to heritage site conservation, which ensures that these landmarks remain viable for tourism. In addition, UNESCO’s designation of World Heritage Sites has proven to be a robust catalyst, often leading to increased tourism revenue and broader interest in heritage destinations. This institutional backing not only safeguards cultural legacies but also enhances the infrastructure necessary to accommodate a larger volume of heritage tourists, thereby sustaining the industry’s growth trajectory.

A critical aspect contributing to the expansion of heritage tourism is the role of digital platforms and social media, which provide unprecedented access to cultural and historical narratives, significantly influencing travel choices. Virtual and augmented reality have made heritage sites more accessible, offering a preview that drives on-the-ground visitation, while mobile applications guide tourists through heritage-rich locations. These technologies not only expand audience reach but also encourage repeat visits by offering layered, educational, and personalized experiences. Further, the ease of digital access to reviews and itineraries has bolstered the visibility of lesser-known heritage sites, widening the spectrum of destinations within the heritage tourism segment and attracting a diverse visitor base. In July 2024, Tencent unveiled Microcosm, the most extensive virtual urban historical landscape to date, offering an immersive, digital portrayal of Beijing’s Central Axis. This launch aligned with the Central Axis’s recent designation as a UNESCO World Heritage site. Accessible through the Digital Central Axis Weixin Mini Program, Microcosm allowed users to embark on a guided, self-paced virtual tour, exploring a highly detailed 3D replica of the historic landmark. Through avatar-led guidance, users could view restored scenes of the site’s storied past, including elements lost or damaged over time, all from a smartphone.

The sustainability trend in the heritage tourism market has become a defining force, reshaping practices and priorities across this sector. As destinations seek to balance the influx of visitors with the preservation of historical assets, sustainable tourism initiatives have emerged as a key strategy. Heritage sites are increasingly integrating eco-friendly practices, from reducing carbon footprints through energy-efficient infrastructure to implementing waste management systems designed to protect the local environment. In addition, heritage tourism stakeholders are collaborating with local communities to ensure that tourism benefits are shared equitably, supporting local economies and creating incentives for cultural preservation. These initiatives not only mitigate the environmental and cultural impact of tourism but also align with the growing demand from travelers for responsible and immersive experiences. Consequently, the industry is witnessing an evolution where sustainability is not simply an option but a central tenet of heritage tourism's long-term strategy, creating a resilient framework for conserving historical assets while enhancing visitor engagement.

Type Insights

The cultural heritage tours accounted for a market share of 55.62% in 2024. The demand for cultural heritage tours is rising as travelers increasingly seek meaningful, immersive experiences that offer insights into the traditions, arts, and history of a destination. This interest reflects a broader shift in consumer behavior, where visitors prioritize experiential travel that fosters a deeper connection to the places they visit. Cultural heritage tours enable travelers to engage with local communities, partake in traditional practices, and appreciate the unique heritage that shapes each locale. In addition, the expansion of digital platforms showcasing cultural richness has enhanced global awareness, spurring interest among tourists who seek authentic and educational experiences that celebrate cultural diversity. This trend aligns with travelers’ growing desire to understand historical contexts, fostering respectful and informed tourism.

The demand for natural heritage tours is expected to grow at a CAGR of 5.1% from 2025 to 2030. Natural heritage tours are gaining traction as travelers increasingly value ecological awareness and the preservation of natural landscapes. These tours offer unique opportunities to explore biodiversity hotspots, protected ecosystems, and scenic landscapes, appealing to eco-conscious travelers committed to sustainable practices. The demand is driven by a rising appreciation for the intrinsic value of nature, reinforced by global conservation efforts and environmental awareness campaigns. Natural heritage tours also promote mindfulness by allowing travelers to disconnect from daily routines and engage with natural surroundings. This focus on sustainability in tourism not only appeals to eco-conscious visitors but also aligns with conservation goals, creating a model where tourism contributes to environmental preservation and supports local efforts to protect natural assets.

Natural heritage encompasses landscapes and sites that have naturally evolved, embodying significant geological and physiographical features. These regions serve as critical habitats for endemic plant and animal species, underscoring their ecological importance. According to UNESCO, the appeal of natural heritage sites is steadily rising, driven by increased access to information that highlights their unique natural and cultural significance, which is expected to support robust segment growth. In addition, there is a notable increase in sustainable tourism to UNESCO natural heritage sites, as efforts intensify to minimize the ecological impact of human presence, preserving these areas for future generations.

Age Group Insights

The demand for heritage tours among travelers aged 51 to 70 captured a market share of 58.42% in 2024, reflecting the heightened interest in culturally enriching and educational travel experiences among this demographic. The growth in demand within this age group can be attributed to a combination of factors, including a greater appreciation for historical and cultural contexts, as well as a preference for immersive, slower-paced travel that aligns with heritage tours. This age segment often possesses the financial means and leisure time to pursue such experiences, seeking both intellectual fulfillment and a deeper connection with global cultural sites, which has solidified their prominent role in the heritage tourism landscape.

The demand among age group 31 to 50 is anticipated to grow with a CAGR of 5.3% from 2025 to 2030. The growth is driven by several nuanced factors tied to demographic characteristics, lifestyle preferences, and shifts in global travel trends. This age group, often encompassing peak income-earning years, demonstrates a strong propensity to seek cultural enrichment, intellectual engagement, and connection to historical legacies during their travels. As individuals within this segment often have more disposable income and greater stability in their careers, they are better positioned to allocate resources toward immersive experiences that offer both personal and educational value.

Approximately 60% of Millennials prioritize an authentic cultural experience as the most essential aspect of their travel. The rise of heritage tourism for this age group is further fueled by a desire to reconnect with cultural roots, especially among those influenced by global migration patterns and the increasing accessibility of genealogical information. With digital advancements making it easier to trace family histories, many travelers are motivated to visit ancestral locations, seeking authenticity in experiences that deepen their understanding of their heritage. This desire aligns well with the broader societal trend of cultural revivalism, as individuals place higher value on understanding and preserving cultural identities within a globalized world.

Booking Mode Insights

In 2024, offline bookings accounted for a market share of 68.78% in 2024. The growth is driven by the enduring appeal of personalized service and the tangible experiences associated with face-to-face interactions. Many travelers, particularly those seeking culturally rich experiences, value the insights and recommendations offered by knowledgeable travel agents and local guides who can provide tailored itineraries and facilitate unique opportunities for engagement with heritage sites. This preference is often amplified by the complexity of planning trips that involve multiple destinations or require specialized knowledge about cultural customs and practices. Moreover, offline bookings can evoke a sense of security and trust, as travelers often appreciate the opportunity to engage with a professional who can address concerns and ensure a smooth travel experience. Consequently, despite the convenience of digital platforms, the demand for offline bookings remains robust, reflecting the diverse preferences of travelers within the heritage tourism sector.

Online bookings are anticipated to grow at a CAGR of 5.7% from 2024 to 2030. The growth is attributed to the increasing penetration of digital technology and the rising preference for convenience among travelers. Online platforms provide users with the ability to research, compare, and reserve heritage experiences at their convenience, often through user-friendly interfaces that enhance the overall customer journey. In addition, these platforms offer a wealth of information, including customer reviews, detailed descriptions, and multimedia content, enabling prospective travelers to make informed decisions about their choices. The integration of advanced payment systems and mobile optimization has further facilitated seamless transactions, making it easier for travelers to book experiences from any location. As digital literacy continues to rise across demographics, online bookings are likely to maintain their upward trajectory, reflecting broader trends in consumer behavior and technological advancements.

Regional Insights

The heritage tourism market in North America held a share of 25.54% of the global revenue in 2024. The regional demand is witnessing significant growth as travelers increasingly seek authentic cultural experiences that connect them to history and tradition. With a rich tapestry of indigenous cultures, colonial history, and diverse immigrant influences, destinations such as the UNESCO World Heritage Sites in the United States, including the Grand Canyon, and the historic districts of cities like Boston and Philadelphia, have become focal points for heritage tourism. Furthermore, government initiatives aimed at preserving these sites and promoting cultural heritage, such as the National Park Service's various programs, have fostered greater awareness and accessibility. This, combined with a growing interest in sustainable tourism, is encouraging travelers to explore heritage-rich destinations, ultimately driving demand.

U.S. Heritage Tourism Market Trends

The heritage tourism market in the U.S. is expected to grow at a CAGR of 4.2% from 2025 to 2030. With a vast array of heritage sites, including National Historic Landmarks, Native American reservations, and civil rights trail sites, the U.S. offers a wide-ranging exploration of its past. Initiatives such as the National Park Service’s efforts to preserve and promote sites like the Freedom Trail in Boston and the Martin Luther King Jr. National Historical Park in Atlanta play a pivotal role in raising awareness about the historical significance of these locations. Moreover, the rise of experiential travel has led many tourists to prefer immersive experiences that allow them to engage with local cultures and traditions, such as participating in festivals, visiting museums, and exploring historic districts. This growing appreciation for cultural heritage, coupled with government support for preservation efforts, is driving an increase in heritage tourism across the country.

Middle East & Africa Heritage Tourism Market Trends

The demand for heritage tours in the Middle East & Africa is expected to grow at a CAGR of 4.7% from 2025 to 2030. In the Middle East and Africa, heritage tourism is on the rise as countries recognize the value of their historical and cultural assets. Egypt, with its iconic pyramids and ancient temples, has long been a center for heritage tourism. Recent government efforts to promote cultural tourism, such as the Grand Egyptian Museum project, aim to enhance the visitor experience while preserving Egypt's rich history. Similarly, South Africa showcases its diverse cultural heritage through initiatives like the Robben Island Museum, which honors the legacy of Nelson Mandela and the struggle against apartheid. Across the region, governments are increasingly investing in the preservation of heritage sites and promoting cultural narratives, which fosters a deeper connection between travelers and the historical significance of the destinations, driving the growth of the market.

Asia Pacific Heritage Tourism Market Trends

Asia Pacific accounted for a revenue share of around 39.76% in the year 2024. The region is experiencing a surge in heritage tourism, largely due to its rich and diverse cultural heritage that spans ancient civilizations, historic landmarks, and unique traditions. Countries such as Japan and China are investing heavily in the preservation of their cultural sites, such as Kyoto’s historic temples and the Great Wall of China, both of which attract millions of tourists annually. In addition, government initiatives, such as the Japanese government's "Cool Japan" campaign, aim to promote cultural heritage and traditional practices to a global audience. As travelers increasingly seek authentic experiences, the appeal of heritage tourism continues to rise, encouraging visitors to explore the historical depth and cultural richness of the region.

Europe Heritage Tourism Market Trends

The European market is projected to grow at a CAGR of 3.9% from 2025 to 2030. In Europe, the increasing interest in heritage tourism is significantly influenced by the continent's extensive historical and cultural landscape. Countries like Portugal are at the forefront, showcasing their rich maritime history, architectural marvels, and traditional festivals. The Portuguese government has implemented strategies to promote its cultural heritage, such as the Route of the Discoveries, which highlights key historical sites associated with the Age of Exploration. Furthermore, the European Union supports heritage tourism through initiatives aimed at conservation and sustainable tourism development, creating a favorable environment for travelers seeking immersive cultural experiences. The rise in heritage tourism reflects a broader trend among European travelers who prioritize authenticity and connection to history, driving growth in this sector.

Key Heritage Tourism Company Insights

The competitive landscape of the heritage tourism market is characterized by a dynamic interplay of diverse stakeholders, including governmental organizations, non-profit entities, private tour operators, and local communities, all of which contribute to the development and promotion of heritage tourism offerings. As global interest in cultural and historical experiences continues to rise, various regions are strategically positioning themselves to attract heritage tourists by emphasizing their unique cultural narratives and historical significance.

Key players in the market, such as governmental tourism boards, leverage their resources to enhance the visibility of heritage sites through marketing campaigns, infrastructure development, and conservation initiatives. For instance, partnerships with international organizations, such as UNESCO, facilitate the recognition of heritage sites, further enhancing their appeal to travelers. In addition, private sector involvement, including boutique hotels and specialized tour companies, plays a crucial role in delivering tailored experiences that cater to the preferences of heritage tourists. These entities often focus on immersive experiences, such as guided tours led by local historians or cultural workshops that provide deeper insights into the traditions and practices of the region.

Moreover, technological advancements are reshaping the competitive landscape, with digital platforms and mobile applications enabling easier access to information about heritage sites and facilitating seamless booking processes. Social media also plays a significant role in influencing traveler decisions, as visually engaging content highlights the allure of heritage destinations.

Key Heritage Tourism Companies:

The following are the leading companies in the heritage tourism market. These companies collectively hold the largest market share and dictate industry trends.

- ACE Cultural Tours Ltd.

- Exodus Travels Ltd.

- Expedia Group, Inc.

- BCD Travel

- TUI AG

- ATG Travel

- Kesari Tours Pvt. Ltd.

- Carlson Wagonlit Travel

- Martin Randall Travel Ltd.

- Travel Leaders Group

Recent Developments

-

In April 2024, Jacada Travel unveiled its latest offerings, featuring journeys to the lesser-known regions of the Caucasus: Georgia, Armenia, and Azerbaijan. This expansion into Central Asia is designed to immerse travelers in the rich history, culinary delights, and adventurous landscapes of these nations. As part of the curated travel packages, guests will have the unique opportunity to attend an exclusive private performance of traditional polyphonic singing in Georgia. Recognized by UNESCO as an intangible cultural heritage, these intricate vocalizations have their roots dating back to the 8th century and are integral to various ceremonies and festivals. In addition, travelers will partake in personalized wild foraging and cooking experiences that highlight the rich culinary heritage and enduring local traditions of Georgian and Armenian cuisines.

-

In July 2024, Heritage Expeditions Africa (HEXA), a leading tour operator, introduced a range of new tour packages designed to showcase Zimbabwe's breathtaking natural landscapes, historical sites, and dynamic urban centers. As the tour operating division of the Rainbow Tourism Group (RTG), HEXA is committed to enhancing its service offerings to the domestic market. To support this initiative, the company has recently acquired a new fleet of luxury buses, minibuses, and vehicles, aimed at providing an elevated travel experience for its clientele.

Heritage Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 624.55 billion

Revenue forecast in 2030

USD 778.07 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age group, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Portugal; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa; Egypt; Morocco; Tunisia

Key companies profiled

Exodus Travels Ltd.; Expedia Group, Inc.; BCD Travel; TUI AG; ATG Travel; Kesari Tours Pvt. Ltd.; Carlson Wagonlit Travel; Martin Randall Travel Ltd.; Travel Leaders Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

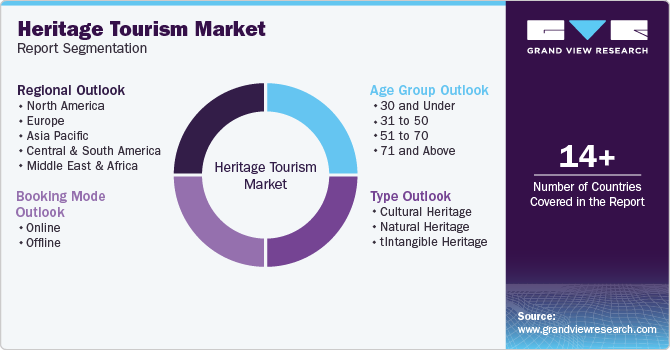

Global Heritage Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the heritage tourism market on the basis of type, age group, booking mode, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cultural Heritage

-

Natural Heritage

-

Intangible Heritage

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

30 and Under

-

31 to 50

-

51 to 70

-

71 and Above

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

Egypt

-

Morocco

-

Tunisia

-

-

Frequently Asked Questions About This Report

b. The global heritage tourism market size was estimated at USD 604.38 billion in 2024 and is expected to reach USD 624.55 billion in 2025.

b. The global heritage tourism market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030, reaching USD 778.07 billion by 2030.

b. Asia Pacific dominated the heritage tourism market with a share of 39.76% in 2024. This is attributed to the affluent cultural assets present in the region, mostly contributed by China, India, and Japan. Higher domestic and international tourist arrivals and longer durations of stay in the region account for higher revenue generation and higher market share.

b. Some key players operating in the heritage tourism market include ACE Cultural Tours Ltd., Exodus Travels Ltd., Expedia Group, Inc., BCD Travel, TUI AG, ATG Travel, Kesari Tours Pvt. Ltd., Carlson Wagonlit Travel, Martin Randall Travel Ltd., and Travel Leaders Group.

b. Market growth is also driven by the increasing importance of culture in international travel. Travelers are increasingly seeking out tangible and intangible cultures while on vacation. These attractions provide distinctive material, spiritual, and intellectual information about the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.