- Home

- »

- Semiconductors

- »

-

High End Lighting Market Size, Share & Trends Report, 2030GVR Report cover

![High End Lighting Market Size, Share & Trends Report]()

High End Lighting Market Size, Share & Trends Analysis Report By Light Source Type (LED, HID, Fluorescent Lights), By Application (Wired, Wireless), By Interior Design, By End Use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-610-3

- Number of Report Pages: 139

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

High End Lighting Market Size & Trends

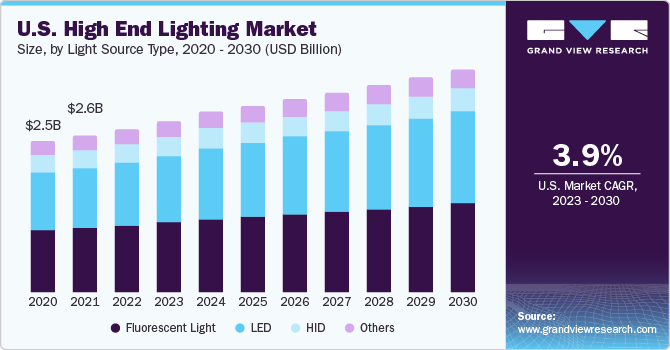

The global high end lighting market size was estimated at USD 16.92 billion in 2022 and is anticipated to grow at a CAGR of 6.0% from 2023 to 2030. Increasing demand for connected lighting and interior designing is anticipated to be a key factor driving the industry growth. Increasing penetration of smartphones and internet connectivity is growing the demand for connected lighting systems, thus impacting market growth. The demand for fluorescent high-end lights was highest in 2016, although the LED segment is expected to capture huge market share owing to its technological and economical advancements such as high efficiency and brightness level. Owing to the ban on incandescent and HID lights in many countries, their respective market share is witnessing a steep decline over the forecast period.

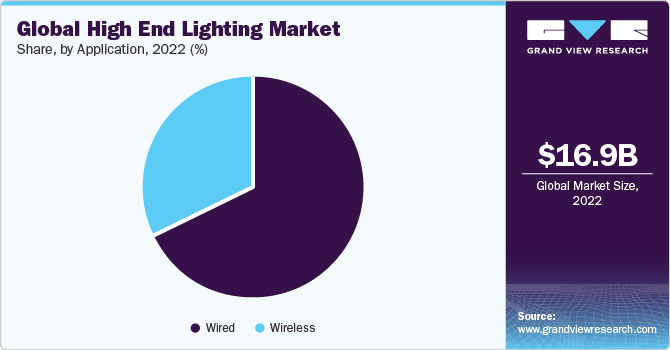

The wired segment accounted for maximum market share, whereas by 2025 wireless segment is projected to grow at a higher growth rate. Rising demand for smart and connected homes which allows better user control of all in-house electronics from distant places is contributing to the demand for wireless lighting products.

The market for modern lighting segment is expected to gain traction over the forecast period, owing to increasing demand for smart homes and various smart city projects initiated by the government across the emerging economies.

The residential application segment is anticipated to dominate the high-end product market owing to increased demand for the connected lighting system with high efficiency as compared to the commodity lighting. The industrial segment is projected to witness high growth over the forecast period, increasing standards and regulations related to industrial lighting is boosting the industry growth.

Application Insights

Based on application, the market can be segmented into wired and wireless type. Wired segment accounted for the largest revenue share of 68.4% in 2022. Wired segment constitutes much larger share as compared to the wireless segment as they are much costlier and require strong network connectivity for its operation their market size was low. But eventually, the wireless segment is going to witness exponential growth owing to high technological penetration in developing countries.

The wireless segment is anticipated to grow with the highest CAGR of 8.3% over the forecast period. Wireless lighting offers certain advantages over their wired counterparts such as they can be controlled remotely, they have smartphone application control support and can be dimmed/color changed as per user requirements.

End-use Insights

The high-end lighting segment can be segmented based on end users into commercial, residential, industrial, and others. The residential segment accounted for the largest revenue share of 50.8% in 2022. The residential segment is growing due to the rising demand for modern homes with interior designs. This is being driven by rapid urbanization and increasing disposable incomes. High-end lighting is used to highlight features, create zones, and alter the overall interior design of a space. It is considered luxurious as it offers uniqueness and enhances residential architectural allure.

The industrial segment is expected to grow at the fastest CAGR of 7.5% during the forecast period owing to increasing demand for energy-efficient lighting solutions in industrial settings. LEDs are becoming increasingly popular in industrial applications due to their long lifespan, low energy consumption, and ability to withstand harsh environments. Additionally, governments and regulatory bodies around the world are promoting the use of energy-efficient lighting in industrial settings, which is further driving demand for high-end LED lighting solutions.

Regional Insights

Asia Pacific dominated the market with a share of 43.9% in 2022 and is expected to grow at the fastest CAGR during the forecast period. The regional growth is mainly driven by the presence of major players, availability of cheaper labor, better infrastructure facilities for manufacturing, good economic conditions, and innovation of new light sources. Increasing demand for high-end lighting in developed countries, mainly due to better infrastructure and higher disposable income, is anticipated to drive the overall industry.

Latin America is anticipated to grow at a significant CAGR of 7.1% over the forecast period. The region's growing economic development, along with a rising focus on infrastructural enhancements and urban development, has propelled the demand for high-end lighting solutions. Additionally, the increasing consumer disposable income, coupled with a growing inclination towards sophisticated and design-centric interior and exterior illumination, has propelled the demand for high-quality, aesthetically pleasing lighting products across residential, commercial, and industrial sectors.

Light Source Type Insights

The market can be segmented by the light source into LED, HID, fluorescent light, and others. The fluorescent light segment accounted for the largest revenue share of 42.2% in 2022 owing to their energy efficiency, long lifespan, wide range of applications, and improved technology. It is also benefiting from the growing demand for sustainable lighting solutions. Fluorescent Lights are a sustainable option than incandescent lights, as they use less energy and produce less waste. This has led to increased demand for fluorescent lights from businesses and consumers who are looking to reduce their environmental impact.

The LED lamps segment is anticipated to grow with the highest CAGR of 6.8% over the forecast period. HID high-end lighting market is expected to witness a steep fall in revenue by 2025. LED lamps offer superior color quality compared to traditional lighting technologies. This is important for applications where accurate color reproduction is critical, such as in retail displays, museum exhibits, and photography. LED lamps do not contain any harmful chemicals, and they produce very little heat. This makes them a good choice for applications where energy efficiency and environmental sustainability are important considerations.

Governments in various countries have already banned conventional light sources such as incandescent lights, halogen lights thus their market has already witnessed a significant loss in revenues. However, newer technologies such as OLED are gaining good market share as they offer many technological advancements over existing light sources. It is believed that OLEDs will soon replace the whole LED and CFL market.

Interior Design Insights

Based on interior designs, the market is segregated into modern, traditional, and transitional segments. The transitional segment accounted for the largest revenue share of 41.0% in 2022. The segment growing as it offers a combination of traditional and modern elements, which appeals to a wide range of homeowners. Transitional lighting fixtures are typically made from neutral materials and feature simple lines and curves, which gives them a timeless look that can complement any décor style. Additionally, transitional lighting is often more affordable than other high-end lighting styles, making it a more accessible option for many homeowners.

The modern segment is expected to grow at the fastest CAGR of 6.7% during the forecast period owing to increasing demand for modern interior in the residential and commercial sector. The modern segment is growing due to advancements in LED technology, growing demand for smart lighting, increased focus on interior design, and the rise of online retailers. Modern high-end lighting fixtures often incorporate LED technology, smart lighting technology, and a sleek, contemporary aesthetic, making them a more attractive option for consumers who want to automate their lighting and complement their décor. Online retailers are making it easier for consumers to purchase these products, further contributing to the growth of the modern segment.

Key Companies & Market Share Insights

The market is highly competitive and fairly concentrated. Innovative light source development and customized products are expected to be key parameters for being competitive in this market, with frequent mergers and acquisitions being undertaken as an attempt to diversify product portfolio and gain market share.

Key High End Lighting Companies:

- Signify Holding

- OSRAM GmbH

- SAVANT TECHNOLOGIES LLC

- WOLFSPEED, INC.

- Digital Lumens

Recent Developments

-

In June 2023, Signify launched new Philips Hue lights and app features that offer more ways to customize the lighting in your home. The Philips Hue luster bulb now comes in a warm-to-cool white and color light, and the Philips Hue panels are now available in new shapes.

-

In June 2023, Signify launched new Philips LED outdoor lights that are energy-efficient and can withstand changing weather conditions. These lights are designed for gardens and other outdoor spaces, and they can provide reliable illumination even in extreme weather.

-

In June 2023, OSRAM, a German company introduced a new version of its popular OSLON Square Hyper Red horticulture LED. The new generation of LEDs is designed to offer faster plant growth and optimized system cost. This is achieved by producing high photosynthetic photon flux (PPF) at higher efficacy than the previous generation of Hyper Red 660 nm LEDs.

-

In May 2023, GE Lighting, a Savant company, released its new Dynamic Effects Neon-Shape Smart Lights for purchase. These lights are the latest additions to the Dynamic Effects product line.

-

In January 2023, GE Lighting, a Savant company announced the expansion of its smart home ecosystem, Cync, with several new products. Cync will be introducing its full Dynamic Effects entertainment lineup, which features 16 billion colors, pre-set and custom light shows, and on-device music-syncing. The company will also be expanding its Wafer light fixture line, which was successfully launched last year. All Cync products can be controlled via the Cync app, powered by Savant. Cync will also be adopting the new Matter smart home standard and rolling out an integration with Schlage.

-

In January 2022, Digital Lumens, Inc. introduced PropTech (Property technology) Innovations to enhance the tenant experience and help Increase the value of commercial real estate by implementing advanced, automated lighting and other comfort-enhancing capabilities

-

In March 2021, Cree Inc., a company based in Durham, North Carolina, that specializes in silicon carbide (SiC) technology, completed the sale of its LED Products business unit (Cree LED) to SMART Global Holdings Inc.

-

In February 2023, Signify began helping the German municipality of Eichenzell become a future-proof smart city by providing intelligent street lighting that offers fast, wireless broadband connectivity. This connectivity will allow Eichenzell to support next-generation IoT applications and future 5G densification.

High End Lighting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.12 billion

Revenue forecast in 2030

USD 27.30 billion

Growth Rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Light source type, application, interior design, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa ,UAE

Key companies profiled

Signify Holding, OSRAM GmbH, SAVANT TECHNOLOGIES LLC, WOLFSPEED INC., Digital Lumens

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High End Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global high end lighting market on the basis of light source type, application, interior design, end use and region:

-

Light Source Type Outlook (Revenue in USD Billion, 2017 - 2030)

-

LED

-

HID

-

Fluorescent Light

-

Others

-

-

Application Outlook (Revenue in USD Billion, 2017 - 2030)

-

Wired

-

Wireless

-

-

Interior Design Outlook (Revenue in USD Billion, 2017 - 2030)

-

Modern

-

Traditional

-

Transitional

-

-

End Use Outlook (Revenue in USD Billion, 2017 - 2030)

-

Commercial

-

Industrial

-

Residential

-

Others

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high end lighting market size was estimated at USD 16.92 billion in 2022 and is expected to reach USD 18.12 billion in 2023

b. The global high end lighting market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 27.3 billion by 2030.

b. Asia Pacific dominated the high end lighting market with a share of 43.1% in 2022. This is attributable to the presence of major players, availability of cheaper labor, better infrastructure facilities for manufacturing, good economic condition, and innovation of new light sources.

b. Some key players operating in the high end lighting market include Signify Holding, OSRAM GmbH, SAVANT TECHNOLOGIES LLC, WOLFSPEED INC., Digital Lumens

b. Key factors that are driving the market growth include increasing demand for connected lighting and interior designing, and higher penetration of smartphones and internet connectivity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."