- Home

- »

- Medical Devices

- »

-

Hernia Mesh Devices Market Size And Share Report, 2030GVR Report cover

![Hernia Mesh Devices Market Size, Share & Trends Report]()

Hernia Mesh Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Hernia (Inguinal Hernia, Incisional Hernia), By Mesh (Biologic Mesh, Synthetic Mesh), By End-use (Hospitals & Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-204-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hernia Mesh Devices Market Summary

The global hernia mesh devices market size was estimated at USD 5,582.0 million in 2024 and is projected to reach USD 8,317.0 million by 2030, growing at a CAGR of 6.9% from 2025 to 2030. Key advancements, including self-fixating meshes and articulating fixation techniques, have been developed to address existing challenges, thereby driving the increased adoption of hernia mesh devices.

Key Market Trends & Insights

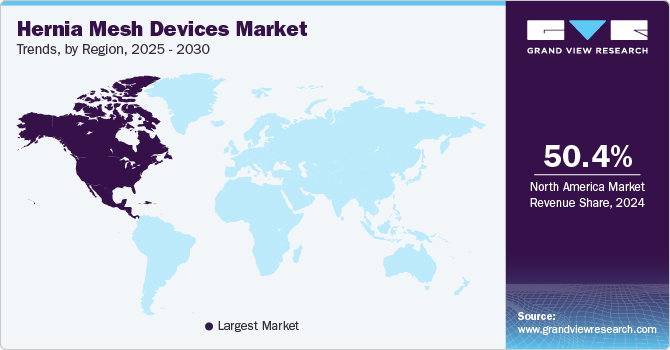

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, South Korea is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, inguinal accounted for a revenue of USD 4,174.5 million in 2024.

- Incisional is the most lucrative hernia type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,582.0 Million

- 2030 Projected Market Size: USD 8,317.0 Million

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

Contributing factors to the rising incidence of hernias include smoking, poor nutrition, genetic predisposition, and lifestyle changes. Genetic predispositions are significant contributors to the risk of hernia formation, as certain hereditary conditions, including connective tissue disorders, can elevate this risk. As awareness of these genetic factors increases, alongside advancements in surgical technology, the demand for hernia mesh devices is anticipated to follow an upward trajectory.

The high global incidence of hernias, combined with improved patient outcomes associated with using mesh devices, particularly in reduced operative and recovery times, are key factors contributing to market growth. For instance, according to the U.S. Food and Drug Administration (FDA), over one million hernia repair surgeries are conducted annually in the United States, with approximately 800,000 of these procedures classified as inguinal repairs. The prevalence of inguinal hernias is notably high in developing countries, where nearly 0.95 million procedures are performed each year. This elevated incidence rate of hernias drives demand for effective hernia mesh devices, which is anticipated to influence market expansion significantly. In addition, the advantages of utilizing mesh in hernia repair include a reduced likelihood of recurrence and diminished postoperative pain, both of which are expected to accelerate market growth further.

Technological advancements in hernia mesh devices have progressed rapidly in recent years, significantly enhancing surgical outcomes. Innovations such as articulating fixation devices and self-fixating (gripping) meshes have been developed to address challenges encountered during laparoscopic procedures. These advancements afford surgeons improved access to vulnerable areas of the abdominal wall, enabling more precise and secure placement of the mesh at the targeted site. This capability is essential for optimizing repair techniques and minimizing complications, thereby contributing to market growth. For instance, a study published in the Journal of Surgical Research indicated that using self-fixating mesh reduced operating time by an average of 20% and significantly decreased postoperative pain compared to traditional fixation methods. Such efficiencies enhance patient outcomes and improve overall workflow in surgical settings, making these options increasingly attractive to healthcare providers. As these technologies continue to evolve, they are expected to play a pivotal role in shaping the future of hernia repair, addressing both patient and surgeon needs while further propelling market growth.

Advancements in surgical techniques, including minimally invasive laparoscopic procedures and the introduction of self-fixating meshes, which improve patient outcomes, are also contributing to the growth of the market. Research has demonstrated that these advanced surgical methods result in lower complication rates and shorter recovery times. A study published in Surgical Endoscopy found that patients undergoing laparoscopic hernia repair with self-fixating mesh experienced a reduction in postoperative pain and a quicker return to normal activities compared to traditional methods.

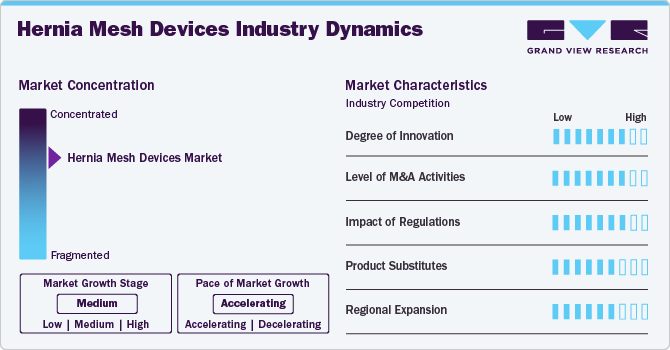

Market Concentration & Characteristics

The hernia mesh devices market is characterized by moderate industry concentration and a mix of established multinational companies and emerging players. Major companies dominate, with advanced technology, extensive distribution networks, and substantial R&D investments. These include leaders such as Johnson & Johnson Services, Inc., C. R. Bard, Inc., W. L. Gore & Associates, Inc., Atrium Medical (Getinge Group), LifeCell, B. Braun SE, Baxter, Cook, Herniamesh S.r.l. The market features highinnovation driven by technological advancements such as advanced Hernia mesh devices. Emerging players contribute by introducing novel solutions and driving competition. The market is influenced by regulatory standards and the need for continuous product development to meet evolving clinical demands.

The degree of innovation in the market is markedly high, driven by ongoing advancements in materials, design, and surgical techniques. Significant developments include creating biocompatible materials, such as absorbable meshes, which reduce long-term foreign body reactions while providing essential support during the healing process; studies have shown these can lead to lower chronic pain and recurrence rates. In addition, self-fixating meshes utilizing micro-grip technology, such as the Symbotex mesh, enhance surgical efficiency by eliminating the need for sutures or adhesives, reducing operative times and complications. Moreover, the evolution of laparoscopic surgical techniques has enabled the design of customizable meshes tailored to individual patient anatomies. Collectively, these innovations reflect a dynamic market focused on improving patient outcomes and addressing the diverse needs of healthcare providers.

The impact of regulations on the market is significant, influencing product development, approval processes, and market entry strategies. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose stringent guidelines to ensure the safety and efficacy of medical devices. For instance, the FDA's premarket approval process requires comprehensive clinical data demonstrating that hernia meshes meet established safety standards before being marketed. This rigorous scrutiny has led to improved product quality and increased confidence among healthcare providers and patients. In addition, post-market surveillance regulations necessitate ongoing device performance monitoring, enabling prompt identification and response to potential complications. As a result, companies in the hernia mesh sector must invest significant resources in compliance, which can impact innovative timelines but ultimately foster a safer environment for users and enhance overall market integrity.

The level of mergers and acquisitions (M&A) activities in the market has been moderate, reflecting strategic moves by companies seeking to enhance their competitive positioning and expand their product portfolios. This moderate M&A activity is driven by the need for innovation and technological advancement, as firms aim to integrate cutting-edge technologies and expertise from acquired companies. In addition, collaborations between established players and startups often focus on developing novel materials or techniques, enhancing the overall landscape of hernia repair solutions.

The market faces moderate competition from various product substitutes, primarily including alternative surgical techniques and materials that can offer effective solutions for hernia repair without using traditional mesh devices. In addition, laparoscopic techniques that utilize sutures instead of mesh for specific types of hernias also present a competitive alternative. Advances in tissue engineering and regenerative medicine are leading to the development of injectable biomaterials that can promote healing and tissue regeneration without needing permanent implants.

The regional expansion of the market is driven by several key factors, including increasing healthcare expenditure, rising incidence of hernias, and advancements in surgical techniques across various regions. For instance, North America, particularly the United States, accounts for a substantial market share, supported by a well-established healthcare infrastructure and high rates of surgical procedures. For instance, according to the American Hernia Society, approximately 1 million hernia repairs are performed annually in the U.S., with a significant portion utilizing mesh technology. In Europe, countries such as Germany and the United Kingdom are witnessing growth due to increased awareness of advanced surgical options and a rising aging population, which is more susceptible to hernias. For instance, a report from the European Hernia Society indicates that around 700,000 hernia repairs are performed annually in Europe, further highlighting the demand for mesh devices.

Hernia Insights

The market is classified by hernia type into inguinal, incisional, femoral and others. The optical tracking systems segment dominated the market, capturing a substantial revenue share of 82.5% in 2024. Several factors contribute to the dominance of the inguinal hernia segment. One significant factor is the feasibility of tension-free repair techniques, which have become increasingly favored over traditional methods. For instance, research published in The British Journal of Surgery highlights that patient undergoing tension-free repair experience lower rates of complications and faster recovery times than those receiving traditional repairs, further driving the preference for mesh devices in inguinal hernia surgeries. In addition, the increasing awareness among healthcare providers and patients regarding the benefits of mesh repair techniques has propelled demand in this segment.

The incisional segment of the market is expected to grow exponentially over the forecast period. Incisional hernias occur at the site of previous surgical incisions and are increasingly prevalent due to the rising number of surgical procedures performed globally. For instance, according to the American College of Surgeons, approximately 16 million surgeries are performed annually in the United States alone, with a notable percentage leading to incisional hernias. It is estimated that incisional hernias account for 10-15% of all hernias, representing a significant patient population needing effective repair solutions. Advancements in surgical techniques, including developing specialized mesh products designed specifically for incisional hernia repairs, contribute to this segment's anticipated expansion.

Mesh Insights

The market is classified by mesh type into biologic mesh and synthetic mesh. The synthetic segment captured the largest market share of 64.61% in 2024. This dominance can be attributed to several key factors, including the widespread adoption of synthetic materials due to their desirable properties and proven effectiveness. For instance, according to a report by the American Hernia Society, over 90% of hernia repairs in the United States utilize synthetic mesh, underscoring its critical role in surgical practice. Additionally, synthetic meshes have been associated with lower recurrence rates, which can be as high as 30% for non-mesh repairs. A systematic review published in The British Journal of Surgery found that using synthetic mesh in inguinal hernia repairs resulted in a recurrence rate of approximately 1% to 3%, further driving surgeon preference for these materials.

The biologic mesh segment is anticipated to grow fastest over the forecast period, driven by increasing awareness of its benefits, advancements in material technology, and a rising preference for more natural, biocompatible options in hernia repair. Biologic meshes, derived from human or animal tissues, offer several advantages, including enhanced integration with host tissue and a reduced risk of chronic pain and complications compared to synthetic alternatives. This growth is largely attributed to a growing number of clinical studies demonstrating the efficacy of biological meshes in various surgical applications. For instance, a meta-analysis published in Hernia found that biological meshes demonstrated a significantly lower recurrence rate of around 6% compared to synthetic meshes in certain patient populations, particularly those with complex hernias or previous surgical complications.

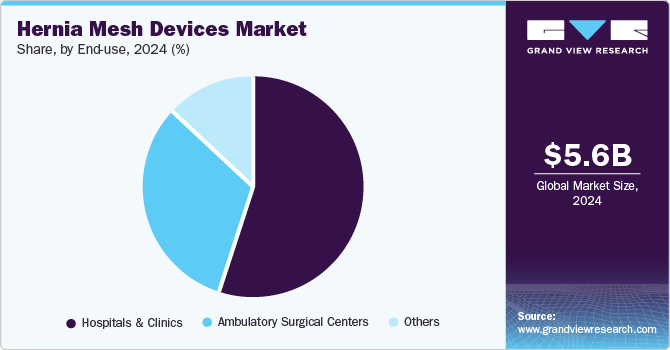

End-use Insights

The market is classified by end use hospitals & clinics, ambulatory surgical centers and others. The hospitals & clinics segment dominated the market with a share of 54.72% in 2024. This dominance can be attributed to several factors, including the prevalence of surgical procedures performed in these settings and the increasing number of specialized surgical centers focused on hernia repairs. Hospitals remain the primary venues for surgical interventions, with data from the American Hospital Association indicating that over 17 million inpatient surgical procedures are performed annually in the United States. A substantial proportion of these procedures involves hernia repairs, further solidifying hospitals', and clinics' market share.

The ambulatory surgical centers (ASC) segment is projected to experience the fastest growth in the market over the forecast period, driven by several key factors, including increased patient preference for outpatient procedures, advancements in surgical technology, and cost-effectiveness. One major factor contributing to the growth of ASCs is the rising demand for minimally invasive surgical options. For instance, according to the Ambulatory Surgery Center Association (ASCA), over 23 million surgeries are performed annually in ASCs across the United States, which has been steadily increasing as patients seek the convenience and efficiency of outpatient care. This trend is particularly relevant for hernia repairs, as many procedures can be performed safely and effectively in an ASC setting, reducing the need for hospital admissions. In addition, advancements in surgical techniques and technologies have enabled more complex procedures in ASCs. For instance, a study published in Surgical Endoscopy found that patients undergoing laparoscopic hernia repair in ASCs experienced comparable outcomes to those in hospitals, with lower rates of complications and shorter recovery periods. This has led to an increased willingness among surgeons and patients to utilize ASCs for hernia repairs.

Regional Insights

North America hernia mesh devices market dominated the overall global market and accounted for 50.4% of revenue share in 2024. This significant market share can be attributed to several factors, including the well-established healthcare infrastructure, high surgical volumes, and a strong focus on innovation in medical devices. In addition, advancements in surgical techniques and the availability of advanced mesh materials have fostered a favorable environment for market growth. The U.S. market is expected to benefit from a rising aging population, with the U.S. Census Bureau projecting that by 2030, approximately 20% of the population is expected to be aged 65 and older, a demographic more susceptible to hernias.

U.S. Hernia Mesh Devices Market Trends

The hernia mesh devices market in the U.S. held a significant share of North America's hernia mesh devices market in 2024. This prominence can be attributed to several factors, including the high prevalence of hernia cases and an extensive surgical volume. In addition, the U.S. has a robust healthcare infrastructure characterized by advanced medical facilities and skilled surgical teams, facilitating the adoption of innovative hernia mesh products. For instance, a report from the Centers for Medicare & Medicaid Services indicates that healthcare spending in the U.S. reached approximately USD 4.1 trillion in 2020, emphasizing the investment in surgical procedures and medical technologies. In addition, the rising awareness of minimally invasive surgical techniques and improvements in patient outcomes associated with the use of mesh devices are driving growth in this segment.

Europe Hernia Mesh Devices Market Trends

The hernia mesh devices market in Europe is experiencing significant growth, driven by several key factors, including an aging population, rising surgical rates, and increasing awareness of advanced treatment options. The European population is projected to age substantially, with estimates indicating that by 2030, around 20% of Europeans are expected to be over the age of 65, a demographic more prone to developing hernias. For instance, according to the European Hernia Society, approximately 700,000 hernia repair surgeries are performed annually across Europe, with a notable shift towards using mesh materials associated with lower recurrence rates and improved patient outcomes. In addition, advancements in surgical techniques, such as laparoscopic procedures, have become more prevalent, further driving demand for innovative mesh devices.

The hernia mesh devices market in UK is experiencing exponential growth, driven by several key factors, including a rising incidence of hernias, advancements in surgical techniques, and increased healthcare investment. For instance, hernias account for approximately 10% of all surgical procedures in the UK, with the National Health Service (NHS) performing around 100,000 hernia repair surgeries annually. In addition, the shift towards minimally invasive surgical approaches has further propelled market growth. For instance, according to a British Journal of Surgery report, laparoscopic hernia repairs, which often utilize advanced mesh materials, have become increasingly common due to their associated benefits, such as shorter recovery times and reduced postoperative pain.

The hernia mesh devices market in France is expected to grow significantly due to several key factors, including an increasing prevalence of hernias, advancements in surgical technology, and enhanced healthcare access. For instance, hernias are among France's most common surgical conditions, with approximately 100,000 hernia repairs performed annually, according to the French National Authority for Health. This high surgical volume is driven by an aging population, as nearly 20% of the French population is projected to be over 65 by 2030, leading to a higher incidence of hernias. In addition, the adoption of minimally invasive surgical techniques has gained momentum, with laparoscopic procedures becoming increasingly prevalent. Research from the French Society of Surgery has shown that using mesh in laparoscopic repairs significantly reduces recurrence rates, which can be as high as 30% with traditional methods. This has led to surgeons' and patients' growing preference for mesh-based repairs.

The hernia mesh devices market in Germany is poised for significant growth, driven by several key factors, including a high surgical volume, advancements in medical technology, and an aging population. For instance, according to the German Society of Surgery, Germany is one of the leading countries in Europe for surgical procedures, with over 300,000 hernia repairs performed annually. This high volume is partially due to the country’s robust healthcare system, which emphasizes quality surgical care and patient access. In addition, the increasing adoption of minimally invasive surgical techniques has further propelled market growth. For instance, a study published in the Archives of Surgery has shown that laparoscopic hernia repairs utilizing mesh result in lower recurrence rates ranging from 1% to 3% and shorter recovery times than open surgeries.

Asia Pacific Hernia Mesh Devices Market Trends

The hernia mesh devices market in Asia-Pacific is experiencing the fastest growth, primarily driven by a rising incidence of hernias, increasing healthcare expenditures, and advancements in surgical techniques. The region is witnessing a significant surge in the number of surgical procedures, with the World Health Organization estimating that over 2.5 million hernia repairs are performed annually across Asia-Pacific countries. This growing surgical volume is largely attributed to an aging population, which is projected to account for approximately 14% of the region’s population by 2030, leading to a higher prevalence of hernias. In addition, advancements in laparoscopic and robotic-assisted surgical techniques contribute to market expansion. For instance, a study published in the Journal of Surgical Research found that laparoscopic hernia repairs using mesh have lower complication rates and shorter recovery times than traditional open surgeries, making them increasingly popular among surgeons and patients.

The hernia mesh devices market in Japan is set for rapid growth, driven by several key factors, including an aging population, advancements in surgical technology, and an increasing emphasis on minimally invasive procedures. Japan has one of the highest life expectancies in the world, with nearly 28% of its population projected to be aged 65 and older by 2030. This demographic shift contributes to a higher prevalence of hernias, with the Japanese Society of Gastroenterological Surgery estimating that approximately 300,000 hernia repair surgeries are performed annually. In addition, the adoption of advanced surgical techniques, such as laparoscopic surgery, is gaining traction in Japan. For instance, research published in the Journal of Japan Surgical Society indicates that laparoscopic hernia repairs utilizing mesh result in significantly lower recurrence rates and reduced postoperative complications compared to traditional open surgeries. This trend is further supported by a government focusing on improving surgical standards and promoting innovative medical technologies, with healthcare expenditures in Japan exceeding USD 390 billion in 2021.

The hernia mesh devices market in China is expanding rapidly, driven by several factors, including a growing aging population, increasing surgical volumes, and advancements in healthcare infrastructure. China has a substantial number of elderly individuals, with projections indicating that by 2030, over 300 million people are expected to be aged 60 and older, significantly raising the incidence of hernias. For instance, according to the Chinese Medical Association, the country sees approximately 1.5 million hernia repair surgeries annually, which is expected to rise as awareness of treatment options increases. The Chinese government’s ongoing investment in healthcare, which reached around USD 900 billion in 2021, further supports the expansion of the hernia mesh market. This investment includes improvements in medical technology and access to advanced surgical products, which are critical for enhancing treatment outcomes.

The hernia mesh devices market in India is highly competitive and driven by several key factors, including a rising incidence of hernias, increasing healthcare accessibility, and advancements in surgical techniques. With over 1.3 billion people, India has a significant population at risk for hernias, particularly given the country's growing aging demographic and lifestyle-related factors. For instance, according to the Indian Journal of Surgery, approximately 1 million hernia repair surgeries are performed annually, which is expected to rise as awareness of treatment options increases. In addition, the shift towards minimally invasive surgical techniques, such as laparoscopic and robotic-assisted surgeries, is gaining momentum in India. For instance, research published in Surgical Endoscopy indicates that laparoscopic hernia repairs lead to lower complication rates and shorter recovery times than traditional open surgery, enhancing their appeal among surgeons and patients.

Latin America Hernia Mesh Devices Market Trends

The hernia mesh devices market in Latin America is driven by several key factors, including a rising prevalence of hernias, advancements in surgical technology, and increased healthcare investments across the region. With a population exceeding 650 million, Latin America is experiencing significant demographic changes, including an aging population that is more susceptible to hernias. The Pan American Health Organization estimates that hernia repairs account for a substantial portion of surgical procedures in the region, with hundreds of thousands of cases reported annually. In addition, the growing adoption of minimally invasive surgical techniques propels market growth. Research published in the Journal of Surgical Research indicates that laparoscopic hernia repairs using mesh result in lower recurrence rates and quicker recovery times, making them increasingly popular among surgeons in Latin America. This shift towards advanced surgical methods is supported by improving healthcare infrastructure, with countries such as Brazil and Mexico investing heavily in modern medical facilities and technology.

Middle East and Africa Hernia Mesh Devices Market Trends

The hernia mesh devices market in the Middle East and Africa is experiencing significant growth, fueled by several key drivers, including the increasing prevalence of hernias, a growing focus on surgical education and training, and heightened regulatory support for medical devices. The rise in hernia cases can be attributed to factors such as urbanization and changing lifestyles, leading to higher rates of obesity and sedentary behavior, which contribute to the incidence of hernias. In addition, the region is witnessing a concerted effort to enhance surgical skills and expertise through various training programs and collaborations with international medical institutions. This emphasis on education is helping to improve surgical outcomes and promote the adoption of advanced techniques, such as the use of biological and synthetic meshes in repairs.

Key Hernia Mesh Devices Company Insights

The competitive scenario in the market is highly competitive, with key players such as Johnson & Johnson Services, Inc., C. R. Bard, Inc., W. L. Gore & Associates, Inc., Atrium Medical (Getinge Group), LifeCell, B. Braun SE, Baxter, Cook, Herniamesh S.r.l. and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Hernia Mesh Devices Companies:

The following are the leading companies in the hernia mesh devices market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- C. R. Bard, Inc.

- W. L. Gore & Associates, Inc.

- Atrium Medical (Getinge Group)

- LifeCell

- B. Braun SE

- Baxter

- Cook

- Herniamesh S.r.l.

Recent Developments

-

In January 2024, RTI Surgical completed its acquisition of Cook Biotech, a move to strengthen its position in the surgical and regenerative medicine markets. This acquisition allows RTI to expand its portfolio of biologic and synthetic products, enhancing its ability to provide innovative solutions for surgical procedures. Integrating Cook Biotech's expertise in hernia repair and wound management is expected to drive growth and improve patient outcomes

-

In January 2022, Cook Biotech Inc. announced a partnership with the European Hernia Society (EHS) to advance hernia repair technologies. This collaboration aims to promote research, education, and clinical practice related to hernia management. By joining forces, Cook Biotech and EHS intend to enhance the understanding of hernia repair procedures and improve patient outcomes through innovative solutions. The partnership underscores a commitment to developing effective treatment options and fostering collaboration within the medical community.

Hernia Mesh Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.91 billion

Revenue forecast in 2030

USD 8.31 billion

Growth Rate

CAGR of 6.87% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Hernia, mesh, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Johnson & Johnson Services, Inc.; C. R. Bard, Inc.; W. L. Gore & Associates, Inc.; Atrium Medical (Getinge Group); LifeCell; B. Braun SE; Baxter; Cook; Herniamesh S.r.l..

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hernia Mesh Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hernia mesh devices market report on the basis of hernia, mesh, end-use and region:

-

Hernia Outlook (Revenue, USD Million, 2018 - 2030)

-

Inguinal

-

Incisional

-

Femoral

-

Others

-

-

Mesh Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologic Mesh

-

Synthetic Mesh

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hernia mesh devices market size was estimated at USD 5.58 billion in 2024 and is expected to reach USD 5.92 billion in 2025.

b. The global hernia mesh devices market is expected to grow at a compound annual growth rate of 7.04% from 2025 to 2030 to reach USD 8.31 billion by 2030.

b. North America dominated the hernia mesh devices market with a share of 50.4% in 2024. This is attributable to improved healthcare facilities, sedentary lifestyle practices, and high adoption of surgical meshes as a treatment option.

b. Some key players operating in the hernia mesh devices market include Covidien plc, Medtronic, Inc., Ethicon, Inc.; BD ; W. L. Gore and Associates, Inc.; Atrium Medical; LifeCell Corporation, and B. Braun Melsungen AG.

b. Key factors that are driving the market growth include a high incidence of hernia globally improved patient outcomes and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.